Standard VII – Responsibilities as a ...

Standard VII(A) – Conduct as participants in CFA Institute programs Members and Candidates... Read More

Infrastructure assets, such as highways, power plants, or water treatment facilities, are a unique type of private market investment. Unlike venture capital or real estate investments, which can be transformed or repurposed over time, infrastructure assets are characterized by their large scale, high degree of illiquidity, and inability to be repurposed. This makes the value creation process in the project life cycle of infrastructure assets distinct from other private market investments.

These assets are large-scale fixed assets that require significant upfront investment to deliver essential services or public goods. For instance, a private equity investor might change their restructuring plans for a tech startup based on market conditions, or a real estate investor might repurpose a commercial building into residential apartments to meet changing demand. However, infrastructure investments, due to their nature, are usually more difficult to liquidate or convert to alternative uses.

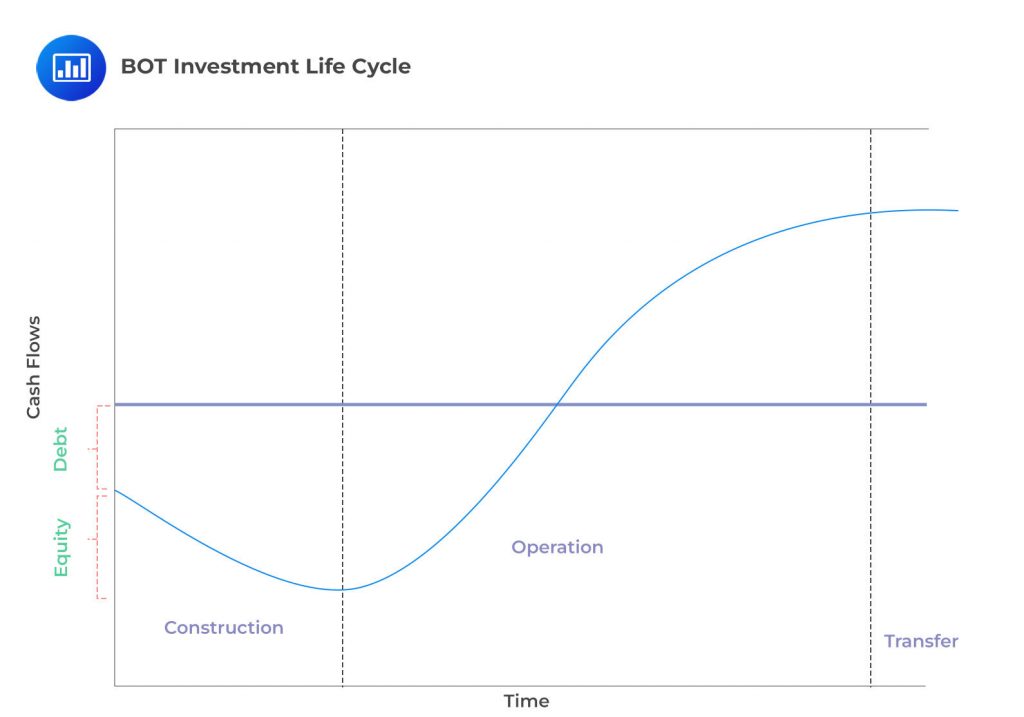

BOT is a form of project financing where a private entity receives a concession from the public sector to finance, design, construct, and operate a facility stated in the concession contract. This model is particularly used for large-scale infrastructure projects such as roads, bridges, and water treatment facilities. The project involves three main phases: the Construction phase, the Operate phase, and the Transfer phase.

The initial stage involves the construction of the infrastructure asset by a private company or consortium. This phase covers all activities from planning, securing financing, to the actual construction of the project.

Significant capital investment is required, with funding often sourced from a combination of debt and equity financing.

The project’s feasibility, design, and compliance with regulatory standards are critical focuses during this phase.

Following construction, the project enters the operational phase, where the asset is utilized to provide the intended service (e.g., toll collection on a road).

Cash flows generated during this period are used to cover debt service, operating and maintenance expenses, and other costs.

Excess revenues are typically distributed to equity investors in the form of dividends, considering the project’s minimal or zero terminal value.

This phase lasts for a predetermined number of years, according to the project agreement.

The final stage involves transferring ownership of the infrastructure asset to a public authority or government entity, often at no cost.

This transfer marks the end of the private entity’s involvement in the project, with no residual value to the private investors beyond the contractually agreed upon terms.

The transfer ensures that the public benefits from the continued use of the asset, aligning with the project’s long-term social and economic goals.

Specialized Fixed Assets: Infrastructure projects involve high sunk costs and specialized assets, making their payout period typically span several decades.

Financing Structure: Unlike other private investments, infrastructure projects rely heavily on dividend payments to equity investors due to the minimal or zero terminal value of the assets.

Debt Repayment: The equity cushion’s reduction over time influences the project’s ability to support debt, necessitating earlier debt repayment in the project’s lifecycle.

Most Special Purpose Vehicles (SPVs) managing infrastructure assets adhere to a strict cash flow waterfall that dictates the prioritization of cash flows for meeting all obligations and payments to debt- and equityholders.

The first allocation of the Project SPV’s income is towards the Operating and Maintenance Costs (O&M Costs). These are the day-to-day expenses necessary to keep the project up and running, and they are prioritized to ensure the continuous operation of the asset.

Once the O&M Costs have been covered, payments are then made to Senior Debtholders. These are lenders or bondholders who have the highest claim on the SPV’s cash flows and typically the lowest risk. Their debt is serviced first out of the available cash flow after O&M Costs.

Following the senior debt, if there are still funds available, Junior Debtholders receive payments. These debtholders hold subordinated debt, which means they get paid only after the senior debt obligations have been met. This debt is generally associated with higher risk compared to senior debt.

Finally, if the SPV has any remaining funds after all debts have been serviced, Equityholders receive their payments. Equityholders own the residual interest in the SPV after all debts have been paid. They typically take on the highest risk because they are last in line to be paid and their returns are not guaranteed.

SPVs often utilize debt, which can be enhanced by establishing reserve accounts for debt service and other obligations. This practice is particularly common when project cash flows are unpredictable. A Debt Service Reserve Account (DSRA) is typically set up to accumulate enough cash to meet specific debt service requirements. Funds from this account are released when payments are due. Reserve accounts are also frequently used for operating and maintenance costs, as well as for decommissioning equipment at the end of its serviceable life. For instance, consider the case of a wind farm project. At the end of the project’s life, a reserve account would be used to cover the costs of dismantling the wind turbines and restoring the site to its original condition.

The roles of debt and equity financing in infrastructure projects can vary significantly. This depends on the business model, the underlying industry, and the public and private entities involved in a specific project. Debt investors often consider leverage and coverage measures to evaluate creditworthiness. These include the Loan to Value (LTV) and the Debt Service Coverage Ratio (DSCR) which can be calculated using

$$ \text{LTV} = \frac{\text{Loan Amount}}{\text{Appraised Value}}$$

$$ \text{DSCR} = \frac{\text{Net Operating Income}}{\text{Total Debt Service}}$$

For example, if a company is seeking to finance a new manufacturing plant, the LTV ratio would be calculated by dividing the amount of the loan by the appraised value of the plant. The DSCR would be calculated by dividing the net operating income of the plant by the total debt service.

Equity investors, on the other hand, evaluate before-tax returns using actual or expected net cash flow from operations minus debt service to establish an equity dividend rate.

$$\text{Equity dividend rate} = \frac{\text{Before-tax net cash flow}}{\text{Equity invested}}$$

Where:

$$\text{Before-tax net cash flow} = \text{Net cash flow from operations} – \text{Debt service}$$

It’s important to note that this equity return calculation rate does not include fees.

The General Partner (GP) fees can be calculated by:

$$ R_{\text{GP Net with hurdle}} = (P_1 \times r_m) + \max\{0, [P_1(1 – r_m) – P_0 \times (1 + r_h)] \times p\} $$

The GPs are compensated through a management fee for managing the investment and through a performance fee for achieving returns above a predefined hurdle rate, aligning the interests of the GP with those of the investors by incentivizing superior performance.

The infrastructure investment process and the use of debt and equity are similar to other private markets during the development and construction phases. However, the predefined operating period places constraints on the use of leverage. More complex, larger-scale projects in developing economies often rely on financial incentives, subsidies, and guarantees from multilateral institutions, developed market governments, and private partners to attract additional foreign debt and equity investors.

Practice Questions

Question 1: Consider an investor looking to diversify their portfolio with private market investments. They are considering venture capital, growth or buyout equity, value-add or opportunistic real estate projects, and infrastructure assets. However, they are concerned about the liquidity and flexibility of these investments. Based on the characteristics of these investment types, which of the following statements is most accurate?

- Infrastructure assets are characterized by their size, a higher degree of liquidity, and the ability to repurpose, unlike other private market investments.

- Unlike private equity investors who may alter restructuring or company exit plans based on market conditions, infrastructure investments are usually easier to liquidate or convert to alternative uses.

- Infrastructure assets are large-scale fixed assets that are often difficult to liquidate or convert to alternative uses, unlike other private market investments.

Answer: Choice C is correct.

Infrastructure assets are indeed large-scale fixed assets that are often difficult to liquidate or convert to alternative uses, unlike other private market investments. Infrastructure investments, such as roads, bridges, airports, and utilities, are typically large, illiquid, and have long investment horizons. They are not easily converted to other uses and are not readily saleable in the market, making them less flexible and liquid compared to other types of investments. This is a key characteristic that differentiates infrastructure investments from other private market investments like venture capital, growth or buyout equity, and real estate projects. These other types of investments may offer more flexibility and liquidity, as they can be more easily sold or repurposed based on market conditions and investor needs. Therefore, while infrastructure investments can provide diversification benefits and potential for high returns, they also come with significant liquidity risks that investors need to consider.

Choice A is incorrect. While infrastructure assets are characterized by their size, they do not typically offer a higher degree of liquidity or the ability to repurpose. As mentioned above, these assets are often large, illiquid, and not easily converted to other uses.

Choice B is incorrect. Infrastructure investments are not usually easier to liquidate or convert to alternative uses compared to private equity investments. In fact, the opposite is often true. Private equity investors may have more flexibility to alter restructuring or company exit plans based on market conditions, while infrastructure investments are typically more difficult to liquidate or repurpose.

Question 2: A Special Purpose Entity (SPE) is considering investing in an infrastructure asset. They are aware that once an infrastructure asset enters the operating phase, cash flows are used to pay debt service, operating and maintenance expenses, and other costs, after which funds are available to equityholders in the form of dividends. Given the characteristics of infrastructure assets, which of the following statements is most accurate regarding the cash flow of SPEs investing in infrastructure assets?

- Most SPEs investing in infrastructure assets have a flexible cash flow waterfall that allows for a high degree of cash flow reinvestment and growth options.

- Most SPEs investing in infrastructure assets are characterized by a strict cash flow waterfall that dictates the prioritization and use of project cash flow to meet all obligations, as well as payments to debt- and equityholders.

- Most SPEs investing in infrastructure assets prioritize payments to equityholders over all other obligations, including debt service, operating and maintenance expenses.

Answer: Choice B is correct.

Most Special Purpose Entities (SPEs) investing in infrastructure assets are characterized by a strict cash flow waterfall that dictates the prioritization and use of project cash flow to meet all obligations, as well as payments to debt- and equityholders. This is because infrastructure assets are typically large, long-term investments that require significant upfront capital and ongoing maintenance. The cash flow from these assets is used to pay off the debt service, operating and maintenance expenses, and other costs before any funds are available to equityholders. This strict prioritization of cash flow is necessary to ensure that all obligations are met and that the project remains financially viable. The cash flow waterfall is a key feature of infrastructure investments and is designed to provide a predictable and stable return to investors, while also ensuring that the project’s financial obligations are met.

Choice A is incorrect. Most SPEs investing in infrastructure assets do not have a flexible cash flow waterfall that allows for a high degree of cash flow reinvestment and growth options. This is because the cash flow from infrastructure assets is typically used to meet strict financial obligations, leaving little room for reinvestment or growth.

Choice C is incorrect. Most SPEs investing in infrastructure assets do not prioritize payments to equityholders over all other obligations. This is because the cash flow from these assets is first used to meet debt service, operating and maintenance expenses, and other costs. Only after these obligations are met are funds available to equityholders. This prioritization ensures the financial viability of the project and protects the interests of all stakeholders.

Private Markets Pathway Volume 2: Learning Module 7: Infrastructure; LOS 7(c): Discuss the infrastructure investment process over the project life cycle and the roles of infrastructure debt and equity financing

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.