Potential Risks due to Poor Corporate ...

Debtholders, also known as lenders, provide a company with finite-term financial capital. In return, the issuers agree to make regular interest payments and repay the principal on predetermined dates.

Lenders do not possess decision-making authority within the corporation but can use debt agreements to safeguard themselves by establishing financial requirements and legal claims on specific company assets if the debt is not repaid according to the agreed terms.

On the other hand, equity investors contribute permanent capital to the company. Issuers typically do not commit to providing future dividends or repayments to shareholders. Instead, equity represents a residual claim (residual meaning whatever is left after expenses, investments, and debt obligations have been satisfied) on the company’s cash flows, subject to the board of directors’ discretion.

Unlike debtholders, equity investors hold voting rights in crucial company matters, such as selecting the board of directors responsible for appointing and overseeing management.

Debtholder interest payments are usually considered tax-deductible expenses, reducing the company’s taxable income, whereas dividends paid to shareholders do not offer the same tax benefits.

A summary of the comparison between debt and equity claims is given in the following table:

$$ \begin{array}{c|c|c|c|c|c|c}

& {\text{Legal} \\ \text{repayment } \\ \text{obligation}} & {\text{Residual} \\ \text{asset} \\ \text{claim}} & {\text{Discretionary} \\ \text{payments}} & {\text{Tax-}\\ \text{deductible} \\ \text{expense}} & {\text{Finite} \\ \text{term}}& {\text{Voting} \\ \text{rights} } \\ \hline

\textbf{Debt} & \surd & & & \surd & \surd & \\ \hline

\textbf{Equity} & & \surd & \surd & & & \surd

\end{array} $$

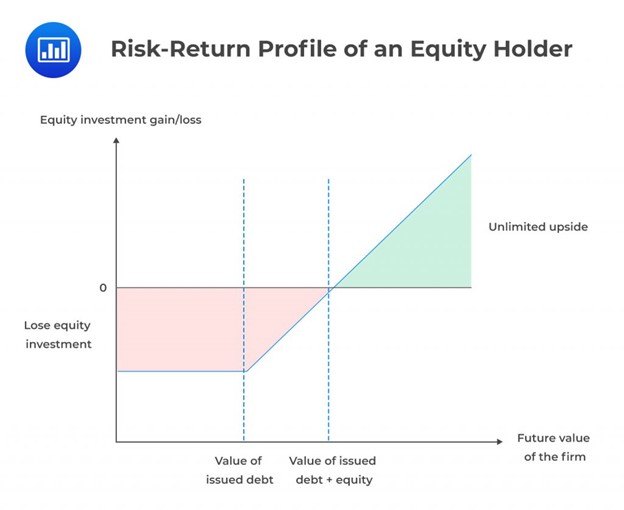

The maximum loss equity holders can incur is capped at their investment amount in a company. There is no limit to an equity holder’s gains if a company succeeds. Investment risk is higher for equity holders than debtholders as a company is not obligated to repay equity holders’ dividends. An equity holder may lose their entire investment if a company goes bankrupt.

Equity holders are interested in maximizing a company’s net value as a higher net value directly translates to increased share value.

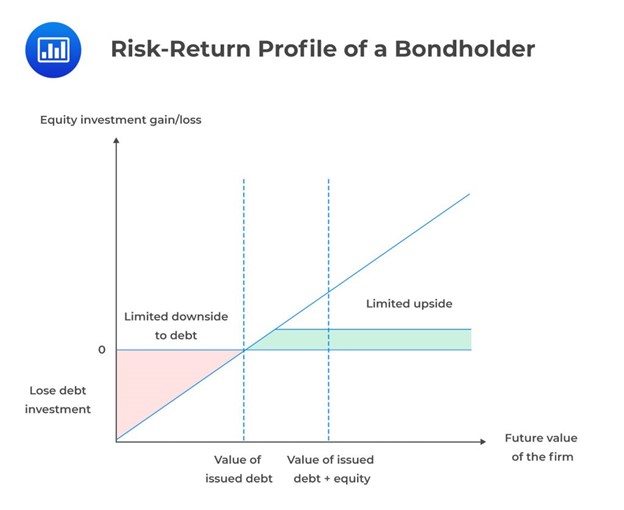

Bondholders have fixed priority claims on a company through contractually promised interest payments and return of the principal amount. Unlike equity holders, bondholders do not receive more than the promised interest payments when a company becomes attractively profitable. However, there is a brighter side to this.

Investment risk is lower for bondholders than equity holders. When a company is financially healthy, bondholders are assured of their returns. A financially healthy company is also capable of providing collateral. Therefore, the upside gains to a bondholder are capped at the interest payments plus the principal. However, there are downside losses if a company falls below the book value of the debt.

In contrast to equity holders, bondholders have recourse opportunities when a company is in financial distress. Their payments are prioritized in case of financial stress and they can use the contractual agreement to force the issuer to liquidate assets to repay their debt.

However, they can also lose their entire investment and therefore, they are keener on the default risk of a company and its ability to meet debt obligations. The debt soundness of a company is determined by the following:

Corporations prefer debt capital to equity capital because the cost of debt is lower than the cost of equity, and debtholders’ return is capped at the interest payments and principal repayment. Moreover, equity capital dilutes ownership and is only appropriate when the issuer’s cash flows are absent or unpredictable.

However, bonds are riskier than shares since they involve contractual agreements that must be honored. Increased financial leverage resulting from an increased use of debt for a given amount of equity increases the probability of a firm’s inability to repay its debtholders, leading to bankruptcy/ liquidation, a risk that is absent in the case of equity financing.

In extreme cases where an issuer cannot meet bondholders’ obligations, it can avoid bankruptcy by renegotiating repayment terms with the bondholders. If the negotiation fails, the issuer can file for bankruptcy protection. In this case, assets will be liquidated to pay the bondholders. An extreme solution is reorganizing the company, in which case the bondholders take over.

Bondholders’ and equity holders’ interests often collide due to their contrasting risk and return preferences. Equity holders, have their losses capped at their initial investment, and they seek maximum returns. This makes them inclined towards a company’s management investing in high-calculated risks with the potential for substantial gains. Their unlimited upside potential drives them to take on the risk of losing their investment if the company faces financial troubles. Equity holders can also demand for higher dividends which increases leverage and risk to bondholders.

In contrast, bondholders have a more conservative approach. Their potential return is limited to the face value of the bond and coupon payments, and they do not benefit from the company’s risky investment decisions. As a result, bondholders favor investments in less risky projects that generate predictable cash flows, albeit small, to ensure timely interest and principal repayments.

Despite lacking control over a company’s investment decisions, bondholders utilize covenants to safeguard their investment and impose contractual restrictions that protect their interests. This way, bondholders aim to maintain the stability of their investment and mitigate potential risks associated with uncertain ventures.

Question #1

Which of the following statements is most likely true?

- Bondholders have residual claims on a company’s assets after all other stakeholders have been paid.

- Stocks are riskier than bonds to the issuer since shareholders are the residual claimants on the firm.

- Equity and bondholders have comparable investor perspectives regarding maximum loss.

Solution

The correct answer is C.

The maximum loss for both the bondholders and equity holders is their initial investment amount. However, equity holders have unlimited return potential but are exposed to higher investment risk due to a lack of contractual obligation between them and the issuing company.

A is incorrect. Equity holders are the residual claimants of a company’s cash flows and assets. This implies that they are only paid after all other stakeholders, such as creditors, suppliers, and government, have been paid.

B is incorrect. Stocks are riskier for investors because the issuing company has no contractual obligation to distribute dividends to shareholders or repay their capital investment. On the other hand, bonds are riskier than stock for the issuer because bonds increase the leverage risk to a company.

Question #2

Which of the following is most likely to have a residual claim on the issuer’s profits:

- Government.

- Shareholders.

- Lenders.

Solution

B is correct. Shareholders have a residual claim to the company’s profits after deductions of obligations (e.g., interest payment, taxes, employee benefits.)

A and C are incorrect. Only shareholders have a claim to the company’s profits.