Swap Spread

The swap spread is obtained by taking the difference between a swap’s fixed... Read More

An exchange-traded fund (ETF) is an investment fund that holds assets such as bonds, stocks, and commodities and is traded on the stock exchange. An ETF operates with an arbitrage mechanism planned to keep it trading close to its net asset value (NAV). Most ETFs often track an underlying index. An example is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index.

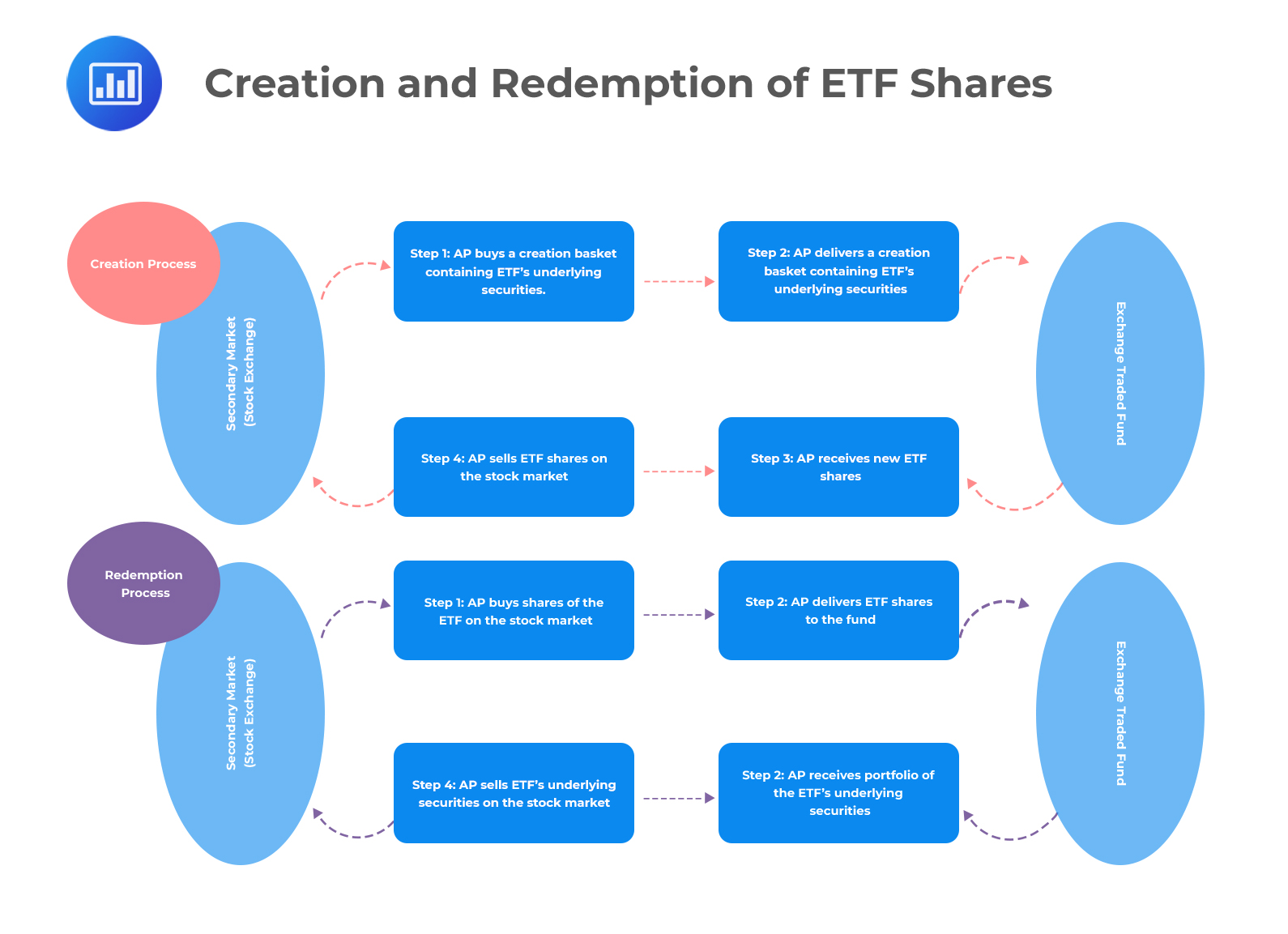

ETF shares are created by an exercise called creation and redemption, which occurs at the fund level in the primary market. It allows authorized participants (APs) such as approved market makers to exchange a pre-specified basket of securities, which include cash, for a certain number of ETF shares.

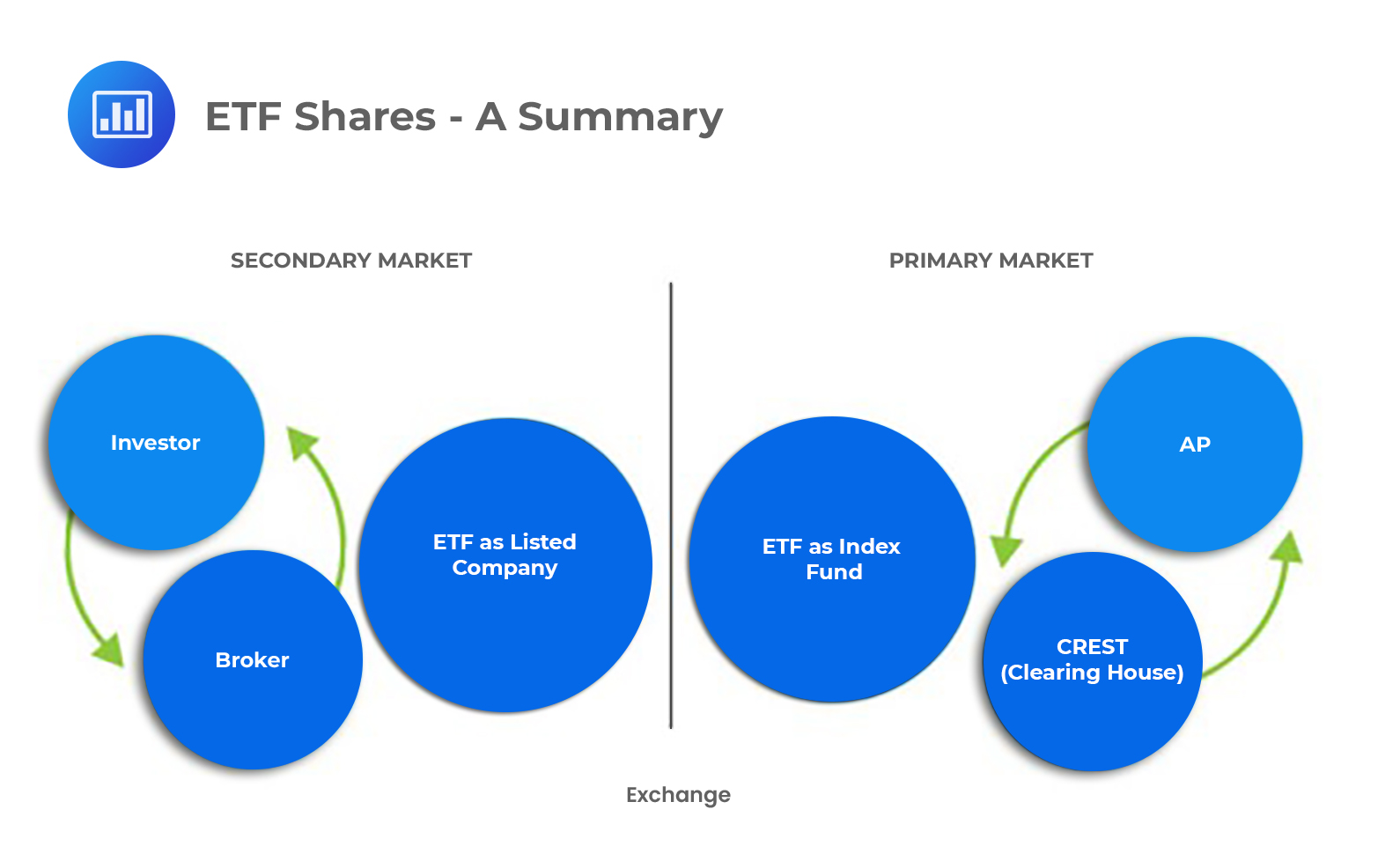

The process begins with a potential investor placing a buy order in their brokerage account. The broker then submits that order to the public market to find a willing seller. The order is carried out, and the investor receives shares of the ETF in the brokerage account.

Here, the ETF sponsor (manager or issuer) is not involved in the transaction. Shares simply move from one investor to another in the open market through a settlement process based on the exchange rate of the locality in which the trade took place.

The ability to create and redeem shares maintains an ETF’s price in line with its underlying net asset value. It also establishes that an ETF derives its liquidity from the underlying securities held within the fund.

The following diagram summarizes the process:

Functions of Authorized Participants

Functions of Authorized ParticipantsAuthorized participants (APs) are market makers approved by the ETF manager to participate in the creation or redemption process. They are the only investors who can create or redeem new shares of an ETF.

Other than participating in the creation or redemption process, the APs transact with the ETF issuer in kind to create new ETF shares. They acquire securities from the creation basket (a collection of securities) in the specified share amounts by trading in the public markets. Afterward, the AP delivers the acquired securities to the ETF issuer to get the equivalent value in terms of ETF shares.

Furthermore, in case the AP has unwanted ETF shares, they deliver them to the ETF manager in exchange for a redemption basket (list of securities the AP acquires after redemption of ETF shares). Although the redemption and creation baskets have the same composition in terms of securities, a dissimilarity may occur if the ETF manager decides to trade on some of the securities.

The disclosures of day-to-day holdings of the fund must be given to the APs. Therefore, the AP can perform ETF transactions even after the markets are closed. Moreover, the AP pays for all costs charged by the issuer to cover all the expenses such as processing costs, taxes, etc.

More specifically, the functions of APs include:

Assume that the ETF is trading in the market at $33.70. If the fair value of the ETF based on its underlying securities is $33.60, then an AP will step in to trade and buy the basket of securities at its fair value of $33.60 and simultaneously sell ETF shares in the open market at $33.70, gaining a $0.10 per share difference. In this transaction, the ETF is trading at a premium.

The price of a hypothetical ETF is $30.10. If the fair value of the underlying stock is $30.20, then the AP market maker will step in and purchase ETF shares on the open market while at the same time selling stock on the exchange, hence gaining a $0.10 per share price difference. The process continues until no further arbitrage opportunity exists. Here, the ETF is trading at a discount.

The following infographic summarizes ETF’s creation and redemption and the role of APs.

Question

Sophie Einstein, a junior ETF investor, was asked to state the roles of authorized participants in an investment. She gave the following responses:

- Creating and redeeming ETF’s new shares.

- Submiting orders to the public market.

- Performing ETF transactions after close of the trading day.

Which of the responses above are most likely true?

- 1 and 2

- 2 and 3

- 1 and 3

Solution

The correct answer is C.

Statements 1 & 3 are correct. The functions of authorized participants include the creation and redemption of an ETF’s new shares and all ETF transactions.

Statement 2 is incorrect. Submition of orders to the public markets is done by brokers.

Reading 39: Exchange Traded-Funds, Mechanics and Applications

LOS 39 (a) Explain the creation/redemption process of ETFs and the function of authorized participants.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.