Equity Strategies.

Equity investment strategies, particularly those based on indexes, are a crucial part of... Read More

Private market investments are characterized by specific roles and responsibilities for the general partners (GPs) of closed-end private market funds. These roles differ significantly from those of public market fund managers. For instance, while a public market fund manager at a company like Vanguard might focus on selecting securities or indices based on public information, a GP at a private equity firm like Blackstone would have a more hands-on role in managing investments.

Public Market Fund Managers: Public market fund managers primarily engage in security or index selection based on public information. They use financial statement analysis to select stocks for mutual funds.

Non-Controlling Shareholders: Non-controlling shareholders have management decisions limited to voting rights for public shares or bondholders. However, they lack the power to renegotiate the terms of outstanding bonds prior to maturity.

Characteristics of Public Funds: Public funds are generally open-ended, with continuous inflows and outflows of investor capital. This structure is similar to how mutual funds operate.

Types of Public Investments: Public investments involve standardized equity or debt contracts for mature companies. Additionally, they include ownership of income-producing assets, such as real estate investment trusts (REITs) like Simon Property Group.

Basis for Decisions: Public fund managers base their decisions on financial statement analysis and other means.

Performance Comparisons: Public markets also allow fund performance comparisons with available benchmarks, such as the S&P 500.

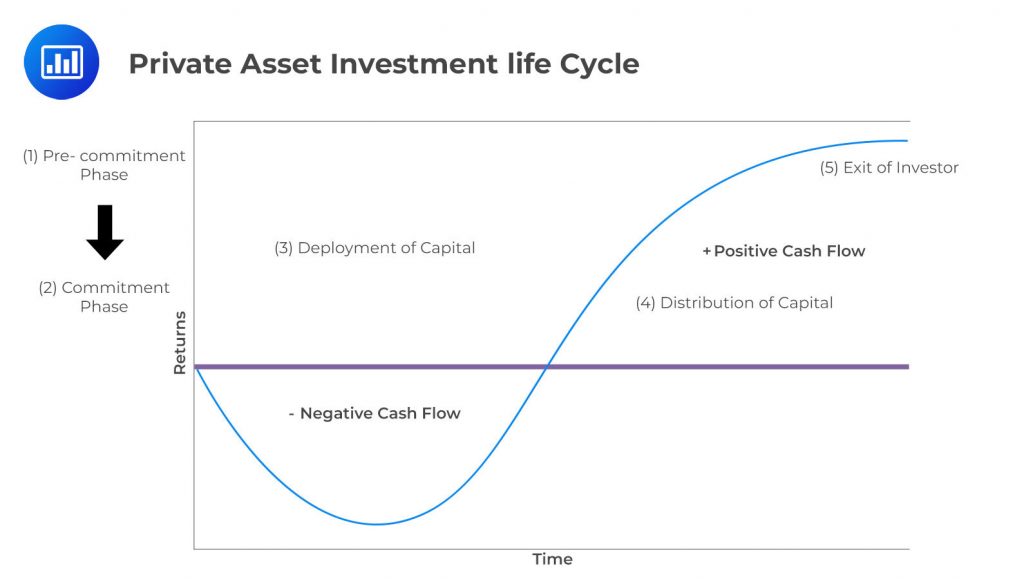

Private Funds: Private funds are typically closed-end, illiquid limited partnerships with a fixed contractual term. For instance, a private equity fund managed by KKR might have a 10-year term.

Capital Commitment: These partnerships usually require an upfront capital commitment from investors. Institutional investors, such as pension funds or endowments, commit a certain amount of capital to the fund upfront.

Investment Deployment: This capital is deployed over time in longer-term, illiquid investments. These investments either mature in the case of debt or are exited near the end of the partnership’s contractual life. Examples include early-stage or mature companies with high potential and undervalued or undeveloped assets.

Focus on Value Addition: Private investments aim to add value and generate returns over the life cycle. This could involve restructuring a company, developing a new product, or improving operations.

Role of General Partners (GPs): GPs operating in private markets typically have control of or significant influence over fewer investments. Price transparency is limited, and reliable benchmarking is scarce during the investment’s life.

The distinct nature of private markets gives rise to unique roles and responsibilities among private market GPs. These duties are shown in the figure below.

Pre-commitment is a crucial step in the process of seeking capital commitments from investors by private fund General Partners (GPs). This step involves the establishment of an investment strategy or thesis that reflects the fund’s focus. The strategy is primarily determined by the specialized knowledge and experience of the GPs, especially in private market fund strategy, due to the higher degree of control exercised over these investments.

Specialized knowledge and experience play a significant role in determining the private market fund strategy. For instance, biotech venture capital fund GPs are often led by researchers and scientists with extensive experience in conducting basic research, clinical trials, and bringing new drugs to market. On the other hand, a Southeast Asia-based real estate GP focusing on new development would typically require local expertise and experience in construction, contracting, and operations.

Identifying areas of investment focus before conducting and completing due diligence on a select few candidates is a crucial pre-commitment step. This step is essential as it helps in identifying potential value creation over the investment life cycle, a common feature among prospective private investments.

Value creation occurs in different ways over the company life cycle, depending on the type of investment. For venture capital, value creation may involve a new product going to market or targeting exponential growth. In contrast, for buyout equity, value creation often involves restructuring and streamlining established operations.

A General Partner (GP) of a private fund, after identifying its primary focus area, dedicates resources to initiate due diligence and formulate business and financing plans for targeted investments. This process involves soliciting unfunded capital commitments from Limited Partners (LPs). Prospective LPs, on the other hand, engage in manager selection by conducting due diligence and analysis of the GP’s track record and prospective investment opportunities. They make unfunded debt or equity capital commitments to a fund by entering into a limited partnership agreement. The limited partnership agreement is a crucial document that is negotiated and specifies the fees, rights, terms, and conditions of the partnership. These elements may vary among individual LPs based on the timing and size of commitment to a fund. The process of capital commitment in private funds is contrasted with public funds through a case study. For example, while an investor in a mutual fund can buy or sell shares at any time, an investor in a private equity fund makes a commitment of capital upfront and cannot easily exit the investment.

Private fund General Partners (GPs) conduct due diligence on top targets and create a detailed business plan for new managers. For example, a GP at a private equity firm might conduct due diligence on a potential acquisition target and create a business plan for how to improve the company’s operations and profitability. A comprehensive financing plan is also created to achieve expected returns before bidding on investments. This might involve determining the optimal mix of debt and equity financing.

The initial year in which capital is deployed in a private market transaction is referred to as a fund’s vintage year. This is an important benchmarking statistic that facilitates performance comparisons among investments made in different periods. A GP deploying capital over multiple years for a single fund has one vintage year, defined as the first year in which capital is deployed. For example, if a private equity fund makes its first investment in 2020, 2020 would be the fund’s vintage year.

In private equity, a GP may deploy buyout capital by purchasing a business for restructuring purposes. This could be an acquisition of a public company in a take-private transaction, the purchase of a public company division, or an acquisition of a private firm. For example, a GP at a private equity firm like Apollo Global Management might deploy capital to buy a struggling company, restructure its operations, and then sell it for a profit. The initial phase of a buyout equity transaction also referred to as a leveraged buyout (LBO), involves the roles of GPs and Limited Partners (LPs).

General Partner Responsibilities: Both the initial financing phase and subsequent refinancing stages fall under the primary responsibility of a general partner (GP). These responsibilities encompass several critical tasks. First, GPs negotiate the purchase price and legal terms of acquiring the target company. Next, they establish an acquiring entity that will facilitate the acquisition process. Additionally, GPs arrange short-term debt financing to support the acquisition. As part of the process, they oversee the merger of the acquiring and target companies. Finally, GPs raise an optimal combination of medium- and long-term debt instruments for the new entity.

Advisers and Support: GPs often collaborate with advisers in various areas, including financing, legal matters, and taxation. For instance, a GP might engage a law firm to handle the legal aspects of a specific acquisition.

Due to the uncertainty of the timing and size of capital drawdowns, GPs may use credit facilities known as subscription lines. These are short-term lines of credit secured by investor fund commitments rather than the underlying assets themselves. For example, a GP might use a subscription line to bridge the gap between when an investment needs to be made and when capital can be drawn down from investors. In these cases, the deployment phase often involves managing and monitoring progress over phases, including land or property acquisition, land improvement, and construction. For example, a GP at a real estate private equity firm might oversee the development of a new office building, from acquiring the land to overseeing the construction process. Periodic drawdown of additional debt and equity are contingent on meeting specific milestones. For instance, additional capital might be drawn down once the building’s foundation has been completed.

Private market fund distributions are uncertain in terms of timing and magnitude, hence the use of compound versus periodic measures of return. These distributions include dividends and divestments for private equity funds, and interest and principal payments for private debt funds. General Partners (GPs) often control portfolio company dividend policies and divestments. For example, a GP might decide to have a portfolio company pay a dividend to investors or sell a portfolio company to generate a return. For private debt, issuer contingencies such as debt prepayability, callability, or interest paid in kind or accrued with an increase in principal outstanding and repaid at maturity, contribute to greater cash flow uncertainty.

General Partners (GPs) and Private Market Secondaries:

GPs play a crucial role in facilitating the purchase or sale of existing partnership stakes in the secondary market, commonly known as secondaries. For instance, a GP might assist in selling an LP’s stake in the fund to another investor.

Secondaries, unlike public securities, trade at wider spreads as a percentage of net asset value (NAV). This difference reflects the inherent illiquidity and uncertainty associated with private market investments.

The secondary market offers new investors an opportunity to acquire seasoned, mid-cycle investments. This allows for diversification across different managers, partnerships, and vintage years. For example, an investor might purchase a secondary interest in a private equity fund that is halfway through its term, gaining exposure to the fund’s existing investments.

On the other side, LPs selling secondaries may seek to reduce exposure to existing investments and free up capital for new partnerships. For instance, a pension fund might sell a secondary interest in a private equity fund to invest in a new fund.

Overall, GPs enable investors to buy or sell otherwise illiquid positions, providing a broader range of opportunities across different stages and timeframes. Additionally, this activity helps expand and diversify their investor base for future transactions.

Private fund GPs are primarily responsible for the sale or exit of an investment, asset, or project at the end of a holding period and the return of capital to investors. For example, a GP might sell a portfolio company to another company or take it public through an initial public offering (IPO).

In the case of private equity, this may involve the sale of a company to a private buyer or an initial public offering to public market investors. For example, a GP at a private equity firm like Carlyle might sell a portfolio company to another company or take it public through an IPO.

GP skills in executing a business plan that creates value and then identifying potential buyer synergies or preparing and executing a public offering under favorable market conditions are critical factors affecting LP returns. For example, a GP’s ability to improve a portfolio company’s operations and then sell it at a high valuation can significantly impact the returns for LPs.

GPs provide periodic fund valuations to investors. Unlike public fund investments, whose net asset value is based on observed market prices, private asset values rely on valuation techniques, such as discounted cash flows, the use of comparable transactions, and market-based multiples. For example, a GP might value a portfolio company based on the price paid in a recent transaction for a similar company.

These private asset valuations are far less transparent, with their potential realization dependent on a GP’s ability to realize illiquid capital gains in the company, project, or asset since inception. For example, the actual value of a portfolio company might not be known until it is sold or goes public.

Practice Questions

Question 1: A student is comparing the roles and responsibilities of public market fund managers and private market fund managers. He notes that public market fund managers primarily engage in security or index selection based on public information and act as non-controlling shareholders. On the other hand, private market fund managers operate in closed-end, illiquid limited partnerships with a fixed contractual term. Given these differences, which of the following statements is most accurate about the nature of investments and decision-making in public and private markets?

- Public market fund managers have more control over their investments than private market fund managers, as they can renegotiate the terms of outstanding bonds prior to maturity.

- Private market fund managers typically have either control of or significant influence over fewer investments, with little or no price transparency or reliable benchmarking available during the life of an investment.

- Both public and private market fund managers have the same level of control and influence over their investments, and both types of markets offer the same level of price transparency and benchmarking.

Answer: Choice B is correct.

Private market fund managers typically have either control of or significant influence over fewer investments, with little or no price transparency or reliable benchmarking available during the life of an investment. This is because private markets are less liquid and less transparent than public markets. Private market fund managers often invest in private equity, venture capital, real estate, and other illiquid assets. These investments are not publicly traded and do not have readily available market prices. As a result, private market fund managers often have significant influence over the management and strategic direction of their investments. They also face challenges in benchmarking their performance due to the lack of comparable publicly traded investments. On the other hand, public market fund managers invest in publicly traded securities, which have readily available market prices and can be benchmarked against public market indices. However, they typically act as non-controlling shareholders and do not have the same level of influence over their investments as private market fund managers.

Choice A is incorrect. Public market fund managers do not have more control over their investments than private market fund managers. While they can sell their holdings if they are dissatisfied with the management or performance of a company, they do not have the ability to renegotiate the terms of outstanding bonds prior to maturity. This is a misunderstanding of the nature of bond contracts and the role of public market fund managers.

Choice C is incorrect. Public and private market fund managers do not have the same level of control and influence over their investments, and the two types of markets do not offer the same level of price transparency and benchmarking. As explained above, private market fund managers typically have more control and influence over their investments, while public markets offer more price transparency and benchmarking opportunities.

Question 2: A financial analyst is studying the characteristics of private market investments. She understands that these investments are usually closed-end, illiquid limited partnerships with a fixed contractual term. The capital for these investments is deployed over time in longer-term, illiquid investments. Given this information, which of the following is most likely to be a characteristic of the companies or assets in which private market funds invest?

- They are mature companies with low potential and overvalued or fully developed assets.

- They are early-stage or mature companies with high potential and undervalued or undeveloped assets.

- They are companies or assets with high liquidity and short-term investment horizons.

Answer: Choice B is correct.

Private market investments typically target early-stage or mature companies with high potential and undervalued or undeveloped assets. These investments are usually made in the form of closed-end, illiquid limited partnerships with a fixed contractual term. The capital for these investments is deployed over time in longer-term, illiquid investments. The goal of these investments is to generate high returns by investing in companies or assets that have the potential for significant growth or value creation. This often involves investing in companies or assets that are undervalued or underdeveloped and then working to improve their performance or develop their potential. This can involve a range of strategies, from venture capital investments in early-stage companies to buyouts of mature companies that are underperforming or undervalued. Therefore, the characteristic of the companies or assets in which private market funds invest is most likely to be that they are early-stage or mature companies with high potential and undervalued or undeveloped assets.

Choice A is incorrect. Private market investments do not typically target mature companies with low potential and overvalued or fully developed assets. While private market funds may invest in mature companies, they are typically looking for companies that are undervalued or have the potential for significant improvement or growth.

Choice C is incorrect. Private market investments are typically illiquid and have longer-term investment horizons. They do not typically target companies or assets with high liquidity and short-term investment horizons. The illiquidity and longer-term nature of these investments is part of what allows them to potentially generate higher returns, as they are able to invest in and develop companies or assets over a longer period of time.

Private Markets Pathway Volume 1: Learning Module 2: General Partner and Investor Perspectives and the Investment Process; LOS 2(a): Discuss a general partner’s roles and responsibilities in managing private investment funds

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.