Strengths and Weaknesses of the Residu ...

Strengths The terminal value does not make up a large portion of... Read More

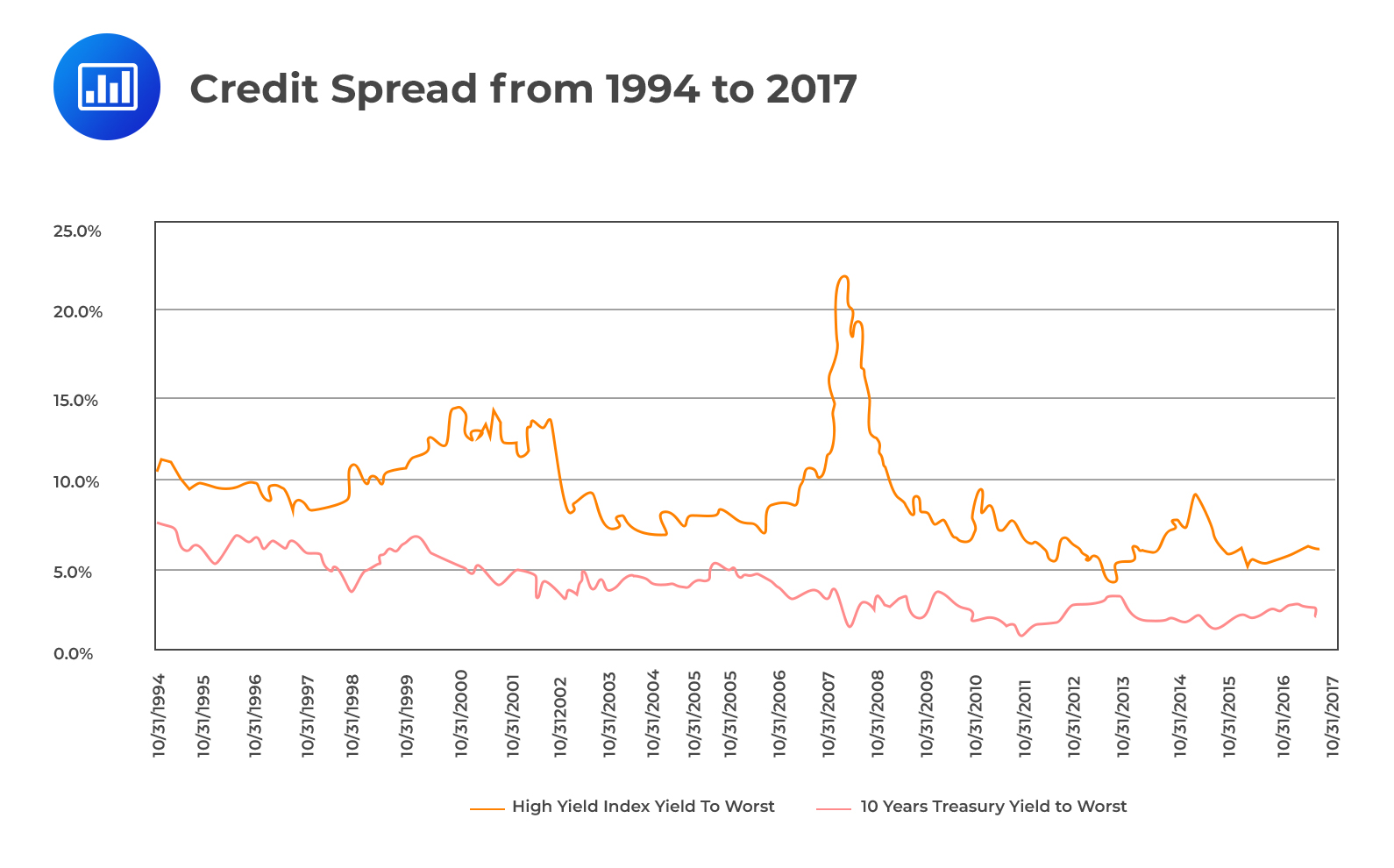

A credit spread is the difference in yield between a corporate bond and a government bond of equal maturity. Investors require the spread as a modality to compensate for the additional credit risk relative to that of government bonds. Besides the interest rate risk that both bonds carry, risky credit bonds bear additional credit risk.

The required discount rate for a risky credit bond has four components, i.e., the risk-free rate, the expected inflation, a risk premium, and the credit spread (additional risk premium for credit risk).

During weak economic times, there is an increased likelihood of corporate default and even bankruptcy. Due to this, investors always demand a higher premium during such periods. The credit spread is, therefore, very high towards and during a recession. However, it declines after a recession.

Defaults also increase during economic downturns, resulting in significant credit losses. When credit spreads decrease, credit risky bonds benefit more than default-free bonds. Generally, lower-rated bonds outperform higher-rated bonds since their yields fall by a larger amount. Conversely, when credit spreads widen, higher-rated bonds perform better, relative to lower-rated bonds since their yields rise less.

Defaults also increase during economic downturns, resulting in significant credit losses. When credit spreads decrease, credit risky bonds benefit more than default-free bonds. Generally, lower-rated bonds outperform higher-rated bonds since their yields fall by a larger amount. Conversely, when credit spreads widen, higher-rated bonds perform better, relative to lower-rated bonds since their yields rise less.

Question

Which of the following statements is most likely correct about the credit spread of risky bonds?

The credit spread:

- Tends to rise during times of economic downturns.

- Increases during expansions.

- Declines during bad economic times.

Solution

The correct answer is A.

Credit spread is the difference between the yield of a corporate bond and that of a government bond with the same currency denomination and maturity. It tends to increase in times of economic downturn. This is attributable to the increment in the likelihood of default. Note, however, that credit spread tends to decline in times of robust economic growth when defaults are less common.

Reading 44: Economics and Investment Markets

LOS 44 (f) Explain how the phase of the business cycle affects credit spreads and the performance of credit-sensitive fixed-income instruments.