Investment Policy Statement

Pension Investment Objectives To meet pension liabilities, defined benefit plans need to mix... Read More

Top-down investment strategies are a type of investment process that begins from a macro or top level. This approach is distinct from bottom-up strategies, which concentrate on individual company and asset-level variables. Instead, top-down strategies take into account broader variables that influence multiple companies. These variables encompass the macroeconomic environment, demographic trends, and government policies. For instance, a top-down investor might start by analyzing global economic trends, then narrow their focus to the economic performance of a specific country, then to the sectors within that country that are poised to perform well given the current economic conditions, and finally to the most promising companies within those sectors.

Country allocation strategies allow investors to diversify their portfolios by investing across different geographic regions, based on the economic prospects of those regions. Such strategies are crucial for global equity fund managers, aiming to balance investments between high-growth areas like Asia and more stable but slower-growing regions like Europe or America.

These strategies utilize supply and demand analysis of equities in various countries, examining share buybacks, investment fund flows, IPO volumes, and secondary share issuances to identify burgeoning markets. Investment decisions rely on a combination of top-down macroeconomic and bottom-up fundamental analyses.

Economic indicators like GDP growth, inflation, and unemployment rates, alongside aggregated company earnings and market capitalization, guide these investment choices. A country’s market might be deemed undervalued if company earnings growth outpaces market capitalization growth, signaling a potential investment opportunity.

Volatility-based strategies are a subset of top-down equity strategies that investors implement based on their predictions about market volatility. These strategies primarily involve the use of derivative instruments, which are financial securities with a value reliant on an underlying asset or group of assets.

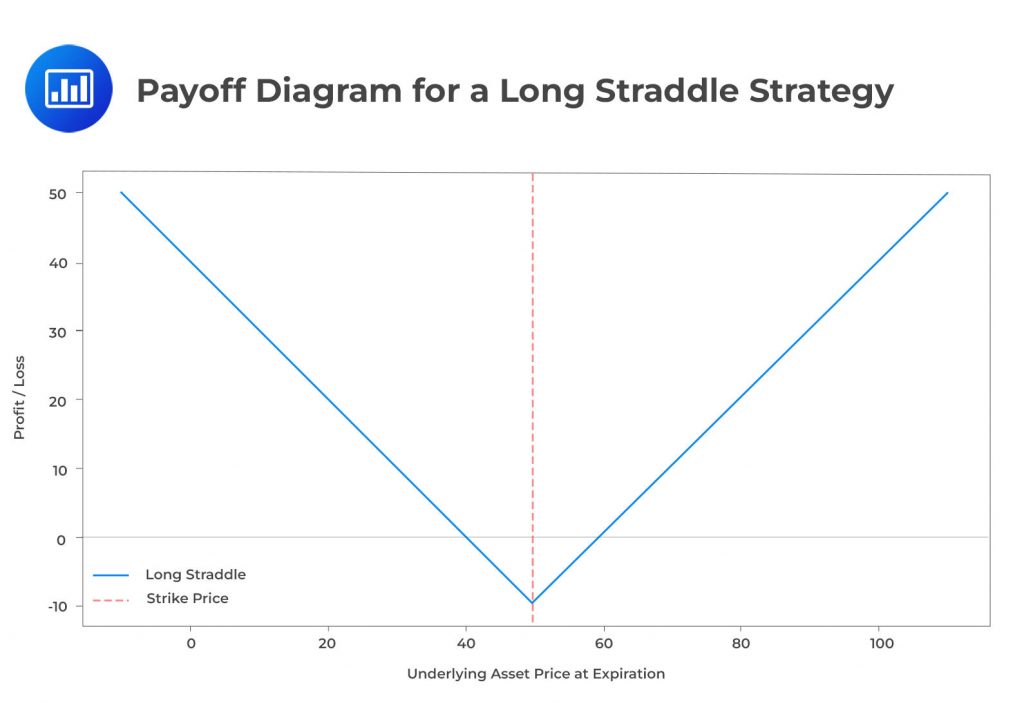

A classic long straddle strategy involves buying both a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy profits from significant price movements in either direction. If the asset’s price moves significantly above the strike price, the call option gains value. If it falls substantially below the strike price, the put option gains value. The loss is limited to the total premiums paid for both options if the price remains near the strike price.

These instruments are typically used by fund managers who believe they can predict future market volatility more accurately than the volatility implied by options prices, as reflected in the VIX Index.

Thematic investing is a method that uses various drivers to identify potential investment opportunities. These drivers can be macroeconomic, demographic, or political, or they can be bottom-up ideas based on industries and sectors. Investment opportunities can also arise from disruptive technologies, processes, and regulations, innovations, and economic cycles. These factors not only present opportunities but also pose challenges to existing companies.

Investors are always on the lookout for new and promising ideas or themes that will drive the market in the future. It is crucial to determine whether a new trend is structural (long-term) or short-term. Structural changes can have long-lasting impacts on people’s behavior or market operations. For instance, the development of smartphones and tablets and the shift towards cloud computing are likely structural changes.

Practice Questions

Question 1: A portfolio manager using a top-down investment strategy is considering various financial instruments to capture macro dynamics and generate portfolio returns. Which of the following is not typically used in a top-down investment strategy?

- Futures contracts

- Exchange-Traded Funds (ETFs)

- Company’s internal financial reports

Answer: Choice C is correct.

Company’s internal financial reports are not typically used in a top-down investment strategy. A top-down investment strategy starts with a broad macroeconomic view and then drills down to specific sectors or industries, and finally to individual companies. This approach primarily focuses on economic indicators, industry trends, and market themes. While company-specific information can be considered in the later stages of the investment process, the primary focus is not on individual company’s internal financial reports. These reports are more relevant in a bottom-up investment strategy, where the focus is on selecting individual securities based on the fundamental analysis of the company. Therefore, company’s internal financial reports are not typically used in a top-down investment strategy.

Choice A is incorrect. Futures contracts are indeed used in a top-down investment strategy. Futures contracts can be used to gain exposure to various asset classes, including commodities, equities, and bonds, and can be used to hedge against macroeconomic risks or to speculate on future price movements. Therefore, they are a common tool in a top-down investment strategy.

Choice B is incorrect. Exchange-Traded Funds (ETFs) are also used in a top-down investment strategy. ETFs provide a way for investors to gain exposure to a broad market index, sector, or industry, which aligns with the macro-level focus of a top-down investment strategy. ETFs can be used to implement investment views on various macroeconomic themes and trends.

Question 2: An investor is considering using a country allocation strategy to form their portfolio. They are interested in investing in different geographic regions based on their assessment of each region’s prospects. In this context, which of the following statements best describes the factors that could influence the investor’s decision to allocate to a particular country or geographic region?

- The investor’s decision is solely based on the tradeoff between different equity markets, such as the US and European markets.

- The investor’s decision is solely based on the overall supply and demand for equities in regions or countries, analyzed by aggregate volumes of share buybacks, investment fund flows, the volumes of initial public offerings, and secondary share issuance.

- The investor’s decision can be based on both top-down macroeconomic and bottom-up fundamental analysis, including economic data for a given country and the market valuation of a country calculated by aggregating all company earnings and market capitalization.

Answer: Choice C is correct.

The investor’s decision to allocate to a particular country or geographic region can indeed be based on both top-down macroeconomic and bottom-up fundamental analysis. Top-down macroeconomic analysis involves looking at the overall economic environment and how it might affect different sectors and industries. This could include factors such as GDP growth, inflation, interest rates, political stability, and regulatory environment. Bottom-up fundamental analysis, on the other hand, involves looking at the financial health and performance of individual companies. This could include factors such as earnings, cash flow, debt levels, and market capitalization. By combining these two types of analysis, an investor can gain a comprehensive understanding of the potential risks and rewards associated with investing in a particular country or region. This approach allows the investor to consider both the broader economic context and the specific characteristics of individual companies, thereby enabling a more informed and nuanced investment decision.

Choice A is incorrect. While the tradeoff between different equity markets can certainly be a factor in an investor’s decision to allocate to a particular country or region, it is not the only factor. As mentioned above, an investor’s decision can also be influenced by a range of macroeconomic and company-specific factors. Therefore, it is overly simplistic to suggest that the decision is solely based on the tradeoff between different equity markets.

Choice B is incorrect. While the overall supply and demand for equities in regions or countries can certainly be a factor in an investor’s decision to allocate to a particular country or region, it is not the only factor. As mentioned above, an investor’s decision can also be influenced by a range of macroeconomic and company-specific factors. Therefore, it is overly simplistic to suggest that the decision is solely based on the overall supply and demand for equities.

Portfolio Management Pathway Volume 1: Learning Module 2: Active Equity Investing: Strategies; LOS 2(c): Analyze top-down active strategies, including their rationale and associated processes

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.