Underwritten, Syndicated Offerings and ...

Issuers sell bonds initially in primary bond markets. Existing bonds are subsequently traded... Read More

Fixed-income securities encompass bonds and loans, serving as crucial avenues of debt financing for corporations and governments. These are formed under standardized agreements, where issuers obtain funds for operational or capital needs, and investors, in turn, lend their capital, expecting interest payments and the eventual return of the principal. These securities are part of a broader spectrum of corporate liabilities, with each debt type possessing unique features such as varying maturities, seniority levels, and currencies.

Importantly, fixed-income securities are distinctive from other liabilities as they involve cash-settled agreements with investors or banks. Governments typically use bond issuance as their primary financing strategy, though some also secure loans from international bodies like the IMF. A distinguishing characteristic of fixed-income securities from equities is their guaranteed periodic cash flows, offering investors regular income and capital return upon maturity.

Master fixed-income concepts faster in a free trial.

A bond’s issuer, whether it’s a national government, a local body, or a private corporation, is responsible for making all interest and principal payments. Sovereign bonds usually carry the least risk due to governmental backing.

This signifies the end date when the issuer completes its payments to bondholders. Securities with a maturity period of one year or less are considered money market securities, while those extending beyond a year are capital market securities. Perpetual bonds, which do not have a definite maturity, are also a unique class of bonds.

This is the amount that the issuer agrees to repay to investors at the end of the bond’s lifespan. Some securities may distribute principal repayment over time rather than in one lump sum at maturity.

Bond interest can be classified as fixed, variable, or part of a single payment at maturity. Fixed-coupon bonds involve regular payments at specific intervals (monthly, quarterly, semi-annual, or annual), with corporate bonds typically paying semiannually. Floating-rate notes (FRNs) have variable interest determined by combining a market reference rate (MRR) and a credit spread. Zero-coupon bonds, on the other hand, do not pay periodic interest; instead, they pay interest along with the principal at maturity and are usually issued at a discount to par value.

$$ \text{Interest expense} =\frac{\text{Par Value of the bond} \times \text{Coupon rate}}{\text{Frequency of payments}} $$

In terms of repayment during liquidation or bankruptcy, senior debt takes precedence over other forms of debt. Junior or subordinated debts are repaid only after senior debts are settled.

Bonds may include clauses for actions under certain circumstances. A contingency provision in bonds includes embedded options like call, put, and conversion to equity. These options cannot be traded separately from the bond but can be valued by comparing it with a similar bond without such provisions.

The bond’s expected cash flows and its price can be used to determine yield measures like current yield and yield-to-maturity.

$$ \text{Current yield} =\frac{\text{Annual coupon}}{\text{Bond price}}\times100\% $$

Yield-to-maturity (YTM) is a more complex measure, calculated as the internal rate of return using the bond’s price and its coupon payments until maturity. It is normally expressed as an annual rate. If all assumptions hold (no default, holding until maturity, reinvesting at YTM), the investor’s rate of return will equal the bond’s YTM at the time of purchase.

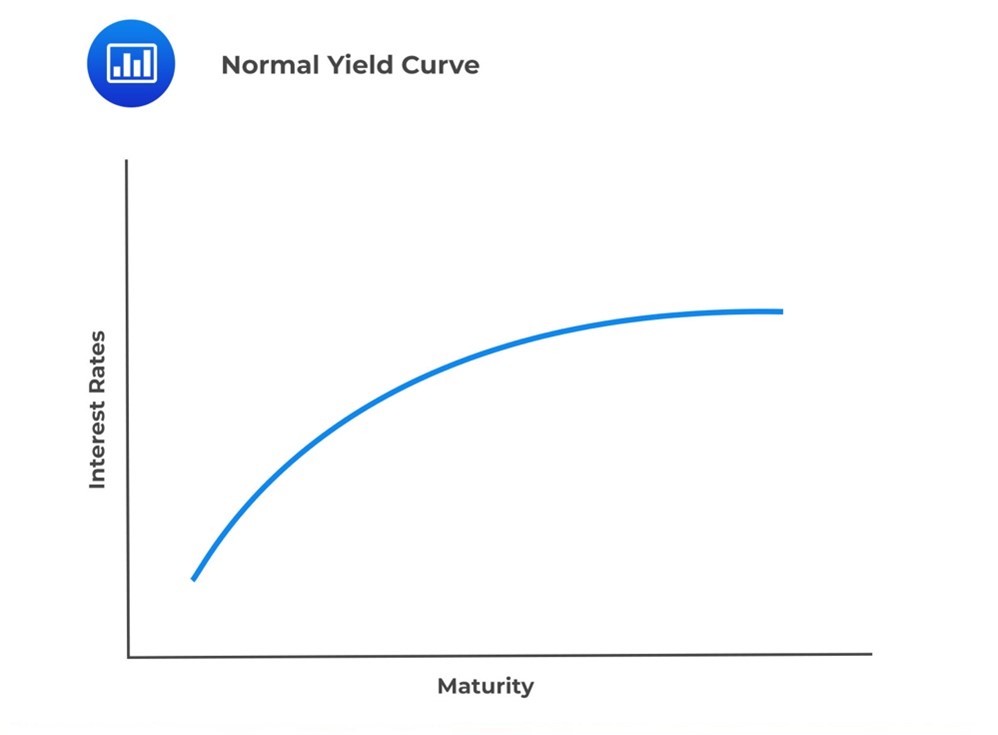

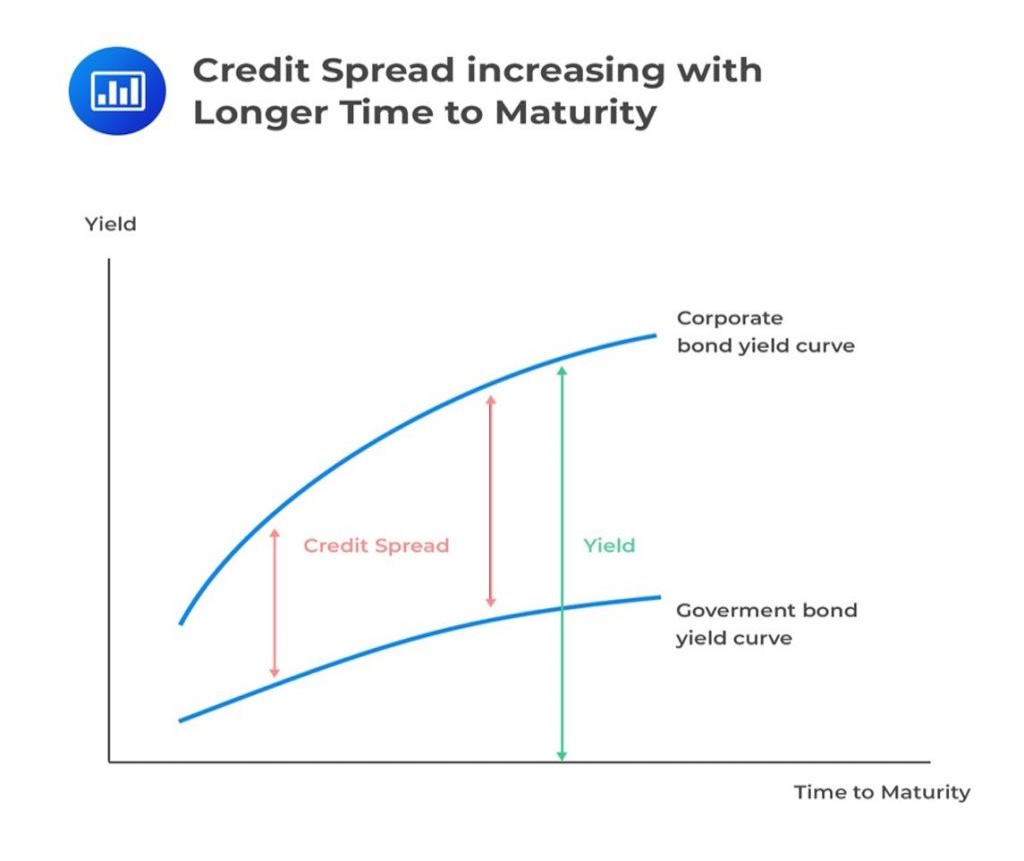

Plotting an issuer’s bonds against their yield-to-maturity and time-to-maturity gives us a yield curve. It is a useful tool for comparing the expected returns on different bonds issued by the same entity. Comparing this with the yield curve of a risk-free bond, like a sovereign bond, gives a measure of the credit risk of the bond.

This is demonstrated in the charts that follow.

Question 1

The coupon payment on a 3% coupon bond with a par value of $200,000 and a quarterly payment frequency is closest to:

- $666.67

- $1500.00

- $24000.00

Solution

The correct answer is B.

$$ \begin{align*} \text{Coupon payment} & =\frac{\text{Par Value of the bond} \times \text{Coupon rate}}{\text{Frequency of payments}} \\

\text{Coupon payment} & =\frac{\$200,000 \times 3\%}{4}=\$1,500 \end{align*} $$Question 2

Consider a floating-rate note (FRN) with a notional value of USD 5 million, issued by a U.S. corporation. The FRN pays quarterly interest equal to the three-month market reference rate (MRR) plus 200 basis points (2.00%). If the current three-month MRR is 1.75%, the corporation’s quarterly coupon interest payable for this period is closest to:

- $46,875

- $87,500

- $187,500

Solution

The correct answer is A.

The FRN coupon consists of the MRR plus the issuer-specific spread.

$$ \begin{align*}

\text{FRN coupon} & = \text{MRR} + \text{Spread.} \\

\text{FRN coupon} & = 1.75\% + 2.00\%. \\

\text{FRN coupon} & = 3.75\%.

\end{align*} $$$$ \text{Annual interest} = \$5,000,000 \times 3.75\% = \$187,500 $$

So that that the quarterly interest is: \(\frac{\$187,500 }{4}=\$46,875\)

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.