Income Approach Methods of Private Com ...

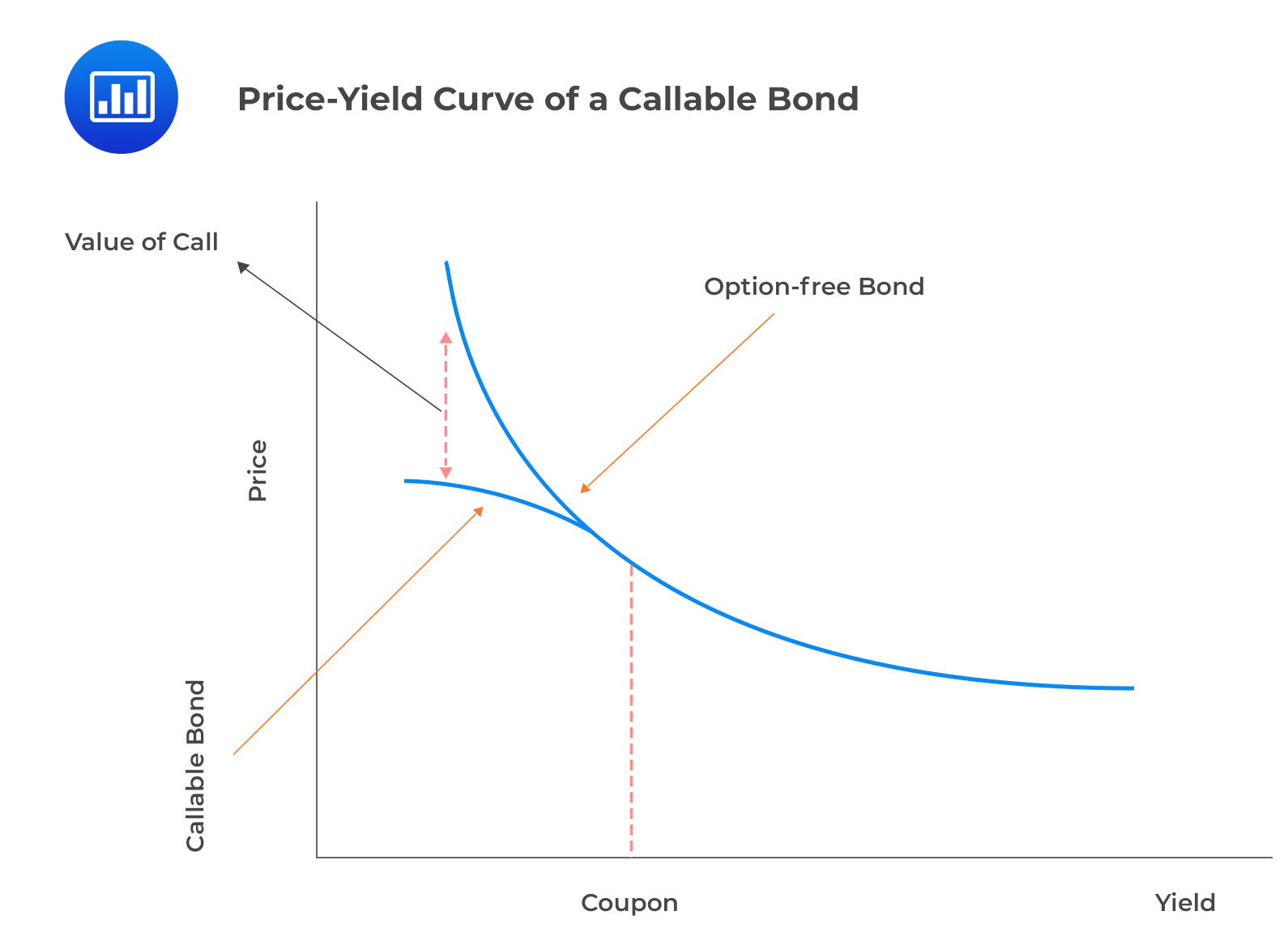

According to the arbitrage-free framework, the value of a bond with embedded options is the sum of the arbitrage-free value of the option-free bond (straight bond) and the arbitrage-free values of any embedded options.

A callable bond is similar to a portfolio with a long position on a straight bond and a short position on a call option. The issuer makes the decision to exercise the call option.

$$ \begin{align*} \text{Value of callable bond}& =\text{Value of straight bond} \\ & –\text{Value of issuer call option} \\ \text{Value of issuer call option}& =\text{Value of straight bond} \\ & – \text{Value of callable bond} \\ \end{align*} $$

i.e.,

$$ \begin{align*} V_{\text{Callable}} &= V_{\text{Straight}} – V_{\text{Call}} \\ V_{\text{Call}} &= V_{\text{Straight}} – V_{\text{Callable}} \end{align*} $$

This has been illustrated in the following diagram:

It is worth noting that callable bonds are riskier, have higher spreads, and generate higher yields relative to put bonds.

It is worth noting that callable bonds are riskier, have higher spreads, and generate higher yields relative to put bonds.

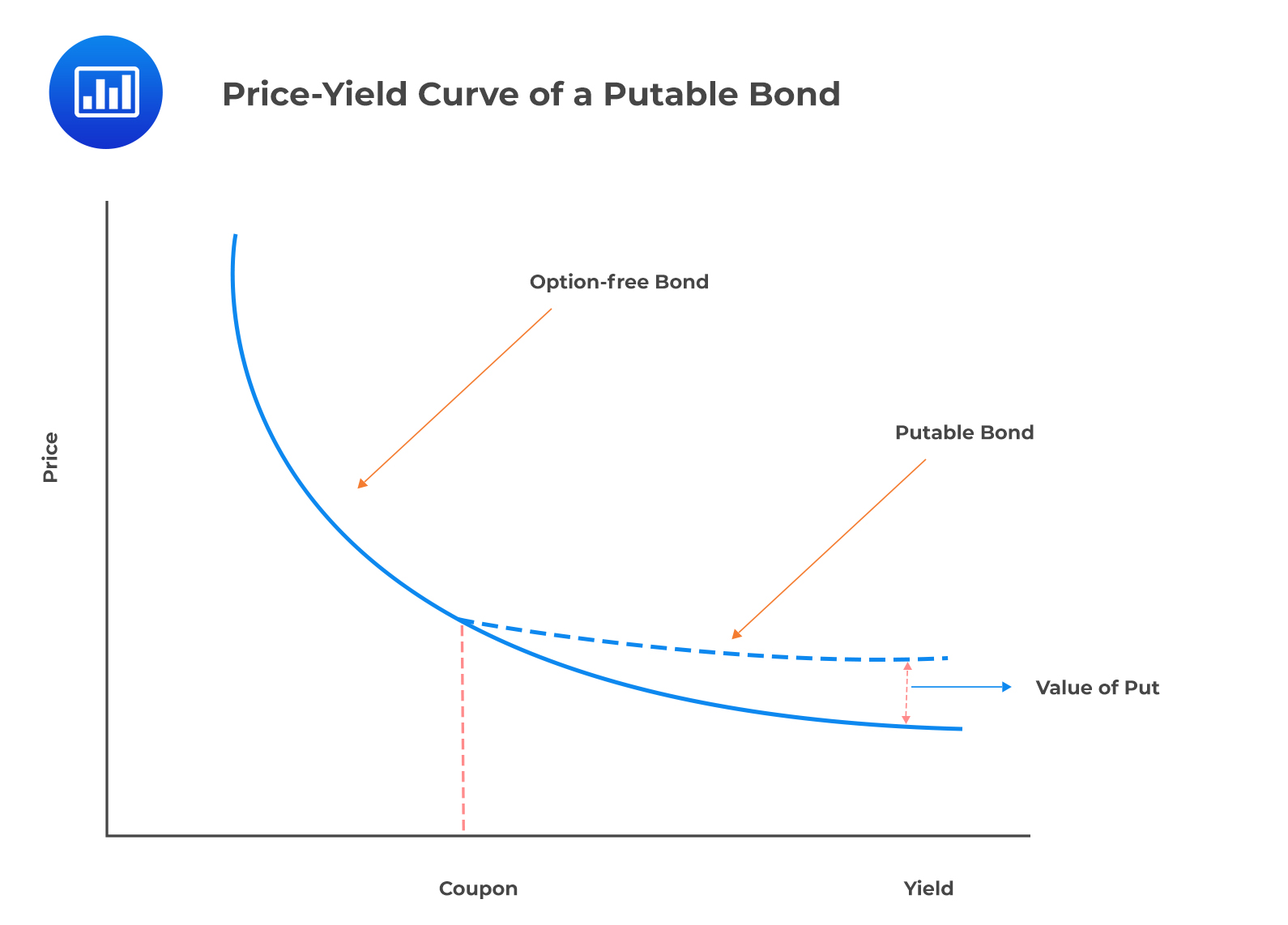

The investor has a long position in both the straight bond and the put option.

$$ \begin{align*} \text{Value of putable bond} & =\text{Value of straight bond} \\ & +\text{Value of investor put option} \\ \text{Value of investor put option} & =\text{Value of putable bond} \\ & – \text{Value of straight bond} \end{align*} $$

i.e.,

$$ \begin{align*} V_{\text{Putable}}= V_{\text{Straight}}+ V_{\text{Put}} \\ V_{\text{Put}}=V_{\text{Putable}} – V_{\text{Straight}} \end{align*} $$

The concept of embedded puts is illustrated in the following diagram:

Question

The value of an option free, 5% annual coupon bond that matures in three years is $106.80. If the value of a callable bond with similar terms is $105.50, the value of the issuer call option is closest to:

- -$1.30.

- $0.00.

- $1.30.

Solution

The correct answer is C.

$$ \begin{align*} \text{Value of issuer call option} &=\text{Value of straight bond} \\ & – \text{Value of callable bond} \\ V_{\text{Callable}} &=$105.50 \\ V_{\text{Straight}} &=$106.80 \\ V_{\text{Call}} &=$106.80-$105.50=$1.30 \end{align*} $$

Reading 30: Valuation and Analysis of Bonds with Embedded Options

LOS 30 (b) Explain the relationships between the values of a callable or putable bond, the underlying option free (straight) bond, and the embedded option.