Cyber Risk and the U.S. Financial Syst ...

After completing this reading, you should be able to: Explain the direct costs... Read More

After completing this reading you should be able to:

In the past, financial regulators and market players perceived climate change as a series of frequent weather disruptions. These disruptions were seen to be easily addressed by the operational risk framework if severe. In actuality, climate change includes extreme and acute climatic events such as warming air, and increasing sea temperatures as well as chronic, slower-moving changes that impact economic activity, such as shifts in water availability or rainfall patterns that affect agricultural production. The negative impact of climate change on economies has increased costs making investors and regulators increasingly aware of climate change risks.

Climate change in the financial sector was first studied in the early 2000s as part of a social and environmental risk appraisal. This appraisal project was sort of a refutation of climate change. It was focusing more on risk from the project to the environment rather than vice versa. This project was mostly aimed at managing the companies’ reputational risks as nonprofit organizations (NGOs) raised concerns about energy projects causing environmental pollution.

The Paris Agreement is a landmark environmental accord within the United Nations Framework Convention on Climate Change (UNFCCC). It was signed by roughly every nation in 2015, and it deals with greenhouse-gas-emissions mitigation and adaptation.

The agreement’s long-term temperature goal is to limit the increase in global average temperature to below \(2^0\) C above the preindustrial level and pursue means to limit the rise to \(1.5^0\) C. The pact is also aimed at increasing the ability of participants to adapt to the unfavorable effects of climate change and provide consistent financial flows towards low greenhouse gas emissions and developments which are flexible to climate change.

According to the Paris Agreement, it is the responsibility of every country to adapt mitigation approaches for global warming. Every country is to provide without compulsion a report on its contribution to the regulation of global warming.

Climate change risks are categorized into two: transition risks and physical risks.

Transition risks are economic risks emanating from mitigation challenges as sectors decarbonize. They can be policy and legal risks, technology risks, market risks, and reputational risks. The initiation of the Intergovernmental Panel on Climate Change (IPCC) is being challenged on the efforts for complete decarbonization. Creating low-carbon societies will invalidate some industries and benefit others. To manage the transition risks, one must have a clear understanding of the nature of the economic changes.

The forces of transition risks are liabilities, government policies, and new technology. Government policies have a proportionate ability to change industry dynamics as they can stop extractive activities such as mountaintop removal or promote green energy through subsidies and renewable generation targets.

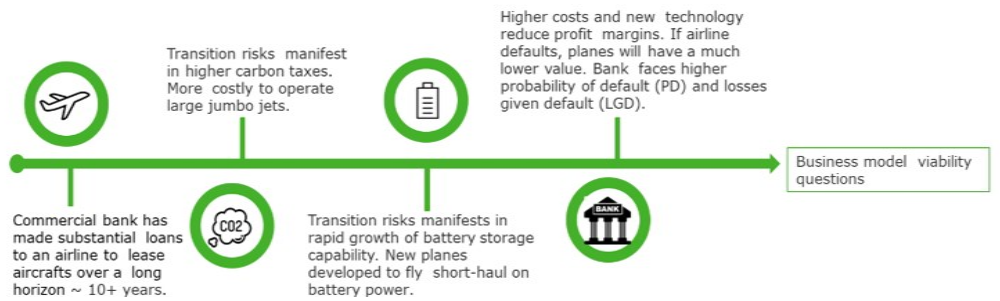

The following diagram illustrates the potential impacts of increased transitional risk on banks:

Physical Risks

Physical RisksPhysical risks are threats arising from the physical impacts of climate change. They range from uncontrollable fires to dangerous tropical storms. Physical hazards can be (acute) extreme events, e.g., fires and hurricanes or (chronic) incremental events, which are long-term environmental impacts.

Financial institutions are concerned with the increasing severity of these disasters. Banks and investors have seen major assets being washed away or being consumed by fire.

The first effects of climate change give a picture of the most dangerous consequences that are to take place later. If this initial effect is a rise in temperature, the effects are largely felt because warming leads to a global change in climate, but with huge geographical and temporal differences. The change in weather will result in modifications of the climate patterns and other related impacts.

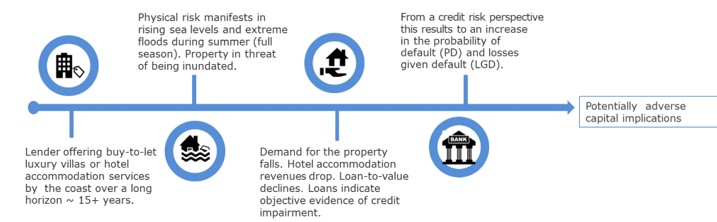

The following diagram illustrates the potential impacts of increased physical risk on banks:

Alongside environmental concerns, many business institutions are concerned that financial markets misprice climate risk; thus, exposing global economies to systemic and financial losses. The climate-related risks must be captured by the risk management frameworks and be given attention just like any other risk. Climate change risk parameters are not being obtained because of the following reasons.

It is worth noting that financial decisions based on traditional risk pricing would be misinformed. Thus, this causes two problems: the financial institutions cannot do their part to orient markets in the right direction to fight climate change, and they are potentially overexposed to risk, causing systemic instability.

The alarming severity of the climate risks to the financial system has made banks and investments to device mechanisms to deal with the menace. In this section, we shall have an overview of the stress test and scenario analysis approaches.

In this section, we will discuss Article 173 of the French Energy Transition Act and the European Commission Sustainable Finance Action Plan.

The Energy Transition for Green Growth (ETGG) Act was adopted in August 2015. The Act made a turning point in carbon reporting. It gives a way of mitigating climate change and diversifying the energy mix and aims at reducing greenhouse gas emissions and energy consumption.

Under this article, a new specific reporting is required on climate change, from both non-financial companies and financial institutions themselves. Its provision for institutional investors was globally acknowledged and opened the way to similar discussions in many other scopes. The provisions of the French Energy Transition Act are:

Since its implementation, several reviews have been published to analyze the progress of the financial institutions in the new reporting requirement, which gives a broad diversity in the methodologies and approaches followed by financial institutions.

Although the provisions of the law seemed extraordinary, its implementation has been regarded unsatisfying because it has not met its preset expectations in the reporting exercise. It does not uncover the strategies and risk exposures, according to the regulator’s expectations.

This action plan is one of the most significant regulatory measures for climate-related financial risks. The European Commission (EC) created a High-Level Expert Group on Sustainable Finance (HLEG) in December 2016. The group was made up of twenty senior experts from civil society, the finance sector, and the observers from European and international institutions. The HLEG’s mandate was to provide advice to the EC on how to:

The action plan on sustainable finance was formed based on the recommendations of the HLEG.

The action plan on the sustainable finance adopted in the EC had three objectives:

The EC adopted a package of measures considering the key actions given in the action plan. The kit includes a proposal for a European Union (EU) taxonomy regulation.

To mobilize central regulation for climate change and sustainability, the EC explores the practicability of and risks related to climate and other environmental factors in institutions’ risk management policies and the potential measurement of capital requirements of banks. This is aimed at defending the consistency and efficiency of the prudential framework and financial stability.

The action plan opens the way to provisions that would operate similarly by either decreasing or increasing capital requirements for holdings related activities that should be invested in priority for a transition.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.