The Forecast Time Horizon

Government policies have an impact on exchange rate fluctuations. These channels include:

This model stipulates that changes in monetary and fiscal policies within a country interfere with interest rates and economic activities. These interferences manifest themselves in capital flows and trading. Particularly, these interferences are reflected in exchange rates. The Mundell-Fleming Model is based on aggregate demand and assumes that the economy could expand without price level increments.

According to this model, expansionary monetary policy affects economic growth by lowering interest rates. When interest rates are lowered, investment and consumption spending shoots up. Note that the reduction of interest rates coupled with flexible exchange rates triggers a reduction of domestic interest rates. This, in turn, makes capital flow to high-yielding markets, resulting in the depreciation of the local currency.

Expansionary fiscal policy (such as increased spending or lowering taxes) causes increased interest rates since a country will be operating with a higher budget deficit, which, nevertheless, must be financed. Increasing interest rates will attract capital from the low-yielding markets when this is coupled with flexible exchange rates and mobile capital. This will occasion domestic currency appreciation. If the money is immobile and irresponsive to interest rate changes, an increase in aggregate demand caused by government policies will increase imports and negatively impact the trade balance. Ultimately, this leads to currency depreciation.

In the case of floating exchange rates and high capital mobility, the domestic currency will appreciate the presence of restrictive domestic monetary policy and/or expansionary fiscal policy. On the other hand, the money will depreciate in the presence of domestic expansionary monetary policy and/or restrictive fiscal policy. This is summarized in the following table.

$$ \begin{array}{l|l} \textbf{Policy Combination} & \textbf{Effects} \\ \hline {\text{Expansionary fiscal vs.} } & \text{Indeterminate} \\ \text{Expansionary monetary policies} & {} \\ \hline \text{Expansionary fiscal vs.} & \text{Domestic currency appreciates} \\ \text{Restrictive monetary policies} & \\ \hline \text{Restrictive fiscal vs.} & \text{Domestic currency depreciates} \\ \text{Expansionary monetary policies} & \\ \hline \text{Restrictive fiscal vs.} & \text{Indeterminate} \\ \text{Restrictive monetary policies} & \\ \end{array} $$

In low mobile mobility, the effects of monetary and fiscal policies are only transmitted through trade flows rather than capital flows. When expansionary monetary and fiscal policies are mixed, downward pressure is exerted on the currency (bearish). This is because the expansionary fiscal policy increases imports and, therefore, a trade deficit. This, in the end, leads to currency depreciation. When expansionary monetary policy is added, the expenses on imports will shoot up, leading to a deterioration of the trade balance. Note that this will occasion further currency depreciation.

A mix of restrictive monetary and fiscal policies will exert upward pressure on the currency since it leads to a decrement in imports and an improvement in the trade balance. The effects based on low capital mobility are summarized below:

$$ \begin{array}{l|l} \textbf{Policy Combination} & \textbf{Effects} \\ \hline {\text{Expansionary fiscal vs.} } & \text{Domestic currency depreciates} \\ \text{Expansionary monetary policies} & {} \\ \hline \text{Expansionary Fiscal vs.} & \text{Indeterminate} \\ \text{Restrictive monetary policies} & \\ \hline \text{Restrictive fiscal vs.} & \text{Indeterminate} \\ \text{Expansionary monetary policies} & \\ \hline \text{Restrictive fiscal vs.} & \text{Domestic currency appreciates} \\ \text{Restrictive monetary policies} & \\ \end{array} $$

The Mundell-Fleming explanation is based on interest rate changes and output. Consequently, it leaves out changes in the price level and inflation. According to monetary models of exchange rate determination, the output is fixed. Further, the models insist that price levels and inflation rates majorly transmit the effects of monetary policies. As such, there are two models:

According to this model, when the domestic money supply increases by a certain percentage, it excites a rise in the price level by the same percentage. If purchasing power parity is assumed to hold (fluctuations in the exchange rates are reflected in inflation rate differentials), an increase (decrease) in domestic foreign prices should induce a proportional reduction (growth) in the domestic currency value.

The assumption of purchasing power parity in both short and long-run turns is a shortcoming of this model. This is because PPP does not, in most cases, hold in short or medium terms.

This model by Rüdiger Dornbusch (1976) assumes that price flexibility in the short run is limited but fully flexible in the long run. The essence of this short-run-long-run flexibility variation is to make sure that an increase in domestic money supply leads to a proportional increase in the domestic price levels. Note that the net effect of an increase in domestic price levels is the long-run depreciation of the domestic currency (consistent with the pure monetary model).

If the domestic price level is not flexible in the short run, this model will imply that the exchange rate will overrun the long-run PPP in the short term. Therefore, we should appreciate that an increase in the nominal money supply will lead to a fall in the domestic interest rate. In the presence of high capital mobility, a reduction in domestic interest rate will increase capital outflow, which, in turn, will cause short-run depreciation of domestic currency below long-run equilibrium value. However, the currency will appreciate following the conventional monetary approach if the nominal interest rate increases in the long run.

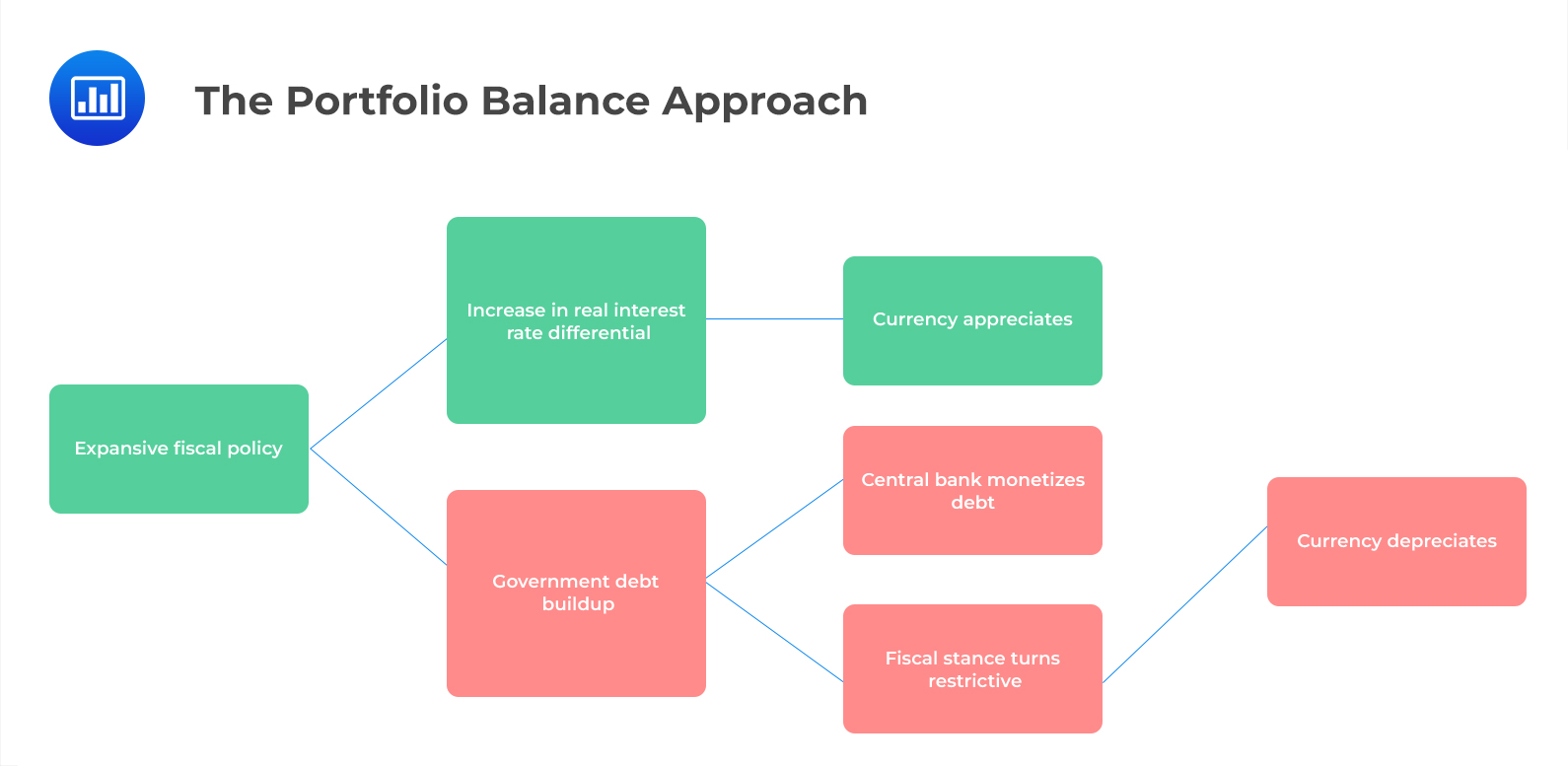

The Mundell-Fleming model does not accommodate the long-term effects of budgetary imbalance caused by continued fiscal policies. The portfolio approach surmounts this shortcoming by assuming that an investment consists of a diversified portfolio of domestic and foreign assets, such as, bonds. The proportion of each asset depends on the anticipated return and risks.

For instance, when the government’s deficit grows steadily, the supply of domestic bonds increases. Investors willingly hold the bonds if they are promised higher returns in the form of:

For instance, when the government’s deficit grows steadily, the supply of domestic bonds increases. Investors willingly hold the bonds if they are promised higher returns in the form of:

Question

A decreasing interest rate and increasing money supply in a country with low levels of public and private debt will most likely cause:

- An indeterminate effect on the currency.

- Currency appreciation.

- Currency depreciation.

Solution

The correct answer is C.

Decreasing interest rates will most likely cause capital flows to high-yielding markets, occasioning currency depreciation.

Reading 8: Currency Exchange Rates: Understanding Equilibrium Value

LOS 8 (k) Explain the potential effects of monetary and fiscal policy on exchange rates.

Practice FX & exchange-rate problems: monetary/fiscal policy scenarios, currency valuation & CFA-style questions

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.