Use of CDS to Manage Credit Exposures

The credit curve shows the credit spreads over a risk-free benchmark rate for... Read More

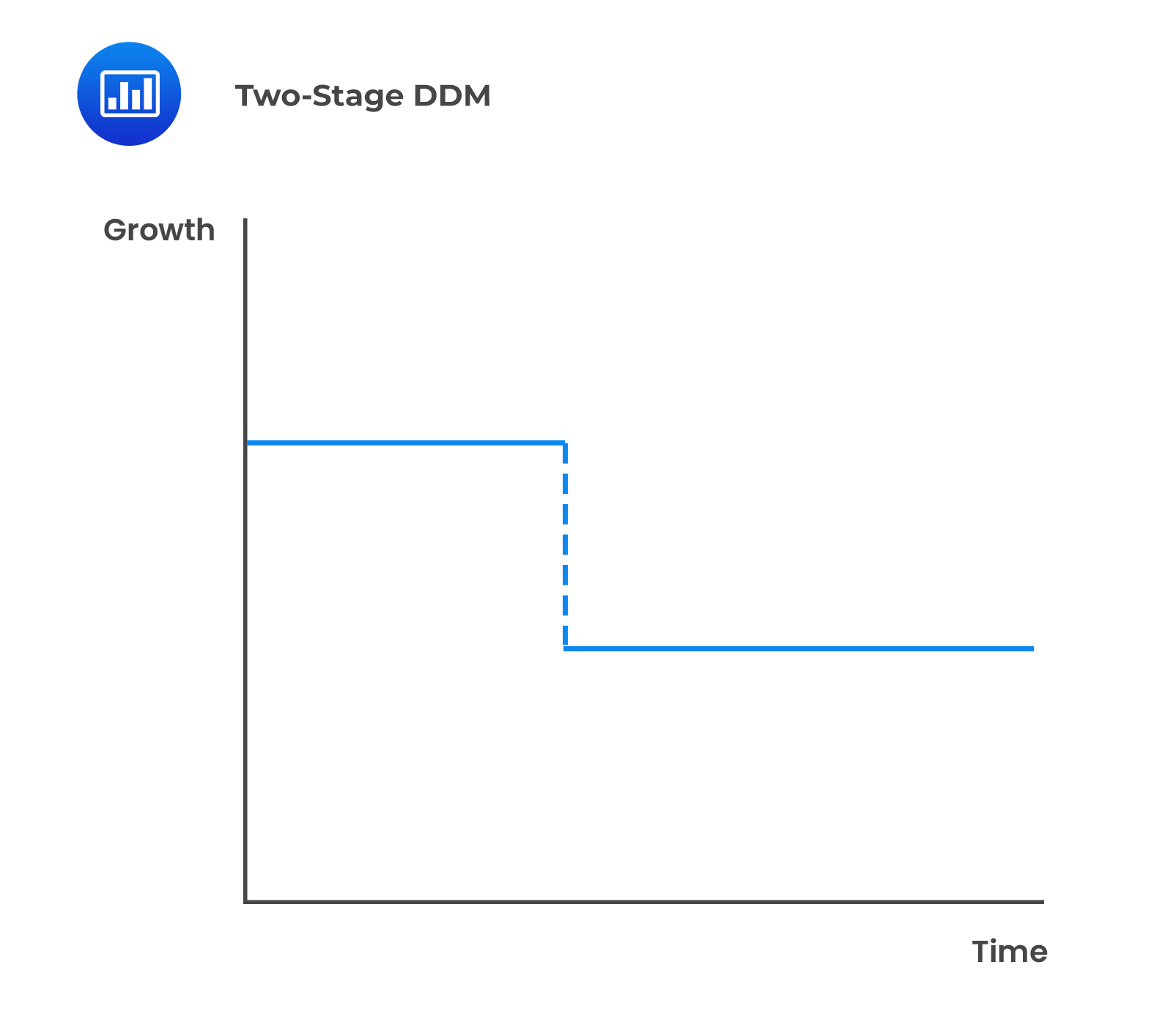

There are several assumptions of the first version of the two-stage DDM:

Formula:

Formula:$$\text{V}_0= ∑_{(\text{t}=1)}^{\text{n}}\frac{\text{D}_0(1+\text{g}_{\text{S}})^\text{t}}{(1+\text{r})^\text{t}} +\frac{\text{D}_0 (1+\text{g}_{\text{S}})^\text{n}(1+\text{g}_{\text{L}})}{(1+\text{r})^\text{n}(\text{r}-\text{g}_{\text{L}})}$$

Where:

\(\text{g}_{\text{S}}=\) Supernormal growth rate at the first stage.

\(\text{g}_{\text{l}}=\) Mature growth rate at the second stage.

\(\text{r}=\) Required rate of return.

\(\text{n}=\) Length of the extraordinary growth rate.

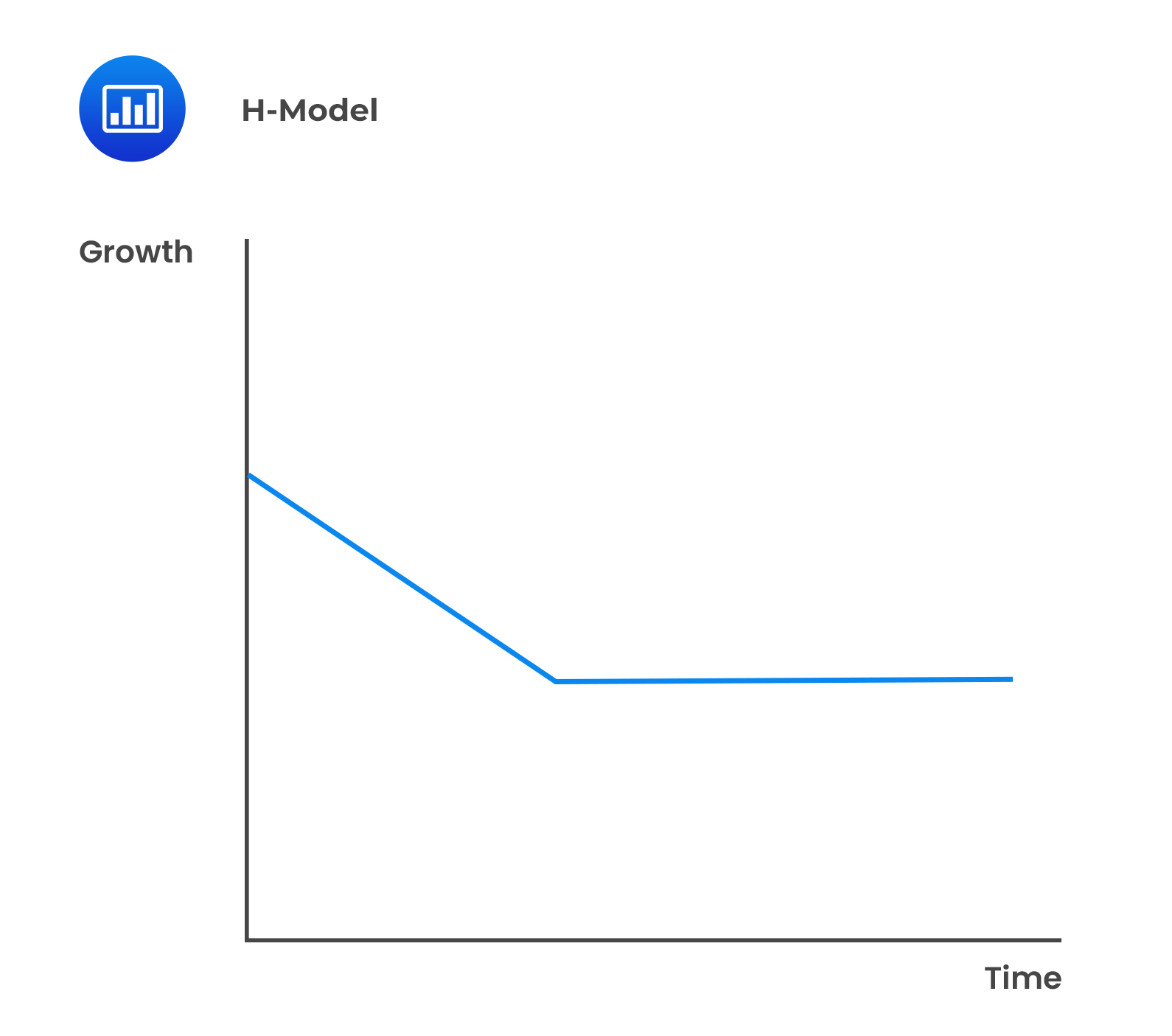

The assumptions of the H-Model include:

Formula:

Formula:$$\text{V}_0= \frac{\text{D}_0 (1+\text{g}_\text{L})+\text{D}_0\text{H}(\text{g}_{\text{S}}-\text{g}_{\text{L}})}{\text{r}-\text{g}_{\text{L}}}$$

Where:

\(\text{H}=\) Half-life (years) of the high growth period.

\(\text{g}_{\text{S}}=\) Initial short term high dividend growth rate.

\(\text{g}_{\text{l}}=\) Sustainable long-term dividend growth rate.

\(\text{r}=\) Required rate of return.

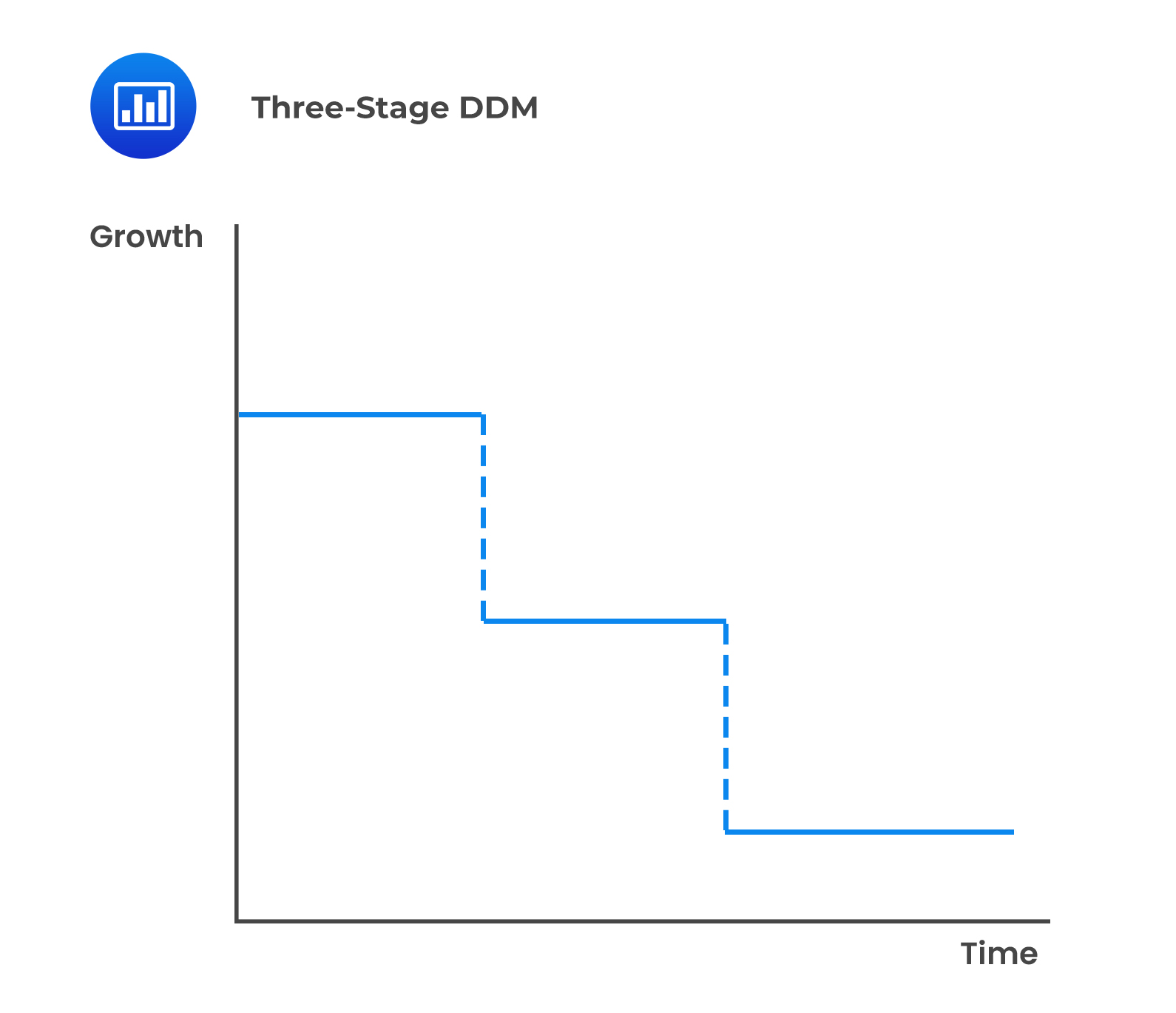

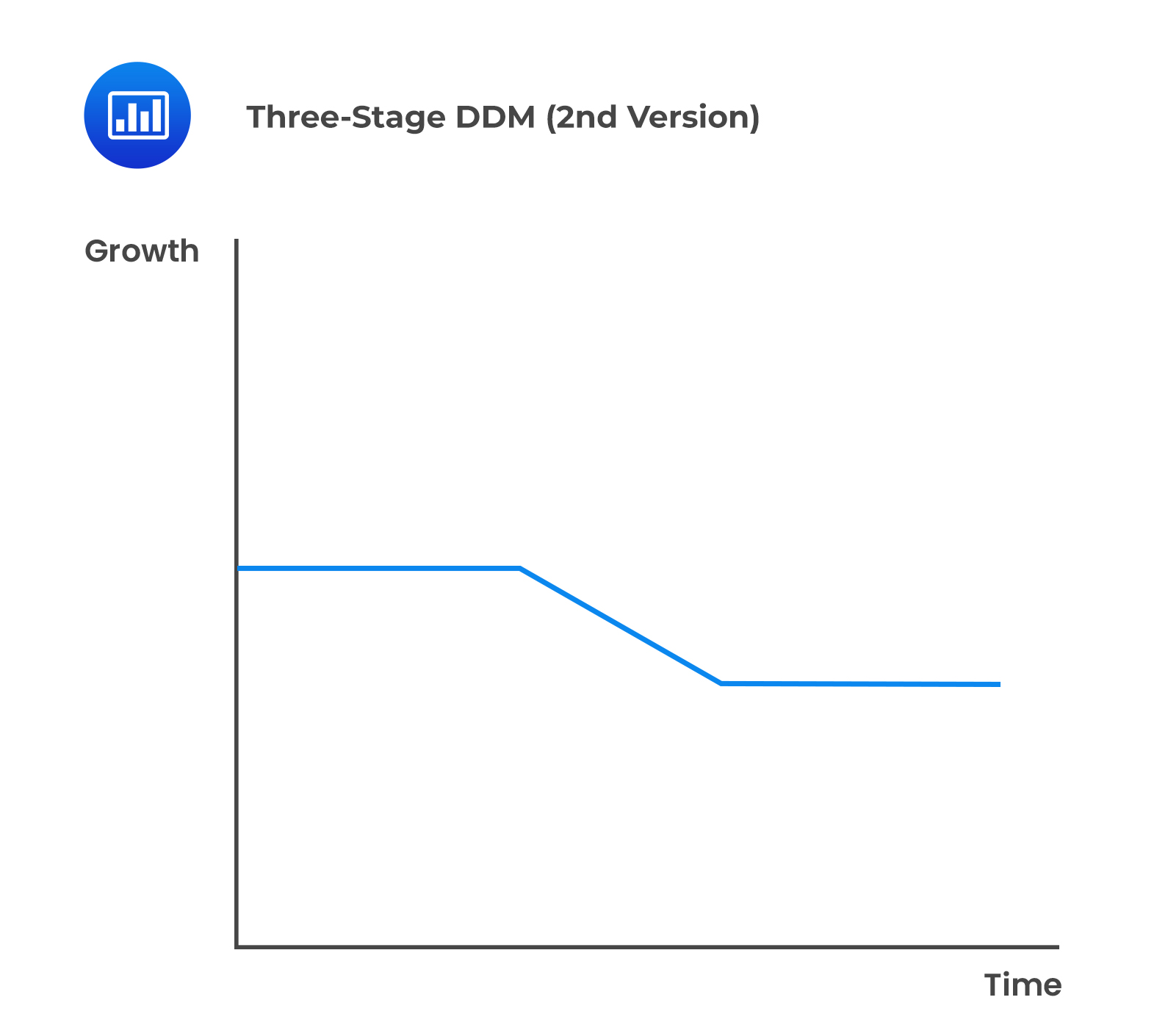

This model is more suitable for companies that are expected to have three separate stages of earnings growth. It is a more complex refinement of the two-stage model.

Calculation steps under this model are:

Calculation steps under this model are:

The steps under this model are:

stage 2 (H-model value).

stage 2 (H-model value).Spreadsheet modeling is used to build complicated models that would require different patterns of dividend growth. Built-in spreadsheet functions also make the calculation simpler. In addition, they allow several analysts to share their spreadsheet models, thus exchanging information.

Spreadsheet models also reduce the probability of computational inaccuracies.

Question

Which of the following is the least likely an assumption of the H-model?

- There are two stages in the H-model.

- A supernormal growth rate characterizes the final stage of the H-model.

- A sustainable long term growth rate characterizes the final stage of the H-model.

Solution

The correct answer is B.

A supernormal growth rate does not characterize the final stage. It is during the first stage of the H-model that the growth rate is expected to be high.

A is incorrect. The H-model assumes there are two stages.

C is incorrect. The final stage of the H-model is characterized by a sustainable long-term growth rate that is expected to continue into perpetuity.

Reading 23: Discounted Dividend Valuation

LOS 23 (j) Explain the assumptions and justify the selection of the two-stage DDM, the H-model, the three-stage DDM, or spreadsheet modeling to value a company’s common shares.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.