Value at Expiration and Profit for Cal ...

[vsw id=”00HzgJftwpU” source=”youtube” width=”611″ height=”344″ autoplay=”no”] In an options contract, two parties transact... Read More

A swap is an agreement between two parties to exchange a series of cash flows, which can also be viewed as a series of forward contracts. Swap pricing is the determination of the initial terms of the swap at the inception of the contract. On the other hand, swap valuation is the determination of market value during the life of the swap contract.

Swaps are equivalent to a series of forward contracts, each created at the swap price. If the present value of the payments in a swap or forward contract is not zero, then the party who will receive the greater stream of payments must pay the other party the present value of the difference, i.e., the net value.

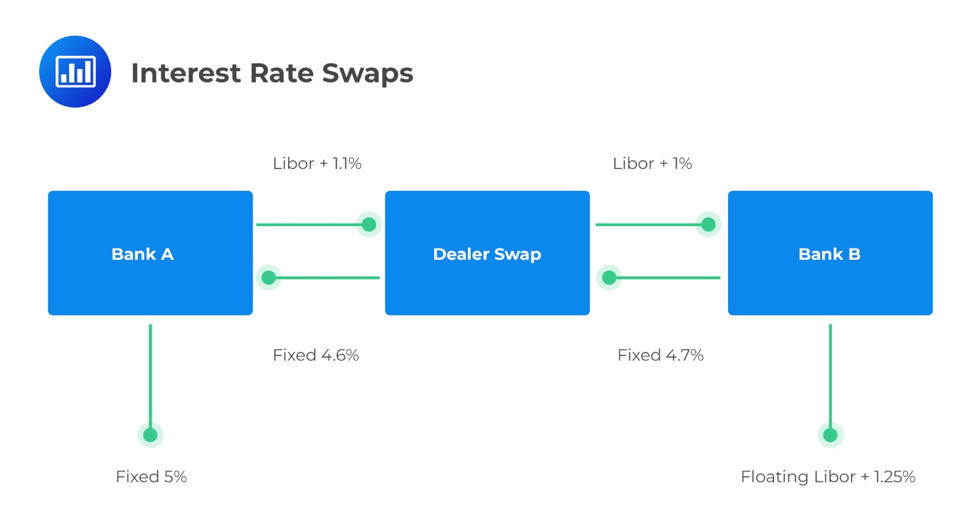

An interest rate swap is an agreement to exchange one stream of interest payments for another, based on a specified principal amount, over a specified period of time. Here is an example of a plain vanilla interest rate swap with Bank A paying the LIBOR + 1.1% and Bank B paying a fixed 4.7%:

As in most financial transactions, a swap dealer is between the two parties taking a commission on the trade.

At inception, the value of an interest rate swap is zero. Therefore, the fixed rate on the swap has to be such that the present value of the fixed payments is equal to the present value of the floating payments. A received fixed-rate swap should be treated as buying a fixed-rate bond and issuing a floating rate bond:

$$\text{Value of swap (receiving fixed)}= \text{Value of fixed-rate bond (long)} – \text{Value of floating-rate bond (short)}$$

Question

What is the difference between the price and the value of a swap?

A. The price of the swap refers to the initial terms of the swap at the start of the swap’s life and value refers to determining the market value of the swap at any point in its life

B. The price of the swap refers to the fluctuating positive/negative prices throughout the lifecycle of the swap and the value is the price of the swap at initiation

C. The price and the value of the swap are exactly the same and they both fluctuate throughout the life of the swap.

Solution

The correct answer is A.

The value of a swap is its market value at any point in time. At inception, the value of an interest rate swap is zero. The price of the swap refers to the initial terms of the swap at the start of the swap’s life.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.