Standard V(B) – Communication with C ...

Members and Candidates must: Immediately disclose to customers and prospective clients the basic... Read More

Private investments, such as private equity and real estate, go through a life cycle that culminates in the sale or exit of the investment. This final stage is critical as it often determines the returns for Limited Partners (LPs) and the performance-related compensation for General Partners (GPs) in the form of carried interest over the investment holding period. However, in some cases like private debt or an equity stake in a Build-Operate-Transfer (BOT) infrastructure project, the maturity or transfer date is predetermined or contractual, and thus, has minimal impact on return.

Private equity GPs, whether investing in early-stage companies or buyout opportunities, conduct due diligence and establish a business plan with the intention to eventually sell the investment in several years. Private funds typically exit investments by following 3 methods

Private market GPs generally select an exit route that maximizes LP returns and GP performance fees. The choice of a particular approach is highly dependent on both top-down macroeconomic and market conditions and industry- and company-specific dynamics.

An IPO is a process that involves the issuance of publicly traded shares on an exchange. This process significantly enhances the liquidity of ownership and provides access to substantial capital from a wide range of investors. An initial share issuance by a private company could either represent the reintroduction of a restructured firm that was previously taken private or the first opportunity to access investment, as seen in the case of a successful startup company.

The primary benefits of an IPO include the ability to maximize valuation multiples under favorable public equity market conditions and to stage a controlled exit process in multiple phases while maintaining continuity of management and business strategy. For instance, a primary issuer can capitalize on strong market conditions and growth following an IPO by executing one or more secondary share offerings. However, this route is not available to all private companies. The ideal IPO candidate is typically larger companies with an established operating history and excellent growth prospects.

Despite its advantages, the IPO process is cumbersome, time-consuming, and costly, with an outcome that is highly dependent on public market conditions. For example, smaller companies may pay as much as 7% of gross IPO proceeds in fees. The value upon exit from the IPO process to private investors depends not only on the initial price achieved in the primary offering but also on continued strong share performance. This is because General Partners (GPs) often sell their controlling stake in a firm in stages and, therefore, rely on continued strong market demand for shares. Additionally, private equity firms are typically subject to a lockup agreement, or sale restriction, at the time of issuance that prevents the GP from fully liquidating its interest in newly issued stock for a predetermined period, often up to 180 days.

A private sale refers to the process of monetizing an existing investment by selling it to another private buyer. This process can involve different parties and can take various forms. The advantages of a private sale include speed and flexibility, lower cost, and price independence. The prices in private sales do not directly depend on favorable public equity market prices. However, factors such as the cost of debt, investor risk appetite, and the public market valuation multiples of comparable public companies used in negotiations can indirectly affect the value a General Partner (GP) can realize upon sale.

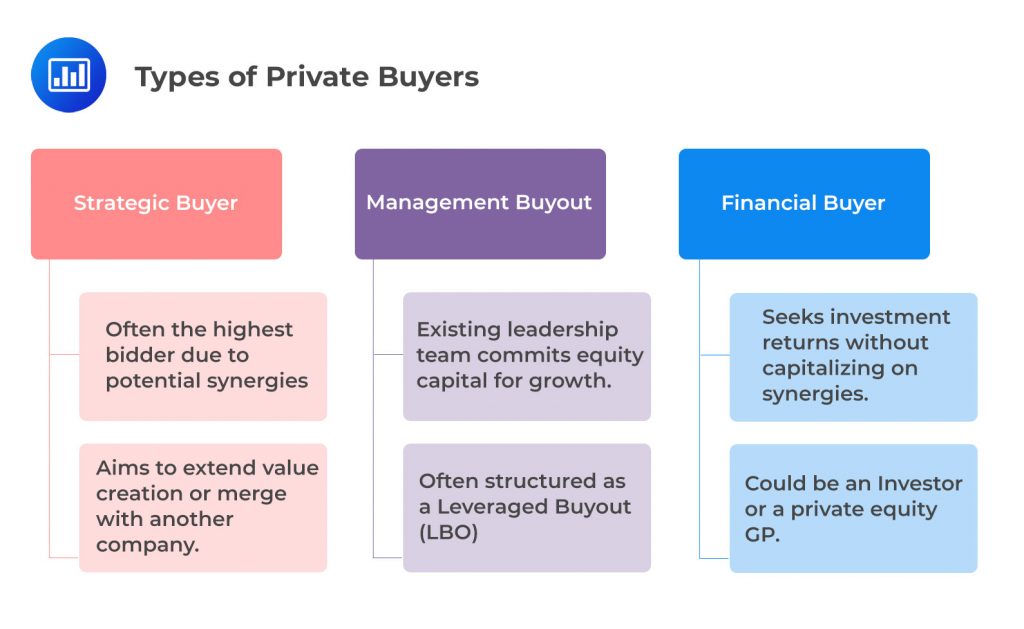

A strategic buyer is often the highest bidder in the acquisition of a company. This type of buyer aims to capitalize on synergies by extending the value creation process initiated by the General Partner (GP), merging the business with another portfolio company, or taking other actions as a controlling investor to increase the firm’s value. Strategic investors often see the greatest potential and are willing and able to assume associated execution risk.

A special case of the private sale to a strategic buyer is a management buyout. In this scenario, the existing leadership team commits its own equity capital as an incentive to grow the firm’s cash flows and value together with one or more private equity GPs. Management buyouts are often structured as a Leveraged Buyout (LBO), with debt forming a significant proportion of the purchase price.

A financial buyer is an individual or entity that seeks to earn investment returns from an existing company without identifying or capitalizing on synergies from a controlling interest. In some cases, a financial buyer may be the highest bidder for a controlling interest in a private firm. The financial buyer could be an investor looking for a strategic buyer or a private equity General Partner (GP) who plans to hold the company in a limited partnership structure. This is often the case due to the finite life of closed-end partnerships and the growing demand for private market investments.

Liquidation is a process that is often initiated by controlling shareholders when a company is no longer viable as a going concern. This is a common occurrence in startup companies that are funded by venture capital equity investments, where the failure rate is extremely high. Despite these companies having very few fixed assets, their liquidation value is often minimal.

On the other hand, large, established companies that are in a declining phase of the company life cycle and facing financial distress may have a market value of the firm’s fixed assets, real estate, inventory, and intellectual property that exceeds the value of its liabilities. In such scenarios, the firm may have the option to seek protection from its creditors, restructure its assets and obligations, and maintain solvency. However, in some cases, the best approach may be bankruptcy and liquidation.

In the event of liquidation, equityholders typically face a loss of their entire investment. However, the sale of assets offers debtholders the highest recovery for their fixed claims. This is because the proceeds from the sale of assets are used to pay off the company’s debts.

Practice Questions

Question 1: In the private investment life cycle, the final stage involves the sale or exit of the investment. This stage is critical as it often determines the returns for Limited Partners (LPs) and the performance-related compensation for General Partners (GPs). Private equity GPs conduct due diligence and establish a business plan with the intention to eventually sell the investment. The exit strategy is usually chosen based on macroeconomic and market conditions, as well as industry- and company-specific dynamics. Which of the following is NOT a typical exit strategy for private equity investments?

- Selling to the public via an Initial Public Offering (IPO)

- Selling to one or more private buyers through different approaches

- Increasing the company’s debt to make it unattractive for acquisition

Answer: Choice C is correct.

Increasing the company’s debt to make it unattractive for acquisition is NOT a typical exit strategy for private equity investments. Private equity firms typically aim to increase the value of their investments, not decrease it. Increasing a company’s debt could make it less attractive to potential buyers, thereby reducing the potential exit opportunities for the private equity firm. Moreover, increasing a company’s debt could also increase its financial risk, which could negatively impact its performance and, consequently, the returns for the private equity firm and its investors. Therefore, this strategy is not typically used as an exit strategy in private equity.

Choice A is incorrect. Selling to the public via an Initial Public Offering (IPO) is a common exit strategy for private equity investments. An IPO allows a private equity firm to sell its stake in a company to the public, often at a significant premium to the price it originally paid for the investment. This can generate substantial returns for the private equity firm and its investors.

Choice B is incorrect. Selling to one or more private buyers through different approaches is also a common exit strategy for private equity investments. This can involve selling the investment to another private equity firm, a strategic buyer (i.e., a company operating in the same industry), or a financial buyer (i.e., a company that is interested in the investment for financial reasons, rather than strategic ones). This strategy can also generate substantial returns for the private equity firm and its investors.

Question 2: The final stage of the private investment life cycle is the sale or exit of the investment. This stage is crucial as it often determines the returns for Limited Partners (LPs) and the performance-related compensation for General Partners (GPs). In some cases, like private debt or an equity stake in a Build-Operate-Transfer (BOT) infrastructure project, the maturity or transfer date is predetermined or contractual. In this context, which of the following statements is true regarding the impact of the maturity or transfer date on the return of such investments?

- The maturity or transfer date has a significant impact on the return

- The maturity or transfer date has minimal impact on the return

- The maturity or transfer date determines the return

Answer: Choice A is correct.

The maturity or transfer date has a significant impact on the return of investments like private debt or an equity stake in a Build-Operate-Transfer (BOT) infrastructure project. The reason for this is that the return on these types of investments is often determined by the cash flows that are generated over the life of the investment and the price at which the investment is sold or transferred. The timing of these cash flows and the sale or transfer price can be significantly influenced by the maturity or transfer date. For example, if the maturity or transfer date is extended, the investor may receive additional cash flows, which could increase the return on the investment. Conversely, if the maturity or transfer date is shortened, the investor may receive fewer cash flows, which could decrease the return. Additionally, the sale or transfer price can be affected by market conditions at the time of the maturity or transfer date. If market conditions are favorable, the sale or transfer price may be higher, leading to a higher return. If market conditions are unfavorable, the sale or transfer price may be lower, leading to a lower return.

Choice B is incorrect. The maturity or transfer date does not have a minimal impact on the return. As explained above, the maturity or transfer date can significantly influence the cash flows and the sale or transfer price, both of which are key determinants of the return on the investment.

Choice C is incorrect. While the maturity or transfer date can significantly impact the return, it does not solely determine the return. Other factors, such as the cash flows generated over the life of the investment and the sale or transfer price, also play a crucial role in determining the return. Therefore, it is incorrect to say that the maturity or transfer date determines the return.

Private Markets Pathway Volume 1: Learning Module 2: General Partner and Investor Perspectives and the Investment Process; LOS 2(e): Discussing Alternative Exit Strategies in Private Investments and Their Impact on Value

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.