Sampling Considerations and 5 Common B ...

[vsw id=”mgY_3CHHYBw” source=”youtube” width=”611″ height=”344″ autoplay=”no”] Sampling considerations refer to the desirable characteristics... Read More

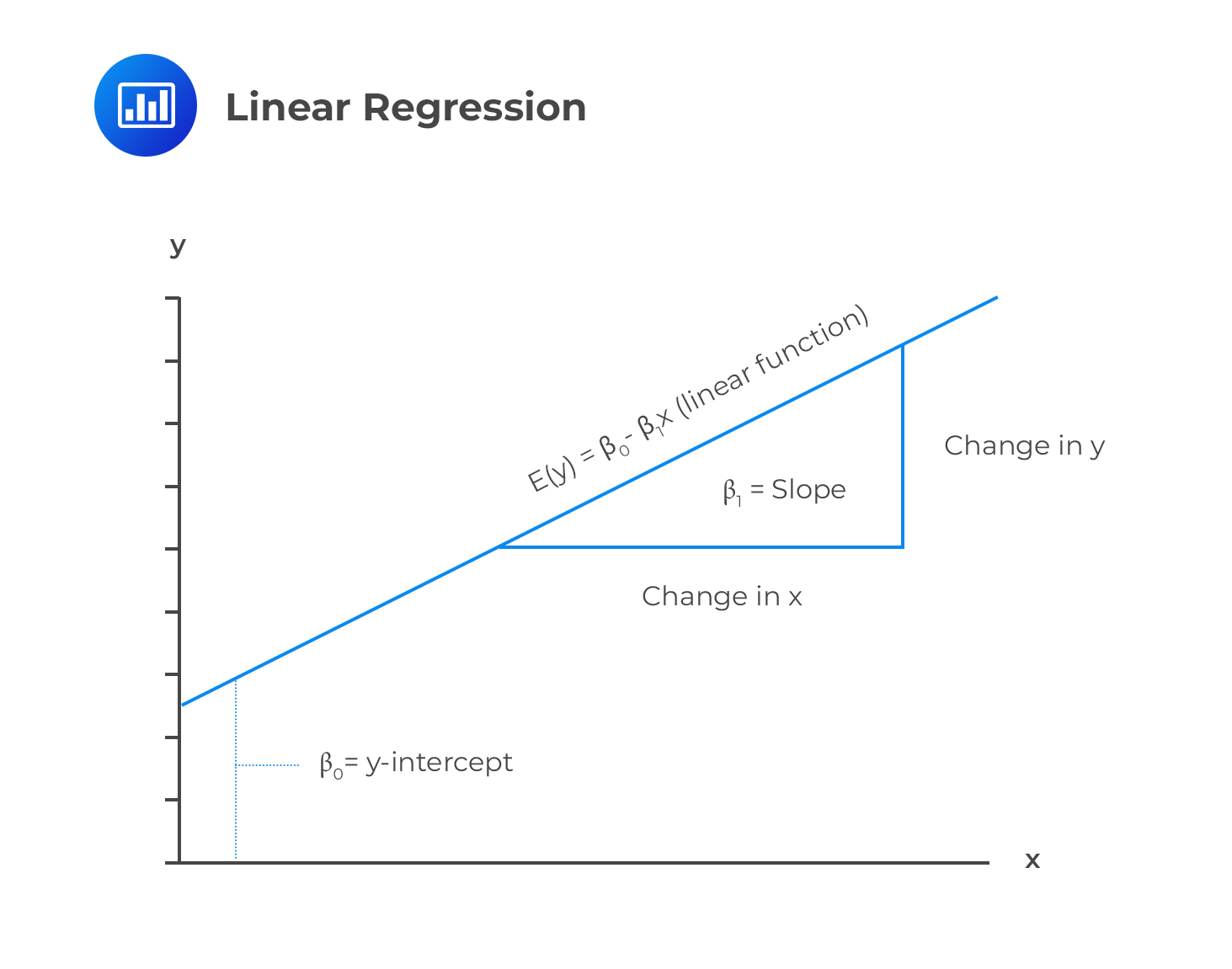

Linear regression forecasts the value of a dependent variable given the value of an independent variable. It assumes that there is a linear relationship between dependent and independent variables.

A dependent variable is predicted by an independent variable and is also known as the explained variable or endogenous variable. An independent variable, on the other hand, explains the variation in the dependent variable. It is also known as the exogenous variable, explanatory variable, or predicting variable.

The following is a simple linear regression equation:

$$Y=\beta_0 +\beta_1X_1+\epsilon$$

Where:

\(Y\) = dependent variable.

\(\beta_0\) = intercept.

\(\beta_1\) = slope coefficient.

\(X\) = independent variable.

\(\epsilon\) = error term (Noise).

\(\beta_0\) and \(\beta_1\) are known as regression coefficients.

The error term refers to the part of the dependent variable that cannot be explained by the independent variable.

Below is an illustration of a simple linear regression model.

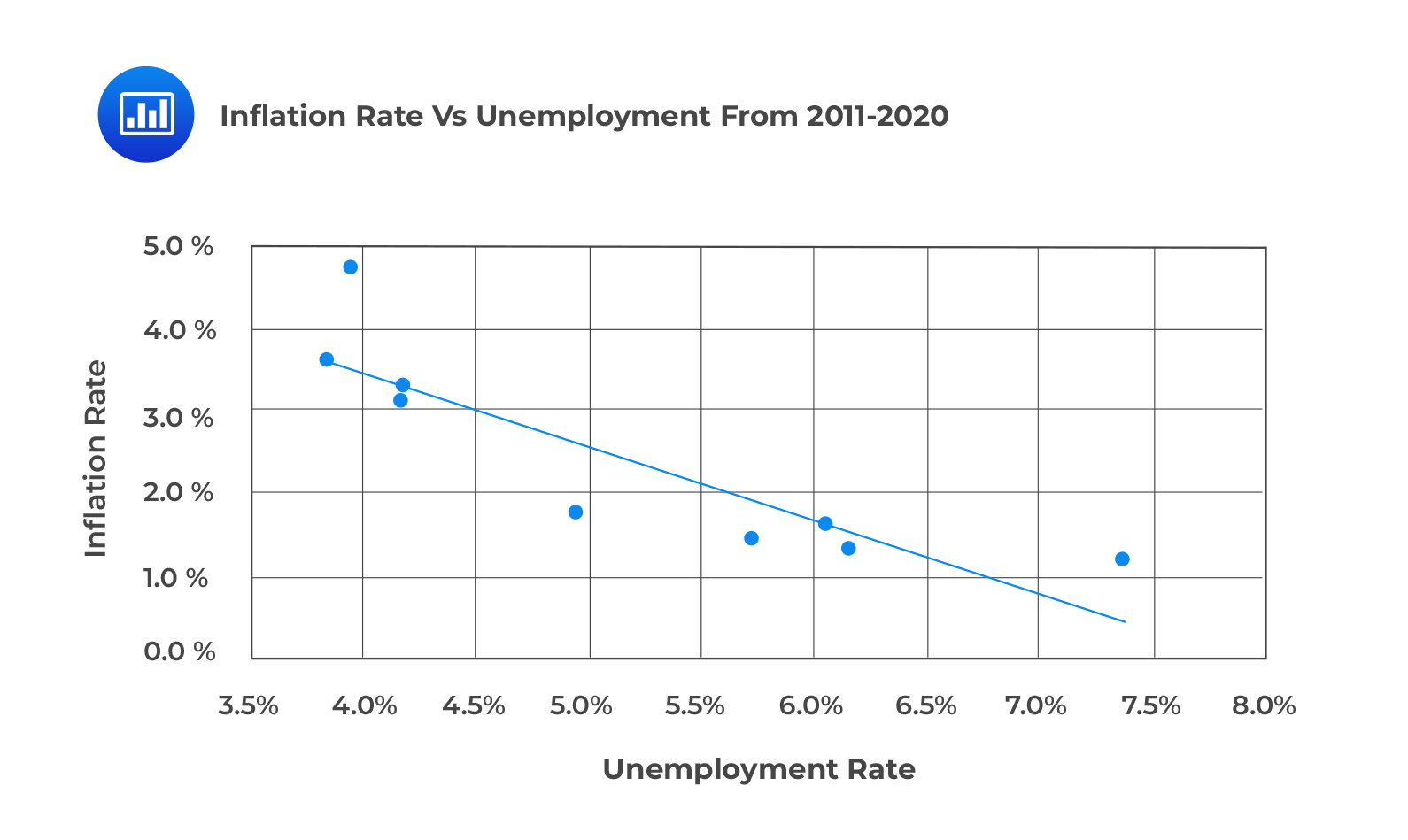

Arth Shah is using regression analysis to forecast inflation given unemployment data from 2011 to 2020.

The following table shows the relevant data from 2011 to 2020.

$$\small{\begin{array}{c|c|c}\textbf{Year} & \textbf{Unemployment Rate} & \textbf{Inflation rate}\\ \hline 2011 & 6.1\% & 1.7\%\\ \hline 2012 & 7.4\% & 1.2\%\\ \hline 2013 & 6.2\% & 1.3\%\\ \hline 2014 & 6.2\% & 1.3\%\\ \hline 2015 & 5.7\% & 1.4\%\\ \hline 2016 & 5.0\% & 1.8\%\\ \hline 2017 & 4.2\% & 3.3\%\\ \hline 2018 & 4.2\% & 3.1\%\\ \hline 2019 & 4.0\% & 4.7\%\\ \hline 2020 & 3.9\% & 3.6\%\\ \end{array}}$$

A scatter plot of the inflation rates against unemployment rates from 2011 to 2020 is shown in the following figure.

What variable is the dependent variable?

What variable is the dependent variable?

Inflation is the dependent variable: It is the variable predicted using the unemployment rates.

Question

The independent variable in a regression model is most likely the:

A. predicted variable.

B. predicting variable.

C. endogenous variable.

Solution

The correct answer is B.

An independent variable explains the variation of the dependent variable. It is also called the explanatory variable, exogeneous variable, or the predicting variable.

A and C are incorrect. A dependent variable is a variable predicted by the independent variable. It is also known as the predicted variable, explained variable, or the endogenous variable.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.