Application of Economic Growth Trend A ...

The expected trend growth rate is an all-important element in developing capital market... Read More

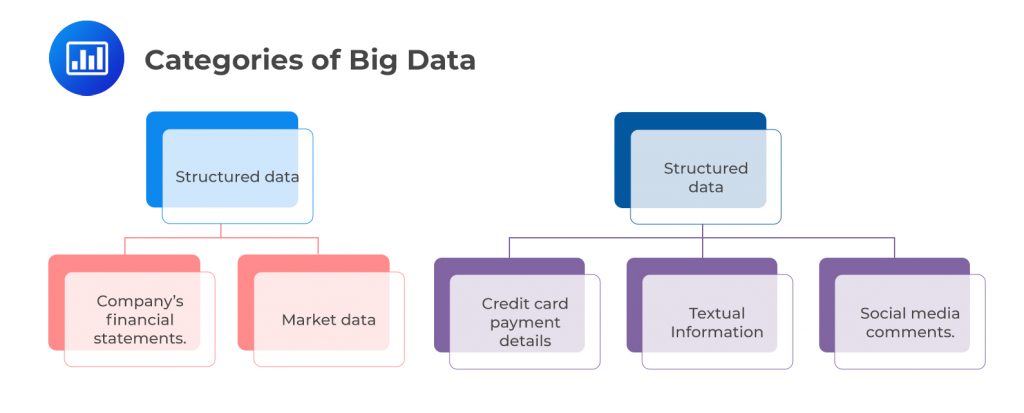

Big data, a term that encapsulates extremely large datasets, can be either structured or unstructured. Structured data, such as traditional financial statements and market data, is organized in a predefined manner, making it easy to comprehend. On the other hand, unstructured or “alternative” data lacks a recognizable structure. The use of this type of data in the investment industry has been limited until recent advancements in technology and computational algorithms.

Structured data is commonly used in the investment industry. A company’s balance sheet or stock market indices are examples of structured data.

Unstructured data, also known as “alternative” data, is complex and lacks a recognizable structure. Examples include social media sentiment towards a brand, satellite images indicating the level of activity in a retail store’s parking lot, or credit card transaction data revealing consumer spending habits.

Practice Questions

Question 1: In the investment industry, the use of data is crucial for making informed decisions. This data can be categorized into structured and unstructured data. Which type of data has seen an increase in its usage in the investment industry?

- Structured data

- Unstructured data

- Both structured and unstructured data

Answer: Choice B is correct.

Unstructured or “alternative” data has seen an increase in its usage in the investment industry. With the advent of big data and advancements in technology and computational algorithms, the investment industry has been able to harness the power of unstructured data. This type of data, which includes sources like satellite images, textual information, credit card payment information, and online mentions of a product or brand, provides a wealth of information that can be used to make informed investment decisions. Unstructured data can provide insights that are not readily available from traditional structured data sources, such as financial statements and market data. For example, satellite images can provide real-time information on the activities of a company, such as the level of inventory in its warehouses or the number of cars in its parking lots. Similarly, online mentions of a product or brand can provide insights into consumer sentiment and potential sales trends. Therefore, the use of unstructured data in the investment industry has increased significantly in recent years.

Choice A is incorrect. While structured data, which includes traditional financial statements and market data, continues to be used in the investment industry, its usage has not increased to the same extent as unstructured data. This is because structured data is already well-utilized in the industry, and the recent advancements in technology and computational algorithms have primarily enabled the increased usage of unstructured data.

Choice C is incorrect. While both structured and unstructured data are used in the investment industry, the question specifically asks about the type of data that has seen an increase in its usage. As explained above, the usage of unstructured data has increased significantly in recent years, while the usage of structured data has not increased to the same extent.

Portfolio Management Pathway Volume 1: Learning Module 2: Active Equity Investing: Strategies; LOS 2(f): Analyze factor-based active strategies, including their rationale and associated processes

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.