Common Behavioral Biases

Mnemonic Devices for Easy Recall Cognitive: The cognitive biases can be remembered with... Read More

Activist investors are a unique class of investors who acquire stakes in publicly traded companies with the intention of advocating for changes that will enhance their investment returns. They may seek representation on the company’s board of directors or employ other tactics to instigate strategic, operational, or financial structure changes. These changes can encompass asset sales, cost-cutting measures, management alterations, capital structure modifications, dividend hikes, or share buybacks.

Activist investors can be hedge funds, public pension funds, private investors, and others. They differ significantly in their strategies, expertise, and investment horizons, and may pursue different outcomes. However, they all share a common objective of advocating for change in their target companies. The goal of activist investing could be either financial gain, through increased shareholder value, or a non-financial cause, such as environmental, social, and governance issues.

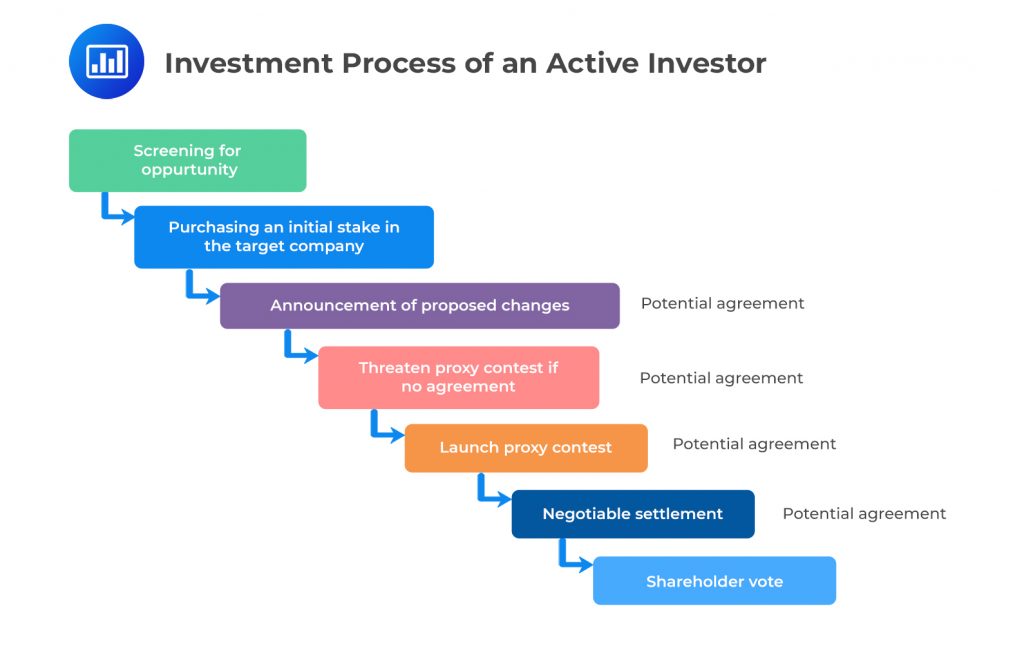

Shareholder activism typically follows a period of screening and analysis of opportunities in the market. The investor usually reviews a number of companies based on a range of parameters and carries out in-depth analysis of the business and the opportunities for unlocking value. Activism starts when an investor buys an equity stake in the company and starts advocating for change, pursuing an activist campaign. These equity stakes are generally made public, with stakes above a certain threshold required to be made public in most jurisdictions.

Shareholder activism, also known as investor activism, is an investment strategy that has been in existence since the 1970s and 1980s. It involves investors, often referred to as corporate raiders, acquiring significant stakes in companies with the aim of influencing their operations. The ultimate goal is to unlock value in the target companies, thereby increasing the value of their shares. For instance, Carl Icahn, a well-known activist investor, has influenced companies like Apple and Netflix to change their strategies and increase shareholder value.

There are differing views on shareholder activism. Advocates argue that it is a crucial and necessary activity that aids in monitoring and disciplining corporate management for the benefit of all shareholders. On the other hand, critics argue that such interventionist tactics can cause distraction and negatively impact management performance. For example, some critics argue that Bill Ackman’s activism at J.C. Penney led to a decline in the company’s performance.

Activist hedge funds are among the most prominent activist investors. They experienced a surge in popularity for several years, with assets under management (AUM) peaking at $50 billion in 2007 before plummeting during the global financial crisis. However, activist hedge fund investing has since rebounded strongly, with AUM nearing $46 billion in 2018. The activities of these investors can be tracked by following their announcements of launching campaigns to influence companies. These hedge funds benefit from lighter regulation than other types of funds, and their fee structure, which offers greater rewards, justifies their concerted campaigns for change at the companies they hold.

The popularity and viability of investor activism are influenced by various factors, including legal frameworks in different jurisdictions, shareholder structures, and cultural considerations. The United States has witnessed the most activist activity initiated by hedge funds, individuals, and pension funds. However, there have also been several activist events in Europe. Other regions have seen more limited activity from activist investors, often attributed to cultural reasons and more concentrated shareholder ownership of companies.

Activist investors play a significant role in shaping corporate strategies to enhance shareholder value. They employ a range of tactics, each with its unique implications and outcomes. Some of these strategies are:

Board Representation and Nominations: Figures like Carl Icahn at Apple Inc. often aim for board seats and suggest nominations to steer decision-making processes.

Engagement with Management: Activists such as Bill Ackman use communication channels like open letters to ADP’s management to propose changes and rally other shareholders for impact.

Proposing Corporate Changes: Individuals like Nelson Peltz at Procter & Gamble advocate for major corporate adjustments at AGMs to boost operational efficiency and profitability.

Balance Sheet Restructuring: Activists, exemplified by David Einhorn at General Motors, recommend restructuring the balance sheet to optimize capital usage and potentially initiate share repurchases or dividend increases.

Management Compensation: There is a focus on ensuring that management compensation aligns with share price performance to harmonize management’s and shareholders’ interests.

Legal Proceedings: In instances like Elliott Management vs. Samsung, activists may initiate legal action against management for failing in their fiduciary duties.

Coordination with Other Shareholders: Activists often collaborate with fellow company shareholders to form a collective force for change.

Media Campaigns: Tactics can include launching media campaigns against management practices, as in Starboard Value’s approach to Yahoo.

Breaking Up Large Conglomerates: Proposals to dismantle large conglomerates to release value, like Third Point’s suggestion for Sony, are common.

Effectiveness and Management Response: The success of shareholder activism depends on how existing management responds and the defensive measures at their disposal. In various jurisdictions, management or major shareholders can deploy strategies to block activist efforts, including:

Activist investors are a unique breed of investors who strive to instigate change within the companies they invest in. They are recognized for their proactive stance and often participate in the decision-making processes of their target companies.

Companies with slower revenue and earnings growth compared to the market are often targeted by activist investors. For instance, a company like IBM, which has seen slower growth in recent years, could be a potential target.

Companies experiencing negative share price momentum, such as Nokia in the early 2000s, are also potential targets.

Companies with weaker-than-average corporate governance, like Enron before its collapse, are also attractive to activist investors.

Activist investors aim to unlock value in underperforming companies by initiating change. This is akin to what Carl Icahn did with his investment in Apple.

They target such companies as they are more likely to garner support from other shareholders and the public, as the proposed changes are often seen as necessary for improving the company’s performance.

Historically, activist investors have targeted small and medium-sized listed stocks, such as those on the Russell 2000 index.

However, this trend has shifted recently, with larger companies like Procter & Gamble becoming subject to activism. This suggests a change in activist investors’ strategies and indicates that no company, regardless of size, is immune to activism.

Practice Questions

Question 1: A public pension fund is considering becoming an activist investor. They are aware that this would involve taking stakes in listed companies and advocating for changes. However, they are unsure about the typical process of activist investing. Which of the following statements accurately describes the typical process of activist investing?

- Activist investing typically involves a period of screening and analysis of opportunities in the market, followed by the purchase of an equity stake in a company and the initiation of an activist campaign. These equity stakes are generally made public, with stakes above a certain threshold required to be made public in most jurisdictions.

- Activist investing typically involves randomly selecting a company to invest in, without any prior screening or analysis. The equity stakes are usually kept secret, regardless of their size.

- Activist investing typically involves purchasing a majority stake in a company without any prior screening or analysis, and then immediately initiating an activist campaign. These equity stakes are usually kept secret, regardless of their size.

Answer: Choice A is correct.

Activist investing typically involves a period of screening and analysis of opportunities in the market, followed by the purchase of an equity stake in a company and the initiation of an activist campaign. These equity stakes are generally made public, with stakes above a certain threshold required to be made public in most jurisdictions. This process is accurate because it reflects the strategic and deliberate nature of activist investing. Activist investors do not randomly select companies to invest in; instead, they conduct thorough research and analysis to identify companies that they believe are undervalued or mismanaged. Once they have identified a target, they purchase an equity stake and then use that stake to advocate for changes that they believe will increase the company’s value. The disclosure of these equity stakes is also accurate, as most jurisdictions require investors to disclose their holdings once they exceed a certain threshold.

Choice B is incorrect. Activist investing does not typically involve randomly selecting a company to invest in, without any prior screening or analysis. This approach would be highly risky and unlikely to yield positive results. Furthermore, the equity stakes are not usually kept secret, regardless of their size. In most jurisdictions, investors are required to disclose their holdings once they exceed a certain threshold.

Choice C is incorrect. Activist investing does not typically involve purchasing a majority stake in a company without any prior screening or analysis, and then immediately initiating an activist campaign. This approach would be highly risky and unlikely to yield positive results. Furthermore, the equity stakes are not usually kept secret, regardless of their size. In most jurisdictions, investors are required to disclose their holdings once they exceed a certain threshold.

Question 2: Shareholder activism, a strategy that has been in existence since the 1970s and 1980s, involves investors acquiring significant stakes in companies with the aim of influencing their operations. What is the primary goal of shareholder activism?

- To distract and negatively impact management performance

- To monitor and discipline corporate management

- To unlock value in the target companies and increase the value of their shares

Answer: Choice C is correct.

The primary goal of shareholder activism is to unlock value in the target companies and increase the value of their shares. Shareholder activists are typically institutional investors or hedge funds that acquire a significant stake in a company with the intention of influencing its operations. They believe that the company’s management is not maximizing shareholder value and that changes in corporate strategy, operations, or governance could lead to an increase in the company’s share price. This could involve advocating for changes in the company’s business strategy, capital structure, or corporate governance. The ultimate goal is to increase the value of the company’s shares, thereby providing a return on the activist’s investment. Shareholder activism can be a powerful tool for driving corporate change and improving shareholder returns, but it can also be controversial and can lead to conflicts with management.

Choice A is incorrect. While it is true that shareholder activism can sometimes lead to distractions and negatively impact management performance, this is not the primary goal of shareholder activism. Rather, it is a potential side effect or risk of the strategy. The primary goal is to unlock value in the target companies and increase the value of their shares.

Choice B is incorrect. While monitoring and disciplining corporate management is one of the tactics used by shareholder activists, it is not the primary goal. The primary goal is to unlock value in the target companies and increase the value of their shares. Monitoring and disciplining corporate management is a means to this end, not an end in itself.

Portfolio Management Pathway Volume 1: Learning Module 2: Active Equity Investing: Strategies; LOS 2(g): Analyze activist strategies, including their rationale and associated processes

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.