Share Repurchases

A share repurchase is a decision by a company to buy back its... Read More

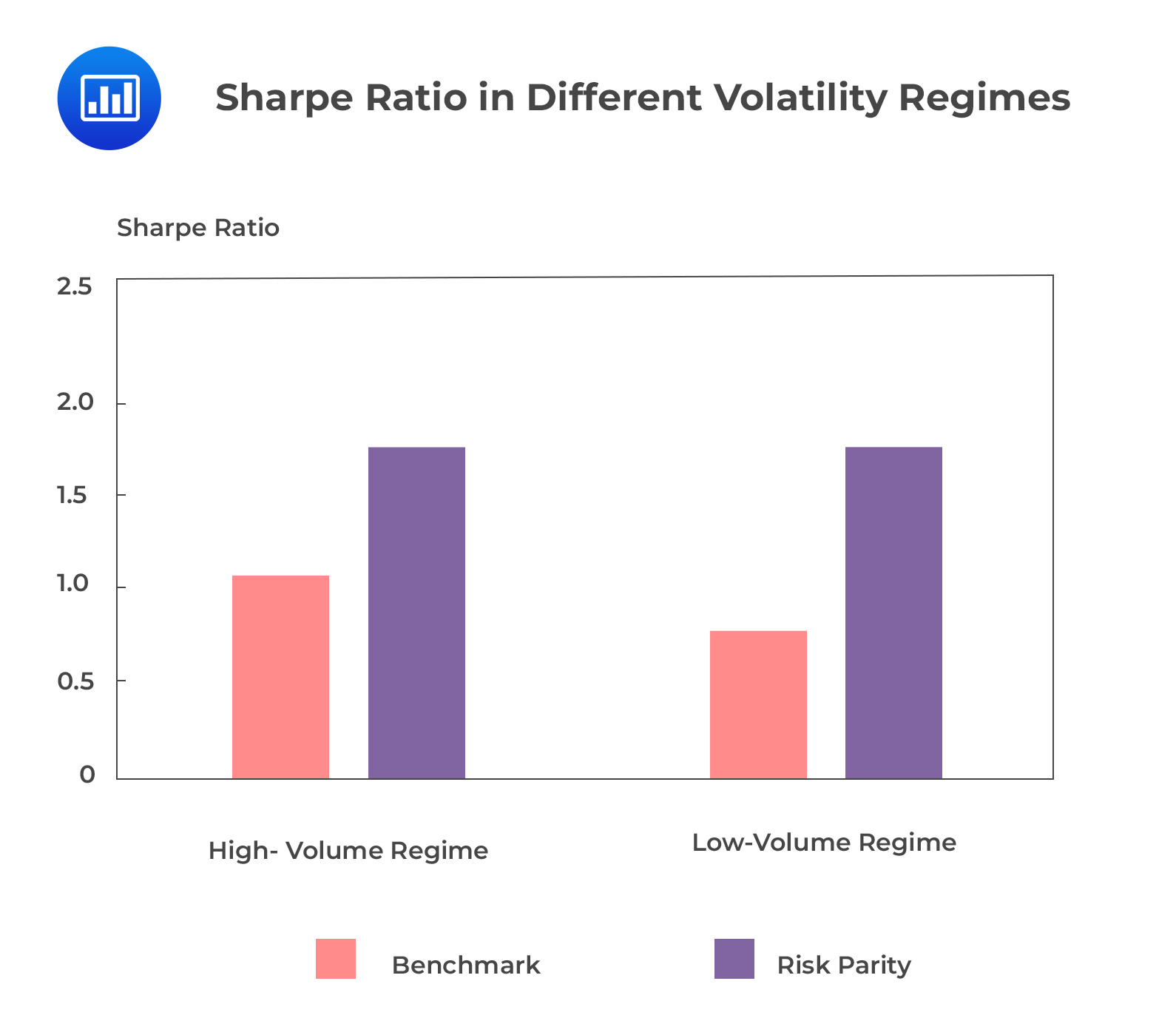

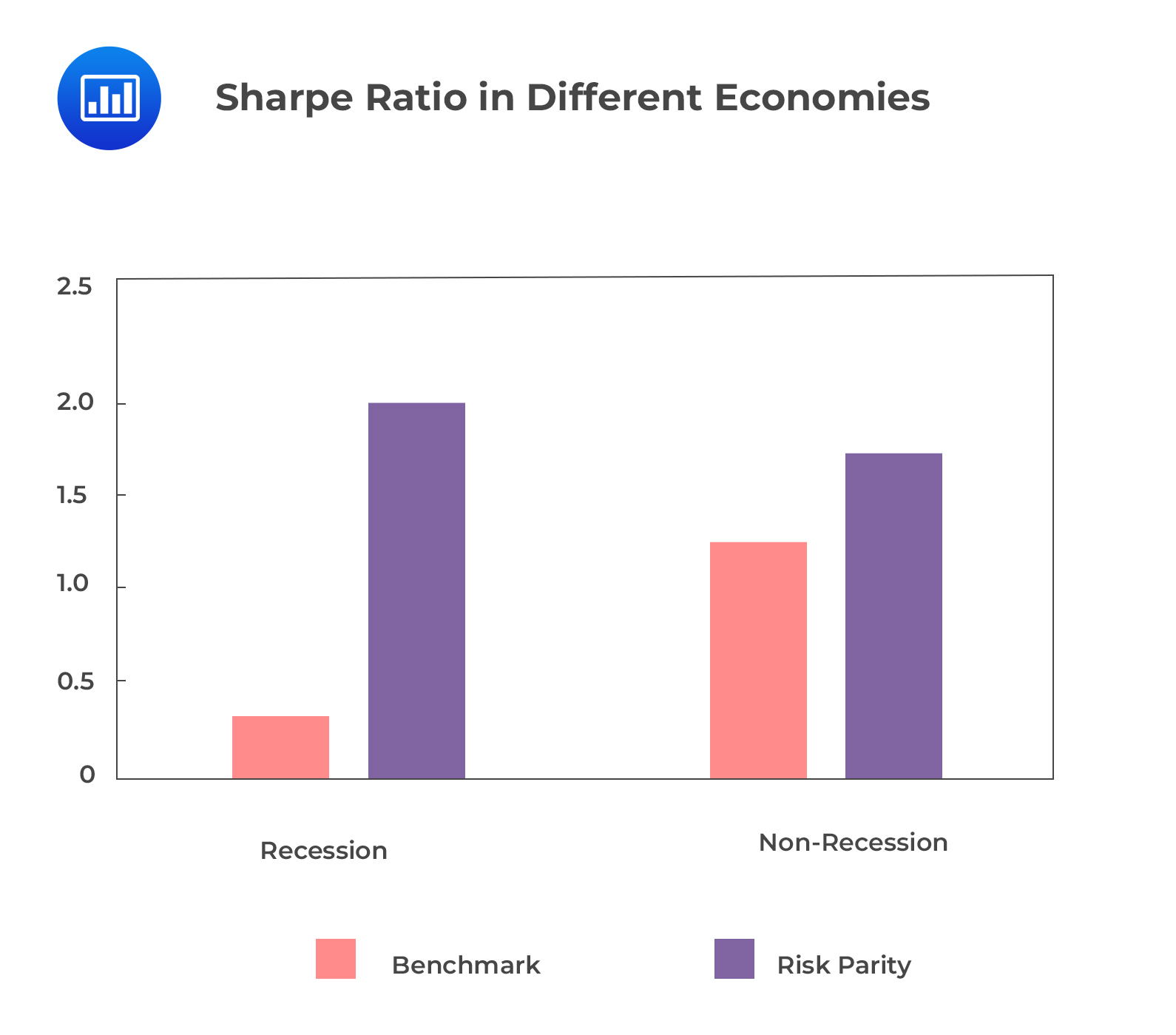

Historical scenario analysis is a form of backtesting that examines the risk and performance of an investment strategy at different structural breaks and structural regimes. The most common types of regime changes are from economic expansion to recessions and from high-volatility to low-volatility.

These two regimes can examine the risk parity and benchmark portfolio:

Question

Mark Jayden conducted a historical scenario analysis to examine the effect of regime changes on his portfolio. He observed that the portfolio had negative skewness and a fat tail to the left in a recession regime. Which of the following is the conclusion that Jayden will most likely make about the his portfolio?

- Lower average returns.

- Higher average returns.

- Cannot be determined.

Solution

The correct answer is A.

Excess kurtosis and negative skewness indicate lower average returns in a recession regime.

B is incorrect. Low kurtosis and positive skewness indicate a higher average return in a recession regime.

C is incorrect. It can be determined that excess kurtosis and negative skewness indicate lower average returns.

Reading 42: Backtesting and Simulation

LOS 42 (e) Evaluate and interpret a historical scenario analysis.