Study Notes for CFA® Level III 2025 � ...

Learning Module 1: Index-Based Equity Strategies Los 1(a): Compare factor-based strategies to market-capitalization-weighted... Read More

Active Share and active risk are two key metrics used to assess a portfolio manager’s performance against their chosen benchmark. They provide insights into the level of security concentration and the absolute or relative risk that managers and their investors are willing to bear. It’s important to note that these measures do not always move in sync, meaning a manager can pursue a higher Active Share without necessarily increasing active risk, and vice versa.

Active Share quantifies the degree of divergence between the holdings of a portfolio and those of a benchmark portfolio. For instance, if a portfolio manager of a tech-focused fund chooses NASDAQ-100 as the benchmark, the Active Share would measure how much the fund’s holdings differ from the NASDAQ-100. An Active Share of 0 indicates a perfect match with the benchmark, while 100% signifies no overlap with the benchmark. For example, an Active Share of 80% implies that 20% of the portfolio capital was invested similarly to the index.

$$ \text{Active Share} = \frac{1}{2} \sum_{i=1}^{n} |\text{Weight}_{\text{portfolio},i} – \text{Weight}_{\text{benchmark},i}|$$

Where:

The Active Share calculation involves no statistical analysis or estimation; it is simple arithmetic.

Active Share can be increased by:

Active risk, on the other hand, is the risk of deviation from the expected return. It is measured relative to the benchmark that the manager has adopted as representative of his investment universe. To outperform his benchmark, a manager must have active weights different from zero.

Realized active risk is the historical standard deviation between the portfolio return and the benchmark return. For instance, if a portfolio manager invested in tech stocks during a period when the tech sector outperformed the S&P 500, the realized active risk would be the standard deviation of the portfolio’s returns from the S&P 500 during that period.

Predicted active risk, however, is a forward-looking measure that requires estimates of future correlations and variances. For example, a portfolio manager might use predicted active risk when constructing a portfolio of emerging market stocks, taking into account expected correlations and variances among those stocks. It’s important to note that while a portfolio manager can control Active Share, active risk is not entirely within her control as it depends on the correlations and variances of securities.

The active risk of a portfolio (\( \sigma_{RA} \)) is calculated using :

\[ \sigma_{RA} = \sqrt{\sigma^2 \left( \sum (\beta_{pk} – \beta_{bk}) \times F_k \right) + \sigma^2_{e}} \]

Where:

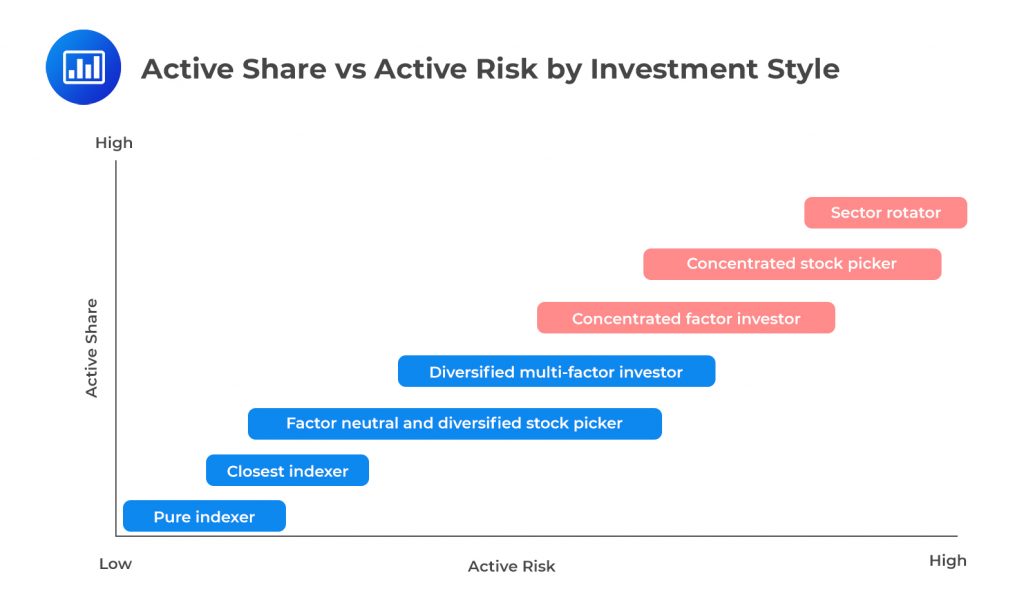

Active risk, Active Share, and factor exposure are interrelated. A high net exposure to a risk factor will lead to a high level of active risk, regardless of the level of idiosyncratic risk. If the factor exposure is fully neutralized, the active risk will be entirely attributed to Active Share. This is shown in more details in the figure below which illustrates how various combinations of factor exposure and idiosyncratic risk affect Active Share and active risk

$$ \begin{array}{l|l|l|l} & {\textbf{Low Active} \\ \textbf{Risk}} & {\textbf{Medium Active} \\ \textbf{Risk}} & {\textbf{High Active} \\ \textbf{Risk}} \\ \hline {\textbf{High Active} \\ \textbf{Share}} & {\text{Factor Neutral} \\ \text{and Diversified} \\ \text{Stock Picks}} & {\text{Diversified} \\ \text{Factor Bets}} & {\text{Concentrated} \\ \text{Stock Picks}} \\ \hline {\textbf{Medium Active} \\ \textbf{Share}} & \text{Closet Indexing*} & & {\text{Concentrated} \\ \text{Factor Bets}} \\ \hline {\textbf{Low Active} \\ \textbf{Share}} & \text{Pure Indexing} & & \end{array} $$

Active Risk and measures provide insights into a portfolio’s correlation with its benchmark, and the extent to which the portfolio manager is actively managing the portfolio.

For instance, if a portfolio manager decides to overweight technology stocks in a portfolio, this decision could increase the portfolio’s active risk. This is because the portfolio becomes less correlated with its benchmark. Similarly, underweighting certain sectors or types of firms can also contribute to active risk.

Consider the 2008 financial crisis, an example where the value stocks underperformed significantly, leading to a sharp decline in the Value factor. This event forced many trades/strategies to deleverage, resulting in the biggest drop of the Momentum factor in over seven decades.

Active risk and Active Share can be used to distinguish between different portfolio management approaches and styles. A manager could be characterized as factor neutral, factor diversified, or factor concentrated. Additionally, they could be classified as diversified (with low security concentration and low idiosyncratic risk) or concentrated (with high security concentration and high idiosyncratic risk).

For example, most multi-factor products typically have a high Active Share but low active risk, indicating a low concentration among securities and diversification across factors and securities. In contrast, a concentrated stock picker would have both a high Active Share and a high active risk.

Practice Questions

Question 1: A portfolio manager is considering two strategies to increase the Active Share of his portfolio. The first strategy involves including securities in the portfolio that are not in the benchmark. The second strategy involves holding securities in the portfolio that are in the benchmark but at weights different than the benchmark weights. Which of the following statements is correct regarding the sources of Active Share?

- Only the first strategy will increase the Active Share of the portfolio

- Only the second strategy will increase the Active Share of the portfolio

- Both strategies can increase the Active Share of the portfolio

Answer: Choice C is correct.

Both strategies can increase the Active Share of the portfolio. Active Share is a measure of the percentage of stock holdings in a manager’s portfolio that differ from the benchmark index. It is used to understand the extent to which a portfolio manager deviates from the benchmark in their investment strategy. The first strategy, which involves including securities in the portfolio that are not in the benchmark, will increase the Active Share because these securities are not part of the benchmark and therefore represent a deviation from it. The second strategy, which involves holding securities in the portfolio that are in the benchmark but at weights different than the benchmark weights, will also increase the Active Share. This is because the portfolio manager is deviating from the benchmark weights, which represents a form of active management. Therefore, both strategies can contribute to increasing the Active Share of the portfolio.

Choice A is incorrect. While the first strategy will increase the Active Share of the portfolio, it is not the only strategy that can do so. As explained above, the second strategy can also increase the Active Share.

Choice B is incorrect. While the second strategy will increase the Active Share of the portfolio, it is not the only strategy that can do so. As explained above, the first strategy can also increase the Active Share.

Question 2: A portfolio manager is looking to control the active risk in her portfolio. She understands that active risk is a complex calculation that depends on the differences between the security weights in the portfolio and the security weights in the benchmark. She also knows that there are two measures of active risk: realized active risk and predicted active risk. However, she is unsure about which measure she can control and which measure is beyond her control. Can you help her understand this better? Which of the following statements is correct?

- The portfolio manager can completely control both realized active risk and predicted active risk.

- The portfolio manager can completely control realized active risk but cannot completely control predicted active risk.

- The portfolio manager can completely control Active Share but cannot completely control active risk.

Answer: Choice B is correct.

The portfolio manager can completely control realized active risk but cannot completely control predicted active risk. Realized active risk is the standard deviation of the differences between the portfolio return and the benchmark return. It is a backward-looking measure that reflects the actual active risk that the portfolio has experienced over a certain period. Since it is based on the actual returns of the portfolio and the benchmark, the portfolio manager can control it by adjusting the portfolio’s holdings to closely match the benchmark’s holdings. On the other hand, predicted active risk is a forward-looking measure that estimates the active risk that the portfolio is expected to experience in the future. It is based on the portfolio’s current holdings and the expected returns and volatilities of the securities in the portfolio and the benchmark. Since it involves future expectations, it is inherently uncertain and cannot be completely controlled by the portfolio manager. The portfolio manager can only manage it to a certain extent by making informed predictions about the future returns and volatilities of the securities and adjusting the portfolio’s holdings accordingly.

Choice A is incorrect. The portfolio manager cannot completely control both realized active risk and predicted active risk. As explained above, predicted active risk involves future expectations and is inherently uncertain, so it cannot be completely controlled by the portfolio manager.

Choice C is incorrect. Active Share is a measure of the proportion of portfolio holdings that differ from the benchmark holdings. While the portfolio manager can control Active Share by adjusting the portfolio’s holdings, it is not a measure of active risk. Active risk involves both the differences in holdings and the differences in returns between the portfolio and the benchmark, so it cannot be completely controlled by adjusting the portfolio’s holdings alone.

Portfolio Management Pathway Volume 1: Learning Module 3: Active Equity Investing: Portfolio Construction; LOS 3(c): distinguish between Active Share and active risk and discuss how each measure relates to a manager’s investment strategy

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.