Applications of CAPM

CAPM can be extended to a number of areas. It provides additional applications... Read More

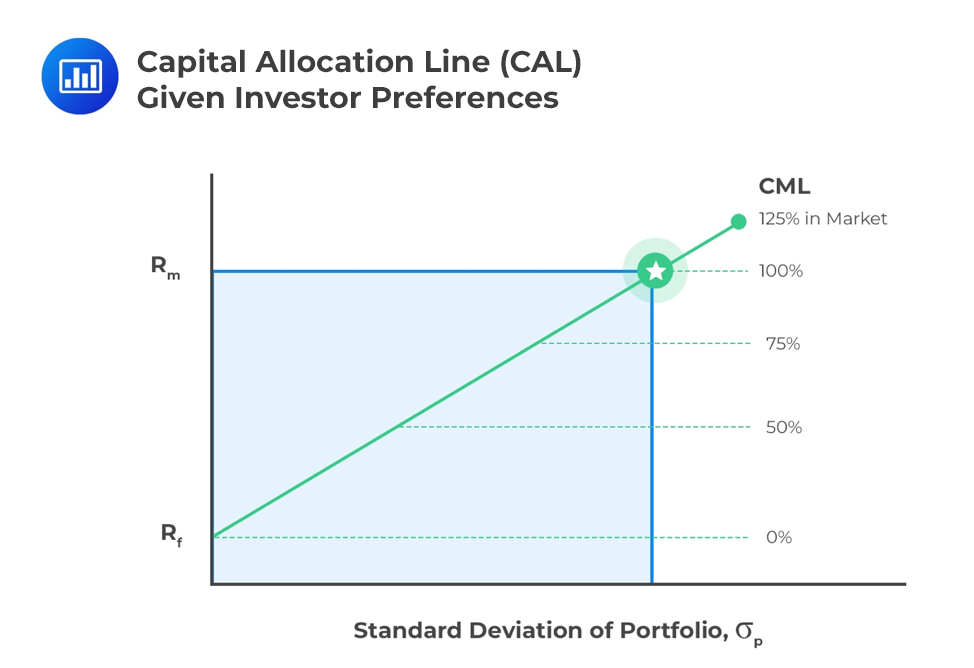

By combining a portfolio of risky assets with a risk-free asset, we can improve the return-risk characteristics of the portfolio and realize a better trade-off. This combination is called the capital allocation line (CAL). The proportion of allocation to risky assets versus allocation to risk-free assets will be dependent on the risk preferences of the investor.

We calculate the expected return of a mixed portfolio by adding up the expected returns of its components. To assess the portfolio’s risk, we need the allocation to each component, the standard deviation of each, and the correlation between them. When the assets aren’t perfectly correlated, the portfolio’s variance will be lower than that of its individual assets.

Each investor will have their own risky portfolio, dependent on the assumptions they make on the likely performance of the underlying assets. Since every investor makes their own unique assumptions about the underlying assets, there is no one optimal risk portfolio. We need to make a simplifying assumption that investor expectations are homogenous in order to derive what would be the optimal market portfolio.

Question

If two underlying assets are negatively correlated, combining them to form a portfolio will make the portfolio risk:

A. Increase.

B. Decrease.

C. Remain constant.

Solution

The correct answer is B.

When uncorrelated assets are combined to form a portfolio, a lack of correlation will reduce the overall portfolio volatility.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.