Choosing a Benchmark

Rules Based: A benchmark should have well-defined criteria for including and excluding stocks,... Read More

In private real estate, understanding the key economic value drivers is crucial. These drivers determine the expected income and price appreciation of a property, based on its current and future economic use. This could be for residential or commercial purposes.

Expected real estate income and price appreciation are determined by the current and future economic use of a property. For instance, a property located in a bustling city center, used for commercial purposes, is likely to yield higher income and price appreciation than a residential property in a rural area.

Specific property features such as location, age, and amenities, as well as regional and local economic conditions, are key economic value drivers. For example, a newly built commercial property with modern amenities, located in a thriving economic region, is likely to have a higher value.

Macroeconomic variables such as GDP, job growth, and wage growth are positively correlated with rental rates and real estate prices. For instance, in a region experiencing significant job growth, demand for rental properties is likely to increase, driving up rental rates and property prices.

Local conditions enhancing the value of a property’s economic use include an attractive business climate and infrastructure, favorable regulatory and tax policies, and the proximity of major suppliers, customers, and employers. For example, a property located near a major employer or in a region with favorable tax policies is likely to have a higher value.

Commercial real estate is an important production input for many industries. Rising employment, population growth, and consumer confidence increase demand for rental and owner-occupied housing. For example, in a city experiencing population growth and rising consumer confidence, demand for both rental and owner-occupied housing is likely to increase.

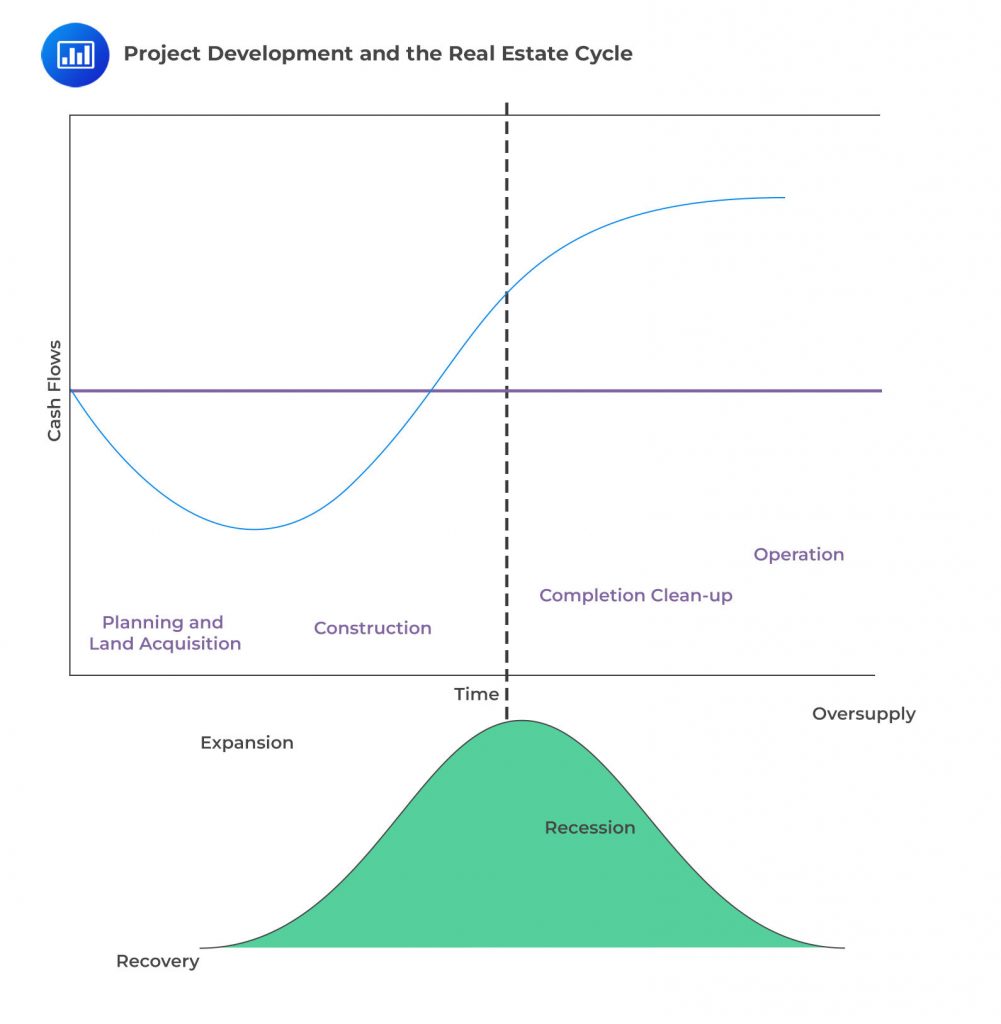

Opportunistic private real estate investments focus more on expected price appreciation than income, which magnifies the importance of real estate cycle timing as an economic value driver. For instance, an investor might buy a property at a low price during a downturn in the real estate cycle, with the expectation of selling it at a higher price during an upturn.

Timing, from project inception to completion and potential market changes, must be factored into the investment decision. For example, an investor planning to develop a commercial property must consider the time it will take to complete the project and how market conditions might change during that time.

Changing market conditions may affect project return. For instance, a rise in interest rates could increase the cost of borrowing, reducing the project return.

The project’s new value can be estimated using the direct capitalization method and assuming a capitalization rate equal to the original expected project rate of return.

$$\text{Property value} = \frac{\text{Expected NOI}}{\text{Capitalization rate}}$$

The project’s estimated value can be further broken down by capitalizing the residual cash flows that accrue to equityholders only.

Total project value is the sum of equity market value and the market value of debt.

$$\text{Total project value} = \text{Market value of equity} + \text{Market value of debt}$$

Changing market conditions affect mortgage debt coverage and leverage. Lower NOI reduces debt service coverage for lenders versus original project assumptions. A decline in market value gives rise to higher leverage.

Let’s analyze the impact of an economic downturn on a real estate project in Metro City, which Jane Doe, a financial analyst, is evaluating. The project, valued at $75 million, faces potential risks from decreased rents, increased vacancies, and higher operating costs.

$$ \begin{array}{l|c|c}

& \textbf{Original} & \textbf{Economic Downturn} \\

& \textbf{Assumptions} & \textbf{Scenario} \\ \hline

{\text{Rent per ft}^2 \text{ (monthly)}}& \$1.20 & \$1.08 \\ \hline

\text{Gross Rent (total units)} & 13,500,000 & 12,150,000 \\ \hline

\text{Average Vacancy} & 675,000 & 1,822,500 \\ \hline

\text{Effective Gross Income} & 12,825,000 & 10,327,500 \\ \hline

\text{Operating Costs} & 4,233,750 & 4,614,625

\end{array} $$

The project is financed with $18,750,000 in equity and $56,250,000 in debt financing with a 25-year 5% mortgage. Based on the original project case, the key financial figures were:

Assume a discount rate of 12% and a target equity dividend rate of 15%

To calculate the percentage decline in BTCF from the original assumptions to the Economic Downturn Scenario for the case of Metro City’s project evaluated by Jane Doe, we need to:

$$ \begin{align*} \text{NOI}_{\text{Downturn}} & = \text{Effective Gross Income} – \text{Operating Costs} \\ & = \$10,327,500 – \$4,614,625 \\ & = \$5,712,875 \\

\text{BTCF}_{\text{Downturn}} & = \text{NOI}_{\text{Downturn}} – \text{Annual Debt Service} \\ & = \$5,712,875 – \$4,438,313 \\ & = $1,934,344 \\

\text{Percentage Decline} & = \left( \frac{\text{Original BTCF} – \text{BTCF}_{\text{Downturn}}}{\text{Original BTCF}} \right) \times 100 \\ & = \frac{4,438,313 – 1,934,344}{4,438,313} \\ & = 56.41\% \end{align*} $$

In the Economic Downturn Scenario, the NOI for the Metro City project is $5,712,875, and the BTCF declines to $1,559,938. This represents a 56.42% decline from the original assumptions. Hence, Jane Doe’s analysis demonstrates a significant impact on the project’s profitability due to the economic downturn, leading to a substantial decrease in before-tax cash flow.

To calculate the revised equity dividend rate under the economic downturn scenario, we use the following formula:

$$ \text{Equity Dividend Rate} = \frac{\text{Before-Tax Cash Flow (BTCF)}}{\text{Equity Investment}} \times 100 $$

Given in the Economic Downturn Scenario:

$$ \begin{align*} \text{Equity Dividend Rate} & = \frac{\text{Before-Tax Cash Flow (BTCF)}}{\text{Equity Investment}} \times 100 \\ & = \frac{1,934,344}{18,750,000} \\ & = 10.32\% \end{align*} $$

This rate represents the return on equity (ROE) based on the before-tax cash flow generated under the downturn conditions, relative to the initial equity investment. A decrease to 10.32% from the original target of 15% indicates a significant impact from the economic downturn on the project’s ability to generate returns for equity investors. This lowered dividend rate reflects the reduced profitability and increased risk associated with the investment due to higher vacancy rates, decreased rents, and increased operating expenses. Investors use such metrics to evaluate the attractiveness of an investment, with the revised lower rate signaling a decline in investment desirability under adverse economic conditions.

To calculate the Loan-to-Value (LTV) ratio under the revised scenario, we use the following formula:

$$ \text{LTV Ratio} = \frac{\text{Loan Amount}}{\text{Revised Property Value}} $$

For this calculation, we need to establish the revised property value under the economic downturn scenario. The loan amount remains unchanged at $56,250,000, as mentioned in the example. To find the revised property value, we can use the net operating income (NOI) and the capitalization rate provided earlier, assuming the cap rate remains constant at 11.28% from the original scenario.

Given:

The property value based on NOI and capitalization rate can be calculated as:

$$ \text{Property Value} = \frac{\text{NOI}}{\text{Capitalization Rate}}=\frac{\text{5,712,875}}{\text{0.1128}} = 50,646,055$$

$$ \text{LTV Ratio} = \frac{\text{Loan Amount}}{\text{Revised Property Value}} = \frac{\text{56,250,000}}{\text{50,646,055}}= 1.1106$$

The LTV ratio exceeding 1 indicates that the loan amount surpasses the revised property value, which is a critical concern for both lenders and investors. Typically, an LTV ratio over 80% is considered risky, as it implies less equity or cushion in the property for the lender in case of default. An LTV ratio of 1.1106 significantly heightens the financial risk associated with the project, suggesting that the economic downturn has not only decreased the property’s value but also increased the leverage to a point where the debt exceeds the property’s worth. This scenario could lead to challenges in securing refinancing options, higher interest rates for existing loans, and potentially necessitate additional equity injections to reduce the LTV ratio to a more manageable level.

Structural changes in demand are another important economic value driver for private real estate investments. The shift towards remote work, for instance, has spurred increased demand for home offices, subsequently affecting the value of residential properties. Property owners have the opportunity to adapt their existing assets to meet the evolving needs of both commercial and residential end users, thereby maximizing return on their investments. An example of such adaptation could be a property owner converting unused office space into co-working spaces to cater to the growing demand for flexible workspaces. Furthermore, investors engaged in value-add real estate strategies aim to acquire existing properties and invest additional funds to implement changes that significantly increase income and property value, often beyond what could be expected based on the property’s current economic use. An example of this strategy could involve purchasing an old residential building, renovating it, and converting it into a luxury apartment complex, thereby elevating its income potential and overall value.

In investments, private real estate holds a significant position. It involves the acquisition of land or existing property, often followed by construction or renovation, to enhance income and capital appreciation potential.

Private real estate investment projects often involve significant activities such as construction or renovation after the acquisition of land or existing properties, with the goal of enhancing income and the potential for capital appreciation. For example, a real estate company might purchase a dilapidated building, renovate it extensively, and then either sell or rent it out for a profit. Value-add investors specifically focus on renovating and repositioning existing income-generating real estate assets to increase their value. This might involve a scenario where a company purchases an old apartment complex, upgrades it substantially, and then increases the rent to generate more income. On the other hand, opportunistic strategies are geared towards new development or the repurposing of properties, often entailing longer investment periods and initial negative cash flow. An example of this could be acquiring a piece of land to develop a new commercial complex. Although both strategies present higher risks, they also offer the potential for higher returns compared to the more stable, lower returns associated with merely operating and maintaining income-producing properties.

Similar to other private markets, private real estate fund portfolios are characterized by a distinct investment cycle that includes multiyear cash calls or commitments, the deployment of committed funds, and the realization of returns only upon the completion and sale of projects. This structure closely mirrors that of a venture capital fund, where investors commit funds over a period and returns are realized once the startup is either sold or goes public. Consequently, investors in private real estate must be prepared to accept long investment time horizons. During this period, the investment remains illiquid, and its net asset value (NAV) carries a degree of uncertainty. This is largely due to the limited ability to sell a property while it is under construction or renovation, making the investment both challenging and potentially rewarding for those who are willing to navigate its complexities.

An increasing number of Limited Partner (LP) investors sell underlying fund interests to new investors in the secondary market. This is similar to how shareholders of a private company might sell their shares to new investors.

These transactions offer existing LP investors an ability to liquidate and diversify their holdings prior to a fund’s termination date.

New investors may be attracted by shorter investment horizons, the ability to acquire a position at a price below the current NAV, and access to otherwise unavailable investments.

General partners often have an interest in leading secondary transactions to promote liquidity or rebalance an existing portfolio.

An increasing number of Limited Partner (LP) investors sell underlying fund interests to new investors in the secondary market. This is similar to how shareholders of a private company might sell their shares to new investors.

These transactions offer existing LP investors an ability to liquidate and diversify their holdings prior to a fund’s termination date.

New investors may be attracted by shorter investment horizons, the ability to acquire a position at a price below the current NAV, and access to otherwise unavailable investments.

General partners often have an interest in leading secondary transactions to promote liquidity or rebalance an existing portfolio.

Practice Questions

Question 1: An investor is considering investing in a private real estate fund. He is aware that these investments often involve multiyear cash calls or commitments and the realization of returns only once projects are completed and sold. However, he is concerned about the long investment time horizons and the illiquidity of the investment during the construction or renovation phase. Which of the following options could potentially address the investor’s concerns about liquidity and investment time horizons?

- Investing in value-add strategies, which focus on renovating and repositioning existing income-generating real estate assets.

- Investing in opportunistic strategies, which involve new development or repurposed properties with longer investment periods and negative cash flow.

- Investing in the secondary market, where he can acquire a position at a price below the current NAV and have access to otherwise unavailable investments.

Answer: Choice C is correct.

Investing in the secondary market can potentially address the investor’s concerns about liquidity and investment time horizons. The secondary market is where investors buy and sell previously issued investments, such as shares of a private real estate fund. By investing in the secondary market, the investor can acquire a position at a price below the current net asset value (NAV) and have access to otherwise unavailable investments. This can provide the investor with a level of liquidity that is not typically available in private real estate investments, as he can sell his position in the secondary market if he needs to liquidate his investment. Furthermore, by buying a position in an existing fund, the investor can potentially shorten his investment time horizon, as the fund may already be partway through its investment period.

Choice A is incorrect. Investing in value-add strategies, which focus on renovating and repositioning existing income-generating real estate assets, may not necessarily address the investor’s concerns about liquidity and investment time horizons. While these strategies can potentially generate higher returns, they also involve significant risks and require a long-term commitment, as the realization of returns depends on the successful renovation and repositioning of the assets. Furthermore, these investments are typically illiquid during the renovation phase.

Choice B is incorrect. Investing in opportunistic strategies, which involve new development or repurposed properties with longer investment periods and negative cash flow, is unlikely to address the investor’s concerns about liquidity and investment time horizons. These strategies involve significant risks and require a long-term commitment, as the realization of returns depends on the successful development or repurposing of the properties. Furthermore, these investments are typically illiquid during the development phase and may generate negative cash flow in the early stages of the investment.

Question 2: A Limited Partner (LP) investor in a private real estate fund is considering ways to diversify their holdings prior to the fund’s termination date. Which of the following options could potentially allow the LP investor to liquidate and diversify their holdings?

- Selling underlying fund interests to new investors in the secondary market.

- Investing in value-add strategies, which focus on renovating and repositioning existing income-generating real estate assets.

- Investing in opportunistic strategies, which involve new development or repurposed properties with longer investment periods and negative cash flow.

Answer: Choice A is correct.

A Limited Partner (LP) investor in a private real estate fund can potentially liquidate and diversify their holdings by selling underlying fund interests to new investors in the secondary market. The secondary market for private equity and real estate fund interests provides liquidity for LPs who wish to exit their investments prior to the fund’s termination date. This allows LPs to manage their portfolio exposure and diversify their holdings. The secondary market has grown significantly in recent years, providing LPs with more opportunities to sell their fund interests. The price at which the LP can sell their fund interests will depend on various factors, including the performance of the fund, the quality of the underlying assets, and market conditions.

Choice B is incorrect. Investing in value-add strategies, which focus on renovating and repositioning existing income-generating real estate assets, does not provide a way for the LP to liquidate and diversify their holdings. While value-add strategies can potentially increase the value of the LP’s investment in the fund, they do not provide a mechanism for the LP to sell their fund interests and diversify their portfolio.

Choice C is incorrect. Investing in opportunistic strategies, which involve new development or repurposed properties with longer investment periods and negative cash flow, also does not provide a way for the LP to liquidate and diversify their holdings. Opportunistic strategies are high-risk, high-return strategies that require a long-term investment horizon. They do not provide immediate liquidity for the LP and can actually increase the LP’s exposure to real estate risk.

Private Markets Pathway Volume 2: Learning Module 6: Private Real Estate Investments; LOS 6(b): Discuss economic value drivers of private real estate investments and their role in a portfolio

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.