Forward Price of an Asset With Zero, P ...

Cost of Carry The cost of carry is defined as the net of... Read More

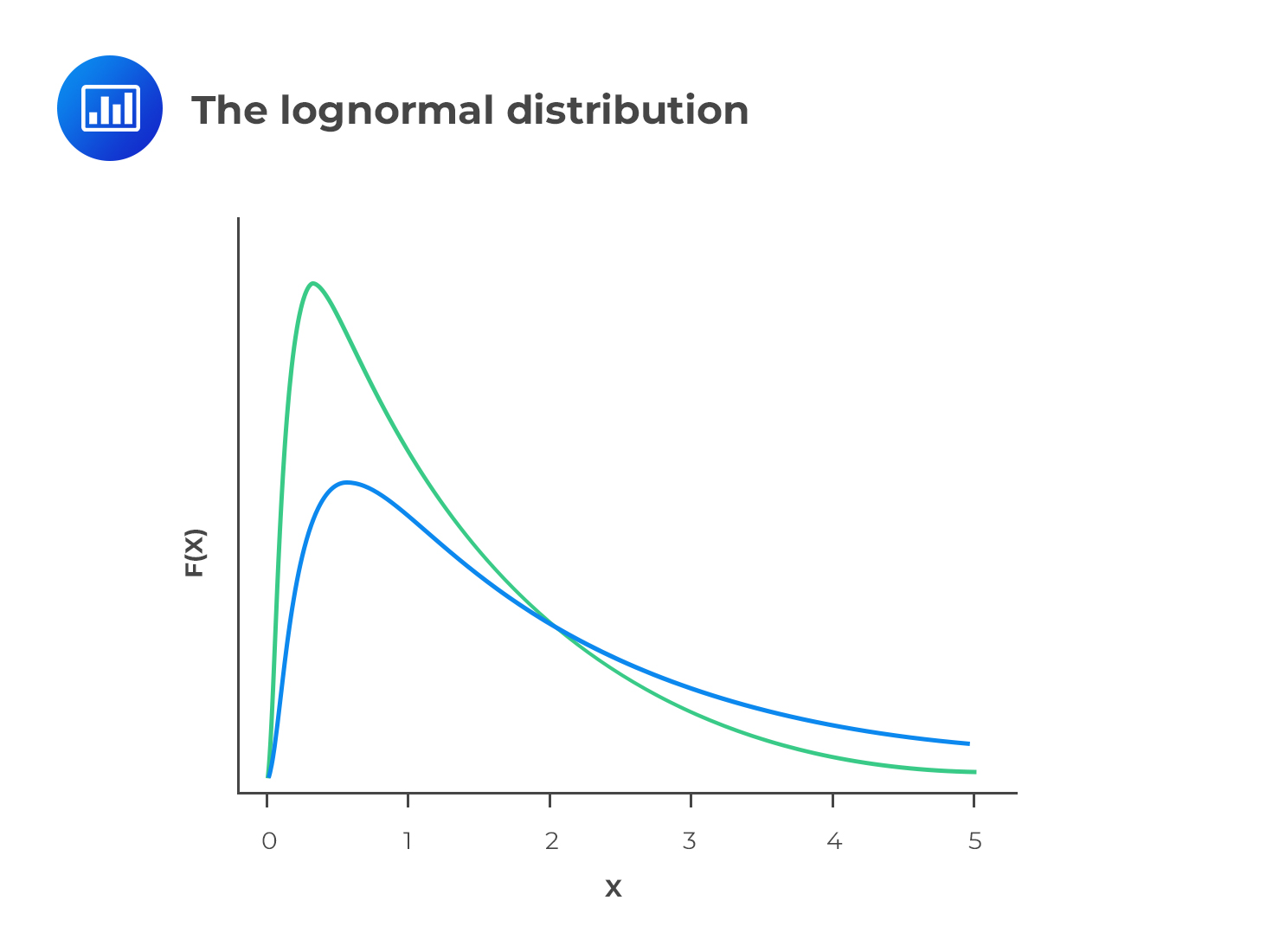

A variable \(X\) is said to have a lognormal distribution if \(Y = ln(X)\) is normally distributed, where “ln” denotes the natural logarithm. In other words, when the logarithms of values form a normal distribution, we say that the original values have a lognormal distribution.

Let’s consider this:

$$Y=e^X$$

Where \(e\) is the exponential constant.

If we take natural logs on both sides, \(lnY = ln\ e^X\), which leads us to \(lnY = X\). Therefore, if \(X\) has a normal distribution, then \(Y\) has a lognormal distribution.

The lognormal distribution is positively skewed, with many small values and just a few large values. Consequently, the mean is greater than the mode in most cases.

Since the lognormal distribution is bound by zero on the lower side, it is perfect for modeling asset prices that cannot take negative values. On the other hand, the normal distribution cannot be used for the same purpose because it has a negative side.

When the returns on a stock (continuously compounded) follow a normal distribution, the stock prices follow a lognormal distribution. Note that even if returns do not follow a normal distribution, the lognormal distribution is still the most appropriate for stock prices.

The probability density function of the distribution is:

$$ f\left( x \right) =\frac { 1 }{ x\sqrt { 2\pi { \sigma }^{ 2 } } } { e }^{ -\frac { { \left( lnx-\mu \right) }^{ 2 } }{ \sqrt { 2{ \sigma }^{ 2 } } } } $$

The Black-Scholes-Merton model used to price options, which we will see in-depth in level II, uses the lognormal distribution as its foundation.

Question

Which of the following statements regarding the properties of lognormal distributions is the least accurate?

- Lognormal distributions are skewed to the right.

- Lognormal distributions are more often used to model asset prices than standard distributions.

- Lognormal distributions can take negative values.

Solution

The correct answer is C.

Lognormal distributions are bounded by 0 because they cannot take negative values. Since normal distributions can take negative values, and asset prices cannot be negative, lognormal distributions are more suitable for describing distributions of asset prices.

Exam tip: If you have negative values, your data isn’t lognormal.

A is incorrect. It is a true statement. Lognormal distributions are bound by zero. This implies that they do not have negative values and are thus skewed to the right.

B is incorrect. Lognormal distributions are bound by zero and thus cannot take negative values.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.