Portfolio Positioning Strategies

Understanding the economic cycle significantly influences the evolution of spread curves. Managers and... Read More

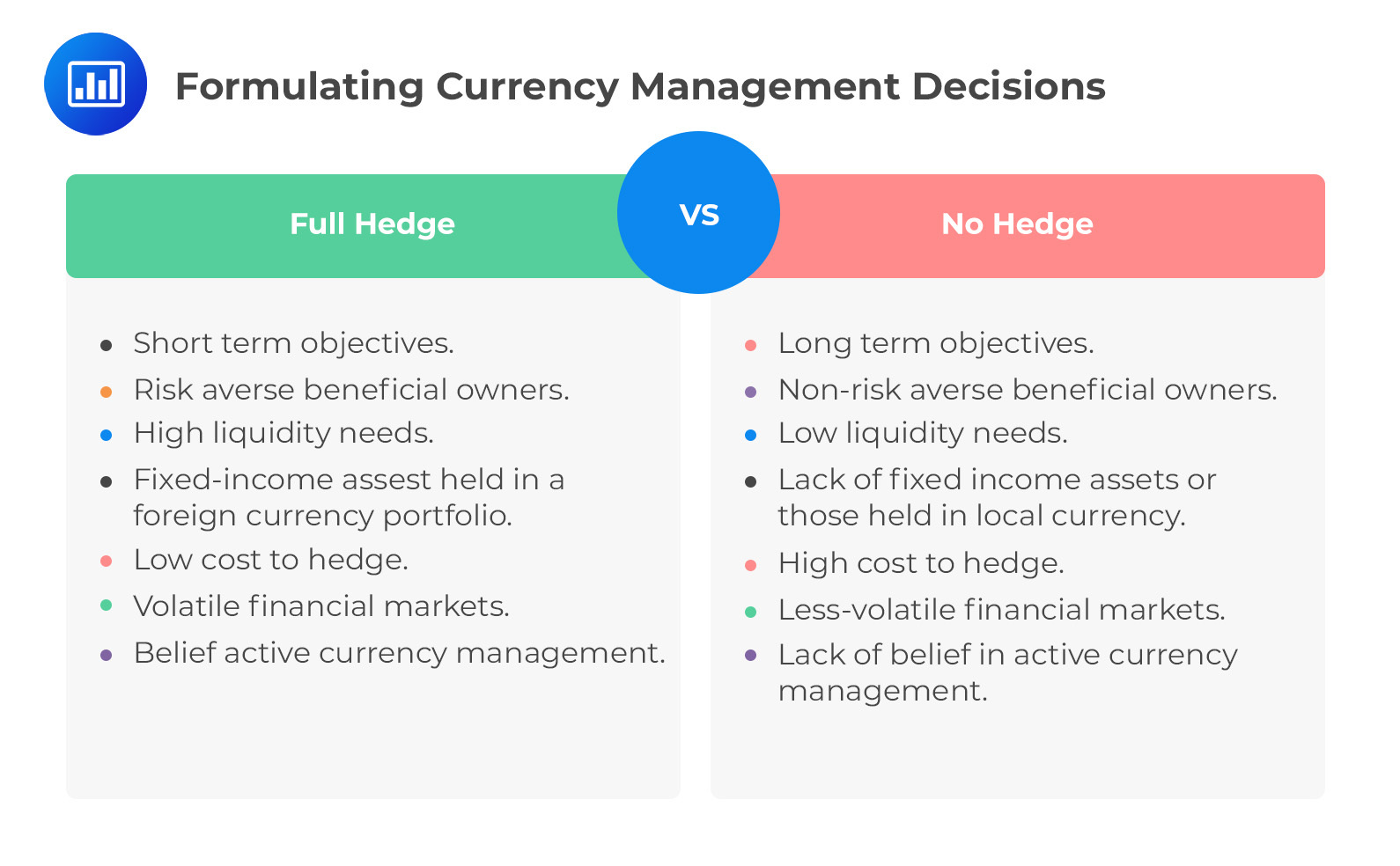

In this section, we will analyze a portfolio from a high-level perspective to make significant strategic choices that will lead to its success. It’s crucial to appreciate that hedging and the factors listed below operate on a spectrum. While the list is presented in a binary manner, it should not be interpreted as strictly binary. Instead, candidates should consider that, for instance, more short-term objectives may necessitate a greater need for hedging. The portfolio manager will need to exercise judgment to determine how much weight to give each factor and its impact on the overall direction of the portfolio.

Question

Toby Monroe manages a portfolio for a wealthy client in Upper Cheswickshireton, U.K. The client has recently made numerous investments in the Middle East. Monroe needs to determine the currency hedging policy for the Investment Policy Statement (IPS). Given that the markets in which the client has invested are exposed to significant political risk, Monroe would most likely choose:

- More hedge.

- Less hedge.

- Not enough information.

Solution

The correct answer is A.:

When a market is exposed to substantial political risk, it becomes more volatile. In such situations, portfolio managers and investors will likely prefer containing that volatility. Therefore, they would opt for more hedging to mitigate the potential risks.

B is incorrect. On the other hand, in markets perceived as stable, calm, or safe, less hedging may be deemed necessary as the risks are considered lower.

Derivatives and Risk Management: Learning Module 3: Currency Management: An Introduction; Los 3(c) Formulate an appropriate currency management program given financial market conditions and portfolio objectives and constraints

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.