Equity Style Rotation.

When it comes to asset returns, a factor is a variable or characteristic... Read More

Statistical arbitrage aims to generate profits by recognizing relationships between two securities and using this relationship to predict the future movement of their prices. Typically, this relationship is based on the correlation between the prices of the two securities. When the correlation breaks down and the prices that were once correlated start to diverge, the statistical arbitrage approach identifies this divergence and places a bet on a return to the previous correlation that has historically persisted over longer periods of time. This strategy is often referred to as pairs trading.

These strategies are often referred to as “market-neutral” or “beta-neutral” because they don’t depend on overall equity market movements to make a profit. The analysis is usually highly systematic, with algorithms executing trades based on their own signals, sometimes with human oversight.

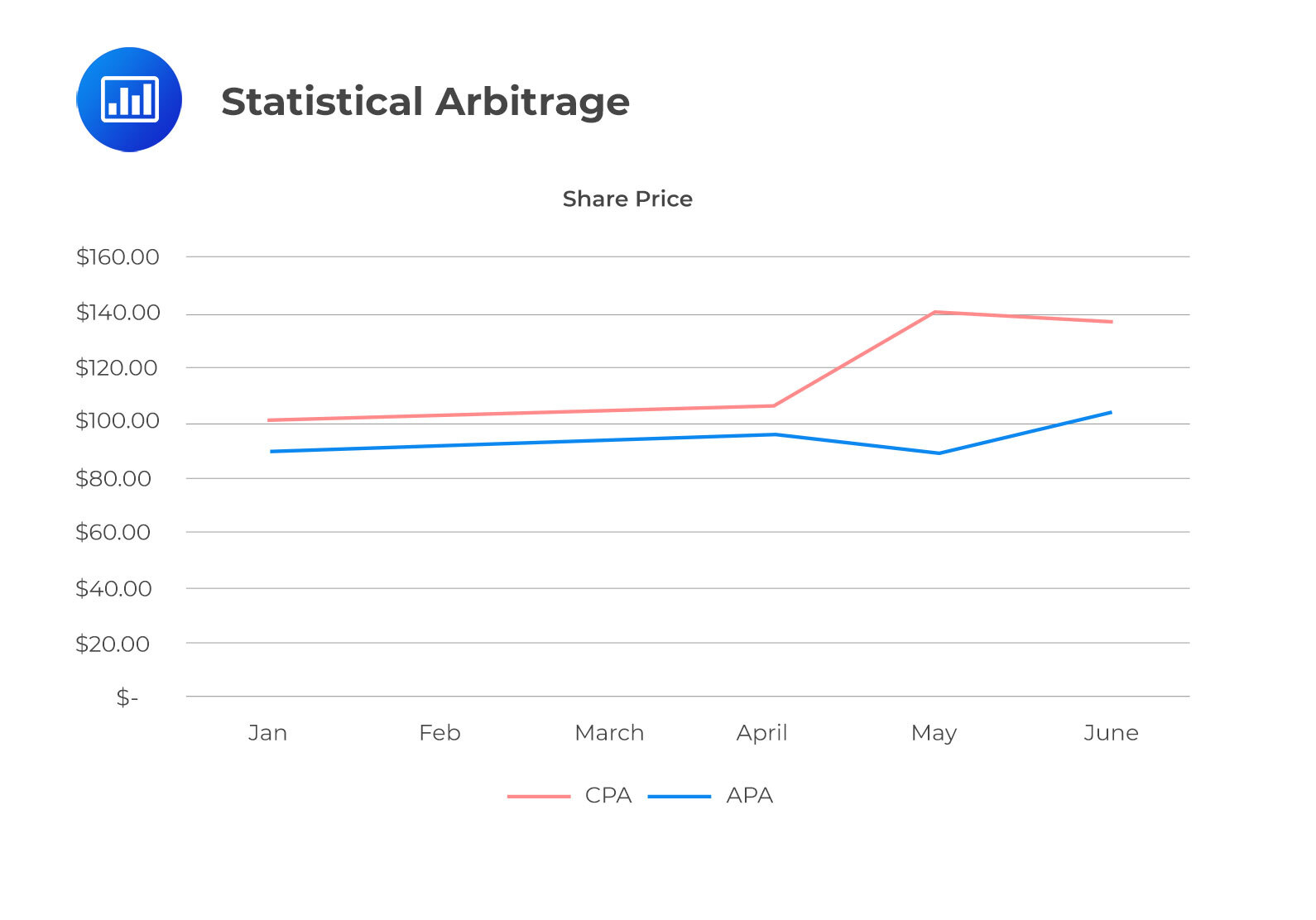

For instance, let’s consider two companies, Canadian Pizza Company (“CPA”) and American Pizza Company (“APA”). These companies tend to move together due to similar risk factors. Looking at the chart below, we can observe that between January and April, the stock prices of CPA and APA consistently increased, showing a near-perfect correlation of +1.00.

In May, however, the connection between the two firms’ stock prices breaks down, and they start moving in opposite directions. Statistical arbitrage models would identify this divergence and probably buy shares of APA while shorting shares of CPA. When the correlation starts to revert in June, a profit is made from the long shares and the short leg of the trade.

This strategy requires:

Market microstructure is about looking at how many people want to buy or sell in the market and taking advantage of situations where there’s a temporary mismatch in what people want to do. This happens really quickly, maybe just for a tiny bit of time, like a few milliseconds or even less.

Event-driven strategies focus on what’s happening within companies. This can include such things as mergers, buying back shares, giving special dividends, splitting into separate companies, selling parts of the business, changing how a company is organized, and announcing how well the company is doing financially.

For instance, when companies are merging, the company being bought might see its stock price go up. On the other hand, the company making the purchase might see its stock price go down temporarily. To make money from this, risk arbitrage investors might buy the stock of the company being bought and sell the stock of the buying company. They’re not trying to make money from the success of the merger itself, but from the time difference between when the merger is announced and when it actually happens. This is because there’s a chance that unexpected things could stop the merger. So, investors can buy the stock of the company being bought before it goes up to the expected price.

These investors don’t create these events, they just want to make money from events that are already happening.

Question

The following passage most appropriately describes which investor type:

“Pradeep Singh, employed at a hedge fund in London, England, recently bought a significant number of shares in a publicly traded watchmaking company. Singh and his team have initiated a proxy battle to persuade fellow shareholders to be more open to an acquisition. The plan is to have the watchmaker acquired by a renowned Italian fashion company, and just before that, they will also short-sell shares of the fashion brand.”

- Market microstructure.

- Risk arbitrage.

- Activist investment.

Solution

The correct answer is C.

The passage describes an investor, Pradeep Singh, and his team actively engaging with the management and operations of a publicly traded watchmaking company. They are initiating a proxy battle to persuade fellow shareholders to be open to an acquisition by an Italian fashion company. This action aligns with activist investors who seek to influence the decisions and operations of the companies in which they invest. Activist investors often aim to bring about changes in management, governance, or strategic direction to enhance shareholder value.

A is incorrect. Market microstructure relates to the study of the organization and mechanics of financial markets, which is not the focus of the passage.

B is incorrect. Risk arbitrage typically involves making bets on the outcome of specific events, such as mergers or acquisitions, but it doesn’t involve the level of active engagement and influence over a company’s strategy and operations seen in the passage.

Reading 25: Active Equity Investing: Strategies

Los 25 (f) Describe active strategies based on statistical arbitrage and market microstructure

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.