Active Share and Risk

Active Share and Active Risk Active Share and active risk are two... Read More

In a holdings-based approach, the style scores of individual holdings within a portfolio are combined. Each holding receives a ‘score,’ which is then summed to evaluate the entire portfolio.

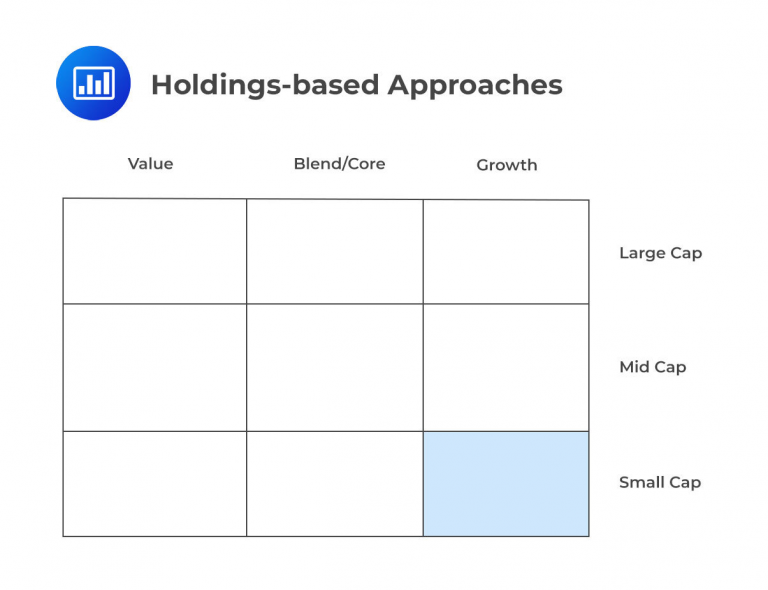

An example of this approach is the Morningstar Style Box, a commonly used method for categorizing holdings, as illustrated below:

The precise definitions of value, blend/core, and growth investment styles, as well as large, mid, and small caps, are not the primary focus here. These concepts are introduced as they are commonly understood and elaborated on in other parts of the curriculum.

What matters in this reading is that each individual holding in a portfolio is assessed and categorized. The goal of categorization is to distribute holdings evenly across style boxes on an axis. For instance, Large, Mid, and Small-cap holdings should be allocated roughly one-third to each category.

When categorizing holdings by value, blend/core, or growth criteria, specific metrics are employed to classify each holding. For instance, value stocks might be evaluated based on metrics such as price-to-earnings ratios and dividend yields. Holdings with higher-than-average dividend yields would be labeled as Value holdings. Blend/core stocks have neither a pronounced value nor growth bias.

This approach aims to identify a portfolio’s investment style by analyzing its historical returns in relation to a set of style indices. Through regression analysis, the coefficients for each style’s influence on the returns are determined, and these coefficients indicate the percentage of the portfolio’s allocation to each style.

For instance, consider a portfolio divided between large-cap and small-cap growth stocks. The regression equation would be structured as follows:

$$ \begin{align*} \text{Portfolio Return }(R_p) & = \text{Constant }(a) \\ & + \text{Percentage Allocation to Small-Cap Growth} (b_1) \\ & + \text{Percentage Allocation to Large-Cap Growth } (b_2) \\ & + \text{Error Term }(e) \end{align*} $$

After regression, the coefficients might appear as follows:

\(b_1\) = 0.4 (40% allocation to small-cap growth).

\(b_2\) = 0.6 (60% allocation to large-cap growth).

The result indicates that the portfolio has a preference for large-cap growth, with almost equal weight between the two factors. Fund managers often self-report their fund’s style. When the self-reported style matches the analysis output, it strengthens the manager’s description. If there’s a disparity, managers should reevaluate their initial analysis and reporting, potentially uncovering overlooked factors. Market-neutral funds don’t align well with returns-based approaches, making self-reporting a more reliable indicator of portfolio style.

Question

The following is likely to be considered the least accurate approach:

- Returns-based approach.

- Multi-factor model approach.

- Holdings-based approach.

Solution

The correct answer is B.

A multi-factor model approach involves analyzing a portfolio’s performance using multifactor models that consider various factors like market exposure, size, value, momentum, and others. This approach is more detailed and provides a factor-by-factor breakdown of a portfolio’s performance. It’s widely used for performance attribution and risk assessment. However, the accuracy of this approach depends on the quality and appropriateness of the selected factors and the model itself, which can sometimes be a limitation.

A is incorrect. A returns-based approach analyzes the historical returns of a portfolio or investment strategy to assess its performance and risk characteristics. This approach can provide insights into past performance, but it doesn’t provide a detailed breakdown of the underlying factors or holdings that contributed to that performance. While it has limitations, it is a valid and commonly used method for performance analysis.

C is incorrect. A holdings-based approach involves analyzing a portfolio’s individual holdings to understand its risk and performance drivers. This approach provides a comprehensive understanding of the portfolio’s composition and the impact of each security. It is often considered a highly accurate and detailed approach, as it looks directly at what the portfolio holds.

Reading 25: Active Equity Investing: Strategies

Los 25 (i) Discuss equity investment style classifications

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.