Performance Evaluation of a PE Fund

Analysis of IRR The IRR, a cash-flow-weighted rate of return, is considered the... Read More

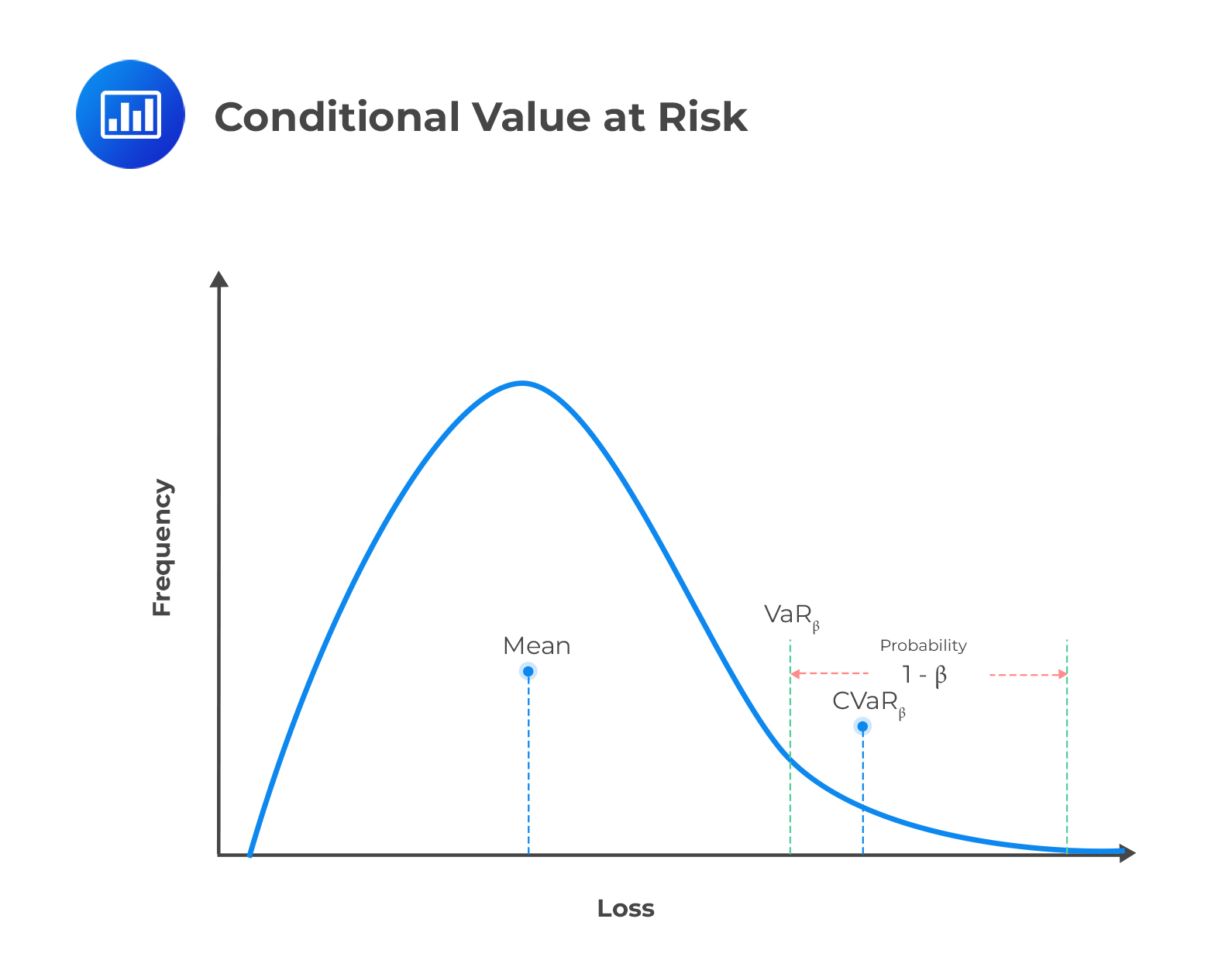

Rockafellar and Uryasev introduced conditional value-at-risk (CVaR) in 2000. CVaR is a tail risk metric that quantifies the amount of the expected losses beyond the VaR cutoff point at a specific confidence level. It is also known as the expected shortfall (ES), average value at risk (AVaR), or expected tail loss (ETL). CVaR is a weighted average of the losses in the tail of the return’s distribution beyond the VaR level.

CVaR is mathematically complex to obtain when the parametric method is used. This can be attributed to the fact that this method cannot be used in the determination of the magnitude of losses more magnificent than the VaR.

CVaR is mathematically complex to obtain when the parametric method is used. This can be attributed to the fact that this method cannot be used in the determination of the magnitude of losses more magnificent than the VaR.

Kevin Dowd introduced incremental value at risk in 1999. Incremental value at risk (IVaR) measures the impact of small changes as a result of taking different positions of the portfolio on the VaR. To obtain IVaR, VaR is repeatedly calculated considering different positions of the portfolio. The difference between the new VaR and the original is the IVaR.

Marginal VaR is a measure of the impact of removing a position from a portfolio on the overall VaR. It is different from IVaR because it measures the impact of removing an entire portfolio holding rather than making small changes, in the portfolio position, on VaR.

Relative VaR measures the risk resulting from the underperformance of a portfolio relative to a benchmark portfolio. Assuming a 95% confidence level, a 1-day relative VaR of $5,000 for portfolio B implies that, on average, the portfolio would underperform only for five days in a hundred days, relative to the benchmark by more than $5,000 due to market changes.

Question

Which of the following statements about the extensions of VaR is the most accurate ?

- Marginal VaR is a tail risk metric that quantifies the amount of expected losses beyond the VaR cutoff point.

- Conditional VaR is a measure of how removing a position from a portfolio may affect the overall VaR.

- Incremental VaR measures the impact on the VaR resulting from small changes caused by taking different positions of a portfolio.

Solution

The correct answer is C.

Incremental value at risk (IVaR) measures the impact on the VaR resulting from small changes caused by taking different positions of a portfolio. To obtain IVaR, VaR is repeatedly calculated considering the different positions of the portfolio. The difference between the new VaR and the original is the IVaR.

A is incorrect. Marginal VaR is a measure of how the removal of a position from a portfolio may affect the overall VaR. It is different from IVaR because it measures the impact that the removal of an entire position rather than making small changes in a portfolio has on VaR.

B is incorrect. Conditional value-at-risk (CVaR) is a tail risk metric that quantifies the amount of the expected losses beyond the VaR cutoff point at a specific confidence level.

Reading 41: Measuring and Managing Market Risk

LOS 41 (e) Describe extensions of VaR.

Master advanced VaR techniques with realistic exam-style practice.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.