Retirement Planning

The retirement problem is perhaps the most important set of financial decisions that... Read More

This section will explore tactical decisions a portfolio manager can make regarding currency risk management. These decisions are driven by the Investment Policy Statement (IPS), which grants the manager some flexibility in handling the portfolio’s currency risk. This flexibility can take various forms, such as adjusting tolerance bands or determining which currency exposures to hedge fully. These choices are considered tactical because the manager expects them to benefit the portfolio’s mean-variance profile by strategically steering its direction.

The approach of using economic fundamentals is based on the idea that various economic factors can significantly influence a currency’s value. In the long run, exchange rates are influenced by the concept of purchasing power parity. Additionally, certain factors determine currency appreciation or depreciation in the short run. While no method can predict future currency movements, understanding these logical relationships can provide valuable insights.

Technical analysis is based on certain assumptions. It considers historical price and volume data to identify patterns that tend to repeat. Unlike economic fundamentals, technical analysis does not focus on logical relationships between economic factors and currency value. Instead, it relies on the following principles:

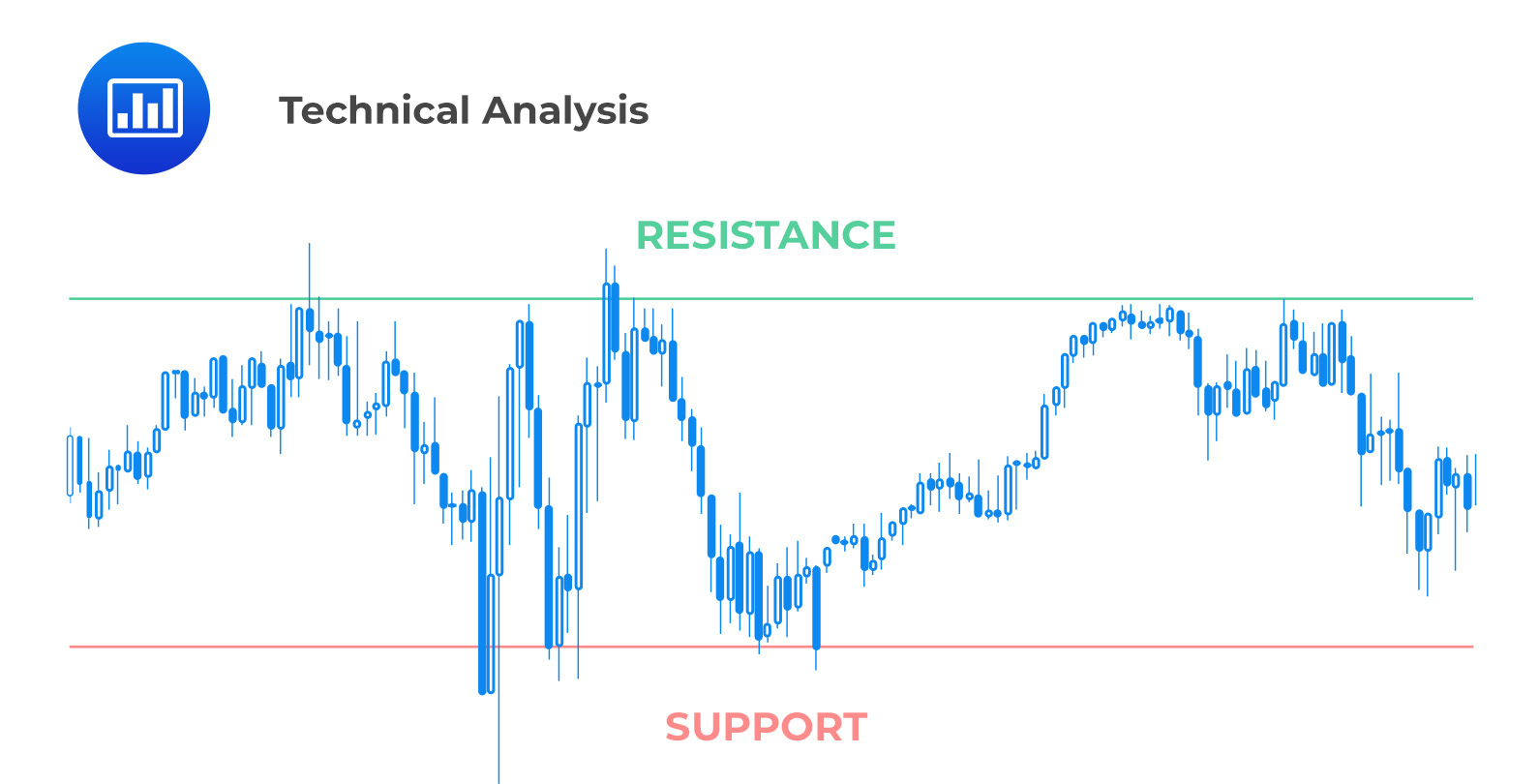

Technical traders often use support and resistance levels to gauge price momentum. Resistance levels indicate that the price has reached its ceiling and is likely to decline. On the other hand, support levels indicate that the price is likely to bounce higher. These levels are crucial in technical analysis and help traders decide based on past price behavior.

Analysts use technical analysis to identify resistance and support levels that can help determine price momentum. Resistance levels act as ceilings on currency prices, indicating that the price has struggled to move above that level. On the other hand, support levels act as floors for currency values, suggesting that the price has previously found strong buying interest at that level. Analysts attempt to make predictions about future price movements by analyzing these levels.

Various moving averages can serve as bullish or bearish indicators for technical traders. A moving average calculates the mean currency value over a specific time frame, such as 30 or 200 days. When current prices or more recent moving averages exceed previous averages, it creates a crossover point, considered a bullish signal. Conversely, if more recent prices fall below previous moving averages, it is interpreted as a bearish sign.

Technical analysis is often employed alone or alongside other methods to facilitate foreign currency trading. For instance, an analyst might have a well-developed market expectation through economic fundamental analysis but may use technical analysis to identify appropriate entry or exit points. The degree to which technical analysis is used varies, but it tends to be more effective in less data-efficient markets.

The carry trade strategy involves borrowing funds in low-yield currencies and investing them in high-yield ones, aiming to profit from the differential interest rate. For instance, in a USD/EUR carry trade scenario:

$$ \begin{array}{c|c} \textbf{USD} & \textbf{EUR} \\ \hline \bf{\text{Given an interest rate of }4\%} & {\text{Given an interest rate of } 2\% } \\ \hline \end{array} \\ \textbf{A trader using the carry trade strategy will:} \\ \begin{array}{l|l} \hline \textbf{Invest USD at 4%.} & \text{Borrow EUR at 2%.} \\ {\textbf{The investment will earn a higher} \\ \textbf{interest rate.}} & { \text{Convert EUR to USD at the spot exchange} \\ \text{rate.}} \\ \hline \end{array} \\ \textbf{The differential between the interest rates is the profit.} $$

Carry trades are attractive during market stability and favorable economic conditions, as the interest rate differential can generate income. However, during increased uncertainty or market turmoil, carry trades can become risky, as adverse exchange rate movements can lead to substantial losses, potentially eroding the interest rate gains.

Uncovered Interest Rate Parity (Uncovered “IRP”) is an essential concept to understand in foreign exchange. In the long run, a carry trade will not generate a profit. Uncovered IRP states that an unhedged investment in a foreign currency should not yield a return greater than an investment in the local currency. This is because interest rates should adjust to the exchange rate movements, ultimately offsetting any advantages that could lead to a profit. See below:

$$ \% \frac {\Delta SH}{L} \approx iH – iL $$

Where:

\(\% \frac {\Delta SH}{L}\) – is the change in exchange rate with the low-yielding currency as a base

\(iH\) – the interest rate of the high-yielding currency

\(iL\) – the interest rate of the low-yielding currency

The formula above indicates that when the exchange rate appreciates (meaning the low-yielding currency strengthens, denoted by H increasing), there should also be a corresponding increase in iH, representing the country’s interest rates. This relationship makes sense as a weaker currency is considered riskier and should offer a higher return to attract investors. However, the breakdown of this relationship allows carry trades to be profitable.

Carry trades are usually funded using safe-haven currencies like USD, CHF, and JPY, considered low-yield currencies where borrowing occurs. On the other hand, certain developing market currencies are seen as high-risk investment currencies, known as high-yielding currencies. The former are called funding currencies, while the latter are called investment currencies.

Volatility trading involves using currency options to isolate specific risk factors known as the Greeks and express sophisticated market views on various factors.

Delta: Delta represents the price risk of the currency option concerning the rate of change in the underlying currency’s value, indicating whether it appreciates or depreciates. It measures the sensitivity of the option price to the change in the underlying value.

Vega: Vega refers to the option contract’s sensitivity to changes in implied volatility. It measures the sensitivity of the option price to the change in the underlying volatility.

Delta Hedging: This strategy uses derivatives to remove a portfolio’s delta risk factor. By appropriately hedging the delta, the portfolio’s price remains stable regardless of the direction of the underlying currencies.

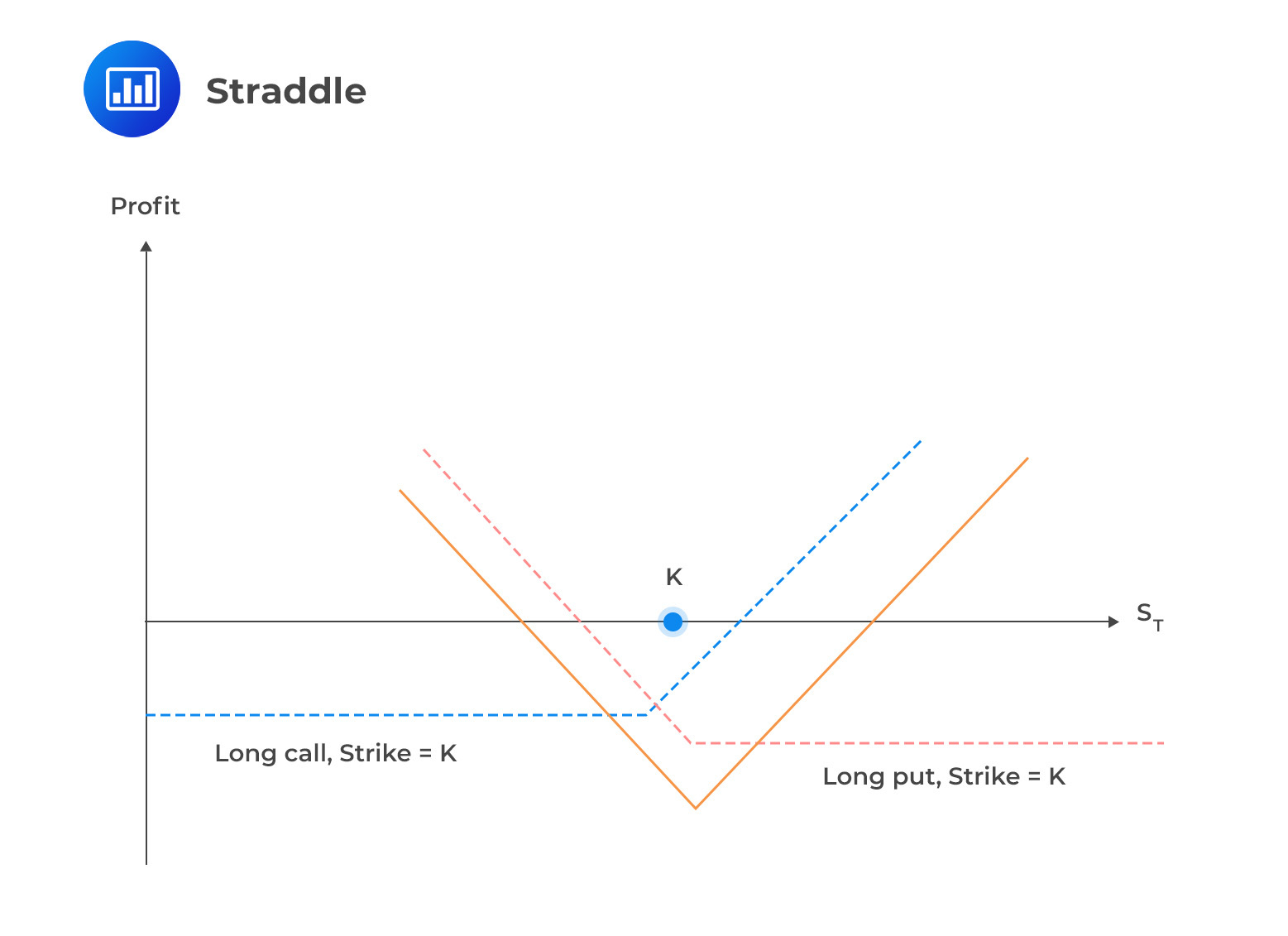

Straddle: The strategy combines a long call and a long-put option at the same strike price, expiration, and underlying. It operates on neutral ground, where the price can move in either direction. If either of the options fails, the two opposite trades will offset the loss, and traders will only lose their initial cost of the trade. Profits are made when there are high variations in price in either direction (up or down), and they offset the trade’s initial cost, leaving the remaining amount as profit for the trader.

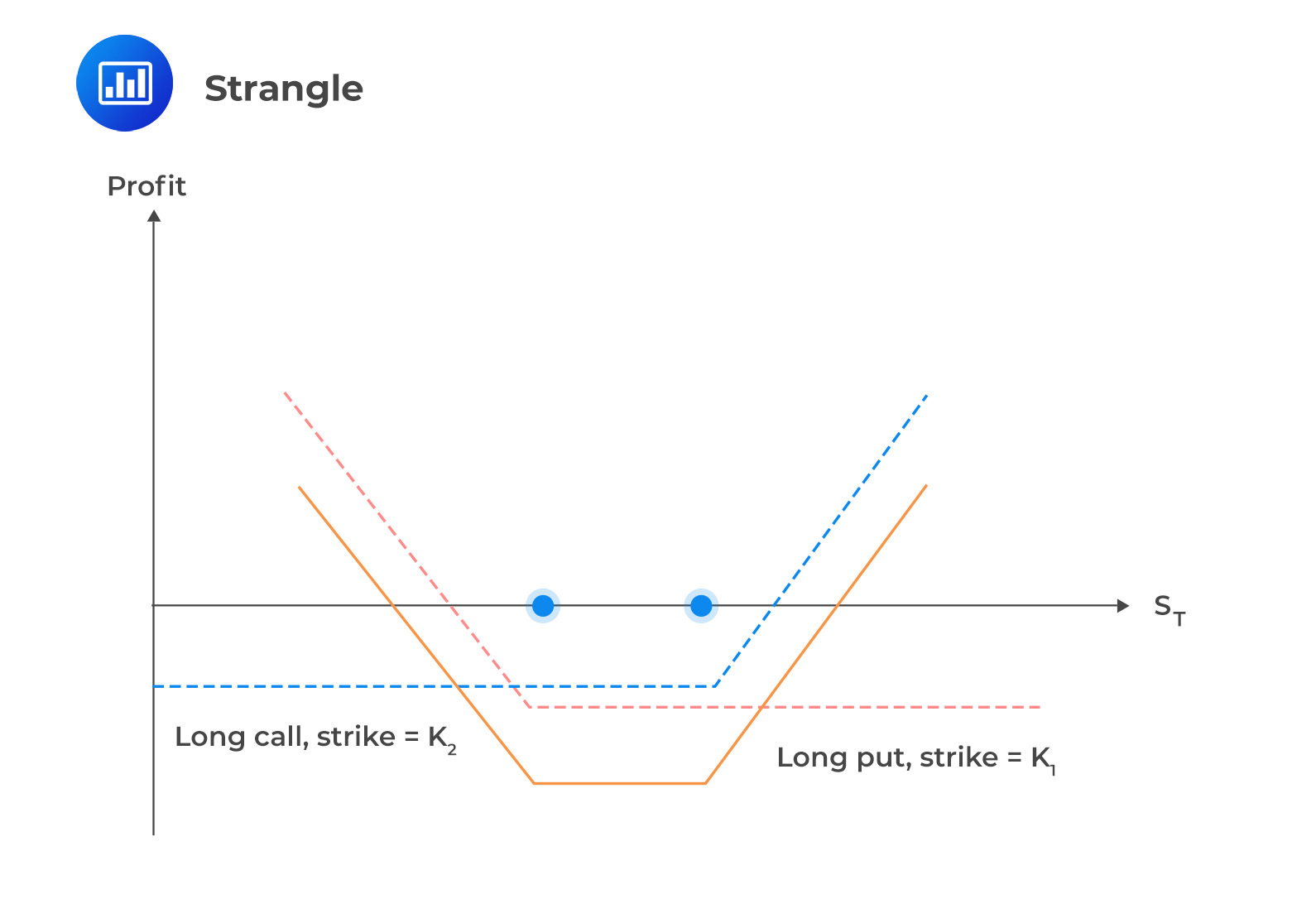

Strangle: The strangle strategy combines a short call and a short put option at different strike prices but with the same expiration and underlying. Similar to straddles, traders in strangles bet that there will be a significant price movement in either direction.

Strangle: The strangle strategy combines a short call and a short put option at different strike prices but with the same expiration and underlying. Similar to straddles, traders in strangles bet that there will be a significant price movement in either direction.

Question

Based on the expectation that interest rates in the U.K. (GBP) will be lower than those in China (CNY), which of the following is the most likely scenario?

- GBP/CNY will appreciate.

- GBP/CNY will depreciate.

- CNY/GBP will appreciate.

Solution

The correct answer is A:

An increase in the base currency’s real exchange rate is likely when the following conditions are met:

- Exchange rate equilibrium in the long run.

- Attraction of foreign capital due to either its nominal or real interest rates.

- Expectation of depreciation of foreign currencies caused by foreign inflation.

- A foreign risk premium makes foreign assets less appealing than domestic assets of the base currency nation.

B and C are incorrect. It is important to note that solutions B and C convey the same idea but in different ways. Therefore, both cannot be the correct answer.

Derivatives and Risk Management: Learning Module 3: Currency Management: An Introduction; Los 3(d) Compare active currency trading strategies based on economic fundamentals, technical analysis, carry-trade, and volatility trading

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.