Macaulay Duration

Definition Macaulay duration was introduced in the previous learning objective. It provides an... Read More

Yields-to-maturity for zero-coupon government bonds could be analyzed for a full range of maturities called the government bond spot curve (or zero curve). Government spot rates are assumed to be risk-free.

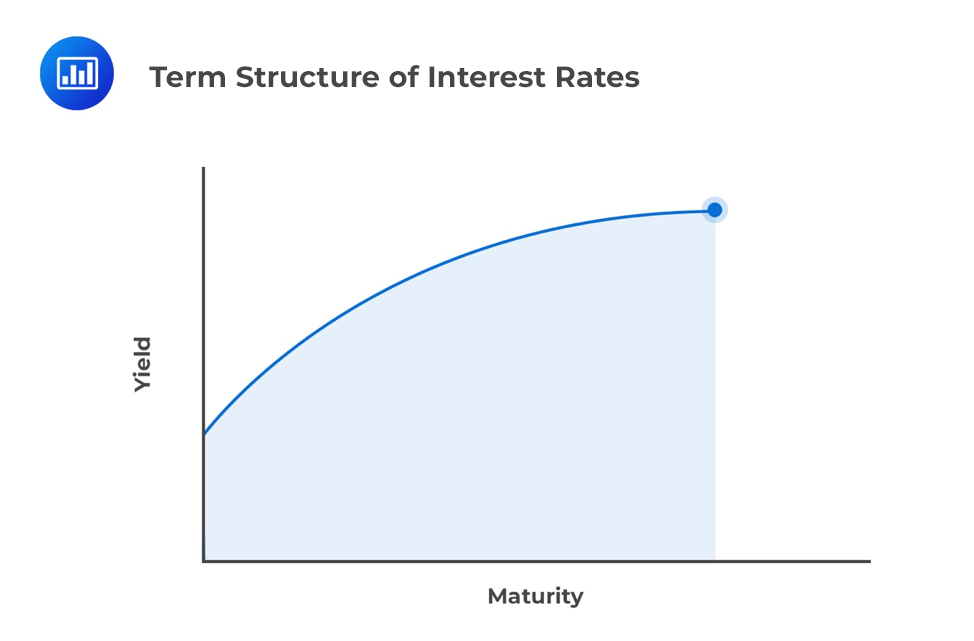

The spot curve is upward sloping and flattens for longer times-to-maturity. As a result, longer-term government bonds usually have higher yields than shorter-term bonds. The hypothetical spot curve is ideal for analyzing the maturity structure because it meets the “all other things being equal” assumption.

The par curve is dirrefent from the spot curve because it is a sequence of yields-to-maturity and each bond is priced at par value. The par curve is obtained from the spot curve. All bonds on the par curve are supposed to have the same credit risk, periodicity, currency, liquidity, tax status, and annual yields. Between coupon payment dates, the flat price (not full price) is equal to par value.

Since the par curve is a sequence of yields-to-maturity and each bond is priced at par value, the formula to obtain par rates is as follows.

\(100=\frac { PMT }{ { (1+{ Z }_{ 1 }) }^{ 1 } } +\frac { PMT }{ { (1+{ Z }_{ 2 }) }^{ 2 } } +…+\frac { PMT + Principal }{ { (1+{ Z }_{ N }) }^{ N } } \)

Where ZN = the spot rate at time N

Assuming that the 1-year and 2-year spot rates on government bonds are 5.25% and 5.75% respectively:

$$100=\frac { PMT+100 }{ 1.0525 } ;\quad PMT=5.25$$

$$100=\frac { PMT }{ 1.0525 } +\frac { PMT+100 }{ { 1.0575 }^{ 2 } } ; \quad PMT=5.736$$

The forward curve is a series of forward rates, each of which has the same time frame. We will talk at length about forward rates in the next learning objective.

Question

The yield curve derived from a sequence of yields-to-maturity on bonds where each bond is priced at par value is most likely called the:

- par curve and all bonds on this curve are supposed to have the same annual yields.

- forward curve and all bonds on this curve are supposed to have the same periodicity.

- flat curve and all bonds on this curve are supposed to have the same liquidity and similar tax status.

Solution

The correct answer is A.

The par curve is a sequence of yields-to-maturity and each bond is priced at par value. All bonds on the par curve are supposed to have the same credit risk, periodicity, currency, liquidity, tax status, and annual yields.