Execution Costs

Execution costs are vital in the provision of favorable portfolio management. They consist... Read More

When General Partners (GPs) consider making a long-term, illiquid investment in private equity, private debt, or a private asset or project in real estate or infrastructure, they conduct a thorough due diligence process. This process in private markets aims to identify intrinsic versus fair market value or potential growth opportunities for a specific asset or investment, similar to public markets. However, it also seeks to establish a business and financing plan to meet or exceed targeted return over a multiyear investment life cycle.

For instance, if a GP is considering investing in a tech startup, they would conduct due diligence to understand the startup’s business model, its potential for growth, and the risks involved. They would also develop a business plan outlining how they plan to help the startup achieve its growth targets and provide a return on investment.

The information available to GPs conducting due diligence for private market strategies varies when pursuing company due diligence versus project or asset due diligence. In the case of the former, early-stage companies have little more than a business idea or prototype with few customers, minimal revenue, and no profits, while mature buyout targets involve both business and accounting due diligence to evaluate a firm’s prospective performance in established products and markets.

The latter form of due diligence often involves initial construction and development phases, creating a real estate or infrastructure asset that produces future income. Private real estate GPs consider real estate market conditions upon project completion when assessing future income, while infrastructure investors focus attention on market and regulatory factors related to the provision of contractual, essential services as a primary future revenue source.

Given the lack of transparent performance benchmarking, upfront capital commitment, and long illiquid investment period of a typical limited partnership, Limited Partners (LP) due diligence on prospective fund managers differs from that in public markets.

Industry and competitive analysis tools and approaches are applicable when conducting due diligence on private equity or private debt opportunities. Company performance is influenced by macroeconomic or industry-wide factors, such as economic growth, and company-specific factors, such as increased market share. Public fund managers rely on economic and industry analysis, publicly available information, and the financial statements of a company and its competitors, clients, and suppliers to forecast financial statements and assess a firm’s intrinsic value versus its recently traded price.

Private fund GPs seeking significant minority or controlling stakes include these techniques in their analysis of investment targets but usually conduct a more exploratory, in-depth, dynamic process that varies greatly based on a company’s life-cycle stage. Prospective analysis of early-stage companies by potential investors often focuses on technical aspects of a prospective product or service and a founder’s ability to rapidly go to market and reach scale. The non-financial aspects of a company’s initial development phase are more important than traditional financial statement analysis in evaluating prospective investments.

Private equity buyout investors in mature companies can conduct more thorough due diligence on the operating history of established companies, which includes but is not limited to financial statement analysis. Private equity GPs typically seek access to far more detailed non-public company information when bidding to purchase a public or private company. GPs usually must sign a non-disclosure agreement, or a legal contract specifying that confidential information received is only for the purposes of evaluating a possible transaction.

Potential buyers are typically granted access to what is referred to as a data room, or a repository for confidential company documents and data. The data room usually includes areas such as legal and organizational, commercial, financial, human resources, intellectual property, information technology, compliance and litigation, environmental, social, and governance (ESG) issues, and taxation.

Private market due diligence is a crucial process that General Partners (GPs) undertake to evaluate a company’s prospects against its competitors and identify areas for improvement over a multiyear investment period. This process forms the foundation of a business plan. Once GPs have identified opportunities for value creation, they need to devise a plan of action for deploying investor capital to achieve targeted returns over an investment holding period.

An essential first step in creating a business plan is defining an industry, its barriers to entry, the competitive forces, and the sources of return. Additionally, it’s important to understand the target company’s current and potential position in the industry sector. For instance, a new entrant in an established industry, such as the health care devices industry, must overcome regulatory and other barriers to disrupt existing market providers and capture a significant market share.

The next step involves quantifying the potential of a new or existing market and the target company’s potential, considering the gap between current and potential future performance. Once the size of an opportunity is established, GPs must prioritize the strategies, investments, and other changes necessary to reach the target’s potential size, scale, and level of profitability. For example, in the case of Maudville, the GP identified a shift from owned to leased fixed assets as a catalyst for increasing asset efficiency and reducing costs.

Lastly, it’s crucial to place any proposed business plan into a market context to understand key risk factors and the performance sensitivity to changes in primary drivers. For instance, while the health care industry tends to face less cyclicality due to inelastic demand for diagnostic testing, regulatory or technological changes may significantly affect performance.

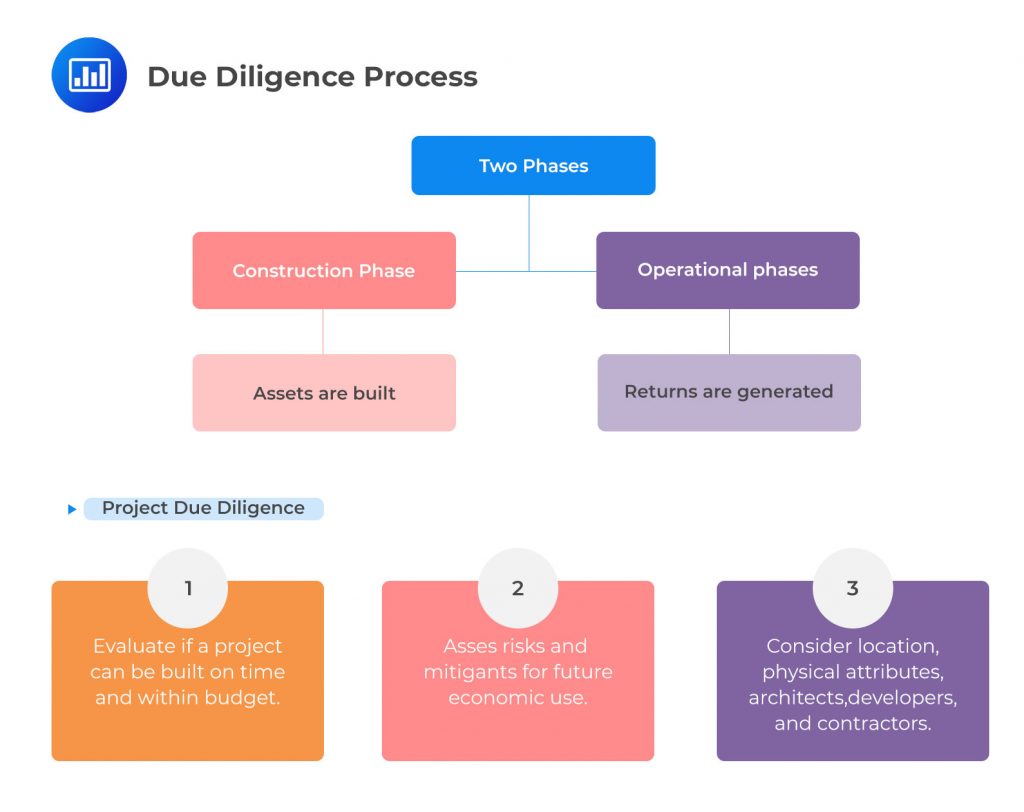

Project due diligence is a critical aspect of real estate and infrastructure investment. Unlike private company analysis, project due diligence distinctly separates the construction and development phase from the operational phase. The construction and development phase is the period during which the asset is built, while the operational phase is the period after completion when returns are generated.

The initial property and project plan review is a crucial part of the due diligence process. It addresses the risks and mitigants associated with the project’s ability to be built on time, within its expected budget, and to the necessary specifications for its future economic use. This phase of due diligence involves examining both the location and physical attributes of the land or property, as well as the architects, developers, contractors, and suppliers involved in the construction phase.

Analysis of the post-completion operational phase is equally important. It seeks to ensure that the expected payments from the asset’s economic use adequately compensate investors for bearing the associated risks over the investment holding period. The nature and level of future asset income depend on the strategy and property type, as well as any contractual commitments in place upon completion.

For instance, a real estate development may be initiated on a speculative basis without prior commitments or built to suit a specific commercial tenant based on pre-agreed terms and a multiyear lease. Infrastructure assets, on the other hand, often rely on concession agreement details to determine whether future cash flows are fixed, inflation-adjusted, or dependent on commercial or regulatory factors.

Project due diligence also incorporates different economic and market scenarios to evaluate key drivers of return. A project business plan often differs in that the explicit development steps and associated milestones drive success in reaching the operational, income-producing phase that generates returns for investors. While the business plan of a private real estate project often involves the sale of a property once it is completed and fully occupied, in the case of infrastructure, a project or concession may have a finite life and be turned over to a public authority at the end at a price of zero or a low terminal value.

Limited Partners (LPs) are required to conduct a comprehensive investigation of General Partners (GPs) before committing to a new fund. This is due to extended capital commitments, illiquidity, and lengthy investment periods. Unlike public fund investors who often use detailed portfolio comparisons and frequent performance benchmarking against other fund managers and indexes, private market investors use a mix of qualitative and quantitative factors to evaluate private fund GPs.

Qualitative factors are non-numerical factors that can influence the decision to invest in a fund. They can include the reputation of the GP, their investment strategy, and their track record. Quantitative factors, on the other hand, are numerical or measurable factors that can be used to compare different funds. They can include the fund’s past performance, its size, and its risk profile.

Practice Questions

Question 1: A General Partner (GP) is considering an investment in a private market strategy. The GP is conducting due diligence on a mature buyout target. In this scenario, what aspects would the GP primarily focus on during the due diligence process to evaluate the firm’s prospective performance in established products and markets?

- Assessing the business idea or prototype with few customers, minimal revenue, and no profits.

- Conducting both business and accounting due diligence to evaluate the firm’s prospective performance.

- Considering real estate market conditions upon project completion when assessing future income.

Answer: Choice B is correct.

When a General Partner (GP) is considering an investment in a mature buyout target, the GP would primarily focus on conducting both business and accounting due diligence to evaluate the firm’s prospective performance. Business due diligence involves a comprehensive examination of the target company’s operations, strategy, market position, and competitive landscape. It helps the GP to understand the company’s business model, its competitive advantages, and the risks and opportunities it faces in its markets. Accounting due diligence, on the other hand, involves a thorough review of the company’s financial statements, accounting policies, and financial controls. It helps the GP to assess the company’s financial health, profitability, cash flows, and financial risks. Both types of due diligence are crucial for the GP to make an informed investment decision and to evaluate the firm’s prospective performance in established products and markets.

Choice A is incorrect. Assessing the business idea or prototype with few customers, minimal revenue, and no profits is more relevant for early-stage venture capital investments, not for mature buyout targets. In a mature buyout, the target company is already established in its markets and has a track record of revenues and profits. Therefore, the focus of due diligence is not on assessing a business idea or prototype, but on evaluating the company’s existing operations, financial performance, and market position.

Choice C is incorrect. Considering real estate market conditions upon project completion when assessing future income is more relevant for real estate investments, not for mature buyout targets. In a mature buyout, the target company is typically not a real estate project, but a company operating in a specific industry. Therefore, the focus of due diligence is not on assessing real estate market conditions, but on evaluating the company’s business and financial performance.

Question 2: A General Partner (GP) is considering an investment in a private real estate project. During the due diligence process, what factors would the GP primarily consider when assessing the future income of the project?

- Assessing the business idea or prototype with few customers, minimal revenue, and no profits.

- Conducting both business and accounting due diligence to evaluate the firm’s prospective performance.

- Considering real estate market conditions upon project completion when assessing future income.

Answer: Choice C is correct.

When a General Partner (GP) is considering an investment in a private real estate project, the GP would primarily consider the real estate market conditions upon project completion when assessing the future income of the project. This is because the income from a real estate project is largely dependent on the market conditions at the time of the project’s completion. Factors such as the demand for real estate, the supply of similar properties, the overall economic conditions, and the interest rate environment can significantly impact the rental income or the sale price of the property. Therefore, a thorough understanding of the real estate market conditions is crucial for the GP to accurately assess the future income of the project. The GP would also consider other factors such as the location of the property, the quality of the construction, and the reputation of the developer, among others.

Choice A is incorrect. Assessing the business idea or prototype with few customers, minimal revenue, and no profits is more relevant for venture capital or early-stage investments, not for real estate projects. While the business idea or prototype may be relevant in some cases, such as for a real estate project that involves a new concept or innovative design, it is not the primary factor that a GP would consider when assessing the future income of a real estate project.

Choice B is incorrect. Conducting both business and accounting due diligence to evaluate the firm’s prospective performance is important, but it is not the primary factor that a GP would consider when assessing the future income of a real estate project. Business and accounting due diligence is more relevant for investments in companies or businesses, not for real estate projects. For a real estate project, the GP would primarily consider factors related to the real estate market and the specific characteristics of the project.

Private Markets Pathway Volume 1: Learning Module 2: General Partner and Investor Perspectives and the Investment Process; LOS 2(d): Discuss the role of conducting due diligence and establishing a business plan in the private investment process

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.