Compare Nominal and Real GDP and Calcu ...

It is economically healthy to exclude the effect of general price changes when... Read More

Aggregate demand is the total demand for goods and services in an economy. It is defined as the sum of the amount spent on real goods and services by all economic agents. It is calculated as shown below.

Aggregate demand = C + I + G + (X – M)

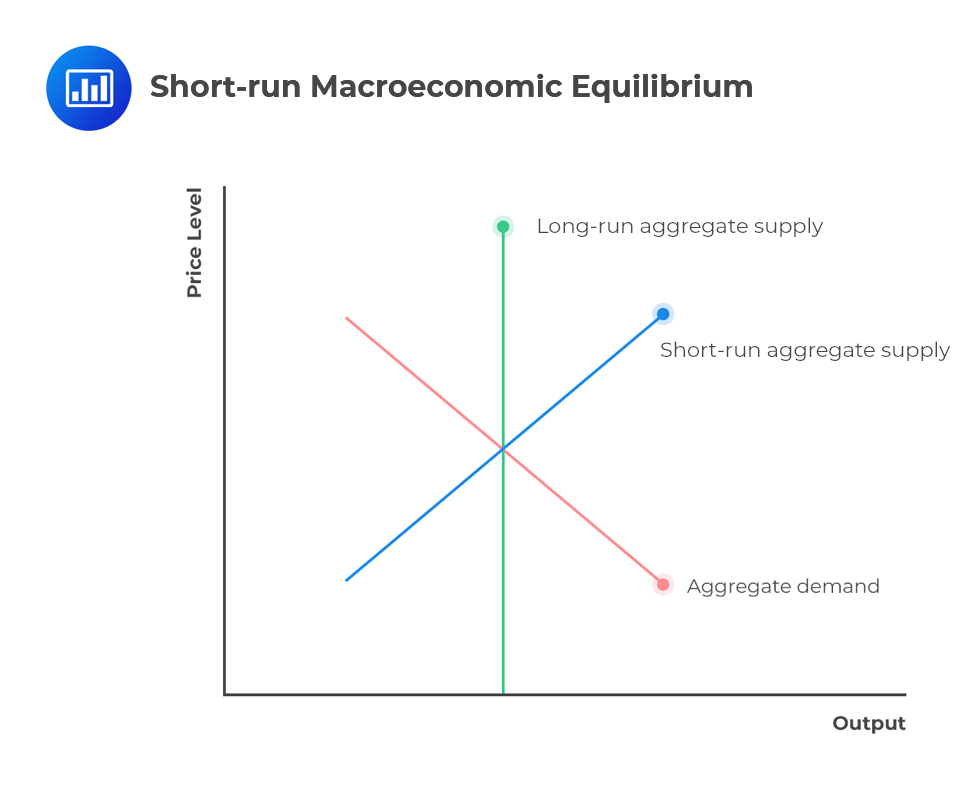

The aggregate demand curve shows the connection between the real output and price levels with other factors held constant. The aggregate demand curve’s trend mirrors the effect of prices on demand. Its curve slopes downwards when price increases because it reduces the wealth of individuals and, as such, lowers their purchasing power with money supply held constant.

Aside from prices, varying factors can shift the aggregate demand curve either leftward or rightward. For example, a contractionary fiscal policy can shift aggregate demand to the left.

Aggregate supply refers to the sum of goods produced in an economy. It connects the number of goods and services supplied to price levels, with all other factors held constant.

The aggregate supply trend mirrors the effect of supply on price. A shortage of supply causes an increase in prices, resulting in higher profits for businesses and encouraging producers to increase their output.

Although in the short run, prices remain stagnant, in the long run, prices are flexible. The curve becomes vertical as a result of input costs adjusting to changes in output prices. However, it is important to note that the economy’s level of potential GDP affects the curve’s position.

When both AD and AS increase, the real GDP will increase. The effect of the increment on inflation will, however, depend on the magnitude of the changes. Note that an increase in AD will increase the price level. On the other hand, an increase in AS will decrease the price level. If the AD increases more than the AS, then, the price level will increase. Conversely, if the AS change is more than the AD change, the price level will decline.

In case both AD and AS decrease, the real GDP and employment rate will drop. The effect of this on price levels will only be known if the magnitude of the changes is known. If the decrement of the AD exceeds that of the AS, the price level will drop. Conversely, if the drop in the AS is more than that of the AD, the price level will rise.

If AD increases while AS decreases, then the price levels will rise. The effect of this on real GDP will be known if we can get the magnitude of the changes. This is because an increase in AD increases real GDP while a decrease in AS decreases the real GDP. However, if the AD increment exceeds the AS decrement, the GDP will increase, and if the reverse happens, the real GDP will drop.

Lastly, let us consider a scenario where the AD decreases while the AS increases. If this happens, the price level will decrease. The effect of this decrement on the real GDP will only be determined if the magnitude of these changes is precisely known. Such is the case because a decrement in the AD reduces the real GDP while an increment in the AS increases the real GDP. However, if the increment in AD is more than the increment in AS, the level of real GDP will decline. On the contrary, if the converse happens, the real GDP will rise.

The combined effects can be summarized by the table below:

$$

\begin{array}{c|c|c|c}

\begin{array}{c} \textbf{Change in Aggregate} \\ \textbf{Demand (AD)} \end{array} & \begin{array}{c} \textbf{Change in Aggregate} \\ \textbf{Supply (AS)} \end{array} & \textbf{Effects on Real GDP} & \begin{array}{c} \textbf{Effect on Aggregate} \\ \textbf{Price Level} \end{array} \\

\hline

\text{Increase} & \text{Increase} & \text{Increase} & \text{Indeterminate} \\

\hline

\text{Decrease} & \text{Decrease} & \text{Decrease} & \text{Indeterminate} \\

\hline

\text{Decrease} & \text{Increase} & \text{Indeterminate} & \text{Decrease} \\

\hline

\text{Increase} & \text{Decrease} & \text{Indeterminate} & \text{Increase} \\

\end{array}

$$

Question

Which of the following factors can make the long-run aggregate supply curve to shift leftwards?

A. Higher nominal wages.

B. A decline in productivity.

C. A decrease in corporate taxes.

Solution

The correct answer is B.

There exists a direct relationship between labor hours and output. The more efficient the workers, the higher their output for the same amount of hours worked.

A decline in output, signals a decline in efficiency. This results in an increase in the cost of labor, thereby decreasing output and profits. Further, this results in a leftward shift in both the short-term and long-term aggregate supply.