Information Needed in Advising Private ...

Personal Information Several factors contribute to the success of a wealth management relationship.... Read More

In this section, we delve into portfolio management and the complexities of handling multiple exposures to foreign currencies. In such cases, managers must consider the correlation among the currencies present in the portfolio.

For instance, one might assume that having exposure to two different foreign currencies in a portfolio would require hedging both currencies’ risks. However, if these currencies display high correlation, meaning they often move in sync, individually hedging each currency could lead to double-hedging or over-hedging. While deliberate over-hedging might be acceptable in specific scenarios, doing so inadvertently can pose risks and challenges.

A cross hedge occurs when a direct or conventional hedge may not be necessary because the portfolio already includes other investments that naturally provide a hedge. Natural hedges involve assets with a negative correlation, meaning they typically move in opposite directions.

For example, having gold in a portfolio can be a cross hedge for inflation risk. During periods of inflation, investors often turn to gold as a safe-haven asset, resulting in a strong negative correlation between the two. Another way to achieve a similar effect is by identifying two highly correlated assets and offsetting long and short positions.

On the other hand, a macro hedge involves using derivative products based on indices rather than specific assets or currencies. In the foreign exchange markets, one common macro hedge involves using derivatives tied to fixed-weight currency baskets, frequently traded in over-the-counter markets.

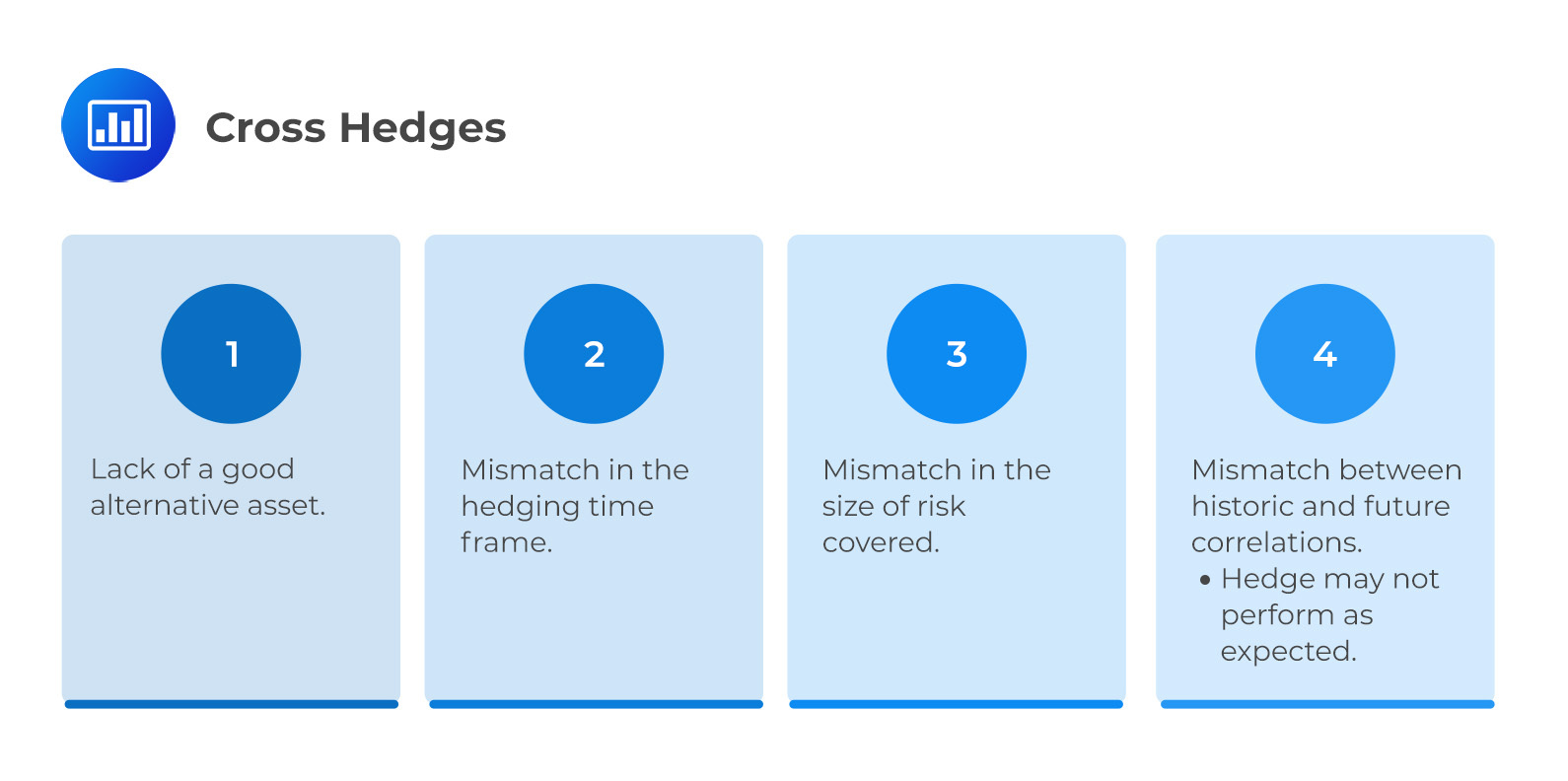

Below is a summary of the limits of cross hedges.

Macro Hedge

Macro HedgeA macro hedge is a specific type of cross hedge that deals with portfolio-wide risk factors instead of focusing on individual asset risks. Rather than targeting the risks of individual assets within the portfolio, a macro hedge considers the portfolio as a whole, considering its various risk exposures. These risk exposures may include credit, term, and liquidity risks.

In essence, a macro hedge looks at the broader picture of a portfolio’s risk profile and seeks to mitigate the impact of these global risk factors. It recognizes that the performance and behavior of different assets within the portfolio are interconnected, and therefore, addressing the collective risks can be more effective in managing overall risk exposure. By employing derivatives or other financial instruments based on indices, a macro hedge provides a systematic approach to hedge against various risk elements simultaneously. This way, it offers a comprehensive risk management strategy for the entire portfolio.

Minimum Variance Hedge Ratio

Minimum Variance Hedge RatioThe minimum variance hedge ratio is a vital concept in hedging strategies. It determines the optimal allocation between an asset and its corresponding hedging instrument. Essentially, it minimizes the overall portfolio’s variance or risk. For direct hedges, where the hedging instrument perfectly matches the underlying asset, this ratio is typically 1 or very close to +1 due to the high correlation between the two. However, in the case of cross and macro hedges, where assets and hedging instruments may not perfectly align, analysts must calculate the hedge ratio that achieves the lowest variance between the assets. This calculation is essential for effectively managing risks in these more complex hedging scenarios.

The minimum variance hedge ratio:

$$ \text{MVHR} = \rho \times \left(\frac {\sigma_a }{ \sigma_b} \right) $$

Where:

\(\rho\) = Correlation between assets a and b.

\(\sigma_a\) = Standard deviation of asset a.

\(\sigma_b\) = Standard deviation of asset a.

Note:

Portfolio managers should know that basis risk is introduced using cross or macro hedges instead of direct currency hedges. Basis risk arises due to the imperfect correlation between the price movements of the exposure being hedged and those of the cross-hedge instrument. Over time, this correlation may change, leading to an increased basis risk associated with the hedging strategy.

Question

All else equal, a lower correlation among the assets used in a cross-hedge most likely means the minimum variance hedge ratio will:

- Not be determinable.

- Be higher.

- Be lower.

Solution

The correct answer is A.

The formula for the Minimum Variance Hedge Ratio is as follows:

$$ \text{MVHR} = \rho \times \left(\frac {\sigma_a }{ \sigma_b} \right) $$

Where:

\(\rho\) = Correlation between assets a and b.

\(\sigma_a\) = Standard deviation of asset a.

\(\sigma_b\) = Standard deviation of asset a.

In the formula above, lower correlations will result in Minimum Variance Hedge Ratios closer to zero. This implies a higher ratio in situations with a negative correlation and a lower ratio when the correlation is positive. Consequently, additional information is required to answer the question accurately.

Reading 3: Currency Management: An Introduction

Los 3 (h) Describe the use of cross-hedges, macro-hedges, and minimum-variance-hedge ratios in portfolios exposed to multiple foreign currencies

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.