Globalization

Globalization is the interaction and integration of individuals, organizations, and governments on a... Read More

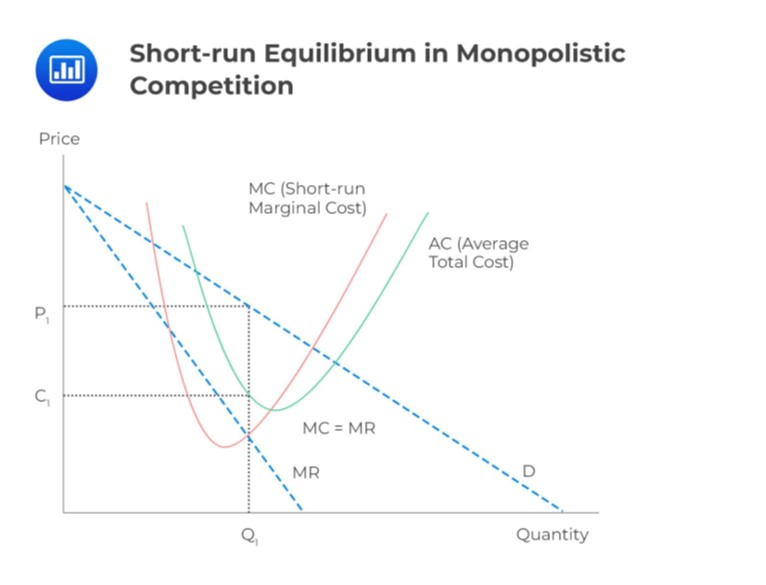

In monopolistic competition, firms have a downward-sloping demand curve, meaning lower prices lead to more demand and vice versa. At some prices, demand is very responsive to changes (elastic), and at lower prices, demand is less responsive (inelastic).

In the short run, a firm maximizes its profit by producing the level of output where marginal revenue (MR) equals marginal cost (MC).

In the graph above, the optimal output level is represented by \(Q_1\), while \(P_1\) represents the price consumers are prepared to pay for this quantity. The rectangle formed by \(P_1\) multiplied by \(Q_1\) represents the total revenue.

In this market structure, the supply function is not well-defined. The appropriate output level is determined by the point where the Marginal Cost and Marginal Revenue curves intersect (MC=MR).

However, it is important to note that price will be charged in accordance with the demand schedule of the market. The supply curve of a firm should measure the quantity that the firm is willing and able to supply at different price levels, unfortunately, the marginal revenue and marginal cost do not represent this information.

In this market structure, the short-run profit-maximizing point is the point where marginal revenue equals marginal cost (MR=MC). Total revenue (TR) is the product of P1 and Q1as shown in the graph above.

The average cost incurred in producing Q units of a product is \(C_1\) (As shown in the graph above), and the total cost (TC) is the area of the rectangle,

$$ C_1×Q_1 $$

The economic profit is the difference between TR and TC. We denote the economic profit by π. Then,

$$ \pi=TR-TC $$

As firms under monopolistic competition start reporting higher profits, and because the barriers to entry are low in this market structure, more firms will enter the market, and consequently drive demand down since the new entrants will attract some customers.

As a result, the economic profits realized by firms in monopolistic competition will fall (to zero in the long run). Further, firms will incur advertising costs for product differentiation. This can be seen in consumer products, such as clothing, with high advertising costs. For example, large sporting brands pay lucrative contracts to professional sports personalities to differentiate themselves from the competition.

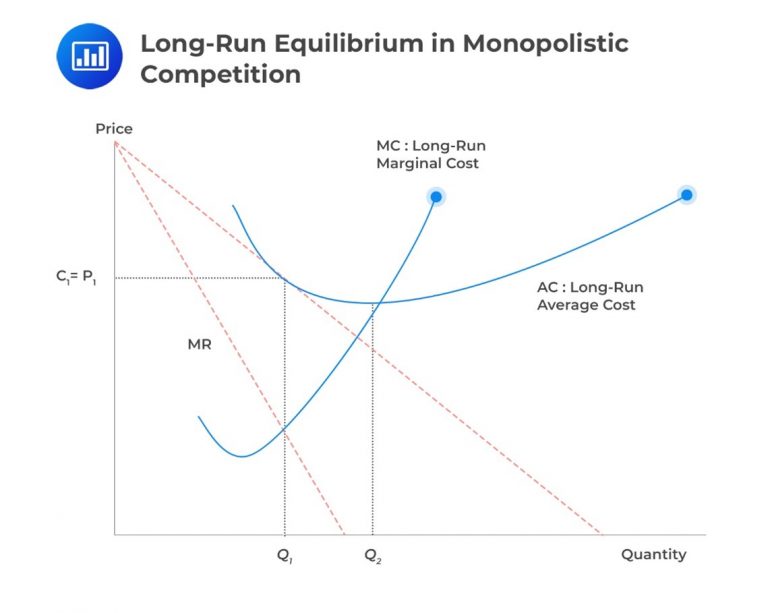

Consider the following diagram:

In long-run equilibrium, the optimal output level is still the level where marginal revenue (MR) equals marginal cost (MC), represented by \(Q_1\). The demand curve determines the price consumers are willing to pay for any amount of the product, in this case, \(Q_1\), for the price \(P_1\).

The total revenue (TR) is represented by the area of the rectangle formed by multiplying \(P_1\) by \(Q_1\). It’s important to observe that, in contrast to the long-run equilibrium in a perfectly competitive market, the equilibrium position in a monopolistic competition market is situated at a higher level of average cost than the output level that minimizes average cost.

The average cost does not hit its lowest point until the output reaches \(Q_2\). In this long-run equilibrium scenario, the total cost is represented by the area of the rectangle obtained by multiplying \(C_1\) by \(Q_1\). The economic profit can be calculated by subtracting the total cost from the total revenue.

Note that in the graph above, the economic profit is zero since total revenue equals total cost. Mathematically,

$$ P_1\times Q_1=C_1\times Q_1 $$

Note that the zero economic profit in the long run in a monopolistic competition market structure resembles a perfect competition market structure. However, the long-run level of output, \(Q_1\), is less than \(Q_2\), which represents the minimum average cost of production and would be the long-run level of output in a perfectly competitive market. Also, note that the economic cost in a monopolistic competition market represents the cost associated with differentiation (for instance, advertising), which is absent in a perfect competition market structure.

Question

A firm that is operating under a monopolistic competition maximizes its profits when:

- The average cost is minimized.

- Marginal revenue equals average cost.

- Marginal revenue equals marginal cost.

Solution

The correct answer is C.

The firm will maximize its profit when the level of output is such that the marginal revenue equals marginal cost. In other words, it will produce a quantity such that MR=MC.

A and B are incorrect. From the graph given below, we can clearly see that it’s neither the point where average cost is minimized nor the point where marginal revenue equals average cost.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.