Portfolio Construction

Risk Constraints in Portfolio Construction In the process of portfolio construction, risk constraints... Read More

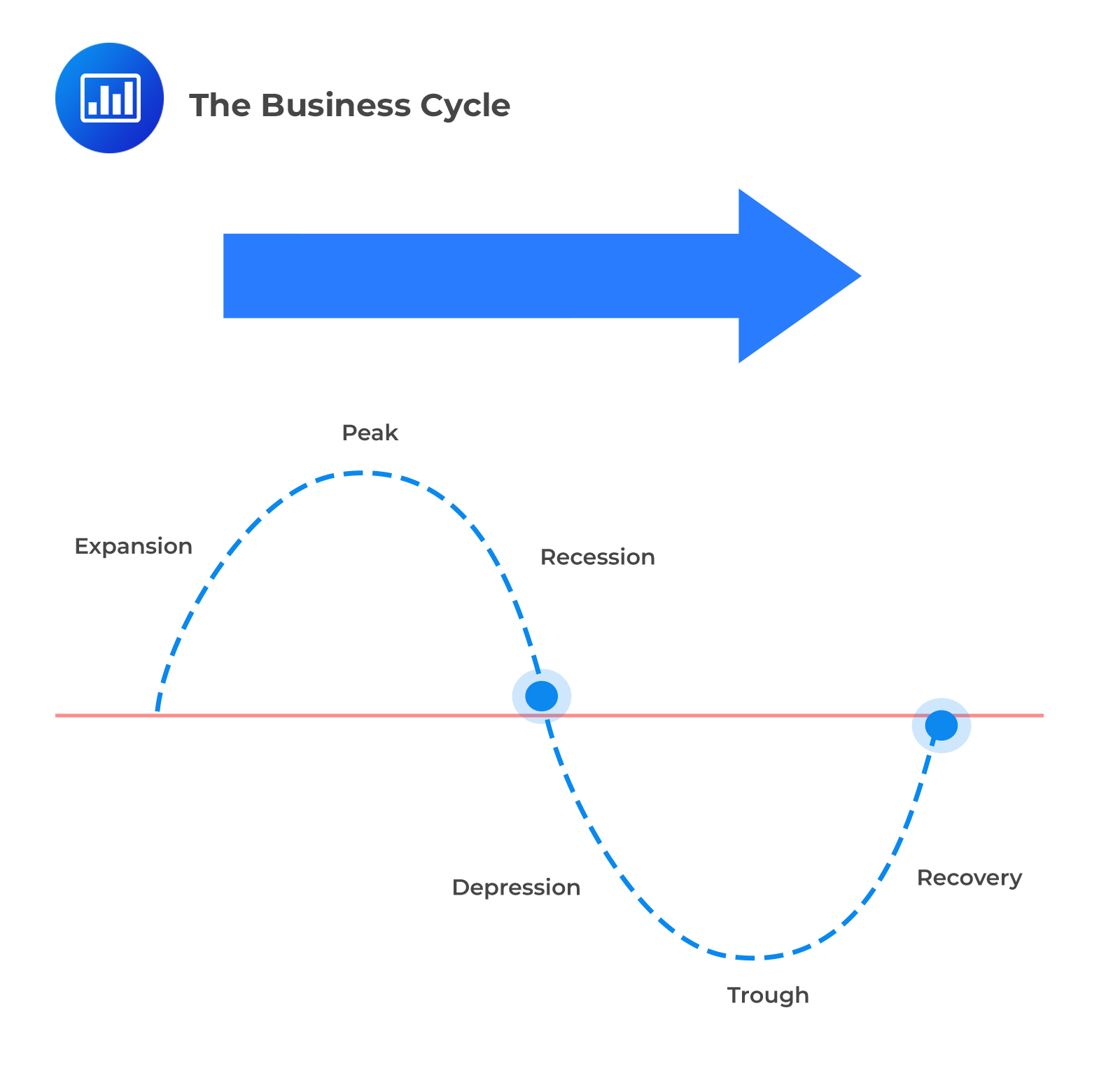

The business cycle refers to variations of economic productivity–often measured in terms of GDP–around its long-term trend rate. It is this long-term trend rate that serves as an anchor for forecasting business environments. This is because the economy cannot sustainably grow faster than its long-term trend rate and because the long-term trend rate means reverting. Since the movements around the trend rate are ultimately stochastic, the business cycle phases can often vary in intensity and length. Despite these fluctuations, a pattern emerges. The business cycle exhibits stochastic processes because it reflects economic decisions that:

The output gap is the difference between the actual output of an economy and the maximum potential output of an economy expressed as a percentage of gross domestic product (GDP).

This formula states that when actual output exceeds maximum output, a positive output gap exists since the economy is outperforming, i.e., overheating. A negative output gap is the opposite, the actual output below the maximum potential output.

Despite varying length and intensity, business cycles tend to follow a pattern. This pattern is encapsulated in the graphic below.

The formulation of capital market expectations seems straightforward under the previous descriptions. If this is true, then making a few forecasts and earning abnormal returns should be easy. The truth is that it is quite a bit more complex than that. Evidence has shown that the business cycle exhibits the highest predictive power of one to three years.

Question

A situation in which actual output is below maximum potential output most likely reflects a:

- Budget deficit.

- Positive output gap.

- Negative output gap.

Solution

The correct answer is C.

Use the following formula:

$$ \text{Actual output} – \text{Maximum potential output} = {(+/-) \text{ Output gap}} $$

This formula states that when actual output exceeds maximum output, a positive output gap exists as the economy is outperforming, i.e., overheating. A negative output gap is the opposite. The actual output is below the maximum potential output.

A is incorrect. A budget deficit occurs when government expenses exceed revenue, and it is not directly related to the actual output of an economy being below its maximum potential output.

B is incorrect. A positive output gap occurs when actual output exceeds potential output, meaning growth is inflationary and above the trend rate. In contrast, a situation where actual output is below maximum potential output reflects a negative output gap, with an economic downturn with unemployment and spare capacity.

Asset Allocation: Learning Module 1: Capital Market Expectations – Part 1 Framework and Macro Considerations; Los 1(f) Discuss how business cycles affect short- and long-term expectations

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.