Forward Contracts, FX Swaps, and Curre ...

Forwards Vs. Futures This section addresses the simplest hedging scenario: a 100% hedge... Read More

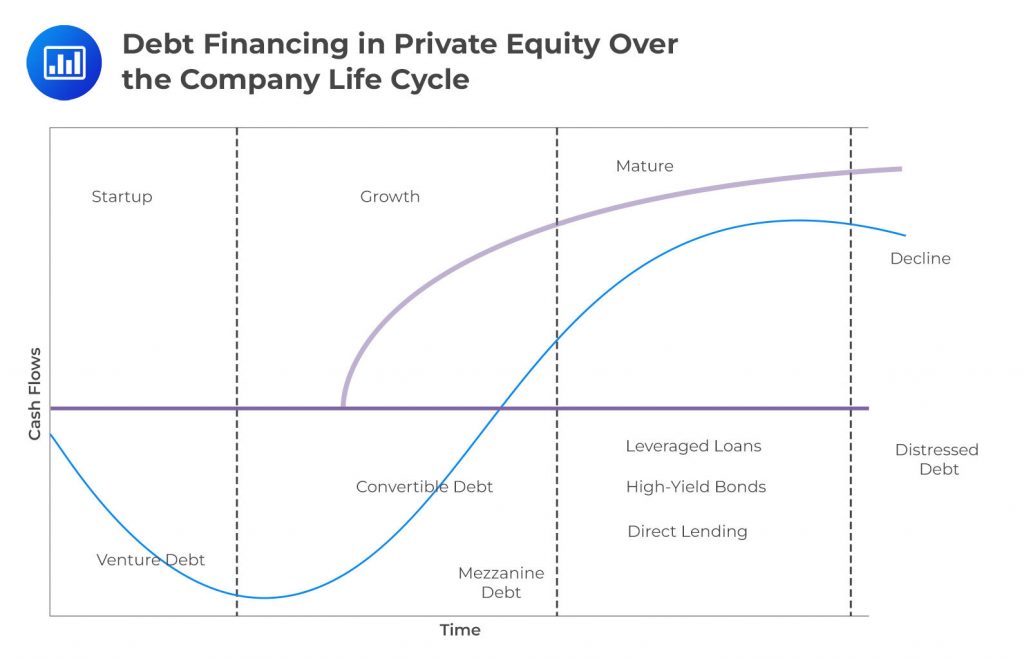

The investment life cycle in private markets, which includes private equity, real estate, and infrastructure, is characterized by the use of debt financing during periods of development or transformation. This use of debt in private markets is significantly different from the use of commercial paper, unsecured revolving credit, and senior unsecured bonds by mature public companies with investment grade ratings.

For instance, consider the case of a well-established tech company like Apple Inc. This company, being a mature public company with high ratings, enjoys a high degree of investor confidence. Investors trust these companies to meet their interest and principal payments from their operating cash flow. They face fewer restrictions in terms of covenants or debt tenor due to their stable cash flows and are seen as less likely to default.

On the other hand, private equity strategies over the company life cycle involve either early-stage startup or growth firms with low or unpredictable operating cash flow, or buyout companies where the use of greater financial leverage increases the likelihood of default. For example, a startup like Uber in its early stages had unpredictable operating cash flow and hence, had to rely on private equity strategies.

To mitigate the overall investment risk associated with debt financing, private equity borrowers must offer debt investors a higher return. They also need to provide protection in the form of restrictive covenants and security in the form of collateral. In some cases, they may also need to offer equity-like returns to compensate lenders for the increased risk. Different types of debt financing methods in an investment cycle are shown below.

Venture debt is a unique form of financing that is specifically designed for startup companies. These companies often have little to no revenue, negative cash flow, and few assets available as collateral. As such, they are generally unattractive candidates for traditional loan or bond financing. However, in certain cases, they can access venture debt, which provides them with the necessary capital to grow and expand their operations.

Unsecured venture debt is typically offered by non-bank lenders to early-stage, revenue-generating firms like TechStart for up to three years. The interest rate is relatively high due to the lack of positive cash flow and high default potential. For example, TechStart might be charged an interest rate of 15% due to its high-risk profile. Venture borrowers usually have large cash balances, and their loan balances reflect low loan-to-value ratios, typically no greater than 10%. This means that TechStart’s loan balance would be no more than 10% of its total value. To minimize refinancing risk, venture debt is typically amortized over the loan period. This means that TechStart would gradually pay off its loan over the agreed-upon term.

Venture debt often involves a loan plus a warrant. This warrant grants a lender the right to purchase common equity shares issued by the company for a fraction (often 10–20%) of the loan amount at a predetermined price over a specific period.

Warrants have a similar payoff profile to equity call options but differ in two ways. They are usually outstanding for longer periods of up to several years, and they are issued directly by a company versus an exchange. This results in dilution due to the issuance of new shares for settlement. This feature is used by borrowers to both reduce financing costs versus common shares and avoid the immediate dilution of equity while accepting contingent dilution if shares appreciate above the warrant exercise price.

For lenders, despite the lack of revenue, cash flow, or tangible collateral, venture debt offers the potential for equity-like returns if shares appreciate. This means that if TechStart’s shares increase in value, the lender stands to make a significant return on their investment. There is potential for additional equity series financing and in some cases a claim against intellectual property as additional default risk mitigants.

A special form of venture debt applicable to early-stage firms with subscription-based revenue is recurring revenue financing (also known as receivables financing or factoring). For example, a software firm like TechStart, with an established software license subscriber base and an established track record of monthly cash flows, could benefit from this type of financing.

The loan, which consists of a discounted upfront monthly payment of expected subscription revenue, is extended in exchange for some or all of the monthly subscriber cash flows as they are received. Key determinants of cost and availability include the size, growth rate, and quality of the underlying subscriber revenue.

Mezzanine Debt is a type of long-term, junior debt that is paid after all senior debts are settled but before equity shareholders.

Characteristics: It is a hybrid form of financing, often with smaller size and arranged privately with non-standardized terms.

Position in Capital Structure: Contractual subordination through agreement, paid after senior secured debts but before dividends to shareholders.

Equity-Like Features: May include call options, conversion rights, or warrants, offering a potential upside by converting debt into equity under certain conditions.

Interest Payment: Offered on a fixed or variable rate basis, with interest paid in cash or as Payment In Kind (PIK), which accrues to the principal and is paid at maturity.

Usage: Flexible financing across the growth and mature phases of a company life cycle, tailored for specific needs such as financing growth or acquisitions.

Convertible debt is a financial instrument blending debt and equity features, allowing debt to be converted into shares at a future date at a predetermined price.

Features: Acts like a bond with an equity call option, often with low to no interest yield due to the conversion feature.

Benefits for Investors: Offers the potential for equity appreciation, beneficial for investors in startups or companies with uncertain cash flows.

Benefits for Issuers: Increases financial flexibility and lowers cost of capital, especially valuable for early-stage companies or those with less predictable cash flows.

Use Cases: Popular in private market strategies, beneficial for early-stage companies, and strategic for financing growth or acquisitions without immediate equity dilution.

Leveraged loans are a type of loan that is extended to companies or individuals who already have considerable amounts of debt. Let’s delve deeper into the characteristics, security, covenants, and the investment and risk associated with leveraged loans.

Leveraged loans are term loans given to borrowers who are considered sub-investment grade, typically with a tenor of four to seven years. For instance, a company with a low credit rating due to high debt might take a leveraged loan to finance a merger or acquisition.

These loans are usually issued to borrowers with a higher degree of financial leverage and are often secured on a senior basis. This means that in the event of bankruptcy, these lenders are the first to be repaid.

The periodic debt coupon of leveraged loans is usually based on a market reference rate (MRR) plus an issuer-specific credit spread. For example, if the MRR is 5% and the credit spread is 2%, the interest rate on the loan would be 7%.

The principal of these loans is either fully repaid upon maturity or amortized based on a predetermined schedule. This is similar to a mortgage or car loan where you make regular payments over a set period.

Leveraged loans are typically callable at par (plus any accrued interest) at any time starting several months after issuance, providing issuers with a high degree of financing flexibility. This means the borrower can repay the loan in full without any penalties.

Leveraged loan investors often require a first or second lien on certain assets due to the higher likelihood of financial distress among private buyout debt issuers. This increases the recovery rate in the event of default versus unsecured debt. For example, a bank might require a lien on a company’s property or equipment as collateral for the loan.

A first or priority lien grants a lender the right to take possession of specific property from a borrower which fails to repay debt, while a second lien loan is secured by an asset with an existing lien and will only be repaid when the first lien creditor receives payment.

Restrictive covenants are common for leveraged loans. These may require the issuer to meet certain metrics for each financial reporting period, such as keeping debt outstanding below a certain total leverage ratio and operating cash flow above an interest coverage ratio. This is to ensure the borrower maintains a certain level of financial health.

In competitive markets with strong demand for leveraged loans, these conditions may be loosened in what is known as a covenant-lite transaction. This means the borrower has fewer restrictions on its financial operations.

Maintenance covenants may be weakened when imposed as incurrence covenants, which are tested only when an issuer seeks to assume additional debt. This gives the borrower more flexibility in taking on additional debt.

Investors in leveraged loans face less duration risk due to changing benchmark interest rates than fixed-coupon bonds and will face higher or lower coupons as market reference rates rise or fall. This means the value of the loan is less sensitive to changes in interest rates.

Many investors access the leveraged loan market by purchasing collateralized loan obligations (CLOs), which raise capital to invest in a portfolio of leveraged loans and are separated into tranches with different priority claims on cash flow from the loan portfolio and exposure to losses based upon a waterfall. For example, a pension fund might invest in a CLO as a way to earn higher returns than government bonds.

High-yield bonds, also known as junk bonds, are fixed-income securities issued by below investment grade borrowers.

Risk Profile: Considered to have more equity-like exposure due to their subordinated position, meaning they are repaid after leveraged loans in a default scenario.

Features: Carry a fixed coupon, have a longer tenor (up to ten years), and include a call feature allowing issuers to prepay before maturity.

Call Protection: Offers investors a period of call protection, after which issuers can call bonds at a premium, typically done to reduce interest costs if the issuer’s financial health improves.

Trading and Use: Though publicly traded, high-yield bonds are significant in private debt transactions, such as leveraged buyouts, as part of financing packages.

Example: Early-stage companies with lower credit ratings, like Tesla in its early years, issuing high-yield bonds to raise capital.

Direct lending is a financial strategy that serves as an alternative to traditional bank intermediation. In this approach, private non-bank lenders provide leveraged loans to small- and medium-sized companies that may have limited access to banks or public markets. This lending method has seen a significant surge as an asset class following the Global Financial Crisis of 2008–9, primarily due to stricter bank regulation and near-zero central bank policy rates.

The debt instruments utilized in direct lending include leveraged loans and unitranche debt. For instance, a company like Tesla might use these loans to finance a new project. These loans are typically issued at a higher coupon than standardized loans to borrowers of similar seniority and credit quality. The higher spread also reflects a greater liquidity premium associated with these borrowers.

Underwriters of these loans may include private credit funds or business development companies in the US. An example of such a company is Ares Capital Corporation, a leading business development company specializing in private debt. These are often a form of closed-end investment vehicle which is often a publicly traded company specializing in private debt.

Direct loans can be either sponsored or non-sponsored. Sponsored loans are those for which a private equity firm with a controlling ownership stake in the potential borrower directly seeks to access debt for a company. For example, if a private equity firm like Blackstone Group has a controlling stake in a company, it might seek a sponsored loan for that company. In the case of non-sponsored loans, or those which lack a controlling financial sponsor, lenders deal directly with a potential borrower’s management team.

In the case of traditional bank lending, financial institutions conduct periodic credit assessments, maintain transactional banking services, and impose constraints such as covenants on a borrower. Under a sponsored loan, lenders are typically able to source firm information and due diligence from the sponsoring private equity firm. In the case of non-sponsored loans, lenders have to bear greater search, due diligence, and monitoring costs.

Sponsored loans may generate a potential conflict of interest between a general partner (GP) and limited partners (LPs), arising from loan arrangement fees charged by GPs but not shared with LPs. Given the existing due diligence, monitoring, and controlling relationship of the private equity sponsor, prospective lenders tend to have less bargaining power in negotiating terms and pricing for sponsored loans. Non-sponsored borrowers may face less bargaining power than sponsored lenders as they may be less sophisticated or have fewer resources to focus on negotiating debt financing.

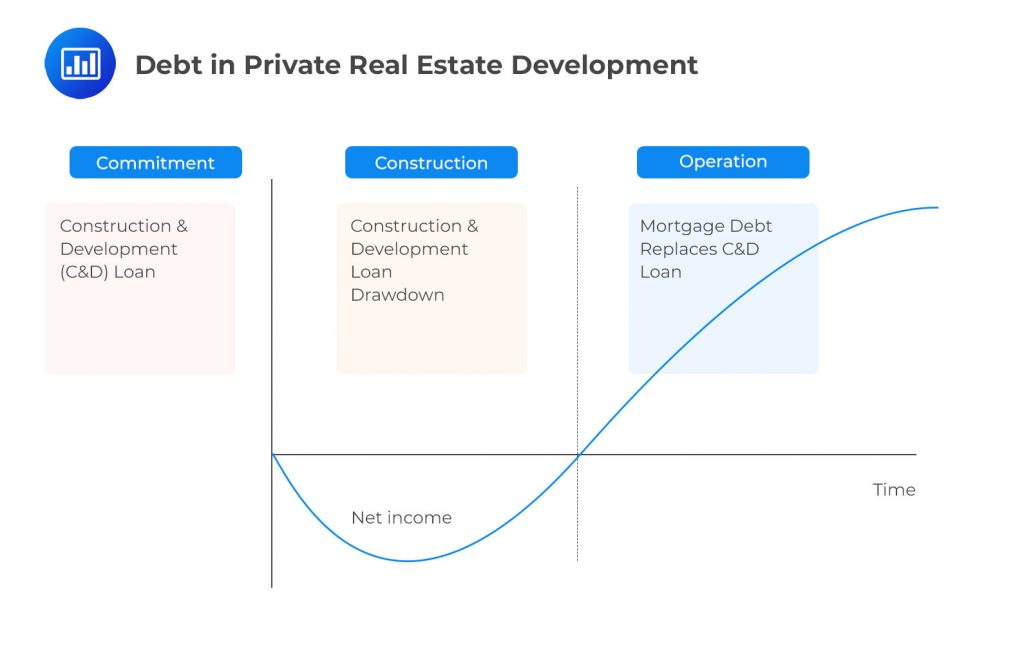

Real estate projects often have an initial period of negative net income during the development phase. Debt and equity capital is committed before the start of a new real estate project and drawn from the time of site purchase through the construction period. Temporary debt in the form of a construction and development (C&D) loan is disbursed in stages to finance building costs as specific project milestones are met. The C&D loan accrues interest over the construction period and is usually repaid upon project completion via a mortgage loan secured by the property and serviced by operating cash flows. C&D loans are typically secured by project assets, but risks include the uncertain resale value of collateral during construction, and the potential for delays and cost overruns.

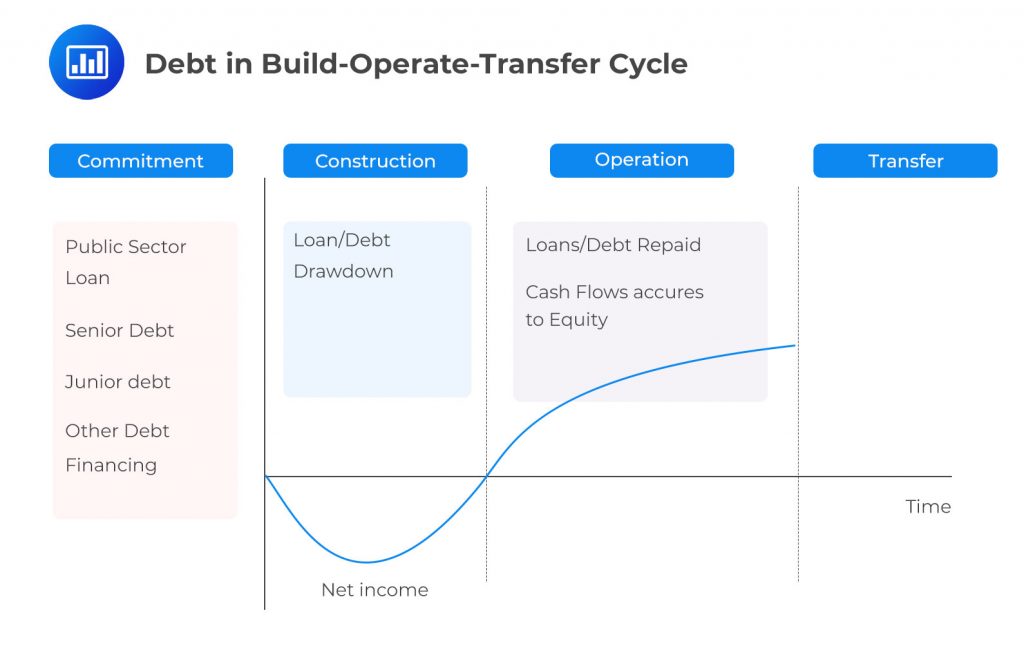

Infrastructure projects, such as build-operate-transfer (BOT) projects, are sponsored by a public entity and transferred to its control after a finite operating period. Debt financing for infrastructure projects may include public as well as private sources of debt. Unlike real estate properties, infrastructure projects with a finite operating period, such as a BOT project, have the debt paid down fully as operations begin, with cash flows accruing to equity holders until the asset is transferred to the public entity with a terminal value of zero.

In both private real estate and infrastructure, the use of loans over bonds is prevalent due to the greater flexibility of prepayment.

Distressed Debt refers to loans or bonds that have a high probability of non-payment or bankruptcy. These types of debts are typically associated with companies that are in financial distress or are under bankruptcy protection.

Practice Questions

Question 1: Consider a scenario where you are an investor looking to invest in a company. You have two options: a mature public company with investment grade ratings and stable cash flows, and a private equity firm in its growth stage with unpredictable operating cash flow. The public company uses commercial paper, unsecured revolving credit, and senior unsecured bonds, while the private equity firm uses debt financing. As an investor, you need to understand the risk and return associated with both options. Which of the following statements best describes the difference in risk and return between these two investment options?

- The public company is less likely to default and faces fewer restrictions in terms of covenants or debt tenor, while the private equity firm must offer higher returns and provide protection in the form of restrictive covenants and collateral due to the increased likelihood of default.

- The private equity firm is less likely to default and faces fewer restrictions in terms of covenants or debt tenor, while the public company must offer higher returns and provide protection in the form of restrictive covenants and collateral due to the increased likelihood of default.

- Both the public company and the private equity firm are equally likely to default, and both must offer higher returns and provide protection in the form of restrictive covenants and collateral.

Answer: Choice A is correct.

The public company is less likely to default and faces fewer restrictions in terms of covenants or debt tenor, while the private equity firm must offer higher returns and provide protection in the form of restrictive covenants and collateral due to the increased likelihood of default. This is because mature public companies with investment grade ratings and stable cash flows are generally considered less risky than private equity firms in their growth stage with unpredictable operating cash flow. The public company’s lower risk profile is reflected in its ability to access a variety of debt financing options, including commercial paper, unsecured revolving credit, and senior unsecured bonds, which typically come with fewer restrictions and lower interest rates. On the other hand, the private equity firm’s higher risk profile necessitates the use of debt financing, which often comes with more restrictive covenants and collateral requirements to protect lenders in the event of default. As a result, the private equity firm must offer higher returns to compensate investors for the increased risk.

Choice B is incorrect. The private equity firm is not less likely to default and does not face fewer restrictions in terms of covenants or debt tenor. In fact, due to its unpredictable operating cash flow and growth stage, it is generally considered more risky and thus faces more restrictions and higher interest rates.

Choice C is incorrect. Both the public company and the private equity firm are not equally likely to default. The public company, with its stable cash flows and investment grade ratings, is generally considered less risky and thus less likely to default than the private equity firm. Furthermore, the public company does not necessarily need to offer higher returns or provide protection in the form of restrictive covenants and collateral, as its lower risk profile allows it to access a variety of less restrictive and lower-cost debt financing options.

Question 2: Imagine you are a private equity borrower in the growth stage of your company. Your operating cash flow is low and unpredictable, and you are using debt financing. To mitigate the investment risk associated with your debt financing, you need to offer certain incentives to your debt investors. Which of the following is NOT a strategy that you would likely use to compensate your lenders for the increased risk?

- Offering a higher return to your debt investors.

- Providing protection in the form of restrictive covenants and security in the form of collateral.

- Reducing the amount of debt financing and increasing the use of commercial paper, unsecured revolving credit, and senior unsecured bonds.

Answer: Choice C is correct.

Reducing the amount of debt financing and increasing the use of commercial paper, unsecured revolving credit, and senior unsecured bonds is not a strategy that a private equity borrower in the growth stage of their company would likely use to compensate their lenders for the increased risk. This is because commercial paper, unsecured revolving credit, and senior unsecured bonds are all forms of unsecured debt, which means they do not have any collateral backing them. This makes them riskier for lenders, as they have no guarantee of repayment if the borrower defaults. Therefore, using these forms of financing would not mitigate the investment risk associated with the borrower’s debt financing, but rather increase it. Furthermore, a company in the growth stage with low and unpredictable operating cash flow may not have access to these types of financing, as they are typically reserved for more established companies with stable cash flows and good credit ratings.

Choice A is incorrect. Offering a higher return to debt investors is a common strategy used by borrowers to compensate for the increased risk associated with their debt financing. The higher return serves as an incentive for investors to lend money to the company, despite the higher risk.

Choice B is incorrect. Providing protection in the form of restrictive covenants and security in the form of collateral is another common strategy used by borrowers to mitigate the investment risk associated with their debt financing. Restrictive covenants are conditions that limit the borrower’s actions in certain ways to protect the lender’s interests, while collateral provides a form of security for the lender in case the borrower defaults on the loan.

Private Markets Pathway Volume 1: Learning Module 4: Private Debt; LOS 4(a): Discuss the use of debt financing in private market strategies over the investment life cycle

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.