Merits and demerits of credit spread m ...

As discussed in the previous LOS, a spread quantifies the yield distinction between... Read More

Private market strategies are investment strategies that focus on non-publicly traded investments. These strategies often employ complex financial structures such as mezzanine structures and unitranche debt. To illustrate, consider an example of a private equity firm investing in a startup. The firm might use a mezzanine structure, which is a type of subordinated borrowing that offers equity-like returns. This means that the firm lends money to the startup and in return, it receives not only interest payments but also a share in the company’s profits or equity. On the other hand, unitranche debt is a type of debt that combines senior and subordinated debt components into a single facility. For instance, a company might take out a unitranche loan that includes both a secured loan (senior debt) and an unsecured loan (subordinated debt).

Mezzanine debt is a unique form of borrowed capital that typically takes a subordinate position and has a longer tenor compared to other forms of debt. The characteristics of mezzanine debt can differ significantly across transactions and geographical regions. For instance, in North America, mezzanine debt structures often resemble bonds, being unsecured with fixed debt coupons. In contrast, European mezzanine debt usually involves floating rates and holds a second lien or subordinated claim to company assets, akin to leveraged loans.

Due to its longer time to maturity with no amortization, deferred debt service in the form of paid in kind interest or the inclusion of warrants, mezzanine debt is commonly used to ease initial cash flow pressures in growth or buyout equity transactions as well as acquisitions. For example, a startup company might use mezzanine debt to finance its expansion plans, while a private equity firm might use it to fund a leveraged buyout.

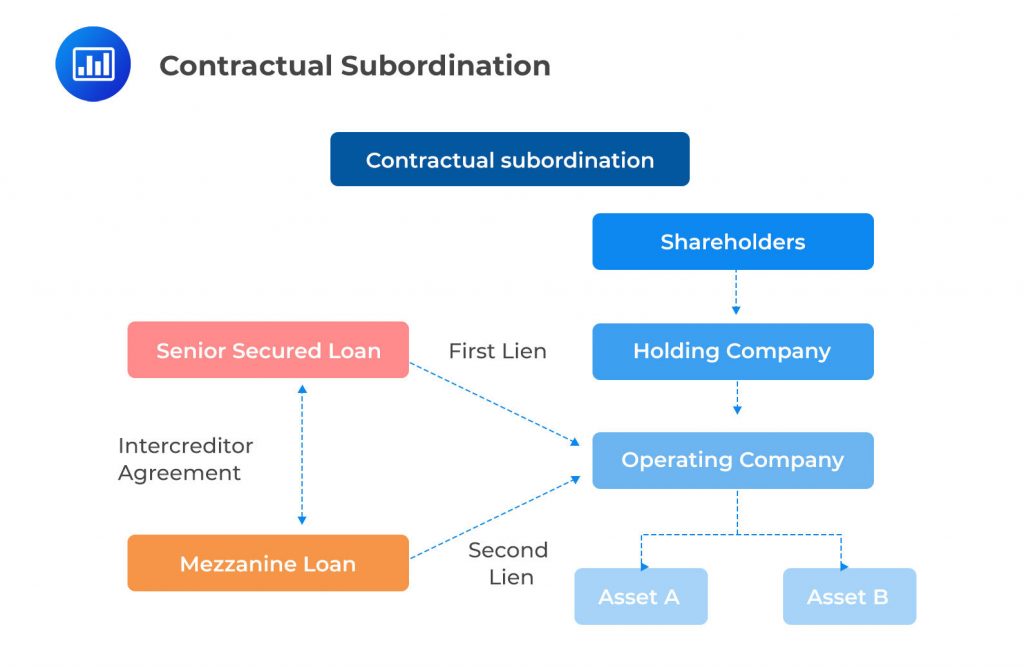

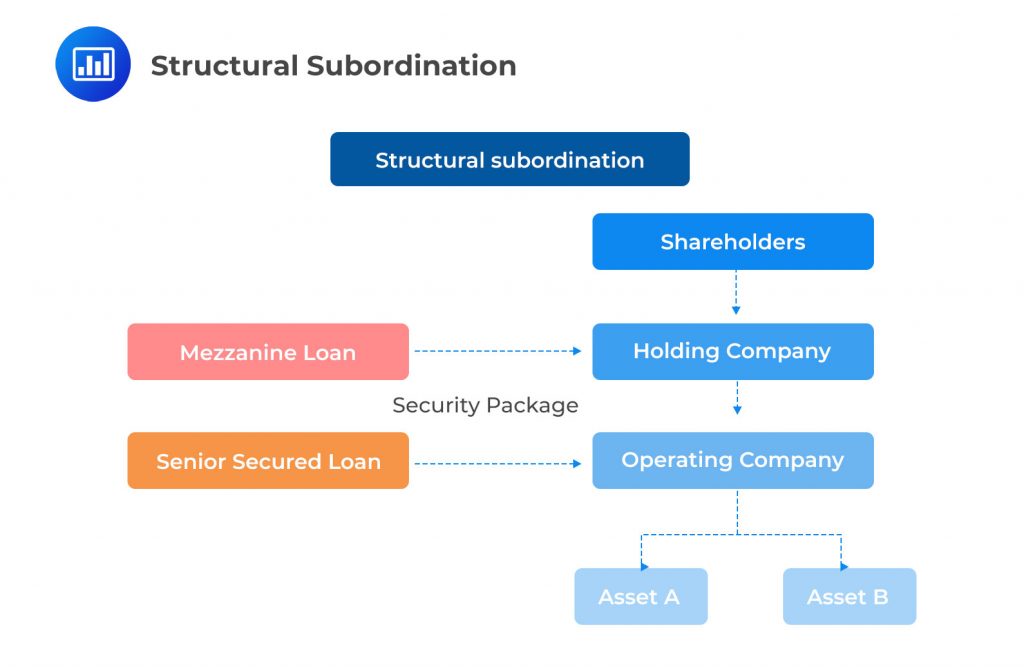

The positioning of mezzanine debt claims after senior secured debt can occur in two forms: contractual subordination or structural subordination.

Under contractual subordination, both senior secured and mezzanine debtholders lend to the same operating company (OpCo) and sign a contract known as an intercreditor agreement . This agreement specifies the priority of claims, details between lenders, and other key terms among debt tranches. For instance, in a company with multiple layers of debt, the intercreditor agreement might specify that the senior secured debtholders have the first claim on the company’s assets in the event of a default, followed by the mezzanine debtholders.

Structural subordination involves debt issued at the holding company (HoldCo) level, such as in the case of high-yield bonds, or one step removed from direct access to the operating company cash flows and pledged assets. In the case of contractual subordination, OpCo lenders have a claim against the assets of OpCo, while under structural subordination, lenders to the HoldCo parent company only have an equity claim to OpCo assets as the owner of its common stock.

If OpCo were to issue preferred stock to any party other than the parent, then the claims of those preferred stockholders rank ahead of the issuer’s common stock claims. Mezzanine debtholders are excluded from the OpCo security agreement governing pledged assets but have a residual HoldCo debt which is satisfied once OpCo senior secured claims are met.

When considering mezzanine debt, factors beyond interest expense, such as staggered debt maturities, restrictions on asset sales, fixed versus floating interest rate exposure, seniority of debtholder’s claim, loan covenants, and other contingencies, all play a role in establishing the most appropriate debt structure for private market strategies. As the most flexible form of subordinated debt, mezzanine structures may be tailored in several ways to meet issuer and investor needs. For example, a company might choose a mezzanine debt structure with a floating interest rate if it expects interest rates to fall in the future.

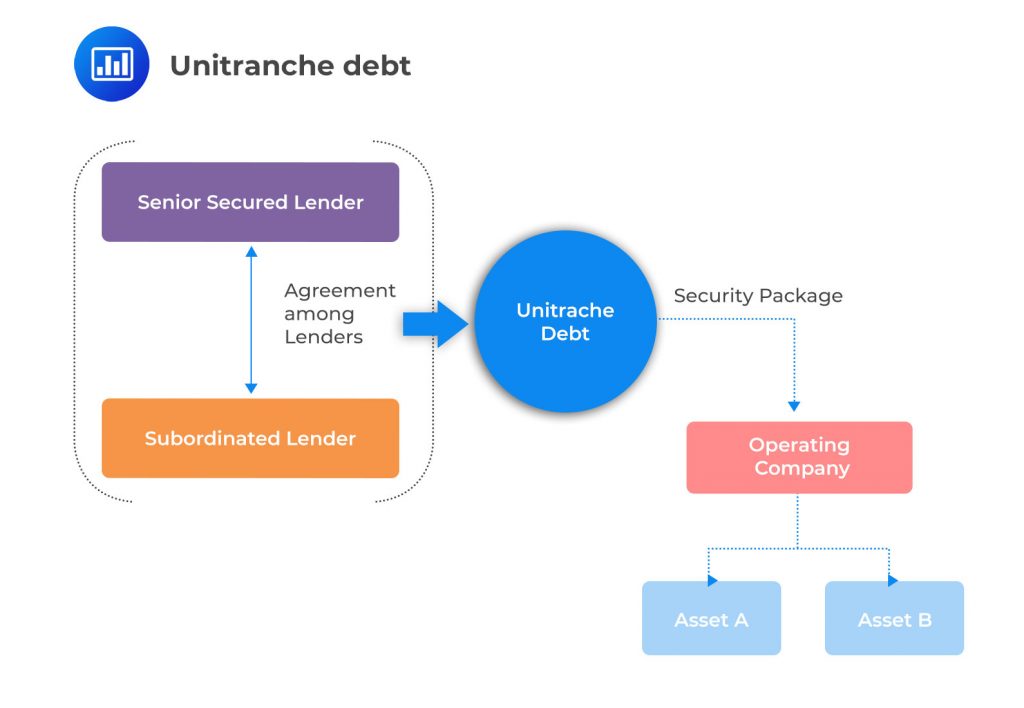

Unitranche debt is a unique form of private company debt that merges the characteristics of senior and subordinated debt into a single hybrid loan. This is a departure from more intricate debt profiles that amalgamate leveraged loans, high-yield, convertible, or mezzanine debt. Unitranche debt can be found in various forms, often encompassing a mix of senior secured and subordinated or mezzanine debt.

This singular tranche loan typically involves a blended interest rate that mirrors the risk of the combined tranches. Creditors individually agree to share differently in the risk and return of the consolidated loan exposure through an intercreditor agreement among lenders. The borrower is not a party to this agreement.

The contractual arrangement between creditors can serve to reallocate the unitranche facility’s interest and principal payments based on a revised priority of claims among lenders. Specific rights are assigned to each lender, or voting rights may be exchanged to make changes to the covenants or other loan terms.

In some instances, the single unitranche debt facility contains two separate tranches or classes of debt: a senior or first-out tranche, which is at an interest rate below the blended rate with amortization prior to final maturity, and a junior, subordinated, or last-out tranche, which is outstanding until maturity at a higher rate than the overall blended rate of a single tranche.

From a borrower’s perspective, the most attractive feature of unitranche debt is the existence of one loan agreement, which can be executed more quickly and with lower fees than public securities or widely syndicated debt arrangements. The relationship among lenders can take several forms, ranging from pari passu treatment to redistribution of claims using an agreement among lenders.

These lenders are often General Partners (GPs) who distribute debt to Limited Partners (LPs) within a closed-end private debt fund and can more directly engage with borrowers to renegotiate loan terms on a proactive basis as needed. However, the non-standard terms of private debt facilities and complexity of agreements among lenders diverges from standard intercreditor agreements and traditional bond and loan structures, which have been widely tested in court. As a result, there is greater uncertainty as to how these private debt structures will perform in the event of financial distress, bankruptcy, and liquidation.

While initial demand for unitranche debt was from private equity firms financing buyouts for small and medium-sized firms with just one or very few lenders, use of this debt structure has become more widespread among larger private firms.

Practice Questions

Question 1: In the realm of private market strategies, two common forms of debt are mezzanine structures and unitranche debt. These forms of debt are known for their flexibility and can be tailored to meet the specific needs of the issuer and investor. They often involve non-standard terms and private, confidential reporting. Given these characteristics, which of the following statements is most accurate about mezzanine structures and unitranche debt?

- They are typically rated and highly liquid.

- They are usually underwritten by bank syndicates with standardized terms and disclosures.

- They are often unrated and highly illiquid.

Answer: Choice C is correct.

Mezzanine structures and unitranche debt are often unrated and highly illiquid. These forms of debt are typically used in private market strategies and are known for their flexibility. They can be tailored to meet the specific needs of the issuer and investor, which often results in non-standard terms and private, confidential reporting. Because of these characteristics, they are not typically rated by credit rating agencies, which require standardized terms and public disclosures to assess credit risk. Furthermore, the bespoke nature of these instruments and the lack of public information make them less attractive to a broad range of investors, resulting in lower liquidity compared to more standardized forms of debt. The illiquidity of these instruments is often compensated by higher yields, which provide an illiquidity premium to investors willing to hold these instruments until maturity.

Choice A is incorrect. Mezzanine structures and unitranche debt are not typically rated and highly liquid. As mentioned above, the non-standard terms and private reporting associated with these instruments make them less attractive to a broad range of investors and less likely to be rated by credit rating agencies.

Choice B is incorrect. Mezzanine structures and unitranche debt are not usually underwritten by bank syndicates with standardized terms and disclosures. These forms of debt are typically tailored to the specific needs of the issuer and investor, which often results in non-standard terms and private, confidential reporting.

Question 2: Non-bank lenders often employ private market strategies such as mezzanine structures and unitranche debt. These lenders often hold a large proportion of a single facility, which increases their ability to directly negotiate initial debt terms and make modifications over time as needed with a private borrower. Which of the following best describes the role of non-bank lenders in the context of mezzanine structures and unitranche debt?

- Non-bank lenders typically have limited ability to negotiate initial debt terms and make modifications over time.

- Non-bank lenders usually rely on bank syndicates to negotiate initial debt terms and make modifications over time.

- Non-bank lenders often hold a large proportion of a single facility, increasing their ability to directly negotiate initial debt terms and make modifications over time.

Answer: Choice C is correct.

Non-bank lenders often hold a large proportion of a single facility, increasing their ability to directly negotiate initial debt terms and make modifications over time. This is particularly true in the context of mezzanine structures and unitranche debt, which are private market strategies often employed by non-bank lenders. These lenders typically have a significant influence over the terms of the debt due to their large stake in the facility. This allows them to negotiate favorable terms at the outset and make modifications over time as needed. This is a key advantage of non-bank lenders in the private debt market, as it gives them greater flexibility and control over their investments. It also allows them to better manage their risk, as they can adjust the terms of the debt to reflect changes in the borrower’s financial condition or the broader market conditions.

Choice A is incorrect. Non-bank lenders typically have a significant ability to negotiate initial debt terms and make modifications over time, particularly when they hold a large proportion of a single facility. This is one of the key advantages of non-bank lenders in the private debt market.

Choice B is incorrect. While non-bank lenders may sometimes participate in bank syndicates, they do not usually rely on these syndicates to negotiate initial debt terms and make modifications over time. Instead, non-bank lenders often hold a large proportion of a single facility, which gives them the ability to directly negotiate these terms themselves.

Private Markets Pathway Volume 1: Learning Module 4: Private Debt;LOS 4(c): Contrast the use of mezzanine debt and unitranche debt in private market strategies.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.