Principles of Portfolio Construction

Once the IPS containing the investment objectives and investment constraints has been determined... Read More

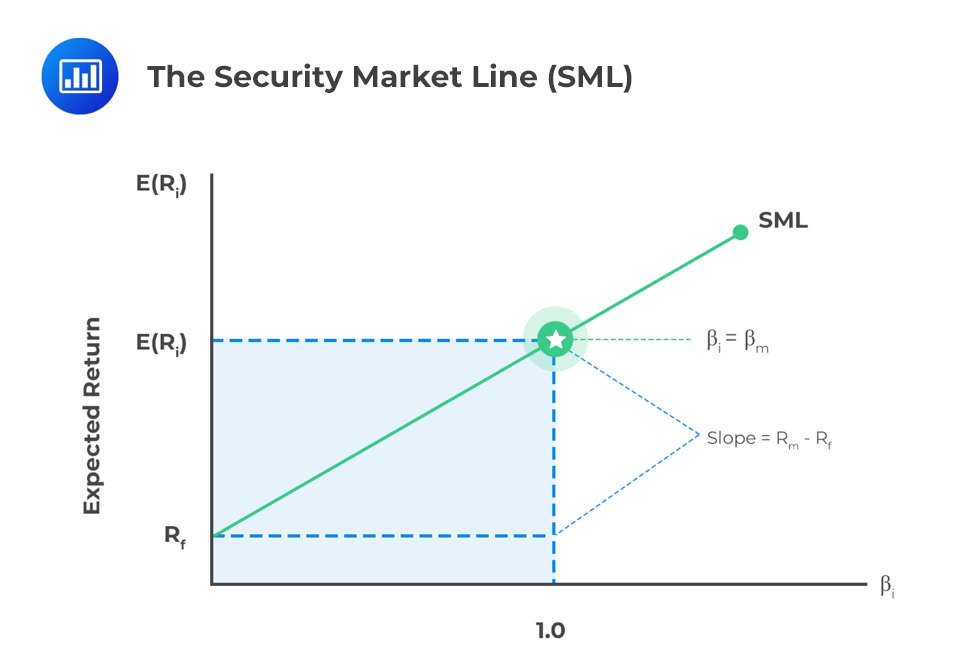

The Capital Asset Pricing Model (CAPM) provides a linear relationship between the expected return for an asset and the beta. The Security Market Line (SML) represents CAPM on a graph. As opposed to the Capital Market Line (CML), where the X-axis was the standard deviation, we’re now using beta – systematic risk – to approximate the expected return.

As with many financial models, it relies on a number of assumptions in order to simplify some of the complexities of the financial markets.

As with many financial models, not all the complexities of the financial markets are accounted for. CAPM makes the following assumptions:

This assumption does not require all investors to have the same degree of risk aversion. Instead, it requires investors to be risk-averse as opposed to risk-neutral or risk-seeking. Investors are assumed to be rational if they correctly evaluate all available information to arrive at well-informed decisions. The rationality of investors has been criticized because personal bias can result in irrational decision-making. However, this behavior does not affect the model outcome.

In addition to indifference to transaction costs, the model also assumes that investors can borrow and lend at a risk-free rate. The transaction costs of many large institutions are negligible, and many investors do not pay taxes. The practical inability to borrow or lend at risk does not materially affect the CAPM results. In spite of this, costs and restrictions on short-selling can introduce an upward bias on asset prices. It is noteworthy that the prices do not affect the CAPM conclusions.

The assumption of a single holding period is convenient since multi-period models have become very difficult. A single-period assumption has shortcomings. It, however, does not severely limit the applicability of the CAPM.

This is the assumption that all investors analyze securities the same way, and using the same probability distributions and inputs for future cash flows. This then means that all asset valuations are identical, and the same optimal portfolio of risky assets is generated – the market portfolio. This assumption can be relaxed as long as the generated optimal risky portfolios are not significantly different.

This is the assumption that investors can hold fractions of assets. It is deemed convenient from a modeling perspective, considering that it allows for continuous rather than discrete jump functions.

If investors are price takers, no investor can single-handedly influence prices through their trades. This assumption is generally true in practice.

The Security Market Line (SML) is the graphical representation of the CAPM with beta reflecting systematic risk on the x-axis and expected return on the y-axis. The SML intersects the y-axis at the risk-free rate, and the slope of the line is the market risk premium, Rm – Rf.

The SML is formulated as follows:

$$ E(R_i) = R_f + \beta_i [E(R_m) – R_f] $$

Where \(\beta_i= \frac{\rho_{ i,m} \sigma_i } {\sigma_m}\)

The Capital Market Line (CML) and SML are similar. Despite their similarity, the CML only applies to portfolios on the efficient frontier providing optimal combinations of risk and return. The SML, on the other hand, applies to any security, regardless of whether it is efficient or not. Total risk and systematic risk are equal for an efficient portfolio because the non-systematic risk has been diversified.

Question

Which statement does not identify assumptions of the capital asset pricing model?

A. Investors are price takers, investors are rational, and transaction costs are ignored.

B. Investors are risk-seeking, fractional ownership is possible, and investors are price takers.

C. Investors have the same holding period, investors value securities identically, and taxes can be ignored.

Solution

The correct answer is B.

CAPM assumes all investors are risk-averse, utility-maximizing, and rational individuals.

Use AnalystPrep’s free trial to solve CFA-style CAPM problems, strengthen your understanding of beta, expected return, and the security market line, and build exam-day confidence.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.