Summarizing Data Using Frequency Distr ...

Frequency Distribution A frequency distribution refers to the presentation of statistical data in... Read More

The continuous uniform distribution is such that the random variable X takes values between α (lower limit) and β (upper limit). In the field of statistics, α and β are known as the parameters of the continuous uniform distribution. We cannot have an outcome of either less than α or greater than β.

The probability density function for this type of distribution is:

$$ { f }_{ x }\left( x \right) =\frac { 1 }{ \beta -\alpha } \quad \quad \alpha < x < \beta $$

\(X \sim U (\alpha, \beta)\) is the most commonly used shorthand notation read as “the random variable x has a continuous uniform distribution with parameters α and β.”

The total probability (1) is spread uniformly between the two limits. Intervals of the same length have the same probability.

Properties of the Continuous Uniform Distribution

$$ \text{Mean} =\cfrac {(\alpha + \beta)}{2} $$

$$ \text{Variance} =\cfrac {(\beta – \alpha)^2}{12} $$

You have been given that \(Y \sim U(100,300)\). Calculate \(P(Y > 174)\) and \(P(100 < Y < 226\)

The probability density function is given by:

$$ f_x(x) =\cfrac {1}{(300 – 100)} =\cfrac {1}{200} $$

Therefore, each “unit interval” has a probability of \(\frac {1}{200}\).

Which means that \(P(Y > 174) =\cfrac {(300 – 174)}{200} = \cfrac {126}{200} = 0.63\)

Similarly, \(P(100 < Y < 226) = 0.63\) because the interval has the same length as above (126) hence the same probability.

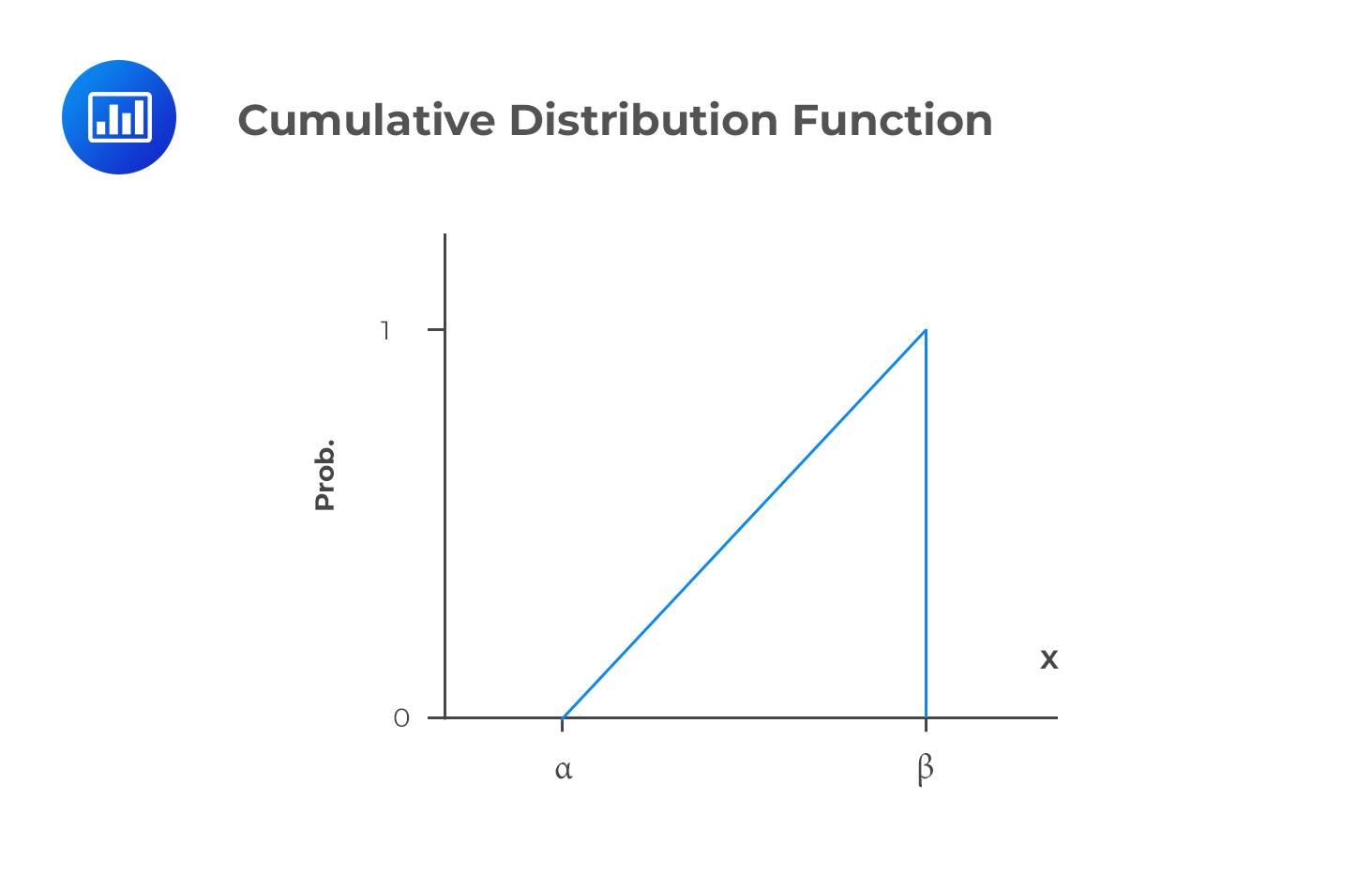

The cumulative distribution function of the continuous uniform distribution looks like this:

The CDF is linear over the variable’s range.

Question

A random variable X is uniformly distributed between 32 and 42. What is the probability that X will be between 32 and 40?

- 8%

- 10%

- 80%

Solution

The correct answer is C.

First, you should determine the pdf:

$$ \begin{align*} f_x(x) & =\cfrac {1}{(42 – 32)} \\ &=\cfrac {1}{10} \\ \end{align*} $$

Therefore,

$$ P(32 < Y < 40) =\cfrac {(40 – 32)}{10} = 0.8 \text{ or } 80\%. $$

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.