Expected Values, Variances, and Standa ...

Expected Value Expected value is an essential quantitative concept investors use to estimate... Read More

Covariance is a measure of how two variables move together. The sample covariance of X and Y is calculated as follows:

$$

\mathrm{S}_{\mathrm{XY}}=\frac{\sum_{\mathrm{i}=1}^{\mathrm{N}}\left(\mathrm{X}_{\mathrm{i}}-\overline{\mathrm{X}}\right)\left(\mathrm{Y}_{\mathrm{i}}-\overline{\mathrm{Y}}\right)}{\mathrm{n}-1}

$$

A major drawback of covariance is that it is difficult to interpret since its value can vary from negative infinity to positive infinity.

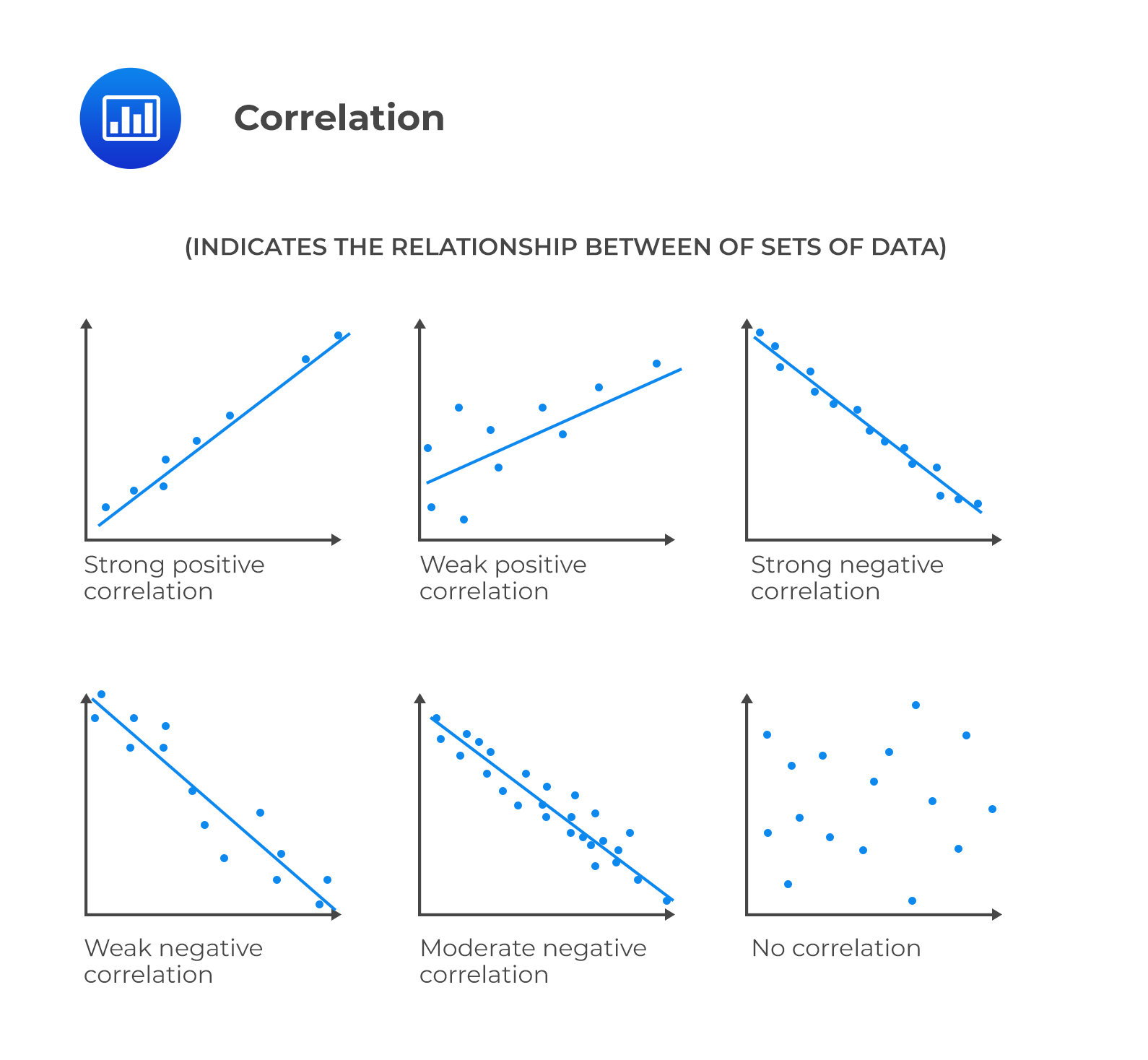

Practice covariance and correlation with a free trial.Correlation is a measure of the linear relationship between two variables. It takes the covariance and divides it by the product of the standard deviations of both variables. As a result, its value ranges between -1 and +1 and is easier to interpret.

The sample correlation coefficient is calculated as follows:

$$ r_{X Y}=\frac{s_{X Y}}{s_{x} \times s_{y}} $$

Where:

\(s_{X Y}\) = Covariance between variable X and Y.

\(s_{X}\) = Standard deviation of variable X.

\(s_{Y}\) = Standard deviation of variable Y.

Question

The correlation coefficient between X and Y is 0.7 and the covariance is 29. If the variance of Y is 25, the variance of X is closest to:

- 8.29.

- 29.

- 68.65.

Solution

The correct answer is C.

$$\begin{align} r_{X Y} &=\frac{s_{X Y}}{s_{X} \times S_{Y}}\\ \Rightarrow 0.7 &=\frac{29}{X \bullet 5} \\ \therefore X&=8.2857\\ \\ \text{Variance} &=8.2857^2=68.65 \end{align}$$

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.