Building Blocks of Active Equity Portf ...

Active returns are assessed in relation to a benchmark. If a portfolio holds... Read More

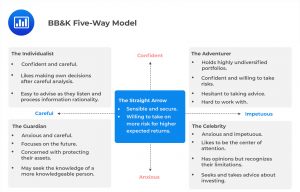

Advisers are encouraged to include behavioral factors in their clients’ portfolios. This tends to improve adviser-client relationships. In addition, the inclusion of behavioral factors in clients’ portfolios yields portfolios that are closer to the efficient frontier. The following models help explain investor behavior and biases.

Barnewall Two-way Behavioral Model – Perhaps, this is the simplest of the three models discussed in this reading. The two-way model classifies investors into one of two categories:

According to this model, active investors risk their capital to gain wealth. For instance, an active investor could start and sell a business. On the other hand, passive investors accumulate their wealth through small, consistent gains. For example, passive investors can sustain their investment through long and steady employment. Absent other factors to look at, the model explains that active investors are likely more tolerant of risk since they have previously shown a predilection for taking on financial risk. On the other hand, passive investors tend to prefer safer and slower methods.

The Bailard, Biehl, and Kaiser (BB&K) Five-Way Model – An advancement of the Barnewall two-way model, the BB&K model adds a few extra categories into which investors may be classified. The model uses a vertical axis on which it measures the degree of confidence versus the degree of anxiousness and a horizontal axis on which it measures careful versus impetuous decision-making.

Like the BB&K Model, the Pompian model has a total of four investor categories known as behavioral investor types. The recommended procedure for classifying investors into one of the four behavioral types involves a four-step process:

Passive Preserver (PP) mainly displays emotional biases and tends to have a low-risk tolerance. Other characteristics of PPs are outlined below:

PPs are difficult to advise since emotional biases drive them. Advisers should focus on the big picture and avoid quantitative details on Sharpe ratios and standard deviations. Additionally, the advice should lean more on the impact of the investment decisions on the emotional aspects of the investor’s life, e.g., lifestyle, heirs, etc. Finally, although PPs take time to trust their advisers, they greatly value professional expertise once trust is gained.

A friendly Follower has likely accumulated wealth passively and has a low to medium risk tolerance level. The characteristics of FFs are as follows:

Friendly followers are difficult to advise since they tend to overestimate their risk tolerance. Advisers must be careful with FFs since they are likely to say yes to advice that makes sense to them, only to regret it later. FFs should be advised on the importance of diversification. Additionally, they should be educated to better understand the implications of investment choices. Lastly, FFs stick to long-term investment plans after they establish loyalty with advisers over time.

This investor is an active accumulator of wealth with medium to high-risk tolerance and tends to be contrarian. They are characterized by the following:

Independent individualists are difficult to advise since they are liberal thinkers. Moreover, they are not aware that they are contrarian. However, they listen to sound advice and respond well to education on relevant investment concepts.

Active accumulators are entrepreneurs who have risked their own capital to build wealth and have a high-risk tolerance. AAs are the most aggressive among the four types of investors and like being hands-on with investment decisions. Other features of AAs include:

Active accumulators are probably the most difficult clients to advise. They lack self-control and need to be monitored for excessive spending. Therefore, advisers need to take control of the investment process. They must demonstrate to AAs that they can help them to make wise, objective, and long-term decisions.

The following table summarizes the four behavioral investor types discussed above:

$$ \begin{array}{c|c|c|c|c} {\textbf{Investor}} & {\textbf{Active/} } & {\textbf{Risk} } & {\textbf{Investment} } & {\textbf{Primary} } \\ \textbf{Type} & \textbf{Passive} & \textbf{Tolerance} & \textbf{Style} & \textbf{Bias} \\ \hline {\text{Passive} } & \text{Passive} & \text{Low} & \text{Conservative} & \text{Emotional} \\ \text{Preserver} & & & & \\ \hline {\text{Friendly} } & \text{Passive} & {\text{Low-}} & \text{Conservative} & \text{Cognitive} \\ \text{Follower} & & \text{Moderate} & & \\ \hline {\text{Independent} } & \text{Active} & {\text{Moderate-} } & \text{Aggressive} & \text{Cognitive} \\ \text{Individualist} & & \text{High} & & \\ \hline {\text{Active} } & \text{Active} & \text{High} & \text{Aggressive} & \text{Emotional} \\ \text{Accumulator} & & & & \\ \end{array} $$

Classifying investors can help financial professionals better understand and serve their client’s needs. Nevertheless, it is important to remember that some of the traits discussed previously are not always static. Individuals may exhibit behaviors from multiple classifications, precluding the ability to fit them neatly into a box. Furthermore, these behaviors can change throughout an individual’s life and depending on their current circumstances. While we can look at behavioral models to help explain what we see, we must realize they are not applicable 100% of the time and in every situation.

Question

An investor with a low-risk tolerance, a preference for a conservative portfolio, and one who exhibits mainly cognitive biases would most likely be classified as:

- Independent individualist.

- Friendly follower.

- Active accumulator.

Solution

The correct answer is B.

A friendly follower has likely accumulated wealth passively and has a low to medium risk tolerance level. This investor primarily suffers cognitive biases, e.g., availability, hindsight, and framing.

A is incorrect: An independent investor is an active accumulator of wealth with medium to high-risk tolerance and tends to be contrarian. This investor mainly suffers cognitive biases as well, including conservatism, availability, confirmation, and representativeness biases.

C is incorrect: Active accumulators are entrepreneurs who have risked their own capital to build wealth and have a high-risk tolerance. The investment style is aggressive, and they are mostly exposed to emotional biases, including overconfidence and self-control.

Reading 2: Behavioral Finance and Investment Processes

LOS 2 (a) Explain the uses and limitations of classifying investors into personality types

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.