Composites: Inclusion and Exclusion of ...

The GIPS standards for constructing composites mandate the timely and consistent inclusion of... Read More

Infrastructure investments, a subset of private market investments, are characterized by their diverse forms and scales. These investments can range from fund investments in a portfolio of infrastructure assets or projects, to co-investments, or even direct investments in a specific project or asset. The scale of these investments can vary greatly. For instance, smaller investors typically participate as one of many limited partners due to the large-scale, highly illiquid nature of these assets. Conversely, larger institutional investors often consider significant minority, majority, or even 100% ownership.

Infrastructure investments require a high degree of technical, engineering, regulatory, and other expertise to ensure the physical and economic feasibility over the life cycle of a project.

Smaller general partner (GP) funds and investors often co-invest with major fund managers, sovereign wealth funds, or pension funds that have the necessary resources and expertise.

Infrastructure investments are often associated with essential services or public goods, and are therefore created and supported in tightly regulated markets governed by regional or national authorities. Public entities often play a key role in determining the investment method, types of financing, and parties involved. In developing countries, regional development banks or supranational entities, such as the International Finance Corporation (IFC), often offer technical assistance for engineering and financing proposals and bid processes.

Most developed market governments have created export credit agencies (ECAs) to promote the export of domestic goods and services via credit insurance, subsidized or guaranteed debt financing. This is often a key factor in reducing cost, extending the tenor, or increasing the availability of debt financing for capital goods used in developing market infrastructure.

ECAs play a crucial role in reducing costs, extending the tenor, or increasing the availability of debt financing for capital goods used in developing market infrastructure projects.

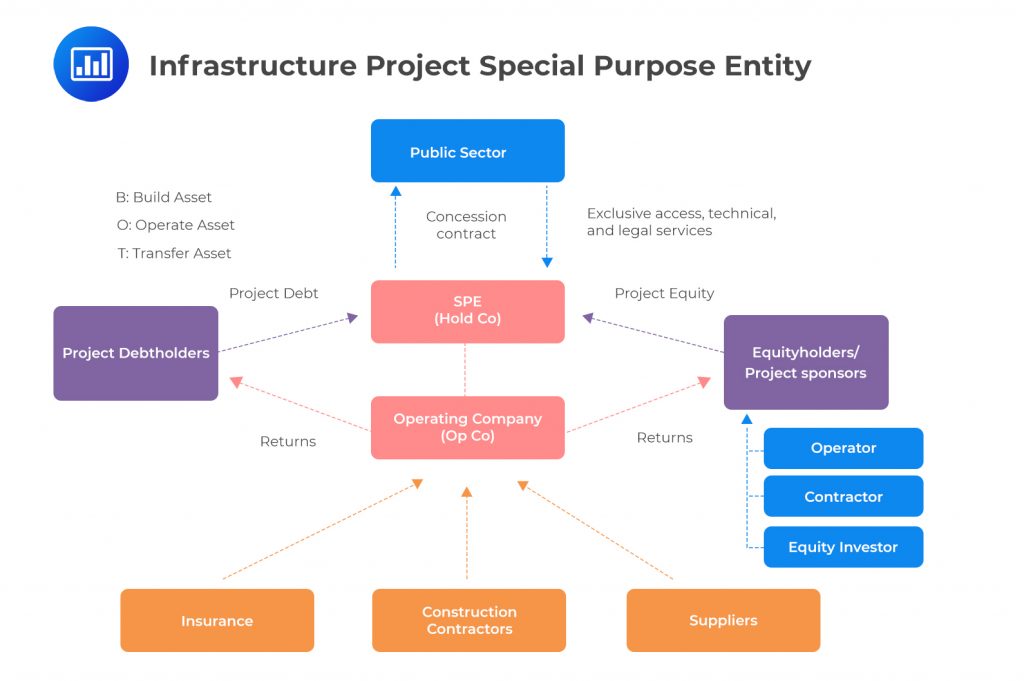

Objective of SPE: To govern the complex contractual relationships among various parties involved in infrastructure projects, including developers, contractors, suppliers, service providers, managers, and investors.

Custom Structure: Each project’s SPE structure is uniquely tailored to suit its specific requirements, ensuring appropriate allocation of cash sources and uses, risks, roles, and responsibilities.

Holding Company (HoldCo): Acts as a financing vehicle, separate from the project’s operational aspects but crucial for its financial structuring.

Operating Company (OpCo): Holds the project’s tangible assets, enters into contracts, and is responsible for generating cash flows from the project’s operations.

Issuance of Securities: Both HoldCo and OpCo may issue securities to raise funds. The terms of these securities, especially the seniority of claims, are crucial for investors to understand in relation to project cash flows.

Legal Segregation: SPEs ensure legal and financial separation of the project from its sponsors, limiting their risk exposure and providing clear financial demarcation.

Standardized Procedures: Infrastructure projects employ standardized procedures for selecting parties involved at various stages (development, construction, operation, financing) once the project’s size, scope, and timing are established.

Project Life Cycle Governance: The SPE structure facilitates governance over the entire project life cycle, aligning with the project’s evolving needs and stakeholder interests.

Risk and Responsibility Allocation: Within the SPE framework, there is a deliberate and detailed allocation of risks and responsibilities among the parties, helping to mitigate project-specific risks effectively.

Investor Awareness: Investors must be acutely aware of the structure of the SPE, particularly the distinctions between HoldCo and OpCo, to understand the implications for their investment’s risk and return profile.

RFP: The RFP serves as a foundational document in the infrastructure project bidding process. It details project specifics, requirements, and timelines, alongside criteria for assessing and selecting the winning bid. The RFP specifies the size, scope, and technical requirements of the project. It also outlines the essential services the infrastructure asset must provide. This comprehensive document is made available to all interested parties intending to submit a bid.

Purpose of the RFP: The main objectives of the RFP process are to ensure a level playing field for all bidders, promote competition, and guarantee transparency throughout the bidding process.

Sealed Bid Submission: Interested parties submit their proposals through a sealed bid process. This method ensures that all bids are kept confidential until the deadline, preventing any undue influence or bias in the selection process.

Assessment Criteria: The RFP outlines specific criteria for evaluating bids. These criteria are used to assess the technical feasibility, financial viability, and overall alignment of each proposal with the project’s objectives.

Awarding Contracts: Contracts are awarded to the bidders who best meet the project’s requirements as outlined in the RFP. The decision is based on a comprehensive evaluation of each proposal against the set criteria.

Fair and Transparent Process: The RFP process is designed to be fair and transparent, providing equal opportunity to all bidders. It aims to select the most suitable proposal based on merit and alignment with project goals.

Practice Questions

Question 1: Consider an investor looking to diversify their portfolio by investing in infrastructure projects. They are considering different forms of investment, including fund investments, co-investments, and direct investments. However, they are aware that the scale of these investments can vary greatly and that they may require a high degree of technical, engineering, regulatory, and other expertise. In this context, which type of investor is most likely to consider significant minority, majority, or even 100% ownership in infrastructure investments?

- Smaller investors who typically invest as one of many limited partners

- General partner (GP) funds and other investors who lack the necessary resources and expertise

- Larger institutional investors

Answer: Choice C is correct.

Larger institutional investors are most likely to consider significant minority, majority, or even 100% ownership in infrastructure investments. These investors, such as pension funds, insurance companies, and sovereign wealth funds, have the financial resources and often the necessary expertise to manage such large-scale investments. They are also more likely to have the long-term investment horizon that matches the long-term nature of infrastructure projects. By taking a significant ownership stake, these investors can have a greater influence over the project and potentially earn higher returns. However, this also means they bear a greater share of the risk and responsibility for the project’s success. Therefore, these types of investments are typically only suitable for larger institutional investors who have the necessary resources and expertise to manage them effectively.

Choice A is incorrect. Smaller investors who typically invest as one of many limited partners are unlikely to consider significant ownership stakes in infrastructure investments. These investors often lack the financial resources and expertise to manage such large-scale investments. They are also more likely to prefer the diversification benefits of investing as part of a larger group of investors, rather than taking on the risk and responsibility of a significant ownership stake.

Choice B is incorrect. General partner (GP) funds and other investors who lack the necessary resources and expertise are also unlikely to consider significant ownership stakes in infrastructure investments. These investors often lack the financial resources and expertise to manage such large-scale investments. They are also more likely to prefer the diversification benefits of investing as part of a larger group of investors, rather than taking on the risk and responsibility of a significant ownership stake.

Question 2: A UK-based company is planning to set up a wind farm. They understand that the project requires assembly, installation, and operation of the wind turbines to generate and transmit electricity to the power grid at optimal levels. In this context, which institution’s regulations and pricing would they need to comply with?

- The British Standards Institution

- The Office of Gas and Electricity Markets

- Both the British Standards Institution and the Office of Gas and Electricity Markets

Answer: Choice B is correct.

The UK-based company planning to set up a wind farm would need to comply with the regulations and pricing of The Office of Gas and Electricity Markets (Ofgem). Ofgem is the government regulator for the electricity and downstream natural gas markets in the United Kingdom. It was formed by the Utilities Act 2000 and is responsible for protecting the interests of existing and future electricity and gas consumers. This includes the regulation of the rates that power producers can charge for their electricity, as well as the standards they must meet in terms of safety, reliability, and environmental impact. In the context of a wind farm, Ofgem would be the relevant institution to ensure that the electricity generated is transmitted to the power grid at optimal levels and at fair prices.

Choice A is incorrect. The British Standards Institution (BSI) is the national standards body of the United Kingdom. BSI produces technical standards on a wide range of products and services and also supplies certification and standards-related services to businesses. While BSI may have standards that relate to the construction and operation of wind turbines, it does not regulate the transmission of electricity to the power grid or set the prices for electricity.

Choice C is incorrect. While both the British Standards Institution and the Office of Gas and Electricity Markets have roles in the broader energy sector, only Ofgem is directly involved in the regulation and pricing of electricity transmission to the power grid. Therefore, a company setting up a wind farm would primarily need to comply with Ofgem’s regulations and pricing.

Private Markets Pathway Volume 2: Learning Module 7: Infrastructure; LOS 7(b): Discuss infrastructure investment methods and investment vehicles and their uses

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.