Put-Call Parity

Put-call parity is a no-arbitrage concept. It involves a combination of cash and... Read More

[vsw id=”0Geaej45v7w” source=”youtube” width=”611″ height=”344″ autoplay=”no”]

By assessing the difference between the investors’ determination of the value of a stock or option versus the prevailing market price, investors can either buy or sell the asset to attempt to profit from this discrepancy. However, the same terminology and principles do not apply to forward, futures, or swap derivative contracts.

Typically, in equity market analysis, the objective is to determine the value (fundamental value) of a stock. When a stock trades at a price different from the investor’s determination of fundamental value, the investor will buy or sell the stock. Thus, the value may not necessarily correspond with the price. Options can be analyzed to determine their fundamental value and differences between price and value exploited.

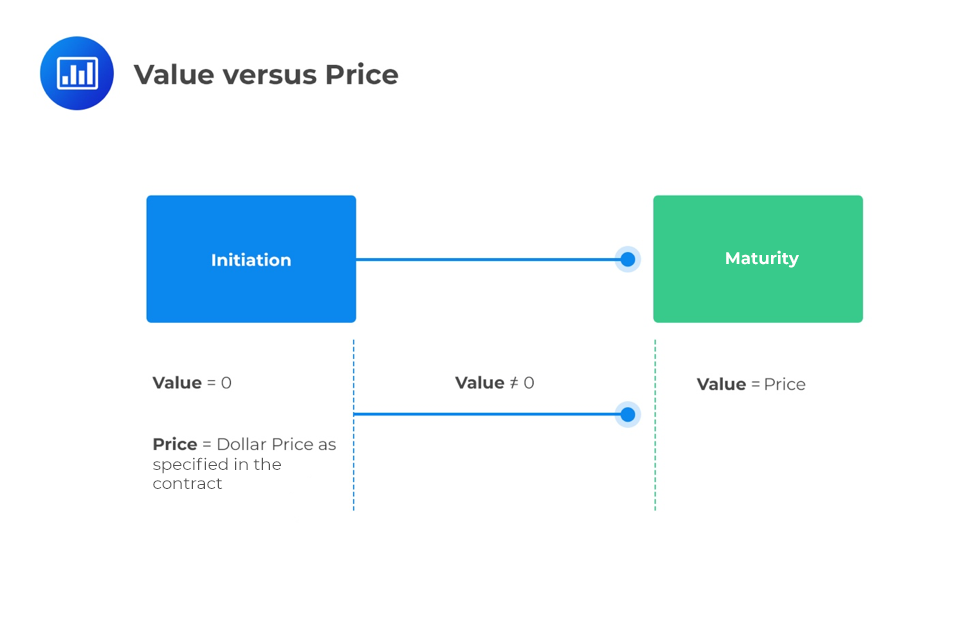

However, forward, futures and swaps use different terminology for price and value. Forwards and futures start with a zero value since they do not require an outlay of cash at the initiation. As the underlying asset moves in price, the value of the contract becomes positive or negative. However, since the price is one of the parameters of the initial agreement signed by both parties, its value is embedded into the contract at inception and remains fixed. This is why the value of both forward and futures contracts fluctuates throughout the life-cycle.

Question

Which of the following best describes the difference between the price of a futures contract and its value?

A. The futures price is fixed at the start, and the value starts at zero and then changes throughout the life-cycle of the contract.

B. The price determines the profit to the buyer, and the value determines the profit to the seller.

C. The futures contract value is a benchmark against which the price is compared for the purposes of determining whether a trade is advisable.

Solution

The correct answer is A.

The futures price is fixed at the start, whereas the value starts at zero and then changes, either positively or negatively, throughout the life of the contract.

Get Ahead on Your Study Prep This Cyber Monday! Save 35% on all CFA® and FRM® Unlimited Packages. Use code CYBERMONDAY at checkout. Offer ends Dec 1st.