The General Principles of Conduct and ...

Responsibilities to Clients The following is an excerpt from the 2022 CFA Institute... Read More

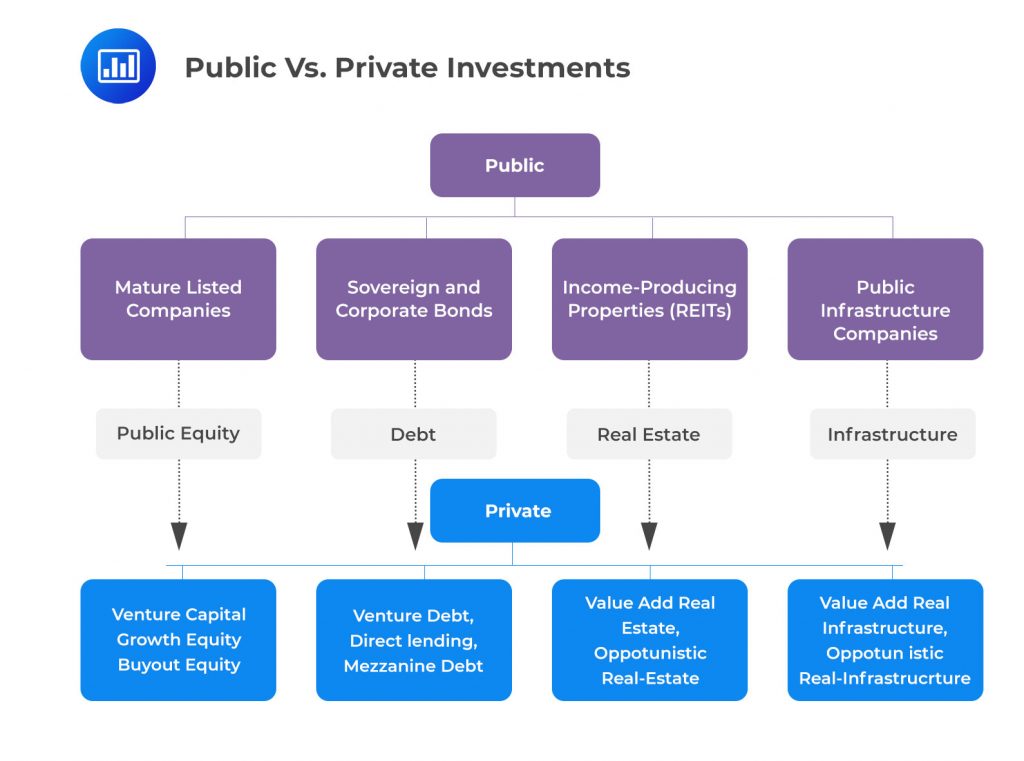

Investing in the financial markets can broadly be categorized into public and private investments. Each type offers distinct features, benefits, and challenges. Understanding these differences is crucial for investors aiming to diversify their portfolios and optimize returns.

Public investments involve listed securities such as debt or equity claims. These securities are traded on exchanges or over-the-counter markets. Public fund managers typically invest in non-controlling positions in mature issuers with stable cash flows. This is characterized by the ability to readily buy or sell positions and access current and historical price data and benchmarks.

Private investments consist of unlisted assets with no organized exchange or over-the-counter market. Private funds often acquire controlling or significant minority stakes held for longer periods for value creation through cash flow improvements. Private debt and equity claims are usually non-standardized and negotiated. The focus is on private investments relevant to institutional investors.

Alternative investments include assets other than traditional public equity, fixed-income, and cash instruments. While most private markets are considered alternative investments, some alternatives involve strategies using public securities. Some alternative investments exist in both public and private forms, for example, REITs (public) and private real estate.

Private equity: This involves investing in companies that are not listed on a public exchange. It includes venture capital, where investors provide funding to startups and early-stage companies with strong growth potential, and buyouts, where investors buy a majority stake in established companies.

Private debt: Unlike publicly issued bonds, private debt involves lending money to companies outside of public markets. This can include direct lending, where investors provide loans to businesses without using a traditional bank, as well as mezzanine financing and distressed debt.

Private special situations: This refers to investments in opportunities created by unusual circumstances, such as company restructurings, bankruptcies, or other unique scenarios. These investments require specialized expertise to navigate and capitalize on the complexities involved.

Private real estate: This involves investing directly in real estate properties or through private real estate funds. The focus can be on a variety of property types, including residential, commercial, and industrial. Investments can range from development projects to income-producing properties.

Private infrastructure: This includes investments in physical structures and facilities essential for the economy and society, such as roads, bridges, airports, water and sewage systems, and energy generation and distribution networks. These investments often require significant capital and have long investment horizons.

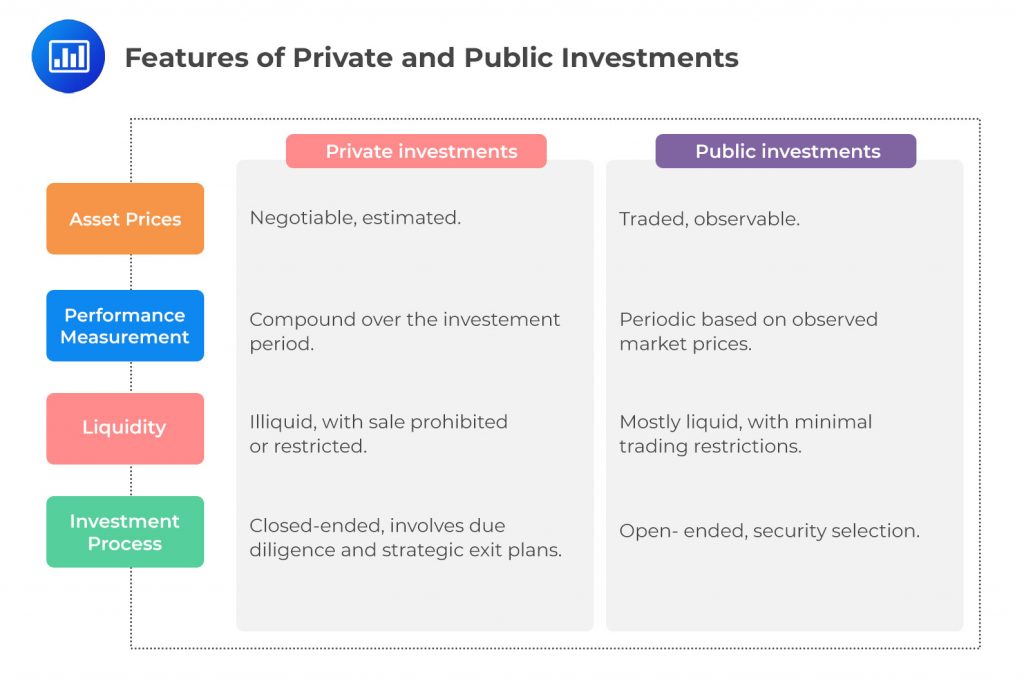

Asset Prices and Performance Measurement is a crucial topic in understanding how investors utilize current and historical price data to make informed decisions in the public markets. This data aids in measuring returns, volatility, and correlations, which are essential for constructing portfolios that balance risk and return efficiently. Public market data serve as a fundamental input for various investment strategies, including judgment-based approaches that aim to capitalize on market views, rule-based strategies that employ factor analysis, and index-based investment strategies.

Unlike public markets, private market investors face challenges due to the lack of price transparency for their investments. This scarcity of information necessitates the use of alternative valuation methods such as relative valuation techniques, discounted cash flow analysis, and examination of recent transactions to estimate asset prices. Furthermore, the valuation estimates provided by fund managers to investors are often delayed and less frequent, typically on a quarterly basis, which hampers their utility for asset allocation decisions.

Liquidity and the Investment Process encompass the differences between trading and investing in public and private markets, each with its unique characteristics and implications for investors and fund managers. Public markets are known for their high liquidity and relatively low transaction costs, making the buying and selling of listed securities straightforward. This liquidity, coupled with price transparency, allows public fund managers to quickly adjust their portfolios in response to market developments, selling overvalued securities or buying undervalued ones. Public issuers typically are in a mature phase with stable cash flows, which contributes to the market’s liquidity.

On the other hand, private investments, such as controlling or minority stakes in a firm, project, or real asset, are characterized by their inherent illiquidity. These investments demand larger capital commitments and a longer investment horizon, often extending to 10 years or more. Transactions in the private market are usually negotiated, limiting the number of potential buyers and sellers and often restricting investors’ ability to sell their positions. This illiquidity necessitates a different investment process, typically a closed-end approach where investor compensation aligns with performance over longer periods.

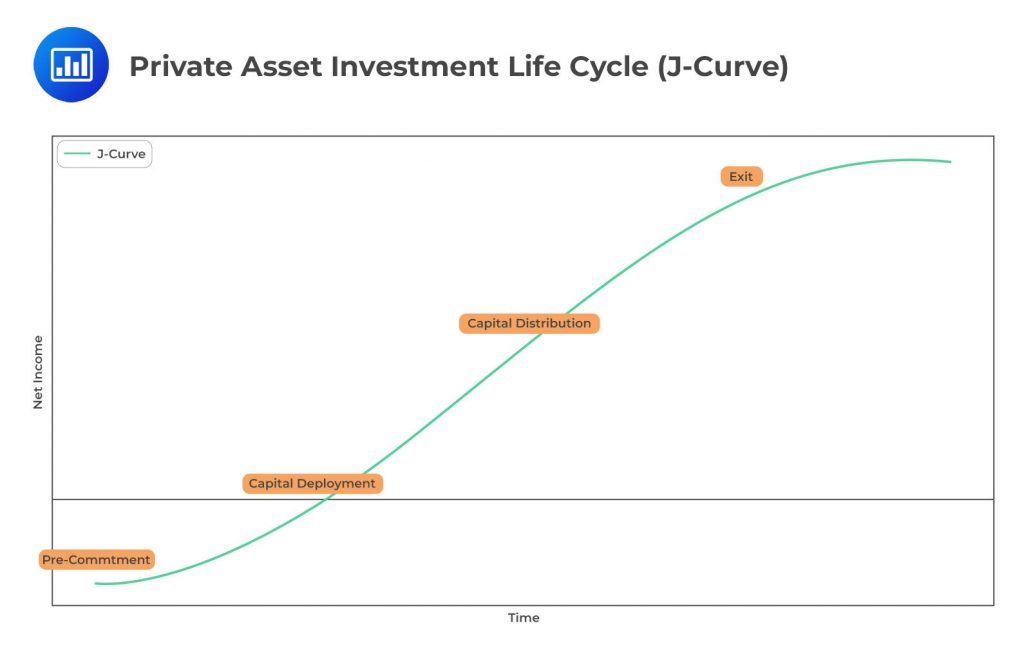

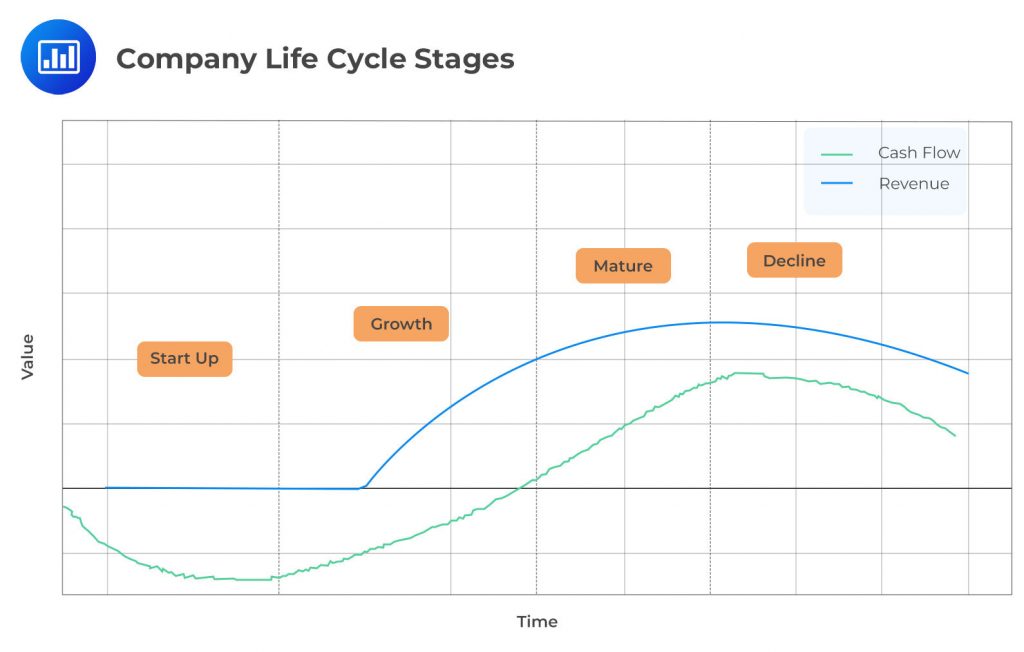

The investment life cycle in private assets includes capital commitment, deployment, distribution, and exit phases. This cycle is marked by the J-curve effect, where initial negative returns gradually turn into cash flow and income growth. Unlike public market investors, who have limited influence over issuers, private investment managers play an active role in managing assets. Their involvement spans from target identification and due diligence to the creation of business and financing plans and, ultimately, managing the value creation process until the investment is exited and capital is returned to investors.

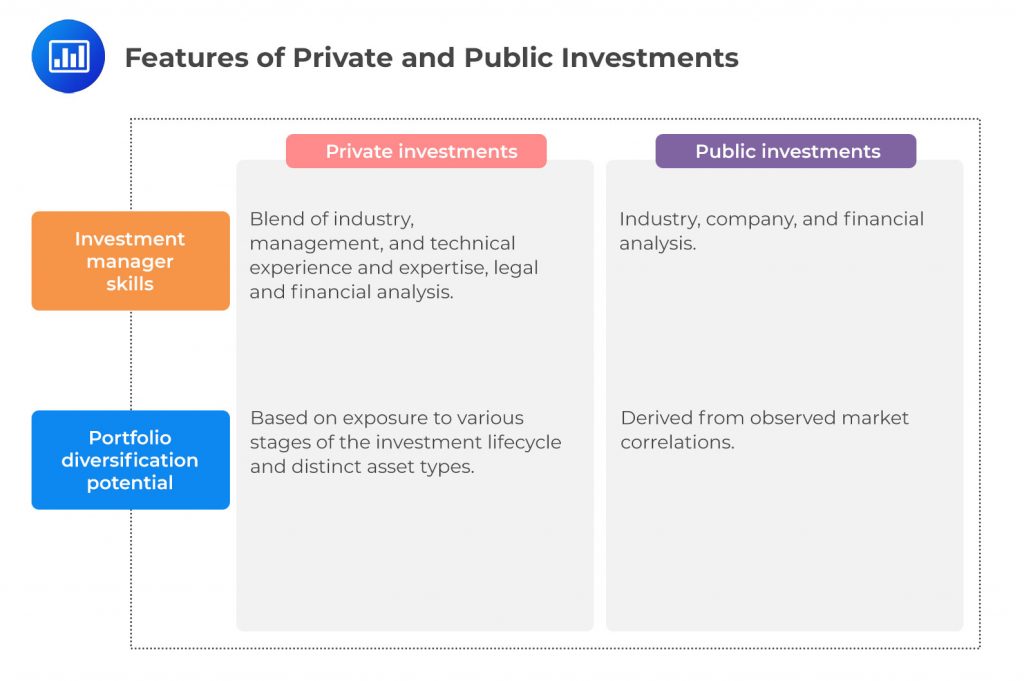

Manager Skills encompass the distinct competencies required by public and private fund managers due to the differing nature of their investment processes, roles, and responsibilities. Understanding these skills is crucial for success in managing portfolios in both public and private markets.

Public fund managers focus on investment research across securities, companies, and industries. They utilize publicly available corporate financial statements and other data sources. Financial ratios and metrics are key tools for investment analysis in public markets.

Private market investments include a wide range of opportunities, such as real estate developments, mature firms in distress, and startups. These investments often lack market price transparency, requiring a broader skill set for successful management. Key skills include local market knowledge and project development for real estate, operational experience and industry expertise in private equity, and significant relationships, management experience, and qualifications in legal, accounting, and tax matters. Private fund managers often need to conduct additional legal analysis due to less standardized contracts.

Venture capital investments in early-stage companies carry high risk and a high rate of failure. Initial success is measured by non-financial milestones, such as product development and market strategy. Investors often contribute capital, experience, contacts, and partnerships to support startups.

Equity capital and industry expertise provided by private fund managers are critical to a startup’s success. For example, NEA’s board membership and involvement in establishing partnerships and drug trials were key to expanding a business in its early stages.

Understanding the diversification potential of private market investments is crucial for investors looking to optimize their portfolios. Private markets, due to their distinct features, offer unique opportunities for diversification away from public market securities.

Private market investments typically show a low correlation with public market returns due to differences in market dynamics and investment characteristics. Illiquidity and longer investment periods in private markets make direct comparison with public markets challenging.

Early-Stage Companies: Startups and early-stage companies, exemplified by CRISPR Therapeutics, offer high return potential but come with a high risk of failure. Their growth, often above-trend, is less influenced by the business cycle, providing a diversification benefit.

Buyout Equity Investments: This involves taking public companies private to reorganize and sell at a higher price. The performance of these companies can significantly diverge from public equities due to the active management by private fund managers.

Alternative Asset Classes: Investments in private real estate or infrastructure involve different risk and return profiles compared to their public counterparts due to factors like major refurbishments or the development of large, single-use assets.

The unique characteristics of private markets that offer diversification benefits also historically acted as barriers to entry for many investors, including lack of price transparency, illiquidity, and large minimum investment sizes. Specialized knowledge is often necessary to navigate and succeed in private market investments.

Despite historical barriers, private market investments have become more accessible to a broader range of investors, including institutional investors and high-net-worth individuals. This change is attributed to evolving investment structures, ownership forms, and methods that accommodate a wider investor base.

Questions

Question 1

A fund manager is considering diversifying his portfolio by investing in different types of assets. He is looking at public investments, private investments, and alternative investments. He wants to invest in assets that are traded on exchanges or over-the-counter markets, and where he can readily buy or sell positions. Which type of investment should he consider?

- Private Investments

- Public Investments

- Alternative Investments

Answer: B is correct.

The fund manager should consider Public Investments. Public investments are those that are traded on exchanges or over-the-counter markets. These include stocks, bonds, and other securities that are listed on public exchanges like the New York Stock Exchange or NASDAQ. The key characteristic of public investments is their liquidity, meaning they can be readily bought or sold. This is because there is a large market of buyers and sellers, and the prices are transparent and readily available. This makes public investments suitable for investors who want the flexibility to adjust their positions quickly in response to changing market conditions. Furthermore, public investments are subject to regulatory oversight, which provides a level of protection for investors.

A is incorrect. Private investments are not traded on public exchanges or over-the-counter markets. Instead, they are sold directly to investors, often through private placements. These investments can include private equity, venture capital, and private debt. While they can offer high potential returns, they are typically less liquid than public investments, meaning they cannot be readily bought or sold. This makes them less suitable for investors who want the flexibility to adjust their positions quickly.

C is incorrect. Alternative investments can include a wide range of asset types, including real estate, commodities, hedge funds, and private equity. While some alternative investments, such as commodities, can be traded on exchanges, many are not. Instead, they are often sold directly to investors and can be less liquid than public investments. Furthermore, alternative investments often require a higher level of expertise to understand and manage, making them less suitable for investors who want a straightforward, liquid investment.

Question 2

An institutional investor is planning to invest in a type of asset where she can acquire controlling or significant minority stakes, held for longer periods for value creation through cash flow improvements. These assets are usually non-standardized and negotiated. Which type of investment is she considering?

- Public Investments

- Alternative Investments

- Private Investments

Answer: C is correct.

The type of investment that the institutional investor is considering is Private Investments. Private investments are typically characterized by the acquisition of controlling or significant minority stakes in companies, with the intention of holding these investments for longer periods to create value through improvements in cash flows. These investments are usually non-standardized and negotiated, which means that they are not traded on a public exchange and the terms of the investment are often tailored to the specific needs of the investor and the company. Private investments can offer higher potential returns than public investments, but they also come with higher risk and less liquidity. They are typically made by institutional investors, such as pension funds, endowments, and family offices, who have the resources and expertise to evaluate and manage these complex investments.

A is incorrect. Public Investments are investments in publicly traded securities, such as stocks and bonds. These investments are standardized, traded on public exchanges, and do not involve the acquisition of controlling or significant minority stakes in companies.

B is incorrect. Alternative Investments is a broad category that includes a wide range of asset classes, including private equity, hedge funds, real estate, commodities, and others. While some alternative investments may involve the acquisition of controlling or significant minority stakes in companies, not all do. Furthermore, not all alternative investments are non-standardized and negotiated. Therefore, this term does not specifically describe the type of investment that the institutional investor is considering.

Private Markets Pathway Volume 1: Learning Module 1: Private Investments and Structures; LOS 1(a): Contrast the features of private and public investments, and discuss characteristics of private and public markets

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.