Risks in Relying on Ratings from Credi ...

[vsw id=”zSl9z7qQB00″ source=”youtube” width=”611″ height=”344″ autoplay=”no”] Investors overwhelmingly believe that credit rating agencies... Read More

The price of a bond is influenced by various factors, including its cashflow features and market discount rate. The cash flow features are periodic payments made to bondholders, such as interest or coupon payments. On the other hand, the market discount rate is the required return based on the bond’s risk. It reflects investors’ expectations and the time value of money. At issuance, the bond price equals the present value (PV) of future interest and principal cash flows.

The price of a bond can be determined using mathematical formulas or spreadsheet functions as highlighted below:

Bond price: \( P=\sum_{t=1}^N \left( \frac{C_t}{(1+r)^t} \right) + \frac{FV_N}{(1+r)^N} \)

Where:

type refers to whether payments are made at the end (0) or beginning (1) of each period

Bonds are categorized into three main types, each representing a specific relationship between price, coupon rate, and market discount rate:

Yield-to-Maturity (YTM) represents the bond’s internal rate of return (IRR), which is the single, uniform interest rate that, when applied to discount the bond’s future cash flows, equals the current price of the bond. In essence, YTM is the implied or observed market discount rate. It is also known as the bond’s “promised yield,” assuming the issuer does not default. YTM (“yield”) is used interchangeably with market discount rate or required yield.Instead of discussing bond prices, market participants might say “yields are rising” to mean “market discount rates are rising” or “bond prices are falling.”

An investor will achieve a return equal to the YTM if the following conditions are met:

The formula for calculating YTM is as follows:

\[ P = \frac{C}{(1 + r)^1} + \frac{C}{(1 + r)^2} + \ldots + \frac{C + F}{(1 + r)^n} \]

Where:

YTM can be calculated using specific functions in spreadsheet tools like Microsoft Excel or Google Sheets:

YIELD Function:

=YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])

Where:

IRR Function: YTM can also be calculated using the IRR function in these tools, as it represents an internal rate of return.

A municipal bond that matures on 1 July 2040 pays semiannual coupons of 2.75% per year and has a face value of 100. The market discount rate is 3.5%. For a trade settlement date of 1 July 2035, the price of the bond as a percentage of par value, assuming a 30/360-day count, is closest to:

The bond price is the sum of the coupon and principal payments discounted at the market discount rate.

\[

PV=\frac{C_1}{\left(1+r\right)^1}+\frac{C_2}{\left(1+r\right)^2}+\cdots+\frac{C_N+FV_N}{\left(1+r\right)^N}

\]

\[

PV=\frac{1.375}{\left(1+0.0175\right)^1}+\frac{1.375}{\left(1+0.0175\right)^2}+\frac{1.375}{\left(1+0.0175\right)^3}+\ldots+\frac{101.375}{\left(1+0.0175\right)^{10}}=96.587

\]

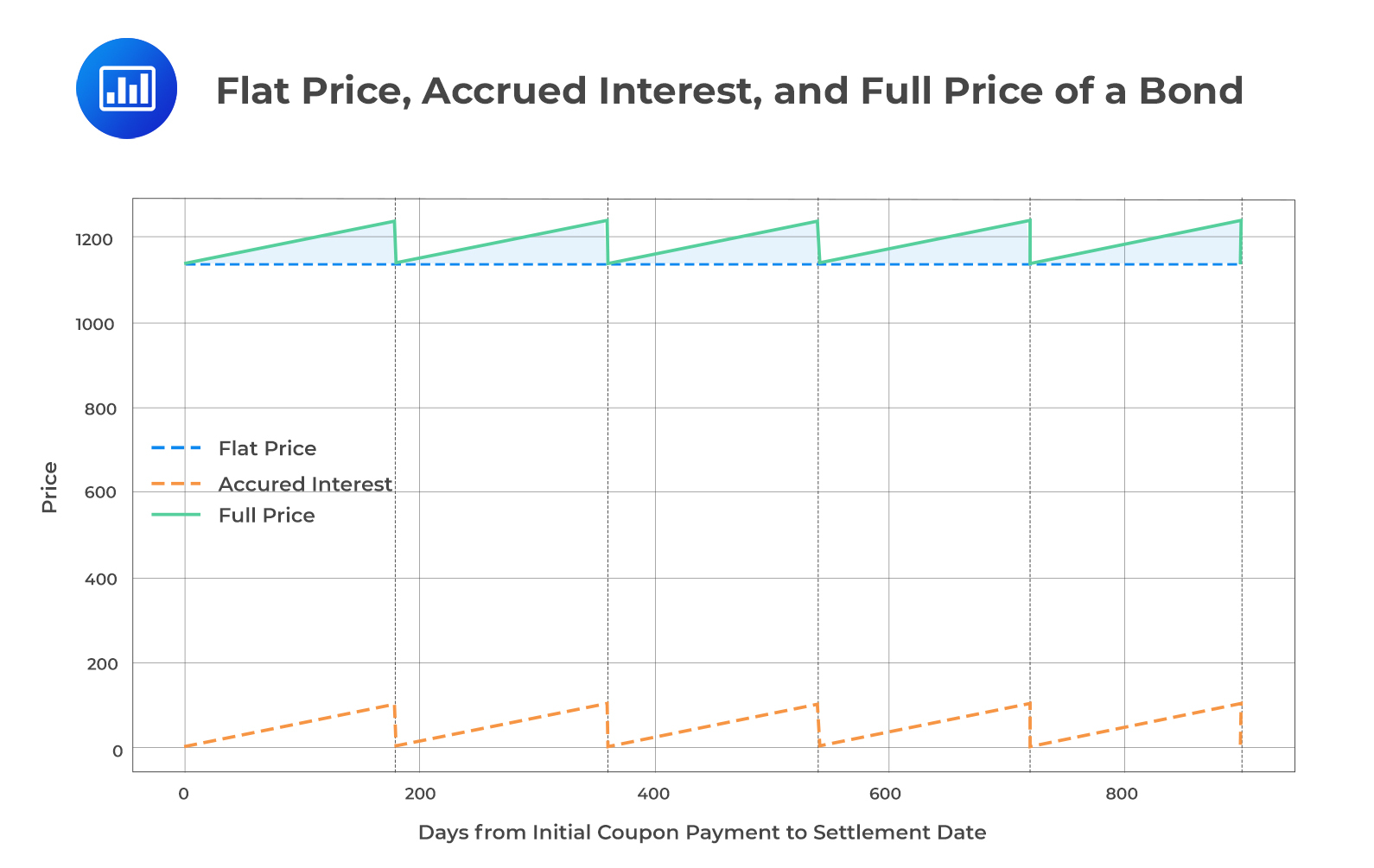

In bond trading, especially when a bond is priced between coupon payment dates, three key components are considered: the flat price, accrued interest, and the full price.

The graph below illustrates the relationship between the flat price, accrued interest, and full price of a bond over its entire lifetime, spanning multiple coupon periods.

The shaded area between the flat price and full price lines visually represents the accrued interest at any given point in time. This graph provides a clear understanding of how these key components of bond pricing interact and evolve over time.

Day count conventions specify how days are counted within a period. 30/360 assumes 30 days in a month and 360 days in a year. On the other hand, Actual/Actual uses the actual number of days in a month/year.

A certain bond pays semiannual coupons of 2.0% per year on 30 June and 31 December each year, with a face value of 100. The YTM is 2.5%. The bond is purchased and will settle on 15 September, when there will be four coupons remaining until maturity. The flat price of the bond as a percentage of par value, assuming an actual/actual day count, is closest to:

\begin{align*}

PV^{\text{Flat}} & = PV^{\text{Full}} – AI \\

PV^{\text{Full}} & = \left[ \frac{PMT}{(1+r)^1} + \frac{PMT}{(1+r)^2} + \ldots + \frac{PMT+FV}{(1+r)^N} \right] \times \left(1+ r\right)^{\left(\frac{t}{T}\right)} \\

PV^{\text{Full}} & = \left[ \frac{1}{(1.0125)^1} + \frac{1}{(1.0125)^2} + \frac{1}{(1.0125)^3} + \frac{1+100}{(1.0125)^4} \right] \times \left(1.0125\right)^{\left(\frac{77}{184}\right)} = 99.547 \\

AI & = \frac{77}{184} \times 1.00 = 0.418 \\

PV^{\text{Flat}} & = 99.547 – 0.418 = 99.129 \\

\end{align*}

Question

A bond that matures on 1 July 2040 pays semiannual coupons of 2.5% per year and has a face value of 100. The market discount rate is 4.0%. For a trade settlement date of 1 July 2038, the price of the bond as a percentage of par value is closest to:

- 94.555

- 90.018

- 97.144

Solution

The correct answer is C:

Using the given values:

\(PMT=1.25\), i.e., \(\frac{(2.5\%)}{2} \times 100\)

\(r=0.020\) (4% annual market discount rate, divided by 2 for semiannual)

\(FV=100\)

\(N=4\) (Since payments are made twice a year for 2 years)

Formula for bond price:

\[PV=\frac{C}{{(1+r)^1}} +\frac{C}{{(1+r)^2}} +\frac{C}{{(1+r)^3}} +\frac{{(C+FV)}}{{(1+r)^4}}\]

\[PV=\frac{1.25}{{(1.020)^1}} +\frac{1.25}{{(1.02)^2}} +\cdots+\frac{101.25}{{(1.020)^4}} =97.144\]

Practice bond‑valuation & YTM problems with step‑by‑step solutions.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.