Application of the Code and Standards

The curriculum’s next section covers Standards I-VII with guidance provided in Reading 30... Read More

It’s crucial to distinguish between two distinct dimensions of risk: volatility and the likelihood of achieving a target return. To comprehensively evaluate the impact of introducing either bonds or alternative investments into an equity portfolio, we must delineate these risk types and consider the relevant timeframes for each.

Volatility pertains to the short-term fluctuations in portfolio performance, whereas the pursuit of a target returns gains significance over extended investment horizons spanning multiple years.

Traditionally, bonds have proven more adept at mitigating volatility, especially in the context of shorter timeframes. However, when focusing on long-term objectives, an excessive allocation to bonds can diminish the prospects of attaining the investment goal. Consequently, for extended investment horizons, alternative investments are deemed a superior hedge when incorporated into an equity portfolio.

Alternative investments often pose unique challenges. Their irregular valuation practices can result in extended periods without recorded valuation changes, potentially leading to an understatement of volatility. Moreover, biases like back-fill and survivorship can further distort the reported volatility associated with alternative investments.

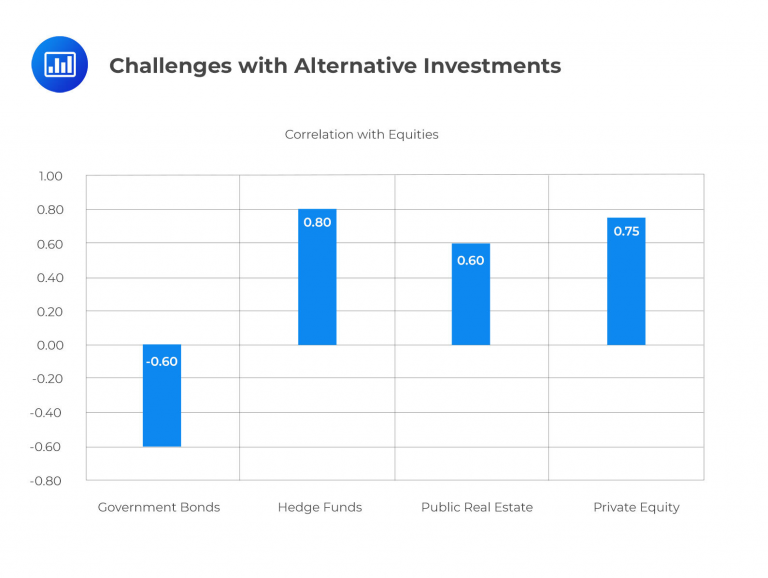

In scenarios necessitating risk mitigation over shorter time horizons, bonds are typically favored over alternative investments. Bonds excel at tempering the impact of volatility within an equity portfolio. One compelling rationale for this preference is that bonds have consistently demonstrated a negative correlation with equity markets, typically around -0.6, particularly during periods characterized by low inflation.

Hedge funds are often positively correlated with equities, with correlations potentially as high as 0.8, while commodities typically show lower correlations, around 0.2.

Modern Portfolio Theory underscores that combining assets with low or negative correlations can effectively reduce portfolio risk without sacrificing returns.

For short timeframes and managing volatility in an equity portfolio, bonds are a preferred choice due to their low correlation with equities.

Alternative investments, despite their liquidity premium, can potentially provide higher returns, often exceeding what bonds can offer. This makes them a preferred choice for increasing the likelihood of achieving the targeted portfolio return.

Question

Rank the following assets from the highest to the lowest in terms of their correlation with equities.

- Hedge funds, public real estate, government bonds.

- Government bonds, public real estate, hedge funds

- Hedge funds, government bonds, private equity

Solution

The correct answer is A.

Hedge funds typically exhibit the highest correlation with equities, approximately 0.8 as of the time of this writing. Public real estate shows a positive but weaker correlation, around 0.6. In contrast, government bonds demonstrate the lowest correlation, with a negative correlation close to -0.6.

B is incorrect. This ranking is not correct because it places government bonds at the top, which typically have a low or negative correlation with equities. Government bonds are usually less correlated with equities compared to the other two asset classes.

C is incorrect. This ranking is not accurate either, as it places government bonds in the middle, which is inconsistent with their usual low or negative correlation with equities.

Reading 28: Asset Allocation to Alternative Investments

Los 28 (b) Compare alternative investments and bonds as risk mitigators in relation to a long equity position