Regulating the Crypto Ecosystem: The C ...

After completing this reading, you should be able to: Define and describe crypto... Read More

After completing this reading, you should be able to:

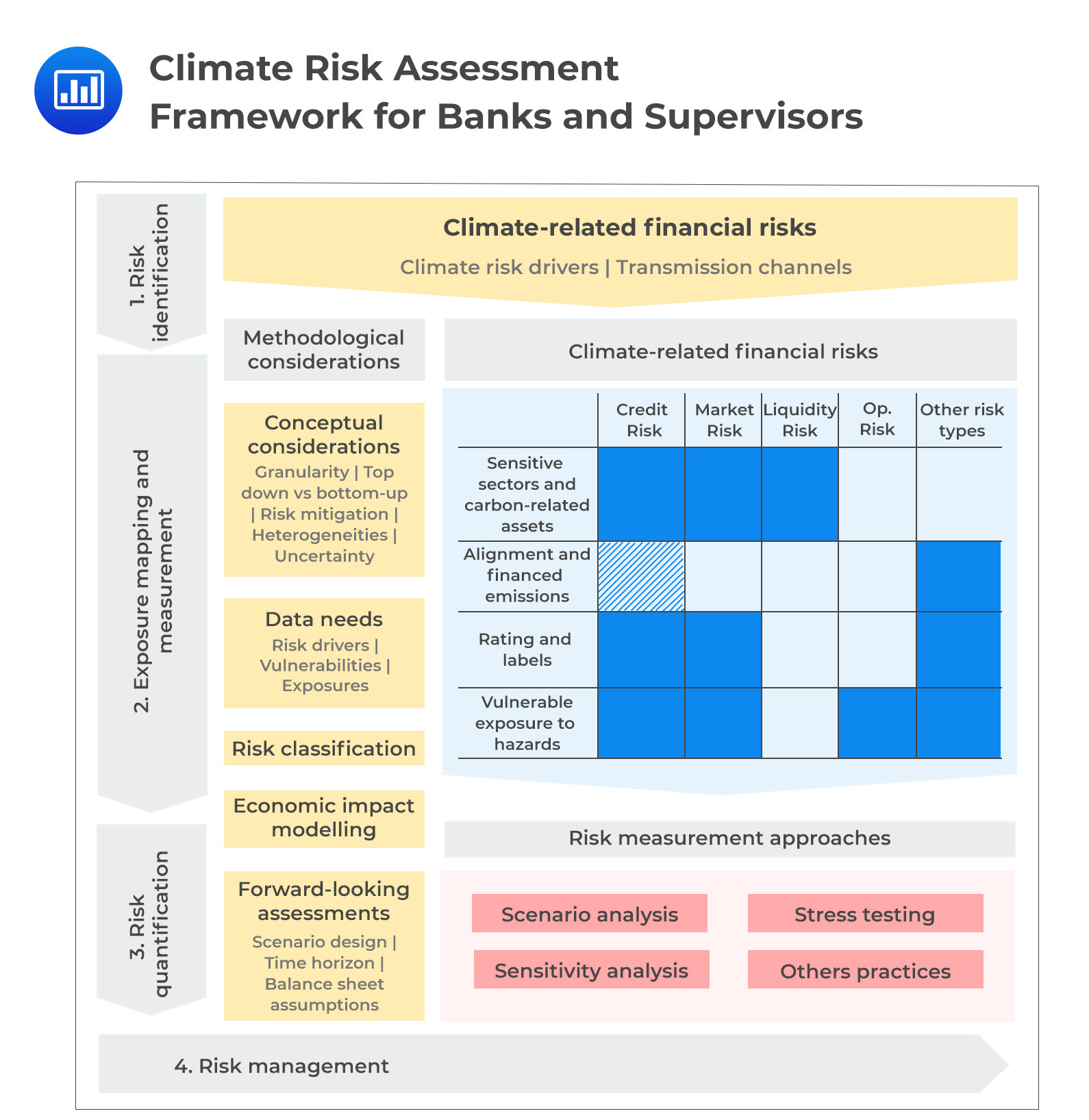

In this section, we discuss general issues in measuring climate-related financial risks and the translation of underlying concepts to concrete climate risk measurement. Climate change may cause both economic and financial effects, which may lead to losses for banks. As a result, banks should have a risk management framework that identifies and measures climate risk drivers, maps and measures climate-related exposures, identifies areas of risk concentration, and converts climate-related risks into quantifiable financial risk metrics.

An overview of measurement methodologies that banks and supervisors are currently applying is discussed here based on conceptual issues related to climate-related financial risk measurement.

According to BCBS (2015), effective risk governance involves mapping and measuring risk exposures. The assessment of climate-related financial risks is similar to that of any other risk. The only difference is that climate-related financial risks have unique features that challenge traditional risk measurement.

As risk managers assess climate-related financial risks, they learn new concepts. These concepts are heavily used in mapping and measuring climate-related financial risks. The following are some key concepts supervisors and banks need to know:

Climate-related financial risks have several unique characteristics. Physical risks and transition risk drivers drive these characteristics, resulting in different exposure mapping and measurement approaches.

Generally, physical risk drivers (physical hazards) can be associated with financial exposures using damage functions that show how a specific risk driver affects tangible assets. We can attribute disruptions to assets, activities, and related financial flows to comprehensive risk models that measure financial risk parameters.

The damage function applied within a specific risk model depends on a bank’s technological and resource capacity, the availability of relevant data, and the purpose for which the estimation is intended. In addition, sectors, the severity of hazards, time horizon factors, and geospatial idiosyncrasies determine specific damage functions.

As a result of their distinct characteristics, physical and transition risks are assessed separately. Some climate change features, however, increase the probability of dependence among these risks. Hence, they can be viewed jointly.

Exposure Granularity

Exposure GranularityBank’s transactions with other parties may expose it to climate-related financial risks. Banks and supervisors will have to decide the level of granularity at which to assess the implications of climate risk drivers for these transactions. The following factors may influence this decision:

This decision drives the selection of available approaches, which then affects a model’s output for risk management.

The selection of top-down or bottom-up is among the conceptual considerations that apply to both exposure mapping and risk estimation.

Top-down approaches typically start by estimating risks at a general or aggregated level and then allocate (push down) the risk measure to individual parts.

On the other hand, bottom-up starts by dimensioning risk at the component level and then aggregating these individual risks to provide a general view of risk.

Banks may need to estimate how potential risk mitigation might moderate or offset climate-related financial risks when considering how to measure them. Climate risk measurement approaches that incorporate mitigation strategies are thought of as showing net exposure. On the other hand, approaches that do not incorporate offsetting strategies are viewed as showing gross exposure. Banks can disaggregate the impact of risks and mitigating actions by distinguishing between net and gross exposures.

Climate-related financial risks can also be offset through counterparty measures to adapt to or mitigate the effects of climate change. The relationship of exposures to risk drivers within the risk models of the bank may be modified by these measures. We have two reasons why we should calculate the gross exposure of an asset or portfolio:

Heterogeneity is an important consideration when selecting measurement approaches. Climate-related financial risks vary by bank, depending on geographical location, markets, sectors, political environments, and technology. The following are among the common heterogeneities:

There is uncertainty associated with estimating climate-related financial risks. As new information is incorporated into climate models, climate sensitivity estimates typically trend higher, suggesting an underestimation of climate-related financial risks.

Unlike traditional data that banks normally use in financial risk analyses, assessing climate-related financial risks will require new and unique data types.

We have three broad data categories needed to assess climate-related financial risk:

This data type is the foundation for assessing the effects of climate-related risks on banking exposure. Climate data and hazard event data belong to this data category. We can use these data as independent variables in order to alter existing economic relationships and influence economic outcomes. Government agencies and academic institutions usually provide this data type, while commercial third parties supply some.

Besides climate-adjusted economic risk factors, banks and supervisors need information about the vulnerability of bank exposures to those risk factors. These data tend to include features specific to those exposures, such as geospatial data for corporates, location data for mortgage collateral, or data on the sensitivity of counterparties to energy prices.

In addition to being used in measurement approaches, these data facilitate the translation of climate-adjusted economic risk factors into financial exposures. Generally, the relevant characteristics of these data differ according to the climate risk driver under consideration.

Climate risk drivers determine the relevant characteristics of these data. Counterparties’ geospatial location primarily determines physical risk exposure. On the other hand, the vulnerability of bank exposures to transition risk depends, however, on the economic activity of counterparties within particular jurisdictions.

Physical risks can result in the destruction of property and inventory, which can affect the economy. As a result, physical hazards should be sufficiently matched with the location of relevant physical touchpoints in order to assess the vulnerability of exposure to physical risks.

It may also be necessary to collect information about interconnections between retail, corporate, and municipal borrowers in order to evaluate the impacts of deteriorating local economic conditions due to a severe or chronic weather event on the local economy. To assess the vulnerability of corporate counterparties’ exposure to transition risk, data concerning their sectors and subsectors, as well as their carbon sensitivity, are often needed.

In order to translate the vulnerability of exposures into financial loss estimates, additional data is usually needed. Banks can turn to variables used in conventional risk measurement approaches. Such data include data used in estimating cash flows, valuations, or prices. Data on portfolio composition and counterparties (e.g., probability of default and loss given default) is required to analyze banks’ risk. In addition, data on rollovers, withdrawals, or pricing will be needed to model potential bank liquidity impacts due to climate risk.

This section discusses conceptual modeling and risk measurement approaches that can be used to estimate climate-related financial risks.

Integrated assessment models (IAMs) combine energy and climate modeling approaches with economic growth modeling. AIMs link projections of transition risk drivers and greenhouse gas (GHG) emissions to economic growth impacts. Even though IAMs have been in use for quite some time, they fail to capture the economic impacts of climate change, extreme weather events, and adaptation possibilities. Furthermore, estimates of total GDP losses from changes in climate produced by IAMs may not be realistic since only some physical risks are considered. Climate models which underpin IAM projections may underestimate the severity of future outcomes if they fail to capture physical risks which are clearly understood or measured.

Input-output models estimate how shocks will affect a sector or region’s economy based on static economic linkages among sectors and geographical locations. In the context of climate economics, an input-output accounting framework is used to examine the impact of policy changes such as an emissions tax or to estimate the supply chain impacts of extreme climate events.

Computable general equilibrium (CGE) models allow policy experiments with complex behavioral interactions between sectors and agents that cannot be solved analytically due to their complexity. Even though some mechanisms can be explained for CGE outcomes, the level of complexity makes it impossible to assess the overall significance of each embedded decision rule and parameter value governing economic agents, resulting in a significant black-box effect.

Dynamic stochastic general equilibrium (DSGE) models make macroeconomic modeling even more complicated, especially uncertainty in agent decision-making and endogenous technological change. These models involve complex computations that can be difficult to solve. Some academic institutions and central banks are taking the necessary steps to make these models more useful in estimating the impacts of climate-related risks.

Overlapping generation (OLG) models are a more transparent and stylized approach to analyzing long-term macroeconomic evolutions. By examining the intergenerational distribution of consumption, these models can highlight one key shortcoming of other approaches: the large role discount rates play in estimating the social cost of carbon.

Agent-based models (ABMs) are the most recently introduced model for measuring climate-related impacts due to their ability to reflect uncertainty and complexity better. An ABM is a simulation in which economic actors interact with institutions and each other based on a set of decision-making rules imposed by the modeler.

Other broad risk measurement approaches currently being used by banks and supervisors include risk scores, scenario analysis, stress testing, and sensitivity analysis.

Climate risk scores rate the climate risk exposure of assets, companies, portfolios, or even countries. In order to assign a quality score to exposures, they combine a risk classification scheme with a set of grading criteria. Banks and supervisors can use climate risk scores to assess the relative climate exposure of existing and take necessary credit interventions.

Scenario analysis can help quantify tail risks and clarify climate-related uncertainties by examining a wide range of plausible scenarios. Climate scenario analysis involves four steps:

Stress testing is a subset of scenario analysis aimed at evaluating a bank’s near-term resilience to economic shocks, often through a capital adequacy target.

Sensitivity analysis is another subset of scenario analysis that examines the impact of a specific variable on economic outcomes. Typically, one parameter is altered across multiple scenarios, and outputs are observed to see what happens each time the parameter is altered.

Among other new approaches developed, we have natural capital analysis and climate value-at-risk.

Natural capital analysis evaluates the negative effects of degradation on a bank. This process typically involves four steps:

Climate value-at-risk (VaR): This approach involves assessments applying the traditional VaR framework to gauge the impacts of climate change on banks’ balance sheets.

In this section, we discuss methodologies for mapping and measuring climate-related financial risks as well as their strengths and weaknesses. We also discuss scenario analysis, stress testing, and sensitivity analysis, which are used to quantify climate-related financial risks. Measurement methodologies are discussed separately for banks, supervisors, and third parties, even though we may have similarities.

Portfolio and sectoral exposures: Measures of carbon/emission intensity, energy efficiency or energy label distribution of a real estate, or physical risk vulnerability of collateral positioned in risky regions are among the examples here. Banks have launched internal processes to evaluate climate-related financial risks qualitatively and map their potential impacts in the absence of quantitative information. The indicators or metrics that banks employ to map, measure, and monitor their exposures can either be distinguished by transition risk or physical risk.

The following are observed practices among banks:

Supervisors use similar metrics and indicators that banks use to map, measure, and monitor exposure to climate-related financial risk.

Stress testing or scenario analysis methods can be used to quantify climate-related financial risks at the bank level.

Supervisors and banks sometimes rely on comprehensive methodologies or tools provided by third parties in addition to specific data or metrics. The same features apply to third-party methodologies as in the context of banks and supervisors, such as exposure mapping, scenario selection, shock introduction, and impact assessment.

The table below summarizes the strengths and weaknesses of the main types of measurement approaches.

$$\small{\begin{array}{l|l|l}

{\textbf{Approach}\\} & {\textbf{Strengths}\\} & {\textbf{Weaknesses}\\} \\\hline

{\text{Integrated}\\\text{assessment model}\\\text{(IAM)}} & {\text{Effectively captures feedback}\\\text{between socioeconomic and}\\\text{climate systems.}\\\text{There is internal consistency}\\\text{in the projections.}\\\text{Policies and assumptions}\\\text{can be accommodated in}\\\text{models.}} & {\text{Highly aggregated.}\\\text{Typically relies on limited}\\\text{damage functions, which}\\\text{do not adequately account for}\\\text{extreme weather events.}\\\text{It is not resilient to imperfect}\\\text{information and endogenous}\\\text{events, such as changes in}\\\text{technology and policy.}\\\text{Finance, banking, and money}\\\text{are not modeled in most IAMs.}}\\&&\\\hline

{\text{Computable}\\\text{general equilibrium}\\\text{(CGE)}} & {\text{Analyzes interconnections}\\\text{across multiple sectors and}\\\text{agents of the economy.}} & {\text{Assumes decision-makers}\\\text{are perfectly informed.}} \\&&\\\hline

{\text{Dynamic stochastic}\\\text{general equilibrium}\\\text{(DSGE)}} & {\text{Incorporating uncertainty in}\\\text{agent decision-making.}\\\text{Used by central banks for}\\\text{policy analysis.}} & {\text{Computationally intensive.}\\\text{Agent decision-making}\\\text{assumptions are unrealistic.}} \\&&\\\hline

\text{Macro-econometric} & {\text{Utilizes the role of prices}\\\text{to explain market distortions.}} & {\text{Estimates are derived from}\\\text{past observations. Focus on}\\\text{macro-level analysis; exclude}\\\text{micro-level analysis.}} \\&&\\\hline

{\text{Overlapping}\\\text{generation}} & {\text{Provides an overview of}\\\text{intergenerational redistribution.}\\\text{Incorporates life-cycle}\\\text{investment decisions.}} & {\text{Closed economy model.}\\\text{Assumes decision-makers}\\\text{are perfectly informed about}\\\text{future economic conditions}\\\text{and prices.}\\\text{Does not take into account}\\\text{endogenous systemic risks}\\\text{(climate change or transition).}} \\&&\\\hline

{\text{Input-output}} & {\text{Describes environmental}\\\text{impacts at the industry level.}\\\text{Captures the effects of demand}\\\text{for goods and services on energy}\\\text{and resources.}\\\text{Captures cascading effects}\\\text{of events.}} & {\text{Prices have a decisive role in}\\\text{limiting policy alternatives to}\\\text{price mechanisms}\\\text{(such as taxes).}} \\&&\\\hline

{\text{Agent-based}} & {\text{Micro (agent) level.}\\\text{Agent/economic interactions}\\\text{are captured well.}} & {\text{Computationally intensive.}\\\text{Significant data is required to}\\\text{develop behavioral rules of agents.}} \\&&\\\hline

{\text{Scenario}\\\text{analysis}} & {\text{Effectively analyze tail risks.}\\\text{Industry collaboration has}\\\text{benefitted scenarios.}\\\text{Relatively computationally}\\\text{simple.}\\\text{Address several aspects of}\\\text{climate uncertainty.}} & {\text{A chronic hazard is often left out}\\\text{of scenarios.}\\\text{Data gaps hinder the analysis.}}

\end{array}}$$

In this section, we discuss key challenges in designing a modeling framework.

Aggregate risk classification approaches not only have advantages but also face several limitations. As a result of the current availability of data, identification criteria may not be sufficiently granular to distinguish counterparties. For example, some risk classification approaches assume that counterparties from the same geographical location have the same risk characteristics. In reality, however, the transition and adaptation capabilities of counterparties may vary depending on the specific physical or transition risk driver being assessed.

In addition, the sensitivity of an individual counterparty to climate-related risks may not necessarily be reflected in a sector or geographical area that is transition-sensitive.

It may be difficult to distinguish between gross and net exposure without being able to clearly identify and measure the hedging strategies employed by counterparties.

While risk classification systems strive for comparability, it comes at a cost. In order to facilitate comparisons between banks’ exposures within or across jurisdictions, standardization and/or simplification elements are introduced. So, there is a trade-off between the level of detail and complexity needed to accurately assess risks and the need to compare and combine risk information from different banks.

Recently, the availability of data and information has been reported as a major challenge hindering the development of climate risk measurement processes.

A major challenge here is that information may be out of the scope of traditional financial data collection. The available information may lack sufficient granularity and further drawbacks that hinder the analysis of the data.

Ratings provided by third parties may not be fully reliable as the users of the ratings may not be so sure about the accuracy of the data provided by the rated firms. Data users may find it difficult to identify the methodological approach adopted by data providers since most scores are based on proprietary models. In addition, the comparability of indicators across vendors is also limited. Therefore, reconciling these approaches is often difficult.

Counterparties provide lenders with proprietary non-public information in order to develop a banking relationship and assess the counterparty’s creditworthiness. By acquiring non-public client information via the lending relationship, the bank is able to address some of the data gaps or quality issues on a bilateral basis. However, for small counterparties, the availability of proprietary climate-related client data may be qualitative rather than quantitative. Consequently, data completeness and precision issues may materialize. Furthermore, banks rarely update data after the underwriting processes are done. This could create gaps in climate reporting for existing exposures.

When proprietary non-public information is not readily available, banks may decide to use public information disclosed by borrowers. It is worth noting that the quantity and quality of public information depend on the size of the firm. Consequently, it limits the comparability of smaller firms with large corporations.

Supervisory reports provide recurring and standardized data useful for measuring climate risk. Their analysis could provide macro- and micro-level insights into banks’ asset portfolios. While existing data can be leveraged in combination with third-party providers, current supervisory reporting may not provide sufficient granularity to assess transition and physical risks.

Financial losses are computed by incorporating all necessary economic and financial variables at a granularity consistent with a risk classification. However, climate-related financial risks are complex and coupled with uncertain climate drivers that go beyond intrinsic future uncertainty inherent in physical and transition risk drivers. Banks and supervisors cite the following aspects as being particularly challenging in modeling comprehensive scenarios:

It is particularly challenging to factor in climate scenario-related variables. Models typically use historical statistics to estimate the impact of given risk drivers on credit risk parameters, such as PDs or LGDs. To estimate robust relationships, historical observations of risk drivers must have sufficient depth and variance. There are no past observations of climate-related risk materializations that can be used to predict future trends. Moreover, financial models cannot generate empirical risk parameters.

Banks and supervisors have to consider horizons longer than usual due to the long-term nature of climate change, which makes stress testing exercises and forward-looking assessments challenging.

In addition, uncertainties associated with climate sensitivity modeling are exacerbated by such long-term horizons, which also impact economic and financial projections, thereby limiting their reliability when assessing risks. In addition, the uncertainty of a model’s projections is directly proportional to the length of the horizons used in forecasts. Limitations in modeling will further reduce projection robustness.

Banks have limited ability to internalize negative feedback associated with their short-term lending decisions. To capture risks over longer time horizons, banks will need to examine the appropriateness of existing measurement approaches as well as possible modifications.

Measurement of climate risk requires adequate infrastructure, relevant human resources, and/or sophisticated organizations. In order to assess their overall exposure to climate risks across all their significant operations, banks need to be able to aggregate and manage large amounts of data. The ability to collect, format, and process enormous amounts of climate-specific data is vital to most methodologies.

In order to measure climate-related financial risk, it may be necessary to pool resources from various business and functional areas, as well as to develop climate-specific expertise in-house or hire experts externally. A bank’s size and complexity also influence its choice of risk measurement methodologies. Internal harmonization towards common risk assessment approaches, metrics, and methodologies may be challenged due to idiosyncrasies among business lines and banking entities. Smaller, less complex banking groups may face sophistication and resource allocation trade-offs.

Practice Question

Given the evolving nature of climate-related financial risks, banks face significant challenges in integrating these risks into their existing risk frameworks. One particular bank, operating globally, is evaluating different methodological approaches to incorporate climate-related financial risks into their credit risk analysis. Which of the following approaches would best enable the bank to effectively incorporate these risks into its credit risk framework?

A. Relying solely on historical financial data for risk assessment.

B. Implementing a dynamic stochastic general equilibrium (DSGE) model.

C. Utilizing traditional risk scores based on past credit performance.

D. Employing scenario analysis and climate stress testing methods.The correct answer is D.

Employing scenario analysis and climate stress testing methods is the most effective approach for banks to incorporate climate-related financial risks into their credit risk framework. These methods allow banks to assess the potential impact of various climate risk scenarios on their portfolios. This forward-looking approach considers the uncertainty and long-term nature of climate risks, enabling banks to evaluate how different climate scenarios might affect credit risk parameters like probability of default (PD) and loss given default (LGD).

A is incorrect because relying solely on historical financial data for risk assessment does not account for the forward-looking and uncertain nature of climate-related risks, which may not be reflected in past data.

B is incorrect because while a dynamic stochastic general equilibrium (DSGE) model is sophisticated, it may be overly complex and not specifically tailored for climate-related risk assessment in a banking context.

C is incorrect because traditional risk scores based on past credit performance may not adequately capture the prospective and unique nature of climate-related financial risks.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.