Latency

Latency is the delay between the occurrence of an event and a subsequent... Read More

Investing in private markets presents a unique set of opportunities and challenges compared to public markets. Private investments often involve more complex structures, longer holding periods, and a higher degree of engagement from managers. Understanding the various methods and structures of private investment is crucial for investors looking to navigate this space effectively.

Private investment methods in the field of private markets offer investors a variety of ways to engage with and benefit from their investments. These methods are primarily distinguished by the level of direct involvement and resources an investor is willing and able to commit. The three prevalent methods in private market investments include Direct Investment, Co-Investment, and Fund Investment Alternatives. Each of these methods has its unique characteristics, advantages, and considerations that cater to different investor profiles based on their commitment size and the ability and willingness to manage the investment actively.

Direct Investment refers to the approach where investors directly purchase equity ownership or make private debt investments in companies, bypassing any intermediaries. This strategy often involves acquiring a significant, if not controlling, stake in a company, as seen in buyout equity transactions. Direct investors take on the responsibility of negotiating purchase prices and devising business strategies to increase value over the investment period. Large asset owners, such as sovereign wealth funds, commonly employ this method to potentially mitigate portfolio concentration risk in sizeable acquisitions. For example, Berkshire Hathaway’s acquisition of Precision Castparts Corp. for $37.2 billion in 2016 is a prime instance of direct investment, showcasing the scale and direct involvement required in such transactions.

Co-Investment allows investors to partner with experienced lead investors, reducing the capital requirement and leveraging the lead investor’s expertise. A real-world example is Google Ventures co-investing with Sequoia Capital in the Series A funding of HubSpot, a marketing, sales, and service software provider. This illustrates how co-investments can provide access to high-quality deals with reduced individual risk.

Direct Co-Investment is a collaborative strategy where investors, alongside one or more partners, acquire an ownership stake or private debt. Partners may include private fund managers. This approach helps investors to distribute their private market portfolio more evenly, capitalize on the expertise of their investment partners, and enjoy lower fees compared to indirect investments. An illustrative case is GIC’s partnership with Oak Street in acquiring STORE Capital, demonstrating how sovereign wealth funds can engage in co-investments with private equity firms, especially in sectors like US real estate.

Limited Partner (LP) Co-Investment is a specialized form where investors, as limited partners, acquire stakes or private debt in investments managed by a private fund manager. LPs with strong relationships with General Partners (GPs) and the willingness to make significant investments might receive co-investment rights. This privilege enables them to participate in opportunities before they are widely available. Such arrangements are often favored for minority stakes in startups, where smaller investments are sought. Despite being open to smaller investors, these opportunities may have a minimal effect on larger portfolios due to startups’ high failure rates. This underscores the value of deep industry knowledge and experience in evaluating investments. Angel investors, who are usually affluent individuals or seasoned entrepreneurs, frequently engage in early-stage financing for startups, showcasing the variety within direct investment strategies.

Benefits for General Partners

Challenges and Considerations for Limited Partners

Fund Investment Alternatives involve investing in private equity or venture capital funds managed by professional managers. This method offers diversification and requires less direct involvement. An example is an investment in the Carlyle Group’s U.S. Equity Opportunity Fund, which diversifies investor capital across multiple companies within the fund’s focus area.

Private investment structures, such as closed-end funds organized as limited partnerships, play a crucial role in managing the relationship between general partners (GPs) and limited partners (LPs). These structures are designed to align interests and manage the investment life cycle effectively.

Corporate Governance and Legal Entities in private markets can vary widely, with minority investors often negotiating for special provisions like board seats or veto rights on strategic decisions. For instance, in the acquisition of Beats by Dre, minority investors negotiated for specific governance rights before the company was eventually sold to Apple.

Take-private transactions and Leveraged Buyouts (LBOs) typically involve creating a new legal entity to facilitate the acquisition, heavily financed through debt. Dell’s $24.4 billion buyout in 2013, led by its founder Michael Dell and Silver Lake Partners, is a notable example of an LBO, showcasing the complex financing and governance structures involved.

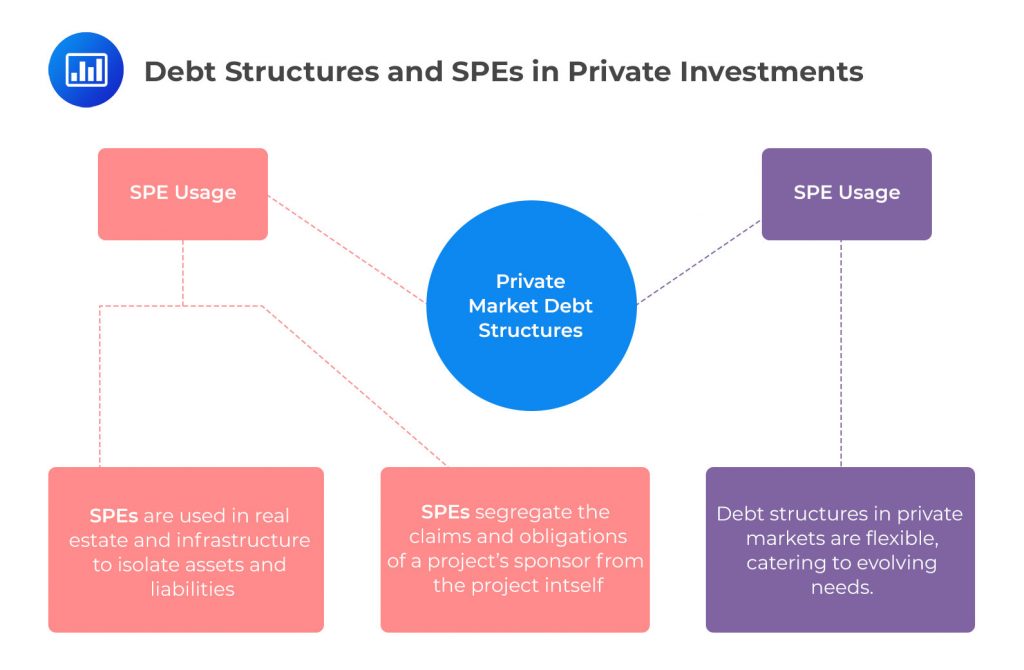

Debt Profile and Financing Structures in LBOs are designed to be flexible, accommodating evolving needs. Direct investment in private debt, such as the senior secured loans provided by Ares Capital Corporation to middle-market companies, illustrates the various ways investors can gain exposure to private debt.

Special Purpose Entities (SPEs) are often used in real estate and infrastructure to isolate investment projects from investors’ balance sheets. The Hudson Yards development in New York City, financed through a mix of equity and debt by a consortium of investors and developers, demonstrates the use of SPEs in large-scale real estate projects.

Questions

Question 1

In investments, public markets and private markets offer different opportunities and challenges. If an investor chooses to invest in public markets, they have the option to either select individual securities directly or delegate the selection to a public fund manager. On the other hand, private market investments involve more complex methods, longer holding periods, and a higher degree of manager engagement. Who are the two key parties in this structure whose interests need to be aligned for the successful functioning of private market investments?

- Public fund manager and individual investor

- General partners (GPs) and limited partners (LPs)

- Securities and fund manager

Answer: B is correct.

The two key parties in the structure of a closed-end fund, typically organized as a limited partnership in private markets, are the General Partners (GPs) and Limited Partners (LPs). The GPs are the managers of the fund who make the investment decisions and are responsible for the day-to-day operations of the fund. They have a fiduciary duty to act in the best interests of the LPs. The LPs are the investors who provide the capital for the fund. They have limited liability, meaning their losses are limited to the amount of their investment. The interests of the GPs and LPs need to be aligned for the successful functioning of private market investments. This is often achieved through the use of performance-based compensation for the GPs, which aligns their interests with those of the LPs by incentivizing them to maximize the return on the fund’s investments.

A is incorrect. The public fund manager and individual investor are key parties in public market investments, not private market investments. While their interests also need to be aligned for successful investing, this is not the structure typically used in private markets.

C is incorrect. Securities and fund manager are not the two key parties in the structure of a closed-end fund in private markets. Securities are the assets in which the fund invests, not a party to the fund structure. The fund manager could be considered a key party, but in the context of a closed-end fund in private markets, the correct term is General Partner.

Question 2

The investment landscape is diverse, with different strategies and structures available for investors. What is the primary characteristic of private market investments that differentiates it from public market investments?

- Private market investments are characterized by shorter holding periods

- Private market investments are characterized by a lower degree of manager engagement

- Private market investments are characterized by longer holding periods and a higher degree of manager engagement

Answer: C is correct.

Private market investments are characterized by longer holding periods and a higher degree of manager engagement. This is the primary characteristic that differentiates private market investments from public market investments. Private market investments, such as private equity, venture capital, and real estate, typically involve a longer-term commitment from investors. This is because these investments are often illiquid and cannot be easily sold or exchanged for cash. Additionally, managers of private market investments are typically more engaged in the operations of the companies they invest in. They often take an active role in strategic decision-making and may sit on the company’s board of directors. This high degree of engagement is intended to align the interests of the managers with those of the investors and to maximize the potential for high returns.

A is incorrect. Private market investments are not characterized by shorter holding periods. In fact, the opposite is true. Private market investments typically require a longer-term commitment from investors due to their illiquid nature.

B is incorrect. Private market investments are not characterized by a lower degree of manager engagement. Again, the opposite is true. Managers of private market investments are typically more engaged in the operations of the companies they invest in, often taking an active role in strategic decision-making.

Private Markets Pathway Volume 1: Learning Module 1: Private Investments and Structures; LOS 1(b): Discuss private investment methods and structures and their uses

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.