Study Notes for CFA® Level III – Ac ...

Reading 25: Active Equity Investing: Strategies Los 25 a: Compare fundamental and quantitative... Read More

Private investment targets are a unique area of focus in the financial world. Unlike public fund managers who primarily focus on security selection, private investment targets require a more hands-on approach. This involves the active engagement of General Partners (GPs) throughout the investment life cycle. It’s not just about identifying potentially undervalued companies and assets, but also narrowing down investment targets to those where a controlling stake or significant minority position can be used to drive substantial value creation over a longer investment period.

Let’s consider Uber company. Before it went public, it was a prime target for private investment. It was a startup with high growth potential in a new and emerging industry – ride-sharing. The founders had a disruptive business model and industry expertise. The value creation for such startups involves non-financial milestones, such as new product prototypes and testing, validating a business concept, and setting a go-to-market strategy.

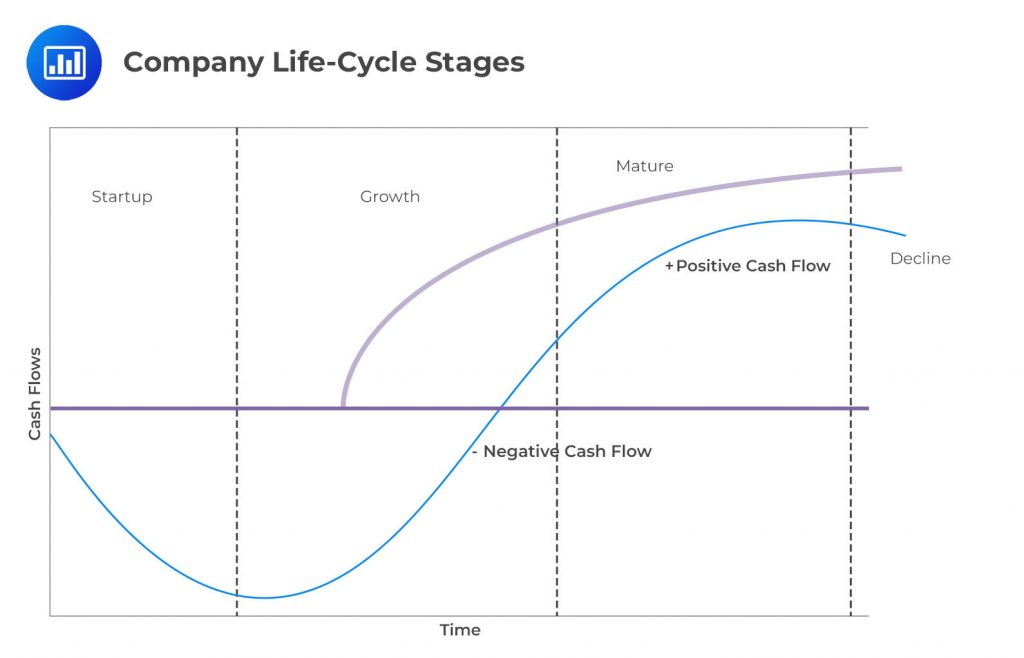

Value creation over the investment life cycle is a common feature among prospective investments. This process occurs differently among startup, growth, and mature companies in the company life cycle as shown in the figure below.

For startup companies without an established product or revenue base, investors target firms with high growth potential in a new or emerging industry or one that seeks to disrupt an established industry with a new product or business model. The most sought-after investments are companies whose founders have patents, other intellectual property, or business ideas and industry expertise and/or a successful record of creating new companies. Value creation for startups involves non-financial milestones, such as new product prototypes and testing, validating a business concept, and setting a go-to-market strategy.

Consider a company like Tesla in its early stages. It had an existing product, customer base, and business model that had the potential for above-trend growth. Capital investments at this stage were needed to create the scale necessary to realize this opportunity for rapid growth.

Buyout equity investors often target mature companies with the aim of unlocking their growth and profitability potential. This is achieved by acquiring the business and transforming or streamlining its existing operations. The ideal targets for these investors are large firms with a strong market share, consistent cash flows, and a substantial fixed asset base in a less competitive industry due to regulation or entry barriers. Firms that meet these criteria and are facing lagging performance or management issues are likely to benefit the most from a buyout transaction.

Value creation in this context involves the use of debt financing to acquire and transform operations by adding management talent, increasing efficiency, and shedding non-strategic businesses. The key elements necessary for reaching a higher market valuation upon exit, which represents the bulk of buyout equity returns, are subsequent debt reduction and higher profitability.

The potential for value creation in private equity targets is influenced by company- and industry-specific forces, as well as macroeconomic conditions. The application of strategic, operational, organizational, and financial value drivers varies greatly among targeted investments based on a company’s stage in the life cycle, its industry, and competitive position.

The future trajectory of an industry and the overall economic outlook are important factors affecting the performance of private equity strategies. For instance, rapid technological change in industries such as biotechnology and information technology often fuel startup growth, which is less sensitive to the economic cycle. On the other hand, buyout targets in mature, cyclical industries that rely on the availability of less costly debt financing face a greater adverse impact from rising interest rates or a cyclical downturn.

In private markets like real estate and infrastructure, which are usually project-based, General Partners (GPs) follow capital commitment, deployment, and distribution phases over a common development life cycle. Real estate investment values stem from a property’s current and expected future economic use. The value creation process in real estate development hinges on a developer’s ability to complete a project on time, reach full occupancy, and generate a stable future income stream whose expected terminal value exceeds project cost plus a required rate of return.

Real estate investment values are primarily derived from a property’s current and future economic use. This perspective aligns opportunistic private real estate projects with startup companies, where initial capital deployment phases are characterized by significant cash outflows. In contrast, the real estate equivalent of mature companies with stable cash flows can be found in existing, well-leased income-producing properties. These properties are often part of publicly traded Real Estate Investment Trusts (REITs), although they are also accessible in private markets through Open-End Diversified Core Equity (ODCE) funds.

When looking at potential real estate development projects, investors consider several key factors:

Real estate investors are exposed to risks such as project delays, changing economic conditions, and real estate cycle timing. They are also exposed to technological change and other structural factors that can have a significant and lasting impact on real estate demand.

Infrastructure assets are distinct from real estate assets in that their value is derived from long-term contracts known as concession agreements, or regulations that govern their economic use and income generation potential. These agreements are made between a granting entity, such as a public authority, and a developer or operator. The agreement is structured on a long-term basis to build, operate, and eventually transfer asset ownership back to the grantor at the end of a prespecified period. This is known as a build-operate-transfer (BOT) project.

In BOT projects, General Partners (GPs) are required to generate all investor returns prior to the transfer of asset ownership to the grantor at zero terminal value. Opportunistic infrastructure projects that are attractive include those that provide essential services with relatively inelastic demand, less exposure to market cyclicality or economic shocks, and the ability to increase user fees along with inflation.

The underlying economic use, industry, and business model under which a proposed new infrastructure project will operate are of primary importance in prioritizing target investments. For instance, many developed countries have introduced subsidies and regulation-based payment schemes, among other incentives, to promote investment in renewable energy. GPs must factor the economic impact of these schemes across jurisdictions into their decision-making process when evaluating target investments.

Like other private market assets, GPs in private infrastructure seek to create value over a transformational life cycle. However, the greater size and illiquidity and a general inability to repurpose investments impose additional constraints on managers in pursuing this objective. With a development cycle involving sizable sunk costs and a finite holding period, which sometimes involves an asset transfer with no exit value, as in the case of BOT projects, GPs often focus on mitigating project risks, maximizing operating efficiency when facing fixed-price contracts (or extracting inflation-adjusted payments over time), and capitalizing on ancillary commercial opportunities when evaluating target infrastructure investments.

The remaining investment cycle phases of deployment, distribution, and exit; detailed evaluation of target investments; and the preparation and execution of the value creation process through the end of the partnership investment period when an asset is sold, exited, or transferred to a granting entity are also crucial aspects to consider.

Practice Questions

Question 1: In the context of private investment targets prioritization, General Partners (GPs) play a crucial role throughout the investment life cycle. This process involves identifying undervalued companies and assets, and narrowing down investment targets where a controlling stake or significant minority position can be used to drive value creation over a longer investment period. Which of the following best describes the value creation process for startup companies in this context?

- Startup companies are targeted for their potential for above-trend growth as measured by a firm’s revenue relative to its total addressable market.

- Value creation for startups involves financial milestones, such as revenue growth and profitability.

- Value creation for startups involves non-financial milestones, such as new product prototypes and testing, validating a business concept, and setting a go-to-market strategy.

Answer: Choice C is correct.

Value creation for startups involves non-financial milestones, such as new product prototypes and testing, validating a business concept, and setting a go-to-market strategy. In the early stages of a startup, the focus is often on validating the business concept, developing and testing prototypes, and setting a go-to-market strategy. These non-financial milestones are crucial for startups as they provide evidence of progress and potential for future success. They also help to attract further investment and support from stakeholders. The achievement of these milestones can significantly increase the value of a startup, even before it has generated any significant revenue or profit. Therefore, General Partners (GPs) often prioritize these non-financial milestones when evaluating potential investment targets in the startup space.

Choice A is incorrect. While startup companies are often targeted for their potential for above-trend growth, this is not the primary method of value creation in the startup context. Above-trend growth is a potential outcome of successful value creation, but it is not the process itself.

Choice B is incorrect. While achieving financial milestones such as revenue growth and profitability is important for startups, it is not the primary method of value creation in the early stages of a startup. Financial milestones are often the result of successful value creation through the achievement of non-financial milestones.

Question 2: The process of value creation over the investment life cycle varies among startup, growth, and mature companies. When considering growth companies, these are firms with an existing product, customer base, and business model that have the potential for above-trend growth. What is the primary characteristic that makes a growth company an optimal investment target?

- Growth companies are those that seek to disrupt an established industry with a new product or business model.

- Optimal investment targets are well-managed young firms that have experienced initial success with a product in high demand but face capacity constraints in attaining their potential future size and level of profitability.

- Growth companies are most sought after when their founders have patents, other intellectual property, or business ideas and industry expertise.

Answer: Choice B is correct.

The primary characteristic that makes a growth company an optimal investment target is that they are well-managed young firms that have experienced initial success with a product in high demand but face capacity constraints in attaining their potential future size and level of profitability. Growth companies have a proven product, a customer base, and a business model that has the potential for above-trend growth. They have demonstrated their ability to generate revenue and are poised for expansion. However, they often face capacity constraints, such as lack of capital or operational resources, that prevent them from reaching their full potential. Investors who identify these companies and invest in them can potentially earn significant returns as these companies grow and overcome their capacity constraints. This is why growth companies are often considered optimal investment targets.

Choice A is incorrect. While growth companies can indeed disrupt established industries with new products or business models, this is not the primary characteristic that makes them optimal investment targets. Disruption is a characteristic more commonly associated with startup companies, not growth companies.

Choice C is incorrect. While having patents, other intellectual property, or business ideas and industry expertise can certainly add value to a company, these are not the primary characteristics that make a growth company an optimal investment target. These factors can contribute to a company’s potential for success, but they do not guarantee it. The primary characteristic of an optimal investment target is its proven ability to generate revenue and its potential for above-trend growth.

Private Markets Pathway Volume 1: Learning Module 2: General Partner and Investor Perspectives and the Investment Process; LOS 2(c): Discuss the favorable characteristics of private investment targets and the sources of value creation in private markets

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.