Behavioral Biases: Cognitive Errors an ...

Behavioral biases are irrational beliefs or behaviors that can influence our decision-making process.... Read More

[vsw id=”ji2GmIdIvOY” source=”youtube” width=”611″ height=”344″ autoplay=”no”]

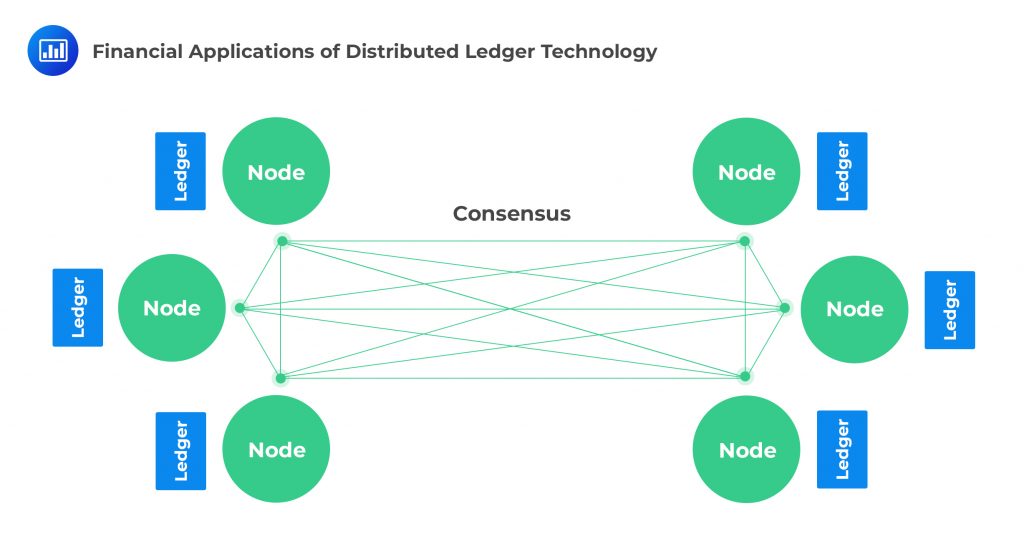

A distributed ledger is a database held and updated independently by each participant (or node) in a large network. Rather than have a central authority, records are independently constructed and held by every node (computer).

Each node has the ability to process a transaction and come up with a conclusion. All the nodes then “vote” on the conclusion. If the majority agrees with the conclusion, the transaction is completed successfully, and all nodes maintain their own identical copy of the ledger. There is no need for a centralized databank as in the case of a traditional ledger.

DLT has several features that make it a favorite among investment managers:

This refers to algorithmic encryption of data such that it is inaccessible to an unauthorized party. Before any transaction can be approved, some computers on the network must solve a cryptographic problem. As a result, DLT has a high level of security and integrity.

These are computer programs that self-execute on the basis of pre-specified terms and conditions agreed to by the parties to a contract. In the derivatives market, for instance, the system could be seen such that daily settlements are made automatically in line with the day’s market movements. If a counterparty defaults on a payment, collateral can be transferred to the relevant party instantaneously.

Blockchain is a type of digital ledger in which information, such as changes in ownership of an asset, is recorded sequentially within blocks that are then linked together and secured using cryptography. Each block is made up of a group of transactions that are linked to a previous block. Blockchain enables the distribution of information while at the same time ensuring that it’s not copied.

A cryptocurrency is an electronic currency that enables payments to be sent between users without passing through a central authority, such as a bank or payment gateway. Cryptocurrencies allow near-real-time transactions between parties, with verification based on cryptography.

Most cryptocurrencies use open DLT systems where a decentralized distributed ledger is used to record and verify all transactions. Although most central banks around the world have been reluctant to integrate cryptocurrencies into the mainstream monetary transactions structure, there are signs this may change in the future.

Tokenization is the process of converting rights to an asset, say stocks, bonds, or even a building, into a digital token on a blockchain. DLT streamlines this process by creating a single, digital record of ownership with which to verify ownership title and authenticity, including all historical transactions related to the asset.

Post-trade transactions are known to be complex and time-consuming since they require multiple interactions between counterparties and financial intermediaries. DLT has the ability to streamline the entire process by providing near-real-time trade verification, reconciliation, and settlement.

In the face of ever-increasing rules and regulations in the field of investment, DLT can help firms ensure compliance by enabling near-real-time review of transactions. This eliminates the need for large post-trade monitoring teams and creates operational efficiency.

Question

Which of the following applications of Distributed Ledger Technology is best suited to streamline real estate transactions?

A. Tokenization

B. Blockchain

C. Cryptocurrencies

Solution

The correct answer is A.

Through tokenization, ownership of real estate assets can be converted into digital tokens that can facilitate trading and recording of all transactions.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.