Capital allocation describes the process companies use to make decisions on capital projects, i.e., projects with a lifespan of one year or more. It is a cost-benefit exercise that seeks to produce results and benefits which are greater than the costs of the capital allocation efforts.

There are several steps involved in the capital allocation process. However, the specificity of the procedures a manager adopts depends on factors such as the manager’s position in the company, the size and complexity of the project being evaluated, and the company’s size.

Capital Allocation Process

The typical steps involved in the capital allocation process are:

- Idea generation: Generating good ideas is the most important step.

- Investment analysis: Information is gathered, which helps forecast cash flows for each project and evaluate a project’s profitability.

- Capital allocation planning: This involves looking at project timing, scheduling, prioritizing, and coordinating.

- Monitoring and post-audit: How a project performs is assessed, and actual results (revenues, expenses, cash flows, etc.) are compared with planned or projected results.

Capital Allocation Principles

- Decisions are based on cash flows: Decisions are made based on cash flows rather than accounting or accrual basis (net income or operating income), which subtracts non-cash expenses such as depreciation.

- Measure incremental cash flows: These are the additional cash flows that result from an investment.

- Timing of cash flows is crucial: These are the predicted cash flows’ anticipated timing, length, volatility, and likelihood.

- Cash flows are analyzed on an after-tax basis: Decisions should reflect the impact of taxes.

- Cash flows are not accounting net income or operating income: Unlike accounting income, economic income (cash inflows + changes in a company’s market value) does not account for non-cash expenses.

- Financing costs are ignored: Financing expenses can be ignored in cash flows since they are considered when calculating the required rate of return.

- The “required rate of return” is the rate used to discount the cash flows disregarding financing expenses. Given a project’s riskiness, the needed rate of return is the discount rate that the issuer’s capital providers want. This discount rate is also known as the “cost of capital” or the “opportunity cost of money.” Based on its average-risk investment and the capital sources used to fund its assets, a company’s weighted average cost of capital (WACC) is its cost of capital at the enterprise level.

Capital Allocation Concepts

- Sunk costs: These are costs that have already been incurred.

- Incremental cash flow: This is the cash flow that is realized because of a decision made.

- Externality: This refers to the effect of an investment on other things besides itself. If possible, these effects should be part of an investment decision. Cannibalization is one example of an externality. This occurs when an investment results in customers and sales moving away from a subsidiary of a company.

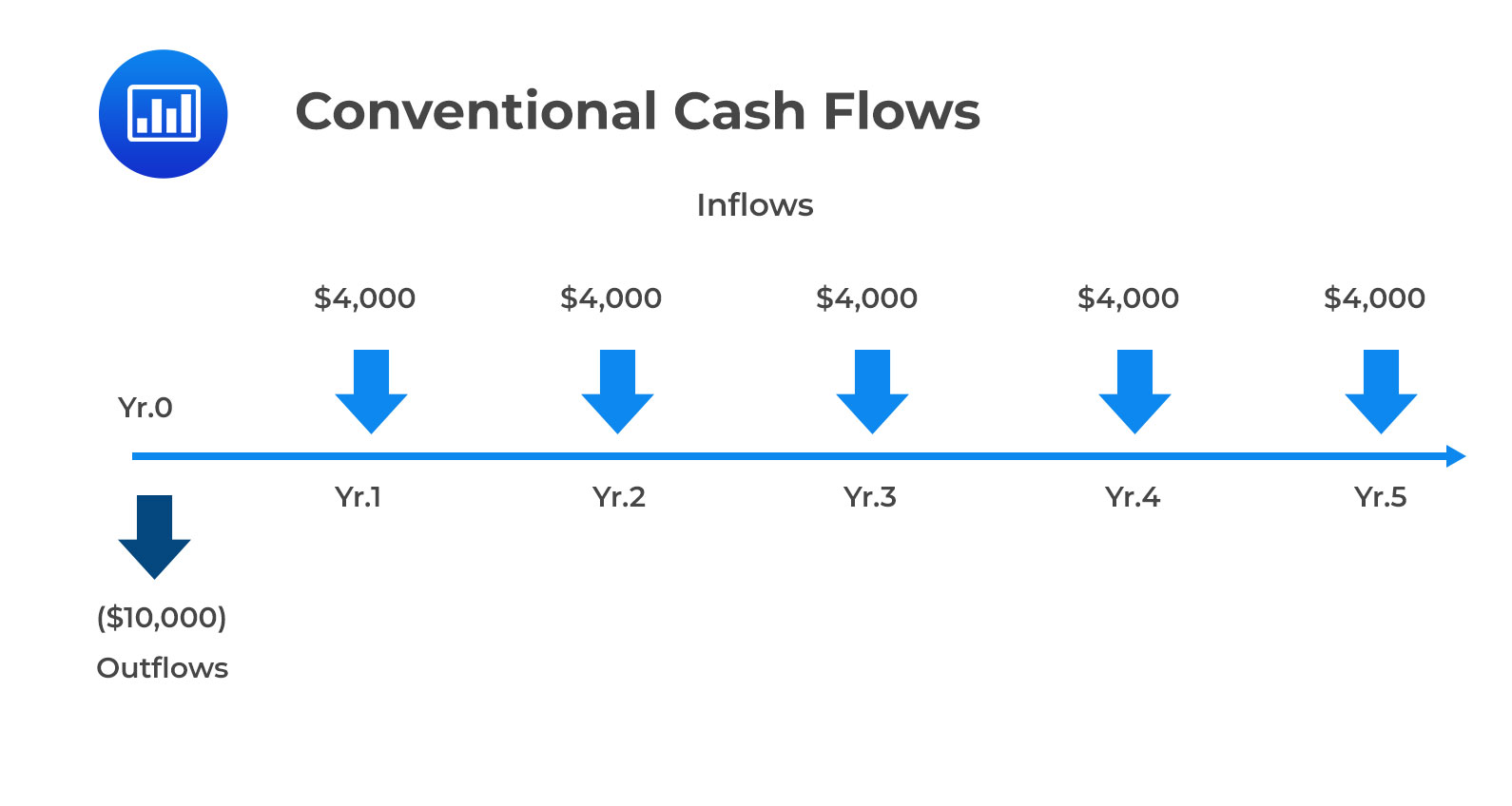

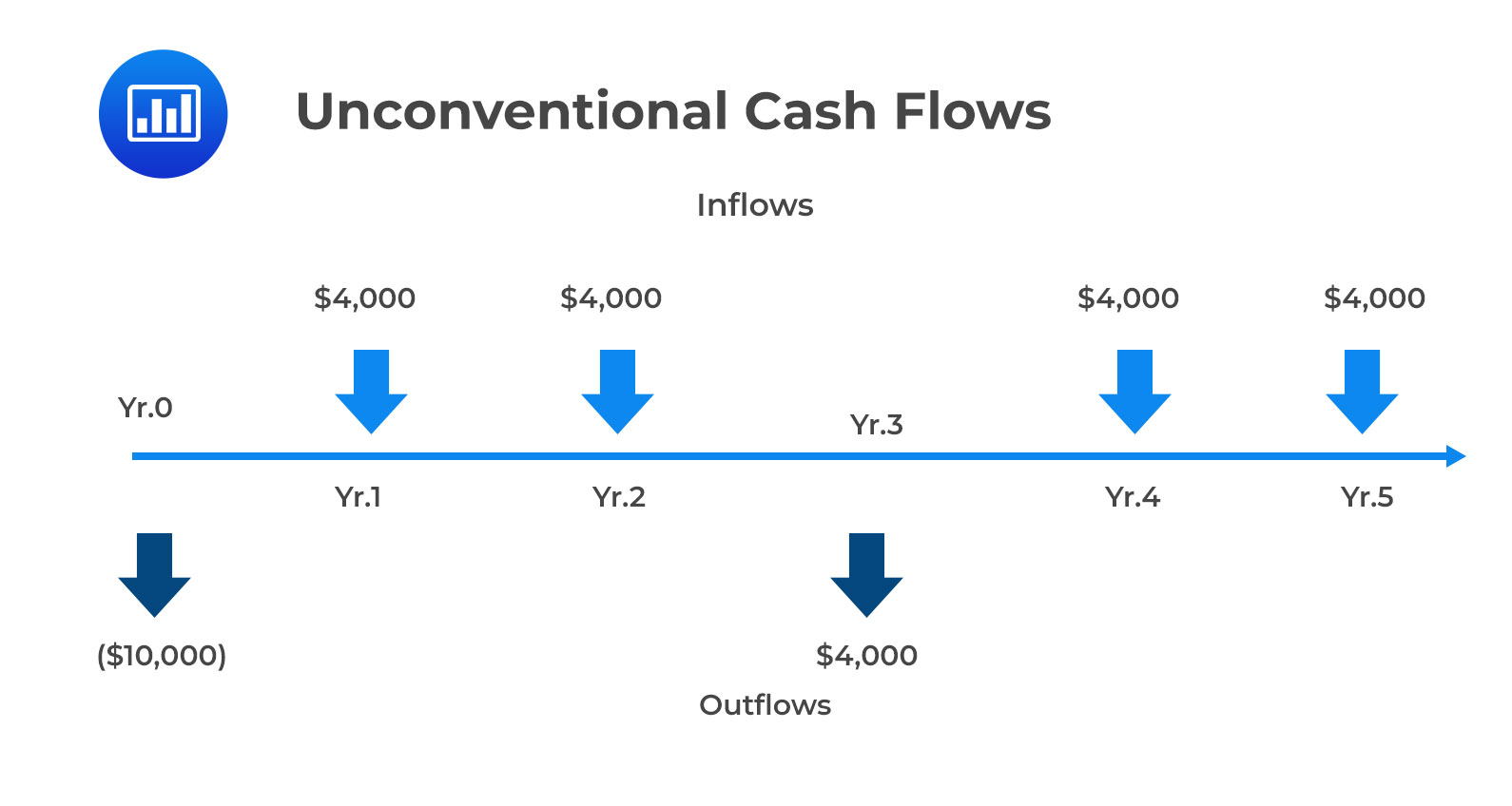

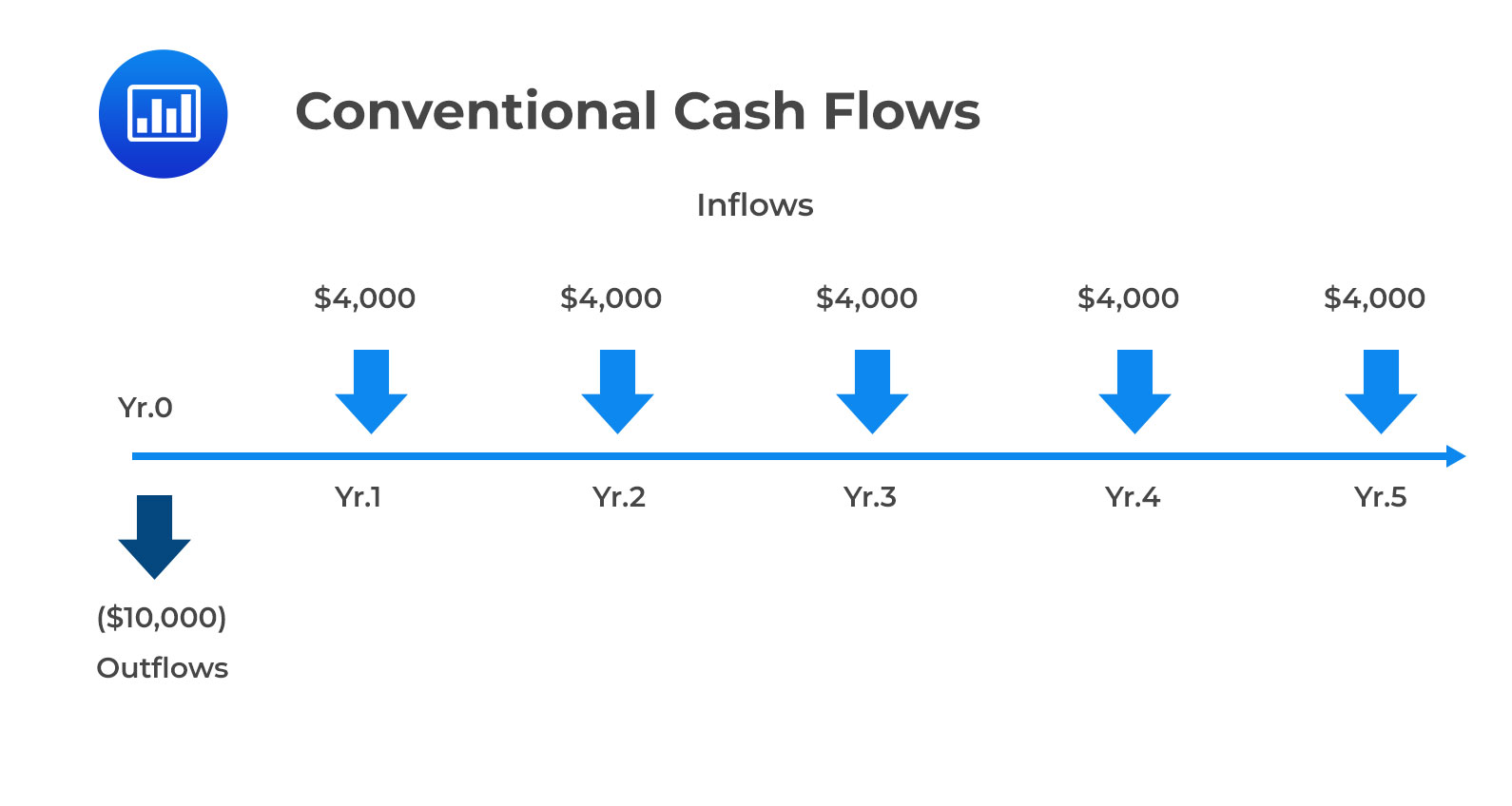

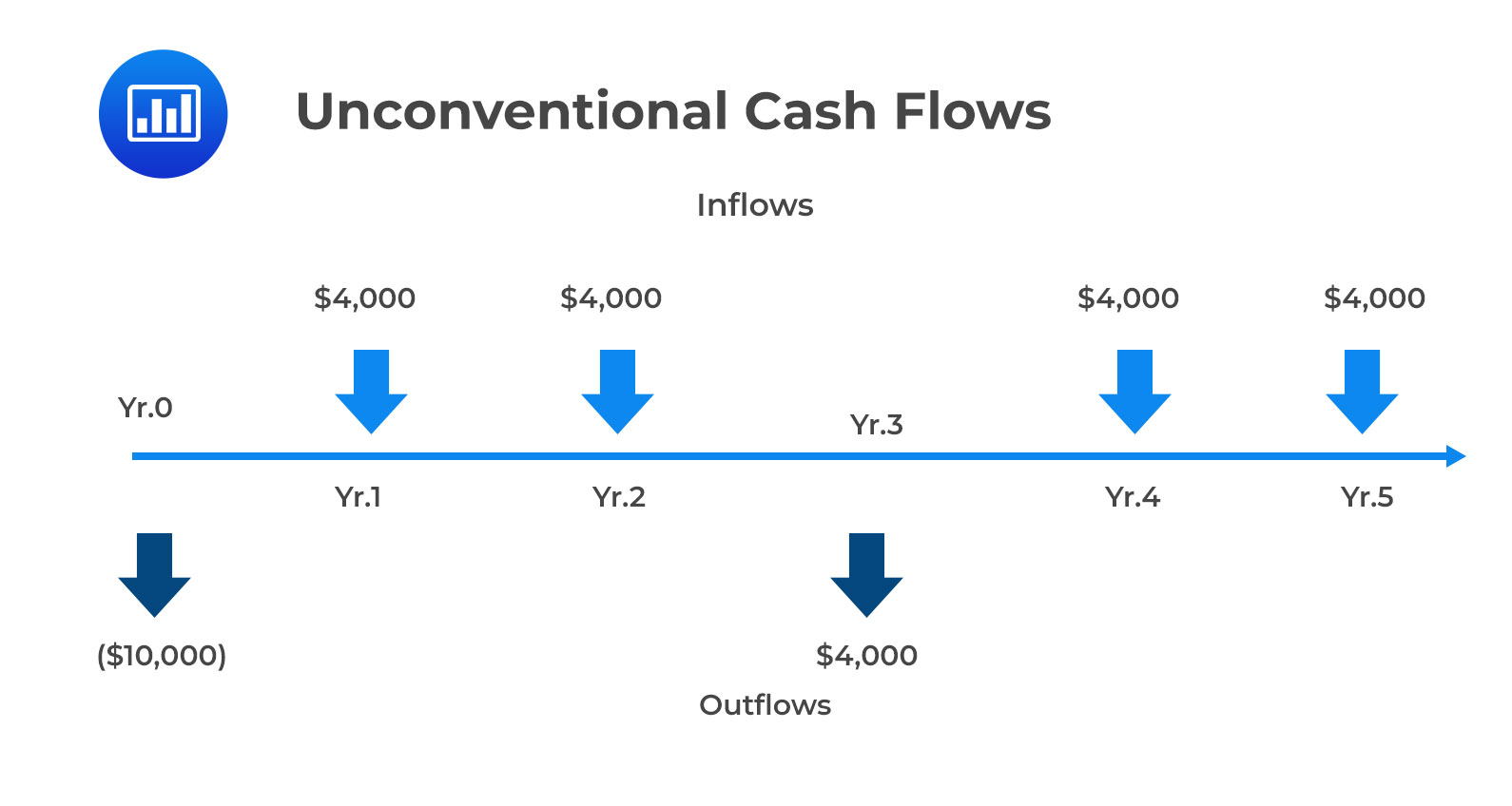

- Conventional cash flows versus non-conventional cash flows: A conventional cash flow pattern has an initial cash outflow followed by a series of cash inflows. Conversely, a non-conventional cash flow pattern is one in which the initial cash outflow is not followed by cash inflows only. The cash flows can shift from positive to negative, again (or even change signs several times).

Independent Projects versus Mutually Exclusive Projects

Mutually exclusive projects are capital projects which compete directly against each other. For example, if a manager has projects X and Y and must choose either of the two and not both, then projects X and Y are said to be mutually exclusive. This scenario differs from independent projects, those whose cash flows are independent of each other and can, therefore, be undertaken together.

Project Sequencing

Project sequencing aims to arrange projects in a logical order for completion. It enables a project manager to determine the order of project completion. Indeed, project sequencing best manages the available time and resources.

Through project sequencing, investing in one project may create the option to invest in future projects. For example, a manager may invest in one project today and then invest in another project in a year. This happens if the financial results of the first project or new economic conditions are favorable.

Question

Which of the following statements is most likely accurate?

- In capital allocation, only pre-tax cash flows should be considered.

- The timing of cash flows is crucial to the capital allocation process.

- A non-conventional cash flow pattern has an initial cash outflow followed by a series of cash inflows.

The correct answer is B.

Capital allocation analysts make an extraordinary effort to detail precisely when cash flows occur.

A is incorrect. Cash flows are analyzed after-tax; taxes must be fully reflected in capital allocation decisions.

C is incorrect. A conventional cash flow pattern (not a non-conventional cash flow pattern) has an initial cash outflow followed by a series of cash inflows.