Standard V – Investment Analysis, Re ...

Standard V(A) – Diligence and Reasonable Basis Members and Candidates must: Analyze investments,... Read More

An economic balance sheet is a snapshot in time of an investor’s assets and liabilities. But rather than just capturing physical and/or financial assets, as does the traditional balance sheet, the economic balance sheet also captures what are known as extended assets and liabilities. Extended assets and liabilities include intangible or invisible assets and liabilities. An example could include the present value of future earnings, a.k.a. human capital.

$$ \text{Financial capital} + \text{Extended capital} = \text{Total wealth} $$

$$ \begin{array}{l|r|l|r} \underline{\textbf{Assets:}} & \underline{\textbf{Value}} & \underline{\textbf{Liabilities and}} & \underline{\textbf{Value}} \\ & & \underline{\textbf{Economic Net Worth:}} & \\ \text{Equity portfolio} & $1,400,000 & \text{Car loan} & $9,000 \\ \text{Lakehouse} & $700,000 & \text{Mortgage} & $250,000 \\ \\ \underline{\textbf{Extended}} & & \underline{\textbf{Extended}} & \\ \underline{\textbf{Assets:}} & & \underline{\textbf{Liabilities:}} & \\ \text{PV of future} & $2,100,000 & \text{PV of expected future} & $1,500,000 \\ \text{earnings} & & \text{consumption} & \\ \\ & & \underline{\textbf{Economic Net Worth}} & $2,441,000 \\ & & \text{Economic net worth} & \\ & & \text{(Economic assets −} & \\ & & \text{Economic liabilities)} & \\ \\ \underline{\textbf{Total}} & \underline{\bf{4,200,000}} & & \underline{\bf{4,200,000}} \end{array} $$

An example economic balance sheet is shown above. This balance sheet aims to calculate the economic net worth, different from traditional net worth in that it aims to capture all forms of wealth, not just financial assets and liabilities. It is thought that capturing an investor’s varying forms of wealth may enable a more precise asset allocation.

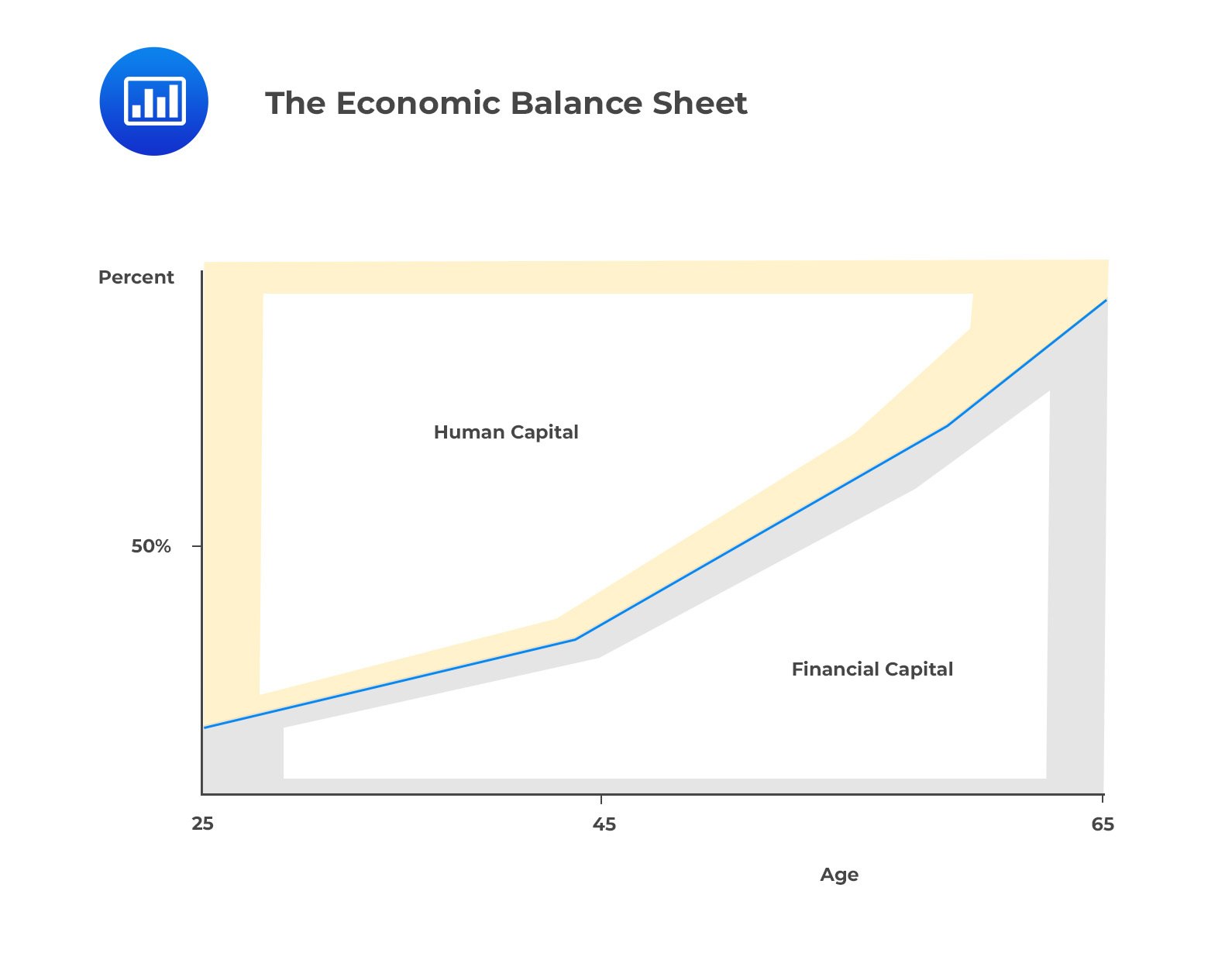

Investors typically begin their working careers with extremely high levels of human capital. The idea is that this human capital will slowly be converted over the investor’s lifecycle into financial capital, as shown in the graphic below. Lifecycle funds attempt to capture the same changes over an investor’s working life by shifting from riskier equity allocations as an investor is younger to more conservative bond-heavy allocations as the investor renttires. According to studies, human capital has 70% of the characteristics of fixed income and 30% of those of equity.

Question

Jill Thomas is 29 and has just found out that her aunt Pearl is independently wealthy, and planning on leaving her a large inheritance. This expected windfall should most likely be classified as which of the following?

- Financial asset.

- Extended asset.

- Financial liability.

Solution

The correct answer is B:

While the expected income will be a financial asset when it is realized, up until that point, it is most appropriately classified as an extended asset. Financial professionals should consider extended assets when planning for client’s futures. In this case, Jill can be expected to have a higher risk tolerance now due to the presence of the extended asset.

C is incorrect. Liabilities represent expected money owed and would not be relevant from Jill’s perspective.

Asset Allocation: Learning Module 3: Overview of Asset Allocation; Los 3(b) Formulate an economic balance sheet for a client and interpret its implications for asset allocation

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.