Factors that Influence Industry Growth ...

External factors affecting an industry’s growth include macroeconomic, technological, demographic, governmental, and social... Read More

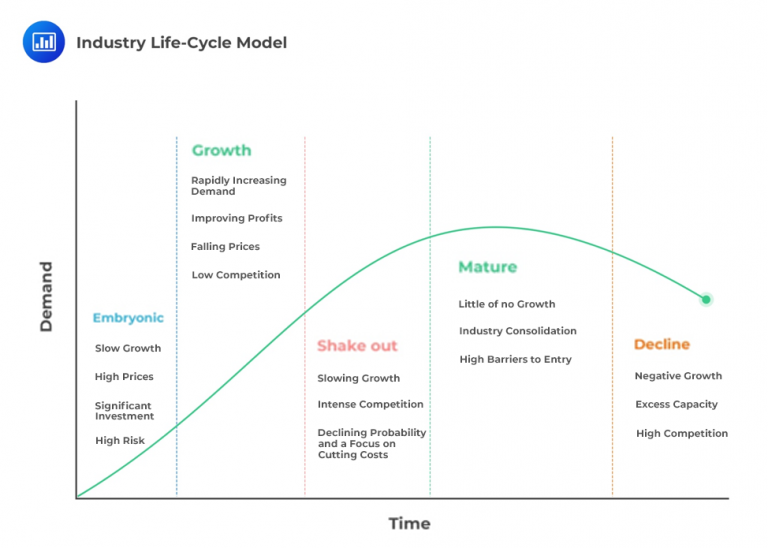

An industry’s life-cycle position often has a large impact on its competitive dynamics, making this position an important component of the strategic analysis of an industry.

The evolution of an industry does not always follow a predictable pattern as various external factors (technological, regulatory, social, or demographic changes) may significantly affect the shape of the pattern. Also, the performance of companies within industries does not always mirror that of the overall industry as there can be successful companies in declining businesses and failing companies in high-growth industries.

Question

The newspaper industry has been shrinking for years in the shadow of the internet and 24-hour cable news networks. What is the life-cycle stage that best fits the newspaper industry?

- Mature.

- Decline.

- Shakeout.

Solution

The correct answer is B.

The newspaper industry has long ago moved past the shakeout stage and has more recently shifted into a period of decline against the increasing popularity of the internet.